HOUSTON--(BUSINESS WIRE)--Contango ORE, Inc. (“Contango” or the “Company”) (NYSE American: CTGO) announced that mining operations have started at its 30% owned Manh Choh Mine (the “Project” or “Manh Choh”), located near Tok, Alaska, U.S.A. With all major contracts, bonding and permitting in place, the Project remains on track and on budget to bring Contango’s 30% interest in Manh Choh into production in the second half of 2024. Based on the Feasibility Study Technical Report Summary (“TRS”), the Manh Choh mine is expected to produce 225,000 gold equivalent ounces (“GEO”) per year over a 4.5 year mine life1. Contango’s share of production is expected to average 67,500 GEO per year. In addition, the Company has initiated a surface drilling program at its 100% owned Lucky Shot project.

Rick Van Nieuwenhuyse, President, and CEO said: “We are indeed excited to report that mining operations have commenced at Manh Choh and that the construction phase has been achieved on budget and on schedule. The opening at the Manh Choh mine was officially celebrated with a ground-breaking ceremony on August 29th. In attendance were the Governor of Alaska, Michael Dunlevy, Tetlin Tribal Chief, Michael Sam, and Tribal Council members, as well as representatives from both Kinross and Contango. At this point, mining operations primarily consist of pre-stripping activities, with any ore encountered to be stockpiled for later transport by road haul trucks to the Fort Knox mill for processing. Meanwhile, mill modification activities continue at the Fort Knox mill with an emphasis on completing outdoor activities before winter arrives. The project continues to be on track to achieve commercial production in H2 2024.”

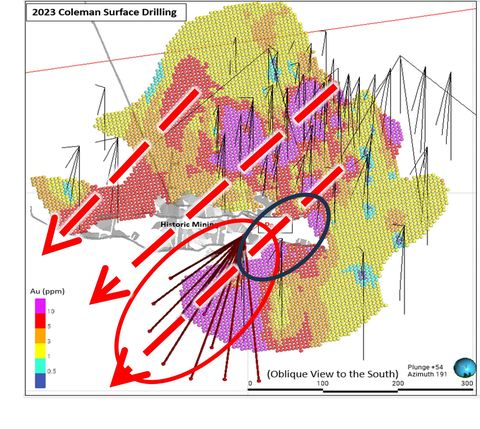

At the Lucky Shot project, the Company initiated a surface exploration drill program on the Coleman segment of the Lucky Shot vein. Figure 2 shows the drill pad that will be used to drill a series of 12 to 15 drill holes totaling approximately 3,000 meters (9,800 feet) in a fan pattern to in-fill and extend the Coleman Segment of the Lucky Shot vein. As previously reported on June 12, 2023, in the Technical Report Summary for the Lucky Shot project2, the Coleman Segment of the Lucky Shot vein contains an estimated 95,092 ounces of Indicated gold resource averaging 15.6 grams per metric tonne (“g/t”) (0.455 ounces per short ton (“oz/st”)) and an additional 23,642 ounces of Inferred gold resource averaging 9.9 g/t (0.289 oz/st). Figure 3 is an image of the planned drill pattern designed to in-fill and extend the mineralization down plunge and along strike of know mineralization.

Rick Van Nieuwenhuyse further commented: “We will complete as much surface drilling as we can safely accomplish from this single drill pad on top of Box Mountain before winter weather conditions shut us down. The program is designed to extend known mineralization on the Coleman Segment of the Lucky Shot vein, and upgrade resources to a measured category so that we can incorporate into a proper mine plan. Future drilling of approximately 12,000 meters (39,000 feet) from underground at Lucky Shot is expected to be undertaken in 2024 to augment resources on the Lucky Shot Segment of the vein. This program is expected to substantially expand the current resource on the Lucky Shot Segment with drill holes having approximately 15 to 20 meters (50 to 65 feet) of separation on each fan and each fan approximately 25 meters (82 feet) apart. Our objective over the next year is to complete the above-mentioned surface drill program followed by the underground drill program at Lucky Shot to identify 400,000 to 500,000 ounces of gold resource that we can then develop a mine plan around.”

Note 1: “GEO” refers to Gold Equivalent Ounces. See: https://www.contangoore.com/press-release/contango-ore-announces-completion-of-s-k-1300-technical-report-summary-for-its-manh-choh-project-in-Alaska.

ABOUT THE LUCKY SHOT VEIN

The Lucky Shot vein is hosted within a shear zone in medium to coarse grained granodiorite intrusive rock. The granodiorite country rock is normally very competent and stands well underground. The shear zone ranges from 1 to 5 meters (3 to 15 feet) thick and hosts one or more brecciated and sheared quartz veins containing sulfides and fine free gold. Individual quartz veins can be 30 cm (1 foot) to over 3 meters (10 feet) thick with associated silicified and stockwork mineralized zones. The Lucky Shot vein is offset along northwest striking and northeast dipping faults that sub-divide the vein structure into segments referred to in the TRS as the Lucky Shot Segment and the Coleman Segment. The Company completed a total of 3,816 meters (12,519 feet) of underground drilling in 29 HQ drill holes from the Enserch tunnel (see S-K 1300 Technical Summary Report for Lucky Shot Project: https://assets.website-files.com/5fc5d36fd44fd675102e4420/6487270414e64406df8280bb_Contango%20Lucky%20Shot%20Project%20S-K%201300%20TRS%202023-05-26.pdf). The quartz vein and associated silicified shear zone have elevated very fine grained dark grey sulfides (sulfosalt and telluride mineral species) and medium to coarse grained pyrite. Detailed mineralogic studies are underway. Samples have been taken from vein material as well the immediate footwall and hanging wall of the vein structure.

Gold was discovered in the Lucky Shot area in 1918, with subsequent mining from 1922 to 1942. The Willow Creek mining district historically produced 19 metric tonnes or approximately 610,874 troy ounces of gold from ore ranging between 30 and 60 g/t making it the third largest historic lode gold producing district in Alaska (Harlan, et al., 2017). The Lucky Shot mine itself produced a reported 252,000 ounces of gold from 169,000 tons of free-milling ore indicating an average head grade of 40 g/t (1.28 oz/st) gold (Stoll, 1997), with additional minor production from the Coleman and War Baby mines. The Company has not undertaken any independent work to verify or confirm the previously reported information (Harlan, et al., 2017 and Stoll, 1997). The historical information may not be representative of the future results of the Company’s activities.

ABOUT CORE

Contango is a NYSE American listed company that engages in exploration for gold and associated minerals in Alaska. Contango holds a 30% interest in Peak Gold, LLC (the “Peak Gold JV”), which leases approximately 675,000 acres of land for exploration and development on the Manh Choh project, with the remaining 70% owned by an indirect subsidiary of Kinross Gold Corporation (“Kinross”), operator of the Peak Gold JV. The Company also has a lease on the Lucky Shot project from the underlying owner, Alaska Hardrock Inc. and through its subsidiary has 100% ownership of approximately 8,000 acres of peripheral State of Alaska mining claims. Contango also owns a 100% interest in an additional approximately 137,280 acres of State of Alaska mining claims through its wholly owned subsidiary, which gives Contango the exclusive right to explore and develop minerals on these lands. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding Contango that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on Contango’s current expectations and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as “expects”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for, developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by Contango or the Peak Gold JV; ability to realize the anticipated benefits of the Peak Gold JV; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; Contango’s inability to retain or maintain its relative ownership interest in the Peak Gold JV; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by an outbreak of disease, such as the COVID-19 pandemic; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect Contango’s exploration program or financial results are included in Contango’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Contango does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.