DES MOINES, Iowa--(BUSINESS WIRE)--A recent survey from Principal Financial Group® shows a disparity between U.S. employers and their employees in financial health and well-being. As employer sentiment and business health remains steady, there are opportunities for employers to support employee financial health.

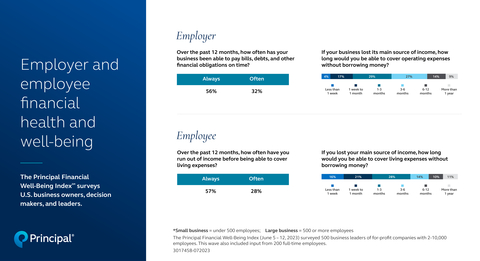

According to the latest Principal Financial Well-Being IndexSM, while both employers’ and employees’ top concerns include rising costs and macroeconomic challenges, employers feel more satisfied with their business’s present financial situation than employees feel about their personal finances. And although employees and employers largely report they’re able to meet their respective financial obligations, that doesn’t translate into workers feeling as satisfied with their current financial situation. Only 34% of employees are “always” or “often” satisfied about their personal finances compared to more than 70% of employers who are “always” or “often” satisfied about their business’s finances.

“As business owners continue to see growth, it’s important to recognize their employees may feel less confident about their financial growth and there are ways to provide greater support,” said Amy Friedrich, president of Benefits and Protection at Principal®. “Employer support could be offering financial wellness tools or providing a holistic benefits package that meets their employees’ needs. This support can be a key differentiator for employers, helping them retain talent, while also making a real difference in the financial lives of their employees.”

According to the survey, nearly two thirds of employees wouldn’t be able to cover expenses for longer than three months if they lost their main source of income. When examining this trend based on demographic differences, over half (55%) of Gen Z and 44% of Millennial employees wouldn’t be able to cover expenses after the first month without their main source of income. Additionally, women are more likely to say that they couldn’t cover expenses for more than one week, while men are more likely to say they’d be able to cover expenses for six months or more.

Businesses continue to experience high levels of growth

Employer sentiment remains high, despite persistent concerns about inflation and the stability of the U.S. economy. More businesses are currently growing compared to this time last year (64% vs. 52%). Small businesses1 also reported year-over-year increases in growth (58% vs. 46%). However, while most businesses report growth, they’re less optimistic about the overall growth of the U.S. economy.

“Small businesses continue to demonstrate positive sentiment and steady cash flow,” said Friedrich. “However, when you move beyond their specific business or region, employers are less confident about the broader economy.”

Employer support for financial well-being

Employers play a critical role in the financial well-being of their employees2. With more than half of employees more stressed about their finances than last year, there are opportunities for employers to pass on their positive sentiment and build a foundation that enables employees to plan for their financial futures.

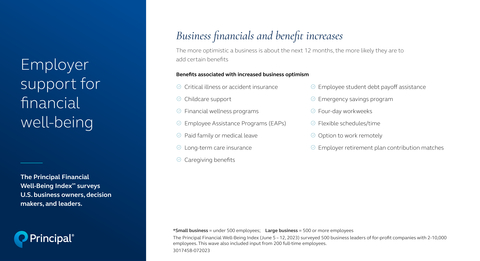

The survey found the more optimistic a business is about the next 12 months, the more likely they are to add certain benefits such as critical illness, childcare support, financial wellness programs, and Employee Assistance Programs (EAPs) to name a few.

Financial wellness programs are expected to emerge as an additional plan resource to further personalize the employee experience3. Outside of retirement savings programs, top financial wellness benefits small businesses believe should be offered include helping employees establish a budget and financial plan, retirement income planning, and investment education. These benefits are key to boosting how secure employees feel across life and work.

See all results and insights from the latest Principal Financial Well-Being IndexSM (PDF).

1 Businesses with two to 499 employees.

2 According to the 2022 Global Financial Inclusion Index sponsored by Principal Financial Group

3 According to the 2023 Principal Future of Retirement Survey

About the Principal Financial Well-Being IndexSM

The Principal Financial Well-Being IndexSM surveys business owners, decision makers and business leaders aged 21 and over who work at companies with 2 – 10,000 employees. The nation-wide survey, commissioned since 2012, examines the financial well-being of American workers and business employers. In 2020, the Well-Being Index was transformed from an annual survey to a regular pulse, offering three waves, revisiting questions and measuring sentiment regarding timely issues in the small and midsized business marketplace. In the first pulse of the Well-Being Index in 2022, the employee audience was added to the survey to compare and contrast key sentiment from employers. The survey was commissioned by Principal® and conducted online by Dynata from June 5 – 12, 2023, with a total of 500 business owners, decision makers and business leader participants and a total of 200 employee participants. The research report focuses on providing a holistic perspective on key trends and timely issues in the small and medium business market.

About Principal Financial Group®

Principal Financial Group® (Nasdaq: PFG) is a global financial company with 19,000 employees1 passionate about improving the wealth and well-being of people and businesses. In business for more than 140 years, we’re helping more than 62 million customers1 plan, protect, invest, and retire, while working to support the communities where we do business, and build a diverse, inclusive workforce. Principal® is proud to be recognized as one of the 2023 World’s Most Ethical Companies® by Ethisphere2, a member of the Bloomberg Gender Equality Index, and a “Best Places to Work in Money Management3.” Learn more about Principal and our commitment to building a better future at principal.com.

1 As of June 30, 2023

2 Ethisphere, 2023

3 Pensions & Investments, 2022

Dynata is not an affiliate of any company of the Principal Financial Group®

Insurance products issued by Principal National Life Insurance Co (except in NY) and Principal Life Insurance Co. Plan administrative services offered by Principal Life. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities offered through Principal Securities, Inc., member SIPC and/or independent broker/-dealers. Referenced companies are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2023 Principal Financial Services, Des Moines, IA 50392, USA.