CHICAGO--(BUSINESS WIRE)--Thirty-six percent of U.S. families have skipped meals due to financial reasons in the last year according to the fourth wave of the dunnhumby Consumer Trends Tracker (CTT) released today. The quarterly study – now completing its first year – also found that 30% of Americans across all age groups reported they have skipped meals. In addition, 18-34-year-olds and 35-44-year-olds have the highest rate of skipping meals out of any age group at 38% and 37% respectively.

dunnhumby also found that 62% of Americans would have a hard time paying an unexpected expense of $400. That percentage jumps to 75% for consumers between the ages of 18-44 and to 72% for families. The CTT is part of The dunnhumby Quarterly, a strategic market analysis of key retail themes. More than 8,000 U.S. consumers were surveyed online across the four waves of this study.

“Over this year-long study, we have seen a very troubling trend of nearly a third of all Americans and nearly 40% of younger Americans, skipping meals due to financial concerns. And wave after wave, our research has also shown that 18-44-year-olds are at the epicenter of a food and financial insecurity crisis that shows no signs of abating,” said Matt O’Grady, President of Americas for dunnhumby. “Unfortunately, the reduction in SNAP benefits, and the stubbornness of center store prices, there doesn’t appear to be relief in the short term for many Americans, especially those who are already food and financially insecure.”

Key findings from the study:

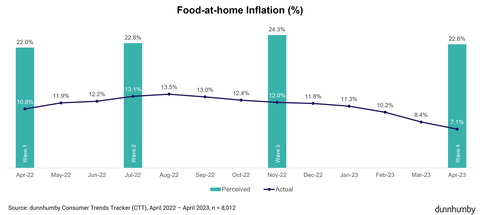

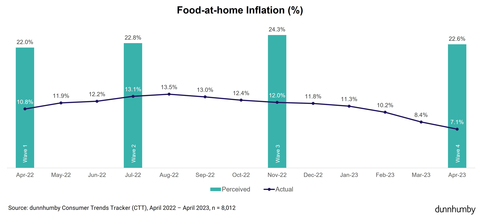

- Americans are not yet feeling relief from the drop in the food-at-home inflation rate and believe it is 15 points higher than the actual 7.1% annual rate as measured by the U.S. Bureau of Labor Statistics. While the latest measurement of consumers' perception of food inflation has dropped 1.6% (to 22.6%), food inflation has actually dropped 4.9% since the last wave of the report.

- The Southern states of Oklahoma, Arkansas, Louisiana, Alabama, Tennessee, Georgia, and West Virginia continue to stand out for having the highest rate of food (36%) and financial insecurity (70%) in the country. These states also have the highest proportion of children at home compared to other geographic regions in the U.S.

- More consumers are looking for deals, with 40% reporting they are shopping at different stores to find the best value, a 9% increase year over year (YoY). Consumers are most willing to shop around for non-alcoholic beverages (60%), packaged foods (55%), and frozen food (54%). Similarly, 41% of consumers are shopping around to get all the products they need, up 5% from wave three and up 6% year over year.

- Consumers have steadily increased their usage of omnichannel resources over the last year to optimize their grocery shopping and save money. Twenty-eight percent of consumers now order groceries online for delivery, at least some of the time (9% increase YoY). Those checking prices online before or during a shop has also increased by 9% YoY, up to 40%. In addition, 37% now interact with retailer apps (7% increase YoY) which is consumers’ second most preferred method of being contacted by a retailer, with email being the first.

- Eighty percent of consumers use at least one grocery rewards program with 20% being light users, 44% are medium users, and 16% are heavy users. Heavy grocery reward users spend an average of $79 more in-store on groceries every month than non-loyalty customers. They also are more likely to be from households with children at home, are between 35-44 years old, and have a household income of more than $100,000.

- Over half of customers (53%) report social media sites have influenced their grocery purchases in-store or online. Families with children at home (75%) and households heavily engaged with loyalty programs (68%) are two groups even more likely to be influenced by social media. Across all age groups, 37% were influenced by Facebook, 31% by YouTube, and 24% by Instagram.

“Consumers changing shopping behavior over the last year, including cross-shopping stores for the best prices and increasing their omnichannel behavior, has created an opportunity for retailers and brands to engage with them in a personalized way. Those that are able to understand the different needs of their customers and then deliver to them tailored content and offers that provide real value, will be able to drive customer loyalty in a very competitive environment,” said O’Grady.

Methodology

After the first year of the CTT, dunnhumby has interviewed 8,012 consumers, representative of the U.S. grocery shopper nationwide. The online interviews for Wave 1 were conducted in April 2022, Wave 2 in July 2022, Wave 3 in November 2022, and Wave 4 in April 2023. Approximately 2000 individuals were interviewed for each wave of the study.

The CTT study is designed to uncover shopper needs, perceptions and behavior over time, and to complement dunnhumby’s Retailer Preference Index which measures the strength of retailers’ customer value proposition. The latest CTT study can be accessed today.

About dunnhumby

dunnhumby is the global leader in Customer Data Science, empowering businesses everywhere to compete and thrive in the modern data-driven economy. We always put the Customer First. Our mission: to enable businesses to grow and reimagine themselves by becoming advocates and champions for their Customers. With deep heritage and expertise in retail – one of the world’s most competitive markets, with a deluge of multi-dimensional data – dunnhumby today enables businesses all over the world, across industries, to be Customer First.

The dunnhumby Customer Data Science Platform is our unique mix of technology, software and consulting, enabling businesses to increase revenue and profits by delivering exceptional experiences for their Customers – in-store, offline and online. dunnhumby employs nearly 2,500 experts in offices throughout Europe, Asia, Africa, and the Americas working for transformative, iconic brands such as Tesco, Coca-Cola, Meijer, Procter & Gamble and Metro.