BOSTON--(BUSINESS WIRE)--Institutional investors are decidedly bullish on just three areas of the market next year – bonds, private equity, and private debt – in a global economy that at least half of institutions see teetering on the verge of recession, according to Natixis Investment Managers’ (Natixis IM) survey of the world’s largest institutional investors.

While views on the stock market are split between bulls (46%) and bears (54%), institutional investors mostly agree that the promise of artificial intelligence will continue to drive outperformance in the technology sector. The two biggest threats throwing shade on their economic forecast are the influence of geopolitical bad actors and a slowdown in consumer spending.

Natixis IM surveyed 500 institutional investors who collectively manage $23.2 trillion in assets for public and private pensions, insurers, foundations, endowments, and sovereign wealth funds around the world. Survey participants also include 92 institutional investors in the US who are responsible for the management of $4.4 trillion in assets.

The survey found institutional investors’ year-ahead outlook to be muted.

- About half (51%) think recession is inevitable, a sentiment that runs strongest in the US (62%) and UK (67%).

- Of those in the recession camp, 74% expect it to be painful or very painful. Importantly, the number of institutions that no longer see recession anywhere on the horizon has more than doubled to 37% from 15% a year ago.

- While rate cuts have been an effective tool for cooling the inflation rate, 60% of institutions agree that higher inflation is the new normal.

- 61% also expect rates to remain higher for longer, though 51%, including 55% in the US, expect rate cuts in 2024, starting in the second (32%) or third (38%) quarter.

“The markets have demonstrated tremendous resilience in absorbing a sharp rise in rates, inflation, and two wars so far in 2023,” said Liana Magner, Executive Vice President and Head of Retirement and Institutional for Natixis IM in the US. “While institutional investors anticipate plenty of headwinds in the year ahead, few are lowering their assumed rate of return for 2024, and long-term return expectations remain solidly at 8% on average.”

Dark shadow of geopolitical uncertainty

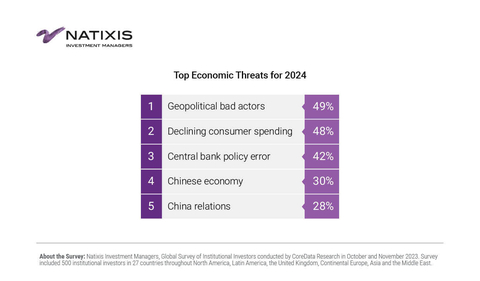

What speaks volumes about institutional investors’ mindset heading into 2024 is the degree to which they are worried about the geopolitical landscape. They see the influence of geopolitical bad actors as the biggest threat to the economy (49%), slightly ahead of a pullback in consumer spending (48%) and central bank policy error (42%).

The survey finds that institutional investors are considering multiple geopolitical risk factors:

- 70% think a growing alliance between Russia, North Korea, and Iran will lead to greater economic instability.

- 64% believe China’s geopolitical ambitions will split the global economy into two spheres, East and West. Similarly, 73% expect increasing fragmentation between the West and the emerging national economies of Brazil, Russia, India, China and South Africa (BRICS).

- 40% of institutions overall, including 47% in the US and 52% in Asia, are actively divesting China holdings as most believe that China’s geopolitical ambitions (73%) and regulatory uncertainties (79%) have made the country a less attractive investment opportunity.

- 62% think emerging markets have been overly dependent on China, and 70% agree that conscious decoupling from China presents an opportunity for new emerging markets to climb the global ladder. In fact, 59% predict that India will surpass China as the top emerging market for investment.

- 54% of institutions predict that the outcome of the 2024 US elections will be more relevant to global markets than in prior years. While 52% agree the election results will be mostly noise for the markets and less important than Fed policy (61%), most think that a messy election campaign will lead to increased market volatility (72%) and partisan divide will negatively impact global markets (71%).

Portfolio positioning reflects recession fears and silver linings

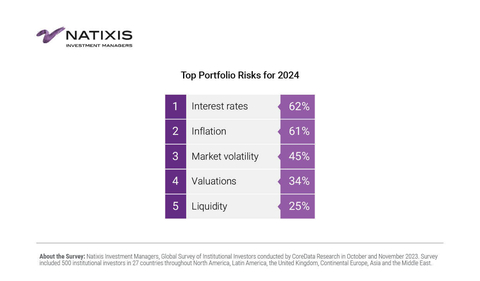

The impact of higher-for-longer rates and inflation remain top portfolio risks and is clearly reflected in institutional investors’ outlook for the markets and consensus calls. The survey found:

- 56% of institutional investors are actively de-risking their portfolios heading into 2024.

- More than two-thirds (69%) are bullish on the performance of bonds, with 62% calling for longer-duration bonds to outperform short. For corporates, their allocations stress quality as 76% expect higher rates and slowing growth to lead to an increase in corporate defaults.

- Most continue to be bullish on private equity (60%) and private debt (64%), with 66% saying there is still a significant delta between private and private assets. They see the best opportunities for private investments in data centers (52%) and housing including senior/assisted living (40%), affordable housing (26%), and student housing (24%).

- 61% expect large-cap stocks to outperform small-caps, and 57% think international markets will outperform. The exception is among US institutions, 65% of whom think US stock market performance continues to lead the rest of the world.

- 52% expect the information technology sector to outperform the stock market, as it did in 2023. Many also expect outperformance by the energy (49%) and healthcare (48%) sectors. They predict market performance or underperformance from remaining sectors, with consumer discretionary pulling up the rear.

“Macroeconomic and market uncertainty complicate the outlook for 2024, and not knowing what will happen next can contribute to higher levels of market volatility,” said Dave Goodsell, head of the Natixis Center for Investor Insights. “The portfolio is where it comes into focus, and most institutional investors tell us they’ve shored up their portfolios for known risks.”

Most institutional investors (59%) are forecasting an uptick in stock market volatility, and 41% expect a higher level of dispersion in returns. This is likely a key reason why nearly seven out of ten (68%) institutional investors expect active management to again outperform in 2024.

Artificial intelligence: Boon to productivity or existential threat?

Artificial intelligence has quickly moved from the stuff of science fiction to mainstream application and one of the hottest investment themes powering the technology sector. Institutional investors are finding both good and bad in the rapid progression of AI. The survey found:

- 75% of institutional investors think AI will unlock new investment opportunities and 63% think it will uncover portfolio risks that were otherwise undetectable.

- 66% see the race for AI supremacy as the new space race and one that will supercharge growth in the tech sector.

- Half (50%) believe AI could be a bigger investment opportunity than the Internet was, and for now, few (35%) are worried about AI being a bubble.

- 81% think it will be difficult for any country to effectively regulate AI. While most aren’t worried, 39% think the downside risk of AI outweighs the opportunity it presents, and 38% think that if unchecked, AI represents an existential threat to civilization as we know it.

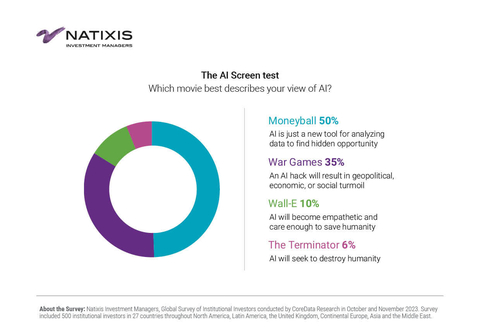

- When asked which movie best describes their view of AI, the top answer (50%) is the film “Moneyball,” reflective of institutional investors’ appreciation for AI as a data analytic tool to find hidden opportunities. In line with their concern about bad geopolitical actors, 35% see the future of AI as more like the 1983 techno-thriller “War Games.” One in ten (10%) believe AI will become more empathetic and care enough to save the planet and humanity, as in Disney’s “Wall-E.” Just 6% see AI as “The Terminator” that seeks to destroy humanity.

A full copy of the report on the Natixis Investment Managers’ Institutional Investor Outlook for 2024 can be found here: https://www.im.natixis.com/us/research/2024-institutional-outlook.

Methodology

Natixis Investment Managers Global Survey of Institutional Investors conducted by CoreData Research in October and November 2023. Survey participants included 500 institutional investors in 27 countries throughout North America, Latin America, the United Kingdom, Continental Europe, Asia, and the Middle East.

About the Natixis Center for Investor Insight

The Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers1 with more than $1.1 trillion assets under management2 (€1.1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various US registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2023 ranked Natixis Investment Managers as the 17th largest asset manager in the world based on assets under management as of December 31, 2022.

2 Assets under management (“AUM”) of current affiliated entities measured as of September 30, 2023 are $1,179.7 billion (€1,114.3 billion). AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed-income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted. Actual results may vary.

6133403.1.1