BOSTON--(BUSINESS WIRE)--For the first time in ten years, nearly all developed countries in Natixis Investment Managers’ Global Retirement Index (GRI), including Canada, received a higher overall score for retirement security over the prior year. The annual index, released today, shows improved economic conditions, mainly the result of employment growth, wage gains, and interest rates. Yet Natixis Investment Managers’ (Natixis IM) research reveals that optimism at the macro level is not being felt in the everyday lives of retirees and working Canadians.

Natixis IM’s survey of affluent, individual investors with at least $100,000 in investable assets found that 32% of working respondents in Canada feel inflation is killing their dreams for retirement. Most (80%) of Canadians surveyed, including 68% of retirees, say that recent history has shown just how big a threat inflation is to their retirement security, devaluing their income and savings. At the same time, many are contemplating the potential threat of reduced government benefits, which ranks among their top three fears about retirement, the survey found.

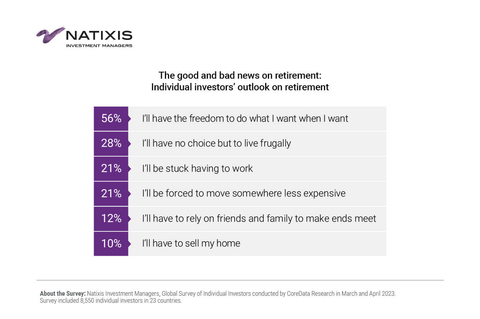

While 36% of working Canadians envision having the financial freedom to do what they want, when they want in retirement, 64% expect to make tough choices and trade-offs, including:

- 41% expect to have no other option but to live frugally in retirement

- 27% expect to be forced to move somewhere less expensive

- 21% expect to have to sell their home

- 20% anticipate being stuck having to work in retirement

- 14% think they will have to rely on family and friends to make ends meet

“As economies have rebounded from the global pandemic, employment and wages have increased but so has inflation, forcing central banks to boost interest rates. It’s a good news-bad news scenario for retirement security, and further underscores the complexity of the retirement funding challenge,” said Liana Magner, Executive Vice President and Head of Retirement and Institutional in the US for Natixis Investment Managers.

Retirement Index Trends

Canada received an overall score of 74% in 2023, up from 71% in 2022. The country ascended to 12th from 15th place in this year’s annual ranking of retirement security among the 44 countries in the Index. This was powered by higher scores in the unemployment and income equality indicators. The improvement also stems from stabilization of Canada’s interest rates and a marked improvement in progress implementing UN Sustainable Development goals which drove improvements in water resources and sanitation. At the same time, Canada saw a slight decrease in the population’s happiness scores as well as a decrease in life expectancy.

Natixis IM created the GRI in collaboration with CoreData Research to establish a global benchmark that incorporates the wide variety of factors essential for people to enjoy a healthy and secure retirement including not only important financial factors but also access to and cost of healthcare, climate conditions, the state of governance and general happiness of the population. The GRI rankings are relative, not absolute, and based on an aggregate of mean scores from 0% to 100% for 18 performance measures in each of four sub-indices -- Finances in retirement, material well-being, health, and quality of life – which are combined to provide an overall picture of the environment for retirees.

For the four sub-indices, Canada ranks as follows in the 2023 GRI compared to the year prior:

- 10th for finances in retirement, up from 12th

- 13th for health, down from 11th

- 17th for quality of life, down from 16th

- 19th for material well-being, up from 27th

The Global Top 25

For the second consecutive year, Norway held its first-place title on the GRI, followed in order by Switzerland (No. 2), Iceland (No. 3), and Ireland (No. 4), all of which held the same rankings as in 2022. Luxembourg and the Netherlands both climbed two places in the rankings to 5th and 6th respectively. In doing so, they outpaced Australia, which dropped out of the top five to 7th, and New Zealand came in at 8th. Germany moved into the top ten at No. 9, replacing Denmark, which dropped from the 9th to 10th spot. The Czech Republic, which has the lowest unemployment in the European Union, dropped out of the list of top 10 countries, plunging from 10th to 18th as it struggles to curb wage-driven inflation.

Nearly all of the developed countries in the Index received a higher overall score for 2023. Among developed countries, only Portugal, Spain and Japan had decreases. The list of countries in the top 25 has remained the same for four consecutive years, with notable shifts among them. Over the past year, Austria and Canada both ascended three places to 11th and 12th, respectively, while Finland and Sweden each slid one spot to 13th and 14th. Slovenia powered up six places to 15th. The UK moved ahead of the US for the first time in five years to 16th from 19th in the Index. The common drivers of performance among the top 25 countries on the GRI are higher interest rates as well as improvements in employment levels and progress on environmental policies.

Five key risks to retirement security

Natixis IM’s 2023 survey of Individual Investors found that 38% of Canadians still working think it will take a miracle to be able to retire securely, up from the 25% who said the same in 2021.

“Saving for retirement was already a challenge. Now, as people think about the impact of higher prices, longer lives, and the potential for reduced retirement benefits, many are doubting whether they will be able to put all the pieces together,” said Dave Goodsell, Head of the Natixis Center for Investor Insights. “They may think they need a miracle, but the best course of action is to face the challenges head-on through planning and education.”

The GRI and Natixis IM’s research identify five key risks to retirement security, including:

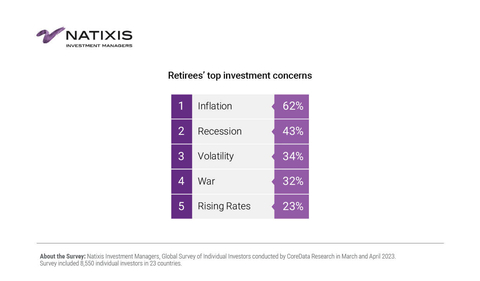

- Inflation: Killing Retirement Dreams. 60% of working Canadians say that inflation has significantly hurt their ability to save for retirement. Inflation ranks as a top investment concern for 63% of Canadian respondents overall, including 65% of retirees. Higher everyday expenses are also a big financial fear for workers (75%) and retirees (77%), many of whom are living on fixed incomes.

- Public Debt: Somebody will eventually have to pick up the tab. The same inflation spike that hurt consumers helped alleviate public debt concerns in the short term. Yet, 73% of Canadians surveyed by Natixis worry that high levels of public debt will result in reduced retirement benefits down the road. When asked about their greatest fears about retirement, among the top three answers was a cut in government benefits (36%), which 57% agree would make it difficult to make ends meet financially.

- Rising Interest Rates: The win few understand. Higher interest rates should be good news for retirees, creating more favorable conditions to generate steady income from their retirement savings and enhancing the ability of bonds to provide a risk ballast in portfolio construction. Yet as interest rates have risen, just 20% of retirees and 26% of workers say they plan to add bonds to their portfolios this year. One reason might be that only 2% of Canadian investors were found to correctly understand how rates affect bond prices and yields.

- Demographics: The silver tsunami makes landfall. Rising old-age dependency on the younger, working population is exerting undue pressure on traditional notions of retirement, particularly as more people live longer. More than eight in 10 (82%) Canadians surveyed agree that government programs don’t take into account the fact that people are living longer now. Moreover, 65% agree that women are at a greater disadvantage when it comes to retirement security because of their longer lifespan and role as caregivers.

- Big expectations and bad assumptions: When it comes down to it, the only factors individuals can control are their expectations of life in retirement, savings goals, and investment returns. 42% of working Canadians say they accept that they are going to have to keep working for longer than anticipated. However, 31% are worried they won’t be able to stay employed as long as they’d like. Indeed, surveyed retirees said they had planned to quit working at age 65 but actually retired four years earlier, at age 61, on average. More than one-quarter of retirees (27%) say their finances are tighter than they had expected.

Natixis IM’s report on the Global Retirement Index includes builds on findings from:

-

Natixis IM 2023 Survey of Individual Investors

A copy of the global report on the Natixis Investment Managers 2023 Survey of Individual Investors can https://www.im.natixis.com/intl/research/2023-individual-investor-survey.

-

2023 Natixis IM Strategist Outlook

https://www.im.natixis.com/intl/markets/2023-strategist-outlook-turn-the-page

-

2023 Natixis Survey of Defined Contribution Plan Participants

https://im.natixis.com/us/research/2023-defined-contribution-plan-participant-survey

A copy of the full report from the 2023 Natixis Investment Managers Global Retirement Index can be found at: https://im.natixis.com/intl/research/2023-global-retirement-index

Methodology

The Global Retirement Index assesses factors that drive retirement security across 44 countries where retirement is a pressing social and economic issue. It was compiled by Natixis Investment Managers with support from CoreData Research. The index includes International Monetary Fund (IMF) advanced economies; members of the Organization for Economic Cooperation and Development (OECD); and the BRIC countries (Brazil, Russia, India and China). The researchers calculated a mean score in each category and combined the category scores for a final overall ranking of the 44 nations studied.

About the Natixis Center for Investor Insight

The Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers1 with more than $1.2 trillion assets under management2 (€1.1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various U.S. registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2023 ranked Natixis Investment Managers as the 17th largest asset manager in the world based on assets under management as of December 31, 2022.

2 Assets under management (“AUM”) of current affiliated entities measured as of June 30, 2023 are $1,230.1 billion (€1,127.5 billion). AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

5944159.1.1