INCLINE VILLAGE, Nev.--(BUSINESS WIRE)--Dealership new vehicle gross margins to remain above pre-Covid levels say 90% of automotive OEMS, according to the just-released annual Kerrigan OEM Survey, but the majority believe dealership earnings will still decline over the next 12 months. The survey, gathered from Kerrigan Advisors’ annual survey of automotive OEM executives in conjunction with the issuance of The Blue Sky Report®, indicates that automakers are looking at a ‘new normal’ when it comes to dealership profitability, inventory levels and customer data sharing. The survey also offers a window into how OEMs view the future of electric vehicle pricing, with 68% expecting some change to pricing methodology.

“This survey was designed to gauge OEM executives’ perspectives on the franchise system, dealer profitability and expected changes to the retail model with the rollout of new drivetrains. It offers an important window into the perspectives of OEM executives whose views are not often shared publicly in the industry,” said Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors. “The results also demonstrate the value OEM executives place in their dealer networks, even as the auto retail model evolves.”

Profits and Days Supply

While only seven percent of OEMs surveyed expect dealership profits to increase in the next 12 months, three-out-of-four expect new car margins to land somewhere between current and pre-Covid levels. This view is supported by the fact that respondents expect inventory levels to remain low, with 59% expecting days’ supply of 30 days over the next 12 months, and 82% expecting the ‘new normal’ for days’ supply will remain lower than pre-pandemic averages.

EV Pricing Model

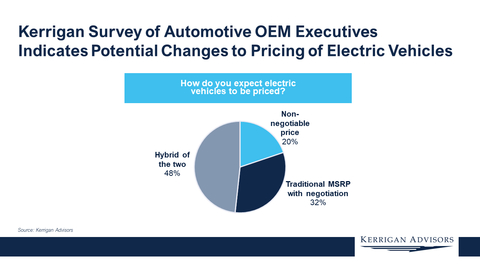

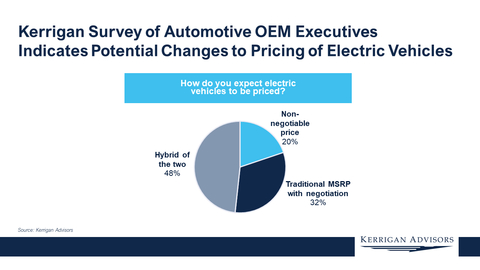

A key OEM/dealership relationship issue addressed by the survey is the future pricing model for electric vehicles, which revealed that nearly one-half (48%) believe some form of non-negotiable pricing will be a part of the retail model of the future, with 20% expecting non-negotiable pricing to be the exclusive means for selling electric vehicles. Only 32% of respondents believe the traditional MSRP pricing model will continue for electric vehicles.

“The data on EV pricing was enlightening, as was data that showed few see the much-discussed EV agency model coming to the US, with just 22% projecting that change, likely due to the strength of state franchise laws in the US,” continued Erin Kerrigan. “The OEM/dealer relationship will continue to evolve as electric vehicles gain market share and alternative retailing models, such as the agency model, are tested. While there will be inevitable conflict, Kerrigan Advisors believes the relationship between the OEMs and their dealers is largely on solid ground and well positioned to manage the evolution of US auto retail.”

Customer Data and Real Estate

Another key topic related to the evolving retail model investigated by the survey is customer data and relationship retention, with the majority of OEMs (66%) expecting both the dealer and OEMs to share the customer data over the next five years, a change from the past when dealers almost exclusively owned the customer data and relationship.

With regard to dealership real estate, the survey reveals that the majority of OEM executive respondents predict facility requirements will either stay the same (52%) or increase (32%), which is surprising given their expectation for reduced inventory and likely fewer employees with a more streamlined, non-negotiable sales process.

“The results of the 2023 Kerrigan OEM Survey are indicative of a business model that is in transition, with OEM views that are not always internally consistent with their proposed retailing changes which are clearly evolving as more data becomes available,” said Ryan Kerrigan, Managing Director of Kerrigan Advisors. “While OEMs and dealers will definitely have differing views on the path forward for electric vehicles, customer data and facility requirements, for the most part, OEMs expect the dealer to remain a key and profitable piece of the auto retail puzzle.”

Key Survey Data

- 69% expect dealership profitability to decline in the next 12 months, while 31% project profits will stay the same or increase.

- 10% believe new car margins will return to pre-Covid levels, while 74% expect them to settle between pre-Covid and current levels in the next 12 months. 16% of respondents project high margins will continue through 2023.

- 59% project days’ supply to be 30 days in the next 12 months; just 3% project a rate of 90 days or more.

- 60% expect the ‘new normal’ for new vehicle days’ supply to settle in at 30 to 60 days, below the pre-Covid average of 60 to 90 days.

- 68% believe some form of non-negotiable pricing will be a part of the retail model of the future with 20% expecting it to be the exclusive means for selling electric vehicles. Only 32% believe the traditional MSRP pricing model will continue for electric vehicles.

- 35% do not believe an agency model will materialize in the US auto retail marketplace, while 43% remain unsure and 22% think it will be introduced to the US in the next five years.

- 66% believe the customer relationship/data will be owned both by the OEM and dealer in five years. 16% expect the OEMs to have exclusive ownership, while 17% believe the dealer will.

- 52% believe facility requirements will largely remain the same over the next 5 years. 32% believe facility requirements will increase and 16% anticipate a decrease.

To download the full 2023 Kerrigan OEM Survey results, click here.

Methodology

The data for The Kerrigan OEM Survey was gathered from Kerrigan Advisors’ annual survey of automotive OEM executives in conjunction with the issuance of The Blue Sky Report®. The Kerrigan OEM Survey is based on over 115 responses from OEM executives in Kerrigan Advisors’ proprietary database. Responses were collected from December 2022 to May 2023.

About Kerrigan Advisors

Kerrigan Advisors is the premier sell-side advisor and thought partner to auto dealers nationwide. The firm advises the industry’s leading dealership groups, enhancing value through the lifecycle of growing, operating and, when the time is right, selling their businesses. Kerrigan Advisors has represented on some of auto retail’s largest transactions and advised on the sale of more top 150 Dealership Groups, than any other buy/sell firm in the industry. Led by a team of veteran industry experts with backgrounds in investment banking, private equity, accounting, finance and real estate, the firm does not take listings, rather they develop a customized approach for each client to achieve their personal and financial goals. In addition to Kerrigan Advisors’ sell-side advisory and capital raising services, the firm also provides a suite of consulting services including growth strategy, market valuation assessments, capital allocation, transactional due diligence, open point proposals, operational improvement and real estate due diligence.

Kerrigan Advisors publishes The Blue Sky Report®, which is the auto industry’s most comprehensive and authoritative quarterly report of dealership buy/sell activity and franchise values, received by over 11,000 industry participants in 35 countries. To register to receive The Blue Sky Report®, click here. Kerrigan Advisors also publishes The Kerrigan Index™, the only monthly report tracking the seven publicly traded auto retail companies. To access The Kerrigan Index™, click here.