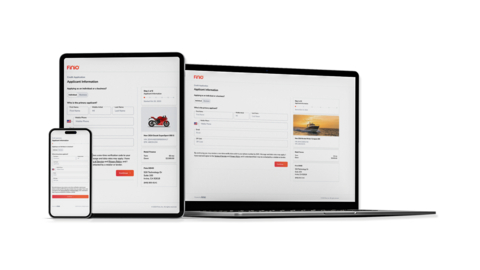

IRVINE, Calif.--(BUSINESS WIRE)--Finio, Inc., the revolutionary digital lending and F&I platform for motorcycle, powersports, marine, RV, commercial vehicle, and other industries, today unveiled its multi-lender credit application web plugin that enables customers to get approved in minutes.

“Credit discovery is quickly becoming an integral part of a customer’s online research,” says Nick Stellman, COO of Finio. “Rather than leaving things up to chance, buyers can now secure firm offers of credit before they set foot into the showroom.”

As an online F&I solution, Finio facilitates a real-time process between dealerships, lenders, and their customers, as credit approval is increasingly moving up in the purchase funnel. Participating dealers benefit from a high degree of configurability, as each can set up their own roster of lenders, submission waterfall, markup rules, and fee structure – to name just a few. Authorized dealership users can access transactions in real time through Finio’s Sales and F&I Portal, which can facilitate an end-to-end digital process or a seamless on- to offline transition. Likewise, lenders benefit from smart lender routing based on their credit appetite, resulting in incremental volume while generating increased efficiencies and lower compliance risk.

“We help generate deep funnel deals in an ecosystem that is reliant on financing and leasing,” adds Andy Hinrichs, CEO of Finio. “With lender approved deals in hand, retailers can better target their customer outreach based on true purchase intent and customers’ financing capacity.”

Finio’s multi-lender digital finance engine can be integrated with any vehicle or leisure marine website, such as dealer, manufacturer, and lender websites, as well as online marketplaces.

About Finio

Finio, Inc. is a modern digital lending and credit aggregation platform for the powersports, motorcycle, marine, recreation, commercial vehicle, and other auto-adjacent industries. The company’s compliant and secure sales and F&I hub facilitates seamless digital retailing and lending processes between dealerships, manufacturers, lenders, and their customers. Based in Irvine, Calif., the company is backed by an award-winning team of financial technology (FinTech) innovators.