EAST AURORA, N.Y.--(BUSINESS WIRE)--Astronics Corporation (Nasdaq: ATRO) (“Astronics” or the “Company”), a leading supplier of advanced technologies and products to the global aerospace, defense and other mission critical industries, today reported financial results for the three and twelve months ended December 31, 2023.

Peter J. Gundermann, Chairman, President and Chief Executive Officer, commented, “We had a very strong close to the year with fourth quarter revenue of $195 million, up 23% over the comparator quarter. This brought total 2023 sales to $689 million, an increase of 29% over 2022. Our financial results demonstrate our improved performance with fourth quarter adjusted EBITDA of $25 million, or 12.7% of sales. The expanded profitability was the result of continued strong demand, an improved supply chain and a more stable and developed team of people. We are encouraged with the momentum in our business and believe we are well positioned to enjoy continued tailwinds as we enter 2024.”

1 Adjusted EBITDA is a Non-GAAP Performance Measure. Please see the attached table for a reconciliation of adjusted EBITDA to GAAP net income.

Fourth Quarter Results

|

Three Months Ended |

|

Year Ended |

|||||||||||||||||||

($ in thousands) |

December

|

December

|

% Change |

|

December

|

December

|

% Change |

|||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||

Sales |

$ |

195,292 |

|

$ |

158,153 |

|

23.5 |

% |

|

$ |

689,206 |

|

$ |

534,894 |

|

28.8 |

% |

|||||

Income (loss) from operations |

$ |

7,782 |

|

$ |

(3,167 |

) |

345.7 |

% |

|

$ |

(6,671 |

) |

$ |

(30,044 |

) |

77.8 |

% |

|||||

Operating margin % |

|

4.0 |

% |

|

(2.0 |

)% |

|

|

|

(1.0 |

)% |

|

(5.6 |

)% |

|

|||||||

Net gain on sale of businesses |

$ |

— |

|

$ |

— |

|

|

|

$ |

3,427 |

|

$ |

11,284 |

|

|

|||||||

Net income (loss) |

$ |

6,976 |

|

$ |

(6,779 |

) |

202.9 |

% |

|

$ |

(26,421 |

) |

$ |

(35,747 |

) |

26.1 |

% |

|||||

Net income (loss) % of sales |

|

3.6 |

% |

|

(4.3 |

)% |

|

|

|

(3.8 |

)% |

|

(6.7 |

)% |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||||||||

*Adjusted EBITDA |

$ |

24,830 |

|

$ |

7,800 |

|

218.3 |

% |

|

$ |

55,579 |

|

$ |

11,307 |

|

391.5 |

% |

|||||

*Adjusted EBITDA margin % |

|

12.7 |

% |

|

4.9 |

% |

|

|

|

8.1 |

% |

|

2.1 |

% |

|

|||||||

*Adjusted EBITDA is a Non-GAAP Performance Measure. Please see the attached table for a reconciliation of Adjusted EBITDA to GAAP net income (loss).

Fourth Quarter 2023 Results (compared with the prior-year period, unless noted otherwise)

Consolidated sales were up $37.1 million, or 23.5%. Aerospace sales increased $30.4 million, or 22.0%, driven by increased demand across our range of aerospace product lines. Test Systems sales increased $6.7 million on higher radio test revenue.

Consolidated operating income was $7.8 million, compared with operating loss of $3.2 million in the prior-year period. Improved operating income reflects higher sales volume, partially offset by $4.2 million in non-cash stock bonuses reinstated in the current quarter. The prior-year period operating loss benefited from a $1.5 million gain related to indemnification proceeds received during the quarter associated with a litigation settlement.

Interest expense was $5.9 million in the current period, compared with $3.6 million in the prior-year period, primarily driven by higher interest rates on credit facilities entered into in January 2023. Interest expense included approximately $0.9 million of non-cash amortization of capitalized financing-related fees.

Consolidated net income was $7.0 million, or $0.20 per diluted share, compared with net loss of $6.8 million, or $0.21 per diluted share, in the prior year. Tax benefit in the quarter was $5.4 million compared with a tax benefit of $0.4 million in the prior year.

Consolidated adjusted EBITDA increased to $24.8 million, or 12.7% of consolidated sales, compared with adjusted EBITDA of $7.8 million, or 4.9% of consolidated sales, in the prior-year period primarily as a result of higher sales.

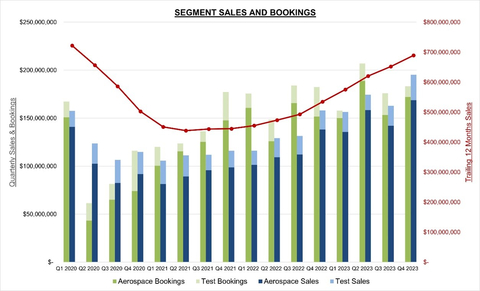

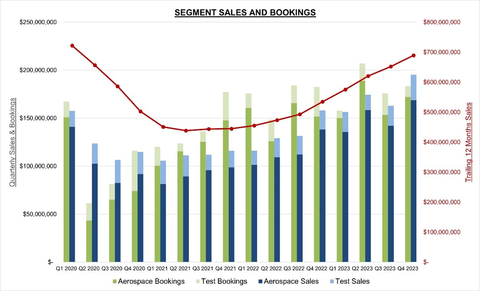

Bookings were $183.3 million in the quarter. For the year, bookings totaled $724.2 million, resulting in a book-to-bill ratio of 1.06:1.

Aerospace Segment Review (refer to sales by market and segment data in accompanying tables)

Aerospace Fourth Quarter 2023 Results (compared with the prior-year period, unless noted otherwise)

Aerospace segment sales increased $30.4 million, or 22.0%, to $168.7 million. The improvement was driven by a 20.8% increase, or $21.3 million, in commercial transport sales. Sales to this market were $124.2 million, or 63.6% of consolidated sales in the quarter, compared with $102.8 million, or 65.0% of consolidated sales in the fourth quarter of 2022. Higher airline spending and increasing OEM build rates drove increased demand.

General Aviation sales increased $5.5 million, or 37.8%, to $20.2 million. Military Aircraft sales increased $4.1 million, or 30.9%, to $17.3 million.

Aerospace segment operating profit of $14.3 million, or 8.5% of sales, compares with operating profit of $5.2 million, or 3.8% of sales, in the same period last year. Operating margin expansion reflects the leverage gained on higher volume. Operating profit in the fourth quarter of 2023 was impacted by $2.7 million in non-cash bonuses compared with no bonuses in the prior-year period.

Aerospace bookings were $172.1 million for a book-to-bill ratio of 1.02:1. Backlog for the Aerospace segment was a record $517.2 million at the end of 2023.

Mr. Gundermann commented, “Our Aerospace business continues to accelerate nicely, with revenue up 22% for the quarter and 31% for the year. Operating margins reflected the top line growth at 8.5% for the quarter and 4.1% for the year, significantly ahead of the comparator numbers for 2022. Demand remains strong with total bookings of $664 million in 2023, against sales of $605 million, for a book-to-bill of 1.10, supporting our expectation of continued growth in 2024.”

Test Systems Segment Review (refer to sales by market and segment data in accompanying tables)

Test Systems Fourth Quarter 2023 Results (compared with the prior-year period, unless noted otherwise)

Test Systems segment sales were $26.5 million, up $6.7 million primarily as a result of higher radio test revenue.

Test Systems segment operating loss was $0.2 million, an improvement over operating loss of $4.0 million in the fourth quarter of 2022. The improvement reflects higher sales volume coupled with the benefit of the realignment of staffing in the second quarter of 2023 and a $1.3 million decrease in litigation-related legal expenses. This helped to offset a $0.7 million increase in non-cash bonuses. Test Systems’ operating loss continues to be negatively affected by mix and under absorption of fixed costs due to volume. The Test Systems segment has been investing in significant new development programs which are expected to result in more profitable business in the near future.

Bookings for the Test Systems segment in the quarter were $11.2 million, for a book-to-bill ratio of 0.42:1 for the quarter. Backlog was $75.0 million at the end of 2023 compared with backlog of $93.7 million at the end of 2022.

Mr. Gundermann commented, “Our Test business ended the year with revenue of $84.4 million, up 14.5% over 2022. The business made significant progress as the year ended towards securing some significant contracts which are expected to result in a step up in volume as we move through 2024.”

Liquidity and Financing

Cash on hand at the end of the quarter was $11.3 million. Capital expenditures in the quarter were $1.6 million. Net debt was $161.2 million.

Cash used by operations was $1.7 million in the fourth quarter of 2023. During the quarter, accounts receivable increased $18.9 million while inventory decreased $10.7 million.

During the quarter, under its at-the-market offering, the Company sold 500,000 shares at an average price of $15.65 per share for net proceeds after offering expenses of $7.6 million.

David Burney, the Company’s Chief Financial Officer, said, “Liquidity continued to be tight during the quarter as investment in net working capital remained at elevated levels driven by higher accounts receivable from the strong fourth quarter sales. We made significant improvement in the second half of 2023 managing our inventory, which had grown significantly in the first half of the year. We are forecasting continuing improvement in inventory turnover and are forecasting cash flow from operations to be strong as we advance through 2024.”

He continued, “Our business is operating more smoothly and predictably with each passing quarter. As we are improving, we have reinitiated certain compensation and incentive programs that were suspended since the beginning of the pandemic. These programs normally pay out in cash, but are being paid in stock for now due to our cash position. We will revert to cash payments as liquidity allows.”

2024 Outlook

The Company expects 2024 revenue to be approximately $760 million to $795 million. The midpoint of this range would be a 13% increase over 2023 sales. Sales in the first quarter are expected to be approximately $170 million to $175 million and are projected to build progressively through the year.

Backlog at the end of the fourth quarter was $592.3 million, of which approximately $526.5 million is expected to ship in 2024. This represents about 68% of expected sales in 2024 at the mid-point of the range.

Planned capital expenditures for 2024 are expected to be in the range of $17 million to $22 million.

Peter Gundermann commented, “We expect 2024 will be another solid year of progress for our Company. First quarter sales are expected to be somewhat lighter than the fourth quarter due to customer schedules, but we expect continued strengthening in our top line throughout the rest of the year. Our guided range suggests another year of strong double-digit growth, and the higher volume will have a positive influence on our margins. We look forward to a year that will finally see us rebounding to the revenue level we were at in 2019 before the pandemic struck.”

Fourth Quarter 2023 Webcast and Conference Call

The Company will host a teleconference today at 4:45 p.m. ET. During the teleconference, management will review the financial and operating results for the period and discuss Astronics’ corporate strategy and outlook. A question-and-answer session will follow.

The Astronics conference call can be accessed by calling (412) 317-0518. The listen-only audio webcast can be monitored at investors.astronics.com. To listen to the archived call, dial (412) 317-6671 and enter replay pin number 10185538. The telephonic replay will be available from 8:45 p.m. on the day of the call through Wednesday, March 13, 2024. The webcast replay can be accessed via the investor relations section of the Company’s website where a transcript will also be posted once available.

About Astronics Corporation

Astronics Corporation (Nasdaq: ATRO) serves the world’s aerospace, defense, and other mission-critical industries with proven innovative technology solutions. Astronics works side-by-side with customers, integrating its array of power, connectivity, lighting, structures, interiors, and test technologies to solve complex challenges. For over 50 years, Astronics has delivered creative, customer-focused solutions with exceptional responsiveness. Today, global airframe manufacturers, airlines, military branches, completion centers, and Fortune 500 companies rely on the collaborative spirit and innovation of Astronics. The Company’s strategy is to increase its value by developing technologies and capabilities that provide innovative solutions to its targeted markets.

Safe Harbor Statement

This news release contains forward-looking statements as defined by the Securities Exchange Act of 1934. One can identify these forward-looking statements by the use of the words “expect,” “anticipate,” “plan,” “may,” “will,” “estimate” or other similar expressions and include all statements with regard to achieving any revenue or profitability expectations, the rate of recovery of the commercial aerospace widebody/long haul markets, the improvement in the supply chain, the productivity of manufacturing personnel and efficiency of staff, the effectiveness on profitability of cost reduction efforts, the timing of receipt of task orders or future orders, the continued momentum in the business and favorable tailwinds, and the expectations of demand by customers and markets. Because such statements apply to future events, they are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the statements. Important factors that could cause actual results to differ materially from what may be stated here include the impact of global pandemics and related governmental and other actions taken in response, the trend in growth with passenger power and connectivity on airplanes, the state of the aerospace and defense industries, the market acceptance of newly developed products, internal production capabilities, the timing of orders received, the status of customer certification processes and delivery schedules, the demand for and market acceptance of new or existing aircraft which contain the Company’s products, the need for new and advanced test and simulation equipment, customer preferences and relationships, the effectiveness of the Company’s supply chain, and other factors which are described in filings by Astronics with the Securities and Exchange Commission. The Company assumes no obligation to update forward-looking information in this news release whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial conditions or prospects, or otherwise.

FINANCIAL TABLES FOLLOW

ASTRONICS CORPORATION |

||||||||||||||

CONSOLIDATED STATEMENT OF OPERATIONS DATA |

||||||||||||||

(Unaudited, $ in thousands except per share data) |

||||||||||||||

|

|

|

|

|||||||||||

|

Three Months Ended |

|

Year Ended |

|||||||||||

|

12/31/2023 |

12/31/2022 |

|

12/31/2023 |

12/31/2022 |

|||||||||

Sales1 |

$ |

195,292 |

|

$ |

158,153 |

|

|

$ |

689,206 |

|

$ |

534,894 |

|

|

Cost of products sold2 |

|

155,319 |

|

|

136,643 |

|

|

|

568,410 |

|

|

463,354 |

|

|

Gross profit |

|

39,973 |

|

|

21,510 |

|

|

|

120,796 |

|

|

71,540 |

|

|

Gross margin |

|

20.5 |

% |

|

13.6 |

% |

|

|

17.5 |

% |

|

13.4 |

% |

|

|

|

|

|

|

|

|||||||||

Selling, general and administrative3 |

|

32,191 |

|

|

24,677 |

|

|

|

127,467 |

|

|

101,584 |

|

|

SG&A % of sales |

|

16.5 |

% |

|

15.6 |

% |

|

|

18.5 |

% |

|

19.0 |

% |

|

Income (loss) from operations |

|

7,782 |

|

|

(3,167 |

) |

|

|

(6,671 |

) |

|

(30,044 |

) |

|

Operating margin |

|

4.0 |

% |

|

(2.0 |

)% |

|

|

(1.0 |

)% |

|

(5.6 |

)% |

|

|

|

|

|

|

|

|||||||||

Net gain on sale of business4 |

|

— |

|

|

— |

|

|

|

3,427 |

|

|

11,284 |

|

|

Other expense (income)5 |

|

301 |

|

|

431 |

|

|

|

(261 |

) |

|

1,611 |

|

|

Interest expense, net |

|

5,947 |

|

|

3,610 |

|

|

|

23,328 |

|

|

9,422 |

|

|

Income (loss) before tax |

|

1,534 |

|

|

(7,208 |

) |

|

|

(26,311 |

) |

|

(29,793 |

) |

|

Income tax (benefit) expense |

|

(5,442 |

) |

|

(429 |

) |

|

|

110 |

|

|

5,954 |

|

|

Net income (loss) |

$ |

6,976 |

|

$ |

(6,779 |

) |

|

$ |

(26,421 |

) |

$ |

(35,747 |

) |

|

Net income (loss) % of sales |

|

3.6 |

% |

|

(4.3 |

)% |

|

|

(3.8 |

)% |

|

(6.7 |

)% |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

Basic earnings (loss) per share: |

$ |

0.20 |

|

$ |

(0.21 |

) |

|

$ |

(0.80 |

) |

$ |

(1.11 |

) |

|

Diluted earnings (loss) per share: |

$ |

0.20 |

|

$ |

(0.21 |

) |

|

$ |

(0.80 |

) |

$ |

(1.11 |

) |

|

|

|

|

|

|

|

|||||||||

Weighted average diluted shares outstanding (in thousands) |

|

34,512 |

|

|

32,401 |

|

|

|

33,104 |

|

|

32,164 |

|

|

|

|

|

|

|

|

|||||||||

Capital expenditures |

$ |

1,606 |

|

$ |

3,392 |

|

|

$ |

7,643 |

|

$ |

7,675 |

|

|

Depreciation and amortization |

$ |

6,346 |

|

$ |

6,872 |

|

|

$ |

26,104 |

|

$ |

27,777 |

|

|

1 In the year ended December 31, 2023, $5.8 million was recognized in sales related to the reversal of a deferred revenue liability recorded with a previous acquisition within our Test Systems Segment.

2 In the year ended December 31, 2023, $3.6 million in non-cash inventory reserves were recorded related to the bankruptcy of a non-core contract manufacturing customer included within the Aerospace segment. In the year ended December 31, 2022, $6.0 million of the Aviation Manufacturing Jobs Protection Program grant was recognized as an offset to cost of products sold.

3 Selling, general and administrative expense in the year ended December 31, 2023 includes $7.5 million in non-cash accounts receivable reserves related to the bankruptcy of a non-core contract manufacturing customer included within the Aerospace segment. The year ended December 31, 2022 reflects $4.6 million related to the settlement of a litigation claim, a customer accommodation dispute, and a lease termination settlement. In the fourth quarter of 2022, the Company was indemnified by other parties for approximately $1.5 million related to the settlement of the litigation claim and record the gain as an offset to SG&A in that period.

4 Net gain on sale of business for the year ended December 31, 2023 and 2022 is comprised of the additional gain on the sale of the Company’s former semiconductor test business resulting from the contingent earnout for the 2022 and 2021 calendar year, respectively.

5 Other expense (income) for the year ended December 31, 2023 includes income of $1.8 million associated with the reversal of a liability related to an equity investment, as we are no longer required to make the associated payment.

Reconciliation to Non-GAAP Performance Measures

In addition to reporting net income, a U.S. generally accepted accounting principle (“GAAP”) measure, we present Adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization, non-cash equity-based compensation expense, goodwill, intangible and long-lived asset impairment charges, equity investment income or loss, legal reserves, settlements and recoveries, restructuring charges, gains or losses associated with the sale of businesses and grant benefits recorded related to the AMJP program), which is a non-GAAP measure. The Company’s management believes Adjusted EBITDA is an important measure of operating performance because it allows management, investors and others to evaluate and compare the performance of its core operations from period to period by removing the impact of the capital structure (interest), tangible and intangible asset base (depreciation and amortization), taxes, equity-based compensation expense, goodwill, intangible and long-lived asset impairment charges, equity investment income or loss, non-cash reserves related to customer bankruptcy filings, legal reserves, settlements and recoveries, litigation-related expenses, restructuring charges, gains or losses associated with the sale of businesses and grant benefits recorded related to the AMJP program, which is not commensurate with the core activities of the reporting period in which it is included. As such, the Company uses Adjusted EBITDA as a measure of performance when evaluating its business and as a basis for planning and forecasting. Adjusted EBITDA is not a measure of financial performance under GAAP and is not calculated through the application of GAAP. As such, it should not be considered as a substitute for the GAAP measure of net income and, therefore, should not be used in isolation of, but in conjunction with, the GAAP measure. Adjusted EBITDA, as presented, may produce results that vary from the GAAP measure and may not be comparable to a similarly defined non-GAAP measure used by other companies.

ASTRONICS CORPORATION |

|||||||||||||||

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

|

|

|

|

|

|

|

|

||||||||

|

Consolidated |

||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

12/31/2023 |

|

12/31/2022 |

|

12/31/2023 |

|

12/31/2022 |

||||||||

Net income (loss) |

$ |

6,976 |

|

|

$ |

(6,779 |

) |

|

$ |

(26,421 |

) |

|

$ |

(35,747 |

) |

Add back (deduct): |

|

|

|

|

|

|

|

||||||||

Interest expense |

|

5,947 |

|

|

|

3,610 |

|

|

|

23,328 |

|

|

|

9,422 |

|

Income tax (benefit) expense |

|

(5,442 |

) |

|

|

(429 |

) |

|

|

110 |

|

|

|

5,954 |

|

Depreciation and amortization expense |

|

6,346 |

|

|

|

6,872 |

|

|

|

26,104 |

|

|

|

27,777 |

|

Equity-based compensation expense |

|

1,595 |

|

|

|

1,319 |

|

|

|

7,198 |

|

|

|

6,497 |

|

Non-cash stock bonus expense |

|

4,249 |

|

|

|

— |

|

|

|

4,249 |

|

|

|

— |

|

Equity investment accrued payable write-off |

|

— |

|

|

|

— |

|

|

|

(1,800 |

) |

|

|

— |

|

Restructuring-related charges including severance |

|

— |

|

|

|

— |

|

|

|

564 |

|

|

|

199 |

|

Legal reserve, settlements and recoveries |

|

— |

|

|

|

(1,500 |

) |

|

|

(2,532 |

) |

|

|

500 |

|

Customer accommodation settlement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,100 |

|

Lease termination settlement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

450 |

|

Litigation-related legal expenses |

|

3,826 |

|

|

|

3,495 |

|

|

|

17,850 |

|

|

|

6,935 |

|

Non-cash 401K contribution accrual |

|

1,333 |

|

|

|

1,212 |

|

|

|

5,106 |

|

|

|

4,512 |

|

AMJP grant benefit |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,008 |

) |

Net gain on sale of business |

|

— |

|

|

|

— |

|

|

|

(3,427 |

) |

|

|

(11,284 |

) |

Non-cash reserves for customer bankruptcy |

|

— |

|

|

|

— |

|

|

|

11,074 |

|

|

|

— |

|

Deferred liability recovery |

|

— |

|

|

|

— |

|

|

|

(5,824 |

) |

|

|

— |

|

Adjusted EBITDA |

$ |

24,830 |

|

|

$ |

7,800 |

|

|

$ |

55,579 |

|

|

$ |

11,307 |

|

|

|

|

|

|

|

|

|

||||||||

Sales |

$ |

195,292 |

|

|

$ |

158,153 |

|

|

$ |

689,206 |

|

|

$ |

534,894 |

|

Adjusted EBITDA margin |

|

12.7 |

% |

|

|

4.9 |

% |

|

|

8.1 |

% |

|

|

2.1 |

% |

|

|

|

|

|

|||||||||||

ASTRONICS CORPORATION |

||||||

CONSOLIDATED BALANCE SHEET DATA |

||||||

($ in thousands) |

||||||

|

(unaudited) |

|

|

|||

|

12/31/2023 |

|

12/31/2022 |

|||

ASSETS |

|

|

|

|||

Cash and cash equivalents |

$ |

4,756 |

|

$ |

13,778 |

|

Restricted cash |

|

6,557 |

|

|

— |

|

Accounts receivable and uncompleted contracts |

|

172,108 |

|

|

147,790 |

|

Inventories |

|

191,801 |

|

|

187,983 |

|

Other current assets |

|

14,560 |

|

|

15,743 |

|

Property, plant and equipment, net |

|

85,436 |

|

|

90,658 |

|

Other long-term assets |

|

34,944 |

|

|

21,633 |

|

Intangible assets, net |

|

65,420 |

|

|

79,277 |

|

Goodwill |

|

58,210 |

|

|

58,169 |

|

Total assets |

$ |

633,792 |

|

$ |

615,031 |

|

|

|

|

|

|||

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|||

Current maturities of long-term debt |

$ |

8,996 |

|

$ |

4,500 |

|

Accounts payable and accrued expenses |

|

112,309 |

|

|

114,545 |

|

Customer advances and deferred revenue |

|

22,029 |

|

|

32,567 |

|

Long-term debt |

|

159,237 |

|

|

159,500 |

|

Other liabilities |

|

81,703 |

|

|

63,999 |

|

Shareholders' equity |

|

249,518 |

|

|

239,920 |

|

Total liabilities and shareholders' equity |

$ |

633,792 |

|

$ |

615,031 |

|

ASTRONICS CORPORATION |

||||||||

CONSOLIDATED CASH FLOWS DATA |

||||||||

|

Year Ended |

|||||||

(Unaudited, $ in thousands) |

December 31, 2023 |

|

December 31, 2022 |

|||||

Cash flows from operating activities: |

|

|

|

|||||

Net loss |

$ |

(26,421 |

) |

|

$ |

(35,747 |

) |

|

Adjustments to reconcile net loss to cash flows from operating activities: |

|

|

|

|||||

Non-cash items: |

|

|

|

|||||

Depreciation and amortization |

|

26,104 |

|

|

|

27,777 |

|

|

Amortization of deferred financing fees |

|

3,023 |

|

|

|

— |

|

|

Provisions for non-cash losses on inventory and receivables |

|

16,003 |

|

|

|

3,415 |

|

|

Equity-based compensation expense |

|

7,198 |

|

|

|

6,497 |

|

|

Deferred tax expense |

|

146 |

|

|

|

19 |

|

|

Operating lease non-cash expense |

|

5,088 |

|

|

|

6,028 |

|

|

Non-cash accrued 401K contribution |

|

5,106 |

|

|

|

4,512 |

|

|

Non-cash accrued stock bonus expense |

|

4,249 |

|

|

|

— |

|

|

Net gain on sale of business, before taxes |

|

(3,427 |

) |

|

|

(11,284 |

) |

|

Non-cash litigation provision adjustment |

|

(1,305 |

) |

|

|

500 |

|

|

Non-cash deferred liability recovery |

|

(5,824 |

) |

|

|

— |

|

|

Other |

|

1,913 |

|

|

|

3,086 |

|

|

Changes in operating assets and liabilities providing (using) cash: |

|

|

|

|||||

Accounts receivable |

|

(31,872 |

) |

|

|

(41,646 |

) |

|

Inventories |

|

(13,283 |

) |

|

|

(34,058 |

) |

|

Accounts payable |

|

(4,495 |

) |

|

|

27,843 |

|

|

Accrued expenses |

|

4,634 |

|

|

|

1,193 |

|

|

Income taxes |

|

(1,949 |

) |

|

|

16,134 |

|

|

Customer advanced payments and deferred revenue |

|

(4,835 |

) |

|

|

5,264 |

|

|

Operating lease liabilities |

|

(4,880 |

) |

|

|

(7,295 |

) |

|

Supplemental retirement plan liabilities |

|

(408 |

) |

|

|

(405 |

) |

|

Other assets and liabilities |

|

1,285 |

|

|

|

(145 |

) |

|

Net cash used by operating activities |

|

(23,950 |

) |

|

|

(28,312 |

) |

|

Cash flows from investing activities: |

|

|

|

|||||

Proceeds from sales of businesses and assets |

|

3,537 |

|

|

|

22,061 |

|

|

Capital expenditures |

|

(7,643 |

) |

|

|

(7,675 |

) |

|

Net cash (used) provided by investing activities |

|

(4,106 |

) |

|

|

14,386 |

|

|

Cash flows from financing activities: |

|

|

|

|||||

Proceeds from long-term debt |

|

139,732 |

|

|

|

125,825 |

|

|

Principal payments on long-term debt |

|

(131,233 |

) |

|

|

(124,825 |

) |

|

Stock award and employee stock purchase plan (“ESPP”) activity |

|

2,476 |

|

|

|

97 |

|

|

Proceeds from at-the-market (“ATM”) stock sales |

|

21,269 |

|

|

|

— |

|

|

Finance lease principal payments |

|

(47 |

) |

|

|

(93 |

) |

|

Debt acquisition costs |

|

(6,762 |

) |

|

|

(2,416 |

) |

|

Net cash provided (used) by financing activities |

|

25,435 |

|

|

|

(1,412 |

) |

|

Effect of exchange rates on cash |

|

156 |

|

|

|

(641 |

) |

|

Decrease in cash and cash equivalents and restricted cash |

|

(2,465 |

) |

|

|

(15,979 |

) |

|

Cash and cash equivalents and restricted cash at beginning of year |

|

13,778 |

|

|

|

29,757 |

|

|

Cash and cash equivalents and restricted cash at end of year |

$ |

11,313 |

|

|

$ |

13,778 |

|

|

ASTRONICS CORPORATION |

||||||||||||||

SEGMENT DATA |

||||||||||||||

(Unaudited, $ in thousands) |

||||||||||||||

|

|

|

|

|

|

|||||||||

|

Three Months Ended |

|

Year Ended |

|||||||||||

|

12/31/2023 |

12/31/2022 |

|

12/31/2023 |

12/31/2022 |

|||||||||

Sales |

|

|

|

|

|

|||||||||

Aerospace |

$ |

168,784 |

|

$ |

138,335 |

|

|

$ |

605,001 |

|

$ |

461,206 |

|

|

Less Inter-segment |

|

(37 |

) |

|

— |

|

|

|

(171 |

) |

|

(10 |

) |

|

Total Aerospace |

|

168,747 |

|

|

138,335 |

|

|

|

604,830 |

|

|

461,196 |

|

|

|

|

|

|

|

|

|||||||||

Test Systems1 |

|

26,545 |

|

|

19,818 |

|

|

|

84,376 |

|

|

73,717 |

|

|

Less Inter-segment |

|

— |

|

|

— |

|

|

|

— |

|

|

(19 |

) |

|

Total Test Systems |

|

26,545 |

|

|

19,818 |

|

|

|

84,376 |

|

|

73,698 |

|

|

|

|

|

|

|

|

|||||||||

Total consolidated sales |

|

195,292 |

|

|

158,153 |

|

|

|

689,206 |

|

|

534,894 |

|

|

|

|

|

|

|

|

|||||||||

Segment operating profit (loss) and margins |

|

|

|

|

|

|||||||||

Aerospace2 |

|

14,287 |

|

|

5,202 |

|

|

|

24,629 |

|

|

(1,883 |

) |

|

|

|

8.5 |

% |

|

3.8 |

% |

|

|

4.1 |

% |

|

(0.4 |

)% |

|

Test Systems1 |

|

(224 |

) |

|

(3,993 |

) |

|

|

(8,745 |

) |

|

(8,118 |

) |

|

|

|

(0.8 |

)% |

|

(20.1 |

)% |

|

|

(10.4 |

)% |

|

(11.0 |

)% |

|

Total segment operating profit (loss) |

|

14,063 |

|

|

1,209 |

|

|

|

15,884 |

|

|

(10,001 |

) |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

Net gain on sale of business |

|

— |

|

|

— |

|

|

|

3,427 |

|

|

11,284 |

|

|

Interest expense |

|

5,947 |

|

|

3,610 |

|

|

|

23,328 |

|

|

9,422 |

|

|

Corporate expenses and other3 |

|

6,582 |

|

|

4,807 |

|

|

|

22,294 |

|

|

21,654 |

|

|

Income (loss) before taxes |

$ |

1,534 |

|

$ |

(7,208 |

) |

|

$ |

(26,311 |

) |

$ |

(29,793 |

) |

|

1 In the year ended December 31, 2023, $5.8 million was recognized in sales related to the reversal of a deferred revenue liability recorded with a previous acquisition within our Test Systems segment, which also benefits operating loss for the period. Absent that benefit, Test Systems operating profit loss was $14.6 million.

2 Aerospace segment operating profit in the year ended December 31, 2023 includes reserves for $11.1 million in accounts receivable and inventory related to the bankruptcy filing of a non-core contract manufacturing customer classified within the Aerospace segment. In the year ended December 31, 2022, $6.0 million of the Aviation Manufacturing Jobs Protection Program grant was recognized as an offset to the cost of products sold in the Aerospace segment.

3 Corporate expenses and other for the year ended December 31, 2023 includes income of $1.8 million associated with the reversal of a liability related to an equity investment, as we will no longer be required to make the associated payment.

ASTRONICS CORPORATION |

||||||||||||||||

SALES BY MARKET |

||||||||||||||||

(Unaudited, $ in thousands) |

||||||||||||||||

|

|

|

|

|

||||||||||||

|

Three Months Ended |

Year Ended |

2023 YTD |

|||||||||||||

12/31/2023 |

12/31/2022 |

% change |

12/31/2023 |

12/31/2022 |

% change |

% of Sales |

||||||||||

Aerospace Segment |

|

|

|

|

|

|

|

|

||||||||

Commercial Transport |

$ |

124,183 |

$ |

102,843 |

20.8 |

% |

|

$ |

432,199 |

$ |

314,564 |

37.4 |

% |

62.8 |

% |

|

Military Aircraft |

|

17,282 |

|

13,198 |

30.9 |

% |

|

|

61,617 |

|

54,534 |

13.0 |

% |

8.9 |

% |

|

General Aviation |

|

20,186 |

|

14,647 |

37.8 |

% |

|

|

80,842 |

|

63,395 |

27.5 |

% |

11.7 |

% |

|

Other |

|

7,096 |

|

7,647 |

(7.2 |

)% |

|

|

30,172 |

|

28,703 |

5.1 |

% |

4.4 |

% |

|

Aerospace Total |

|

168,747 |

|

138,335 |

22.0 |

% |

|

|

604,830 |

|

461,196 |

31.1 |

% |

87.8 |

% |

|

|

|

|

|

|

|

|

|

|

||||||||

Test Systems Segment1 |

|

|

|

|

|

|

|

|

||||||||

Government & Defense |

|

26,545 |

|

19,818 |

33.9 |

% |

|

|

84,376 |

|

73,698 |

14.5 |

% |

12.2 |

% |

|

|

|

|

|

|

|

|

|

|

||||||||

Total Sales |

$ |

195,292 |

$ |

158,153 |

23.5 |

% |

|

$ |

689,206 |

$ |

534,894 |

28.8 |

% |

|

||

SALES BY PRODUCT LINE |

||||||||||||||||

(Unaudited, $ in thousands) |

||||||||||||||||

|

|

|

|

|

||||||||||||

|

Three Months Ended |

|

Year Ended |

2023 YTD |

||||||||||||

|

12/31/2023 |

12/31/2022 |

% change |

|

12/31/2023 |

12/31/2022 |

% change |

% of Sales |

||||||||

Aerospace Segment |

|

|

|

|

|

|

|

|

||||||||

Electrical Power & Motion |

$ |

82,337 |

$ |

54,689 |

50.6 |

% |

|

$ |

268,049 |

$ |

187,446 |

43.0 |

% |

39.0 |

% |

|

Lighting & Safety |

|

40,467 |

|

34,008 |

19.0 |

% |

|

|

157,434 |

|

124,347 |

26.6 |

% |

22.8 |

% |

|

Avionics |

|

30,106 |

|

29,781 |

1.1 |

% |

|

|

113,117 |

|

97,234 |

16.3 |

% |

16.4 |

% |

|

Systems Certification |

|

6,423 |

|

10,566 |

(39.2 |

)% |

|

|

26,255 |

|

17,222 |

52.5 |

% |

3.8 |

% |

|

Structures |

|

2,318 |

|

1,644 |

41.0 |

% |

|

|

9,803 |

|

6,244 |

57.0 |

% |

1.4 |

% |

|

Other |

|

7,096 |

|

7,647 |

(7.2 |

)% |

|

|

30,172 |

|

28,703 |

5.1 |

% |

4.4 |

% |

|

Aerospace Total |

|

168,747 |

|

138,335 |

22.0 |

% |

|

|

604,830 |

|

461,196 |

31.1 |

% |

87.8 |

% |

|

|

|

|

|

|

|

|

|

|

||||||||

Test Systems Segment1 |

|

26,545 |

|

19,818 |

33.9 |

% |

|

|

84,376 |

|

73,698 |

14.5 |

% |

12.2 |

% |

|

|

|

|

|

|

|

|

|

|

||||||||

Total Sales |

$ |

195,292 |

$ |

158,153 |

23.5 |

% |

|

$ |

689,206 |

$ |

534,894 |

28.8 |

% |

|

||

1 Test Systems sales in the year ended December 31, 2023 included a $5.8 million reversal of a deferred revenue liability recorded with a previous acquisition.

ASTRONICS CORPORATION |

|||||||||||

ORDER AND BACKLOG TREND |

|||||||||||

(Unaudited, $ in thousands) |

|||||||||||

|

Q1

|

Q2

|

Q3

|

Q4

|

Trailing Twelve

|

||||||

|

4/1/2023 |

7/1/2023 |

9/30/2023 |

12/31/2023 |

12/31/2023 |

||||||

Sales |

|

|

|

|

|

||||||

Aerospace |

$ |

135,597 |

$ |

158,382 |

$ |

142,104 |

$ |

168,747 |

$ |

604,830 |

|

Test Systems1 |

|

20,941 |

|

16,072 |

|

20,818 |

|

26,545 |

|

84,376 |

|

Total Sales1 |

$ |

156,538 |

$ |

174,454 |

$ |

162,922 |

$ |

195,292 |

$ |

689,206 |

|

|

|

|

|

|

|

||||||

Bookings |

|

|

|

|

|

||||||

Aerospace |

$ |

150,096 |

$ |

188,800 |

$ |

153,272 |

$ |

172,106 |

$ |

664,274 |

|

Test Systems |

|

7,740 |

|

18,252 |

|

22,724 |

|

11,176 |

|

59,892 |

|

Total Bookings |

$ |

157,836 |

$ |

207,052 |

$ |

175,996 |

$ |

183,282 |

$ |

724,166 |

|

|

|

|

|

|

|

||||||

Backlog |

|

|

|

|

|

||||||

Aerospace2 |

$ |

472,295 |

$ |

502,713 |

$ |

513,881 |

$ |

517,240 |

|

||

Test Systems |

|

86,319 |

|

88,499 |

|

90,405 |

|

75,036 |

|

||

Total Backlog |

$ |

558,614 |

$ |

591,212 |

$ |

604,286 |

$ |

592,276 |

|

N/A |

|

|

|

|

|

|

|

||||||

Book:Bill Ratio |

|

|

|

|

|

||||||

Aerospace |

|

1.11 |

|

1.19 |

|

1.08 |

|

1.02 |

|

1.10 |

|

Test Systems1 |

|

0.51 |

|

1.14 |

|

1.09 |

|

0.42 |

|

0.76 |

|

Total Book:Bill1 |

|

1.05 |

|

1.19 |

|

1.08 |

|

0.94 |

|

1.06 |

|

1 In the first quarter of 2023, Test Systems and Total sales include the $5.8 million reversal of a deferred revenue liability. The book:bill ratios have been calculated excluding the impact of that transaction.

2 In November of 2023, a non-core contract manufacturing customer reported within the Aerospace segment declared bankruptcy, and as a result, Aerospace and Total Backlog was reduced by $19.9 million in all periods affected. In the bar chart presented, Aerospace and Total Bookings was reduced by $2.6 million and $17.2 million in second and third quarters of 2021, respectively.