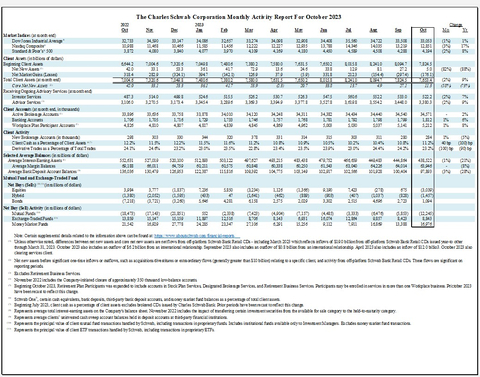

WESTLAKE, Texas--(BUSINESS WIRE)--The Charles Schwab Corporation released its Monthly Activity Report today. Company highlights for the month of October 2023 include:

- Core net new assets brought to the company excluding Ameritrade brokerage originated clients equaled $16.1 billion for the month, while total core net new assets across all clients totaled $11.3 billion in October. These flows reflect expected attrition from former Ameritrade clients as well as delayed tax disbursements by clients in certain states such as California.

- Total client assets were $7.65 trillion as of month-end October, up 9% from October 2022 and down 2% compared to September 2023.

- Client cash on the balance sheet plus bank deposit account balances ended the month at $397.9 billion, as client tax disbursements and seasonal advisory fee payments influenced the October trend. Equaling 5.2% at October month-end, the ratio of transactional sweep cash to total client assets has remained relatively stable since July.

- In an effort to further enhance transparency regarding all the components of client cash, the company has added incremental data to the Monthly Activity Report Supplement available on the Investor Relations website.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with 34.6 million active brokerage accounts, 5.2 million workplace plan participant accounts, 1.8 million banking accounts, and $7.65 trillion in client assets as of October 31, 2023. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiaries, Charles Schwab & Co., Inc., TD Ameritrade, Inc., and TD Ameritrade Clearing, Inc. (members SIPC, https://www.sipc.org), and their affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent, fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at https://www.aboutschwab.com. TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are separate but affiliated companies and subsidiaries of TD Ameritrade Holding Corporation. TD Ameritrade Holding Corporation is a wholly owned subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank.

| The Charles Schwab Corporation Monthly Activity Report For October 2023 | |||||||||||||||||||||||||||||||||||||||||||

2022 |

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change |

|||||||||||||||||

Oct |

|

Nov |

|

Dec |

|

Jan |

|

Feb |

|

Mar |

|

Apr |

|

May |

|

Jun |

|

Jul |

|

Aug |

|

Sep |

|

Oct |

|

Mo. |

Yr. |

||||||||||||||||

| Market Indices (at month end) | |||||||||||||||||||||||||||||||||||||||||||

| Dow Jones Industrial Average® | 32,733 |

|

34,590 |

|

33,147 |

|

34,086 |

|

32,657 |

|

33,274 |

|

34,098 |

|

32,908 |

|

34,408 |

|

35,560 |

|

34,722 |

|

33,508 |

|

33,053 |

|

(1%) |

1% |

|||||||||||||||

| Nasdaq Composite® | 10,988 |

|

11,468 |

|

10,466 |

|

11,585 |

|

11,456 |

|

12,222 |

|

12,227 |

|

12,935 |

|

13,788 |

|

14,346 |

|

14,035 |

|

13,219 |

|

12,851 |

|

(3%) |

17% |

|||||||||||||||

| Standard & Poor’s® 500 | 3,872 |

|

4,080 |

|

3,840 |

|

4,077 |

|

3,970 |

|

4,109 |

|

4,169 |

|

4,180 |

|

4,450 |

|

4,589 |

|

4,508 |

|

4,288 |

|

4,194 |

|

(2%) |

8% |

|||||||||||||||

| Client Assets (in billions of dollars) |

|

|

|||||||||||||||||||||||||||||||||||||||||

| Beginning Client Assets | 6,644.2 |

|

7,004.6 |

|

7,320.6 |

|

7,049.8 |

|

7,480.6 |

|

7,380.2 |

|

7,580.0 |

|

7,631.5 |

|

7,650.2 |

|

8,015.8 |

|

8,241.0 |

|

8,094.7 |

|

7,824.5 |

|

|

|

|||||||||||||||

| Net New Assets (1) | 42.0 |

|

33.1 |

|

53.3 |

|

36.1 |

|

41.7 |

|

72.9 |

|

13.6 |

|

24.6 |

|

33.8 |

|

12.9 |

|

8.1 |

|

27.2 |

|

5.0 |

|

(82%) |

(88%) |

|||||||||||||||

| Net Market Gains (Losses) | 318.4 |

|

282.9 |

|

(324.1 |

) |

394.7 |

|

(142.1 |

) |

126.9 |

|

37.9 |

|

(5.9 |

) |

331.8 |

|

212.3 |

|

(154.4 |

) |

(297.4 |

) |

(176.1 |

) |

|

|

|||||||||||||||

| Total Client Assets (at month end) | 7,004.6 |

|

7,320.6 |

|

7,049.8 |

|

7,480.6 |

|

7,380.2 |

|

7,580.0 |

|

7,631.5 |

|

7,650.2 |

|

8,015.8 |

|

8,241.0 |

|

8,094.7 |

|

7,824.5 |

|

7,653.4 |

|

(2%) |

9% |

|||||||||||||||

| Core Net New Assets (2) | 42.0 |

|

33.1 |

|

53.3 |

|

36.1 |

|

41.7 |

|

53.9 |

|

(2.3 |

) |

20.7 |

|

33.8 |

|

13.7 |

|

4.9 |

|

27.1 |

|

11.3 |

|

(58%) |

(73%) |

|||||||||||||||

| Receiving Ongoing Advisory Services (at month end) |

|

|

|||||||||||||||||||||||||||||||||||||||||

| Investor Services | 487.3 |

|

514.0 |

|

499.8 |

|

524.6 |

|

515.5 |

|

526.2 |

|

530.7 |

|

526.3 |

|

547.5 |

|

560.6 |

|

552.2 |

|

533.0 |

|

522.2 |

|

(2%) |

7% |

|||||||||||||||

| Advisor Services (3) | 3,106.0 |

|

3,270.5 |

|

3,173.4 |

|

3,345.4 |

|

3,289.6 |

|

3,369.3 |

|

3,394.9 |

|

3,377.8 |

|

3,527.8 |

|

3,619.8 |

|

3,554.2 |

|

3,448.0 |

|

3,380.3 |

|

(2%) |

9% |

|||||||||||||||

| Client Accounts (at month end, in thousands) |

|

|

|||||||||||||||||||||||||||||||||||||||||

| Active Brokerage Accounts (4) | 33,896 |

|

33,636 |

|

33,758 |

|

33,878 |

|

34,010 |

|

34,120 |

|

34,248 |

|

34,311 |

|

34,382 |

|

34,434 |

|

34,440 |

|

34,540 |

|

34,571 |

|

- |

2% |

|||||||||||||||

| Banking Accounts | 1,706 |

|

1,705 |

|

1,716 |

|

1,729 |

|

1,733 |

|

1,746 |

|

1,757 |

|

1,768 |

|

1,781 |

|

1,792 |

|

1,798 |

|

1,799 |

|

1,812 |

|

1% |

6% |

|||||||||||||||

| Workplace Plan Participant Accounts (5) | 4,826 |

|

4,810 |

|

4,807 |

|

4,817 |

|

4,839 |

|

4,845 |

|

4,869 |

|

4,962 |

|

5,003 |

|

5,030 |

|

5,037 |

|

5,141 |

|

5,212 |

|

1% |

8% |

|||||||||||||||

| Client Activity |

|

|

|||||||||||||||||||||||||||||||||||||||||

| New Brokerage Accounts (in thousands) | 298 |

|

303 |

|

330 |

|

344 |

|

320 |

|

378 |

|

331 |

|

314 |

|

315 |

|

303 |

|

311 |

|

280 |

|

284 |

|

1% |

(5%) |

|||||||||||||||

| Client Cash as a Percentage of Client Assets (6,7) | 12.2 |

% |

11.5 |

% |

12.2 |

% |

11.5 |

% |

11.6 |

% |

11.2 |

% |

10.8 |

% |

10.9 |

% |

10.5 |

% |

10.2 |

% |

10.4 |

% |

10.8 |

% |

11.2 |

% |

40 bp |

(100) bp |

|||||||||||||||

| Derivative Trades as a Percentage of Total Trades | 24.1 |

% |

24.6 |

% |

23.2 |

% |

23.0 |

% |

23.5 |

% |

22.8 |

% |

23.4 |

% |

23.5 |

% |

23.9 |

% |

23.0 |

% |

24.4 |

% |

24.2 |

% |

23.2 |

% |

(100) bp |

(90) bp |

|||||||||||||||

| Selected Average Balances (in millions of dollars) |

|

|

|||||||||||||||||||||||||||||||||||||||||

| Average Interest-Earning Assets (8) | 552,631 |

|

527,019 |

|

520,100 |

|

512,893 |

|

503,122 |

|

497,627 |

|

493,215 |

|

483,438 |

|

479,752 |

|

466,659 |

|

449,483 |

|

444,864 |

|

438,522 |

|

(1%) |

(21%) |

|||||||||||||||

| Average Margin Balances | 69,188 |

|

66,011 |

|

64,759 |

|

60,211 |

|

60,575 |

|

60,848 |

|

60,338 |

|

60,250 |

|

61,543 |

|

63,040 |

|

64,226 |

|

64,014 |

|

63,946 |

|

- |

(8%) |

|||||||||||||||

| Average Bank Deposit Account Balances (9) | 136,036 |

|

130,479 |

|

126,953 |

|

122,387 |

|

115,816 |

|

109,392 |

|

104,775 |

|

103,149 |

|

102,917 |

|

102,566 |

|

101,928 |

|

100,404 |

|

97,893 |

|

(3%) |

(28%) |

|||||||||||||||

| Mutual Fund and Exchange-Traded Fund | |||||||||||||||||||||||||||||||||||||||||||

| Net Buys (Sells) (10,11) (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||

| Equities | 3,984 |

|

3,777 |

|

(1,837 |

) |

7,236 |

|

5,850 |

|

(3,234 |

) |

1,126 |

|

(1,366 |

) |

9,190 |

|

7,423 |

|

(278 |

) |

675 |

|

(3,039 |

) |

|||||||||||||||||

| Hybrid | (1,380 |

) |

(2,052 |

) |

(1,595 |

) |

(433 |

) |

47 |

|

(1,641 |

) |

(462 |

) |

(889 |

) |

(903 |

) |

(407 |

) |

(1,037 |

) |

(828 |

) |

(1,457 |

) |

|||||||||||||||||

| Bonds | (7,218 |

) |

(3,721 |

) |

(3,260 |

) |

5,646 |

|

4,281 |

|

6,158 |

|

2,575 |

|

2,029 |

|

3,302 |

|

2,515 |

|

4,696 |

|

2,723 |

|

1,094 |

|

|||||||||||||||||

| Net Buy (Sell) Activity (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||

| Mutual Funds (10) | (18,473 |

) |

(17,143 |

) |

(21,851 |

) |

552 |

|

(2,338 |

) |

(7,423 |

) |

(4,904 |

) |

(7,157 |

) |

(4,485 |

) |

(3,333 |

) |

(6,476 |

) |

(5,853 |

) |

(12,245 |

) |

|||||||||||||||||

| Exchange-Traded Funds (11) | 13,859 |

|

15,147 |

|

15,159 |

|

11,897 |

|

12,516 |

|

8,706 |

|

8,143 |

|

6,931 |

|

16,074 |

|

12,864 |

|

9,857 |

|

8,423 |

|

8,843 |

|

|||||||||||||||||

| Money Market Funds | 21,542 |

|

16,929 |

|

27,778 |

|

24,285 |

|

23,347 |

|

27,106 |

|

6,291 |

|

15,256 |

|

9,112 |

|

7,911 |

|

16,869 |

|

13,388 |

|

16,976 |

|

|||||||||||||||||

| Note: Certain supplemental details related to the information above can be found at: https://www.aboutschwab.com/financial-reports. | ||||||||||||||||||||||||||||||

(1) |

Unless otherwise noted, differences between net new assets and core net new assets are net flows from off-platform Schwab Bank Retail CDs - including March 2023 which reflects inflows of $19.0 billion from off-platform Schwab Bank Retail CDs issued year-to-date through March 31, 2023. October 2023 also includes an outflow of $6.2 billion from an international relationship. September 2023 also includes an outflow of $0.8 billion from an international relationship. April 2023 also includes an inflow of $12.0 billion from a mutual fund clearing services client. | |||||||||||||||||||||||||||||

(2) |

Net new assets before significant one-time inflows or outflows, such as acquisitions/divestitures or extraordinary flows (generally greater than $10 billion) relating to a specific client, and activity from off-platform Schwab Bank Retail CDs. These flows may span multiple reporting periods. | |||||||||||||||||||||||||||||

(3) |

Excludes Retirement Business Services. | |||||||||||||||||||||||||||||

(4) |

November 2022 includes the Company-initiated closure of approximately 350 thousand low-balance accounts. | |||||||||||||||||||||||||||||

(5) |

Beginning October 2023, Retirement Plan Participants was expanded to include accounts in Stock Plan Services, Designated Brokerage Services, and Retirement Business Services. Participants may be enrolled in services in more than one Workplace business. Prior periods have been recast to reflect this change. | |||||||||||||||||||||||||||||

(6) |

Schwab One®, certain cash equivalents, bank deposits, third-party bank deposit accounts, and money market fund balances as a percentage of total client assets. | |||||||||||||||||||||||||||||

(7) |

Beginning July 2023, client cash as a percentage of client assets excludes brokered CDs issued by Charles Schwab Bank. Prior periods have been recast to reflect this change. | |||||||||||||||||||||||||||||

(8) |

Represents average total interest-earning assets on the Company's balance sheet. November 2022 includes the impact of transferring certain investment securities from the available for sale category to the held-to-maturity category. | |||||||||||||||||||||||||||||

(9) |

Represents average clients’ uninvested cash sweep account balances held in deposit accounts at third-party financial institutions. | |||||||||||||||||||||||||||||

(10) |

Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. | |||||||||||||||||||||||||||||

(11) |

Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. | |||||||||||||||||||||||||||||