PALO ALTO, Calif.--(BUSINESS WIRE)--Productiv, the leader in SaaS management, today unveiled its 2023 State of SaaS Series which indicates enterprise leaders in procurement, IT and finance need to take immediate action to rationalize their SaaS portfolios before spending and governance challenges spiral out of control. Productiv analyzed how nearly 100 million SaaS licenses were used over the last three years – including more than 100 billion app usage data points – to produce the first of a three-part series released over the summer that provides an in-depth look at pivotal SaaS stats and insights on SaaS growth, spend, consolidation and usage.

To access part one of “2023 State of SaaS Series,” visit here.

“Our data demonstrate the path to immediate action for CFOs is to better identify and consolidate SaaS apps, given the cost reduction pressures currently facing every company,” said Jody Shapiro, CEO and co-founder of Productiv. “Buying and renewing software never stops, but the best procurement practices require collaborative decisions using data across IT, procurement, finance and functional leadership on what software to purchase, renew, downsize and consolidate.”

Key findings from Part One of Productiv’s State of SaaS Series for 2023:

SaaS Growth Continues Apace, Even As Companies Improve SaaS Spend Management

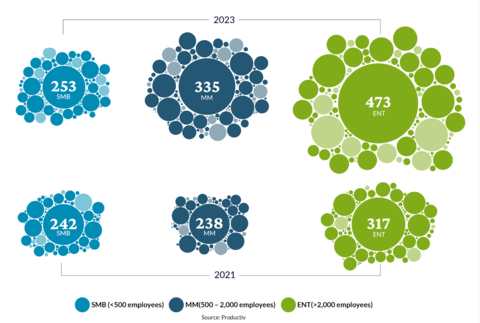

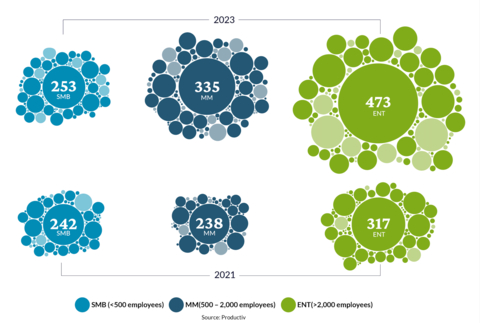

During a time when companies have been looking closely at cost control, Productiv found that SaaS portfolios still continued to grow 32% between 2021 and 2023 to reach an all-time high: organizations now use 371 SaaS apps on average. Data suggest that businesses have tried to establish better procurement and governance practices around SaaS, as shadow IT dropped by 8% from 2022. But employees and lines of business continue to purchase their own software outside of IT control at high rates — 51% of SaaS apps in organizations still remain shadow IT — indicating that there is much room for improvement.

SaaS Spend Still High Amidst Tighter Controls

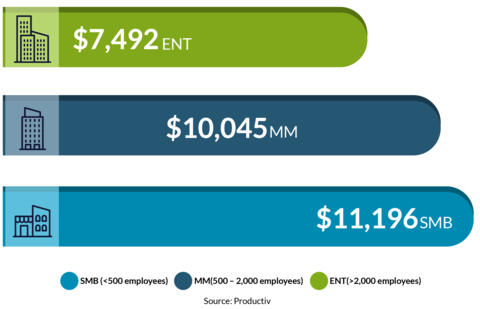

According to Productiv’s data, one-year contracts increased annually as a proportion of all contracts from 79% in 2020 to 85% in 2022, suggesting companies are avoiding being locked into an app and its associated cost if their needs change. However $9.6K per employee will be spent on SaaS apps in 2023 by the average organization, with small businesses paying 49% more per employee than large enterprises, while only 47% of SaaS licenses are used over a 90-day period on average.

SaaS Usage Trends: ChatGPT Takes off, App Consolidation Efforts Fall Short

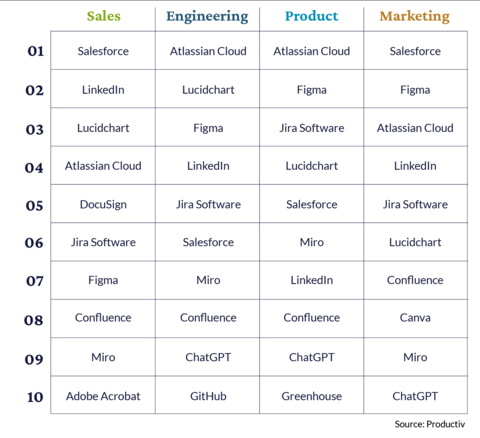

Productiv found popularity of ChatGPT has skyrocketed with key use cases including writing emails and marketing content, summarizing meeting notes, researching issues, writing code and finding coding bugs. The departments using ChatGPT the most include Marketing (10th), Engineering (9th) and Product (10th). Productiv found an 11% reduction in the number of SaaS apps across key categories in 2023, such as project management and recruitment tools, indicating that businesses are focusing on app consolidation. However, the average number of apps per category is still higher than it was in 2021.

“Given our report reveals widespread shadow use of ChatGPT, it’s time for companies to figure out how to foster innovation using ChatGPT without security risks,” said Aashish Chandarana, CIO of Productiv. “To avoid shadow IT, organizations need to develop appropriate SaaS governance policies that help teams take their free and purchased apps out of the shadows and ensure the right level of corporate policies for procurement, security and compliance.”

Reporters who are interested in the media brief should contact productiv@siftpr.com.

Methodology

The findings in the State of SaaS report are based on analysis of anonymized data from businesses using Productiv, which looked at hundreds of active instances of their platform and collected data between Q1 of 2021 and Q1 of 2023. Productiv tracks SaaS application usage by aggregating and joining data from HR systems, finance and expense management systems, and contract management systems and files, as well as integrations with SaaS applications, Single-Sign-On (SSO) tools and Cloud Access Security Broker (CASB) providers. Shadow IT data is based on non-managed applications with a data source from 1) an expense or finance system, 2) network monitoring tools, or 3) Google single sign-on (SSO). The Productiv customer base is mainly focused in the following industries: Technology, Media, and Business and Financial Services.

About Productiv

Productiv is the only SaaS Intelligence™ Platform for the modern enterprise. More than a SaaS management solution, Productiv aligns IT, finance, procurement and business leaders with trusted data to drive cost optimization while delivering operational excellence across your SaaS portfolio. This employee-centric, data-driven approach combines billions of employee app usage data-points with vendor contract and organizational data, enabling teams to easily come together to govern and rationalize SaaS portfolios and streamline SaaS procurement. Founded in 2018 and backed by Accel, IVP and Norwest Venture Partners, Productiv is on a mission to align IT and business leaders to unlock the most value out of their SaaS portfolio at scale. To learn more about Productiv, click here.

1Productiv found the average SaaS spend per employee will be almost $10K in 2023, while companies average $6,584 per employee for single healthcare coverage annually (source).