OptionMetrics Releases Industry’s First Implied Beta Dataset – IvyDB Beta – to More Accurately Assess Expected Returns of Securities with Systematic Risk

OptionMetrics Releases Industry’s First Implied Beta Dataset – IvyDB Beta – to More Accurately Assess Expected Returns of Securities with Systematic Risk

IvyDB Beta helps brokerages, portfolio and risk managers to more accurately price in impacts of earnings reports, macroeconomic and other events, in forecasting expected stock returns

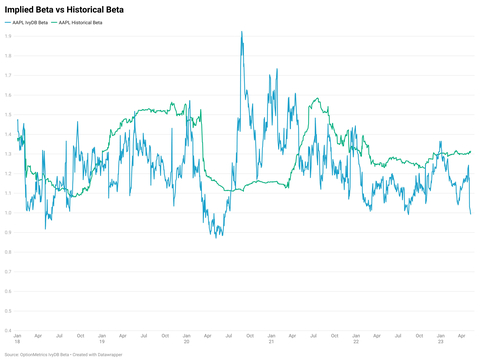

OptionMetrics' new IvyDB Beta empowers brokerages, portfolio and risk managers, market makers, hedge funds, and other industry participants to better assess systematic risk. This chart presents a comparison between the 60-day historical beta estimates, traditionally employed in CAPM calculations, and the implied beta using IvyDB Beta for Apple Inc spanning from 2018 to present. The chart demonstrates that the results derived from IvyDB Beta for AAPL exhibit significantly higher variation compared to traditional beta, with a daily sample variance of 0.0272, surpassing the 0.0216 variance of historical beta. This heightened variability is a direct consequence of the forward-looking nature of implied beta, which promptly incorporates periods of heightened systematic risk. The limitation of relying on backward-looking historical beta becomes evident by the notably flat historical beta line during the COVID-19 pandemic in 2020, reflecting its sluggishness in incorporating new market risk. (Graphic: Business Wire)

NEW YORK--(BUSINESS WIRE)--OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing its new IvyDB Beta dataset with comprehensive beta information for the top 500 SPY constituents and market capitalization single-name US securities from January 2007 onwards. This unique dataset enables brokerages, portfolio and risk managers, market makers, hedge funds and others to gain greater insights into the options market's perception of systematic risk (more accurately pricing in impacts of earnings reports, FOMC meetings, CPI announcements, and other events) to forecast returns across securities.

While the Capital Asset Pricing Model (CAPM) is extensively employed by traders and financial professionals to price securities and assess expected returns, the historical beta utilized in this calculation is often retrospective and sluggish in incorporating new information. In contrast, OptionMetrics’ new IvyDB Beta dataset leverages implied betas, which exhibit considerably more variance compared to the conventional approach, owing to their forward-looking nature. This enables more immediate pricing of periods characterized by higher levels of systematic risk.

“Especially in current, rapidly-changing markets—and with uncertainty in inflation, Fed rate hikes, earnings, and more—having the most accurate information to assess trading strategies, diversification and systematic risk is critical,” said OptionMetrics CEO David Hait, Ph.D. “We are proud to be the first to offer forward-looking implied betas to guide buy side professionals in making more informed investment decisions.”

OptionMetrics IvyDB Beta offers the following features:

- Implied Betas: It provides the term structure of implied betas for the top 500 constituents of the SPY index and individual US securities with market capitalization. These implied betas are calculated from January 2007 onwards, considering various time horizons ranging from 30 to 730 days.

- Implied Correlation (IC) Dataset: This dataset includes pairwise implied correlations for the top 50 constituents of the SPY index, resulting in a total of 2,500 pairs. It offers a more detailed understanding of sector-specific and diversification-related risks.

- Weighted Correlation Dataset: This dataset presents the sum of the average correlation between a specific security and all other constituents within a portfolio. It helps in evaluating the overall correlation of a security with the rest of the portfolio.

IvyDB Beta is part of OptionMetrics’ suite of options and futures products that includes: IvyDB US, providing the most comprehensive US options data, covering 10,000+ underlying stocks and indices from 1996 onward; IvyDB Europe, IvyDB Canada, and IvyDB Asia databases; IvyDB Signed Volume to assess directional options trading; IvyDB Futures to assess optionable futures, and real-time Dividend Forecasting Data, with its recent acquisition of Woodseer Global.

Learn more about leveraging implied betas to help to gain improved portfolio outperformance in “The Implied Beta Against Beta (IBAB) Factor: A New Frontier for Low-Volatility Investing,” from the OptionMetrics Quantitative Research Department.

Contact William Ko to schedule a demo of IvyDB Beta or for more details.

About OptionMetrics

With 20+ years as the premier provider of historical options and implied volatility data, OptionMetrics distributes its IvyDB options, futures and dividend forecast databases to leading portfolio managers, traders, quantitative researchers at 300+ corporate and academic institutions worldwide to construct and test investment strategies, perform empirical research, and assess risk. www.optionmetrics.com, LinkedIn, Twitter

Contacts

Media Contact:

Hilary McCarthy

Clearpoint Agency

774.364.1440

Hilary@clearpointagency.com