TD Ameritrade Investor Movement Index: IMX Score Rises Again in May

TD Ameritrade Investor Movement Index: IMX Score Rises Again in May

Clients increased market exposure despite net selling equities during the month, with the strongest selling in the Communication Services and Information Technology sectors

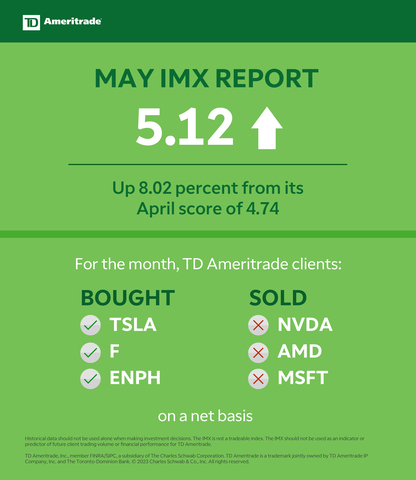

OMAHA, Neb.--(BUSINESS WIRE)--The Investor Movement Index® (IMX℠) increased to 5.12 in May, up from its score of 4.74 in April. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

The reading for the four-week period ending May 26, 2023 ranks “moderate low” compared to historic averages.

“Occasionally, we have a month like May where our clients are net sellers of equities but increase their market exposure overall,” said Joe Mazzola, Director of Trading and Education at Charles Schwab. “That can be confusing, but it generally happens when clients invest more in fixed income securities or perhaps pick up more speculative assets. Given the overall landscape in May – the ongoing influence of high interest rates and continued hikes, concerns around the possibility of the U.S. defaulting on its debt, and an overall uptick in volatility – it’s not a surprise that clients may have looked beyond equities to round out their respective portfolios.”

Equity markets reacted to significant monetary and fiscal policy developments during the May IMX period. At the beginning of the month, the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) raised the effective federal funds rate by another 25 basis points, as expected. Meanwhile, lawmakers continued negotiations regarding the U.S. debt ceiling as the early June deadline loomed. The prior month’s indicators of inflation and consumer spending edged higher, as U.S. consumer debt totals were among the highest on record. The U.S. Labor Department reported that 253,000 jobs were added in April, while revising the previous two months downward; the trailing three-month average is 222,000 jobs added per month.

In May, the S&P 500 (SPX) gained just under one percent, bolstered by a strong rally in growth-oriented companies, primarily those with ties to artificial intelligence (AI). The CBOE Volatility Index (VIX) ended the May period at 17.95--slightly higher--reflecting a mild increase in uncertainty in equity markets. The 10-year Treasury yield climbed to 3.81% and the U.S. Dollar Index rose to 104.21, both closing at their highest levels since March. Crude Oil Futures closed the period at $72.67 per barrel, down nearly four percent.

Despite increasing exposure overall, TD Ameritrade clients were net sellers of equities overall during the period. Popular names bought included:

- Tesla Inc. (TSLA)

- Ford Motor Co. (F)

- Enphase Energy Inc. (ENPH)

- Walt Disney Co. (DIS)

- Bank of America Corp. (BAC)

Names net sold during the period included:

- NVIDIA Corp. (NVDA)

- Advanced Micro Devices Inc. (AMD)

- Microsoft Corp. (MSFT)

- Uber Technologies Inc. (UBER)

- DraftKings Inc. (DKNG)

Millennial Buys & Sells

TD Ameritrade millennial clients increased their exposure during the May IMX period and were net buyers of equities, unlike the overall TD Ameritrade client population.

Tesla (TSLA) was again a favorite purchase of TD Ameritrade millennial clients; the stock soared following CEO Elon Musk’s naming of a new CEO to run Twitter. TD Ameritrade millennial clients also scooped up shares of Ford Motor (F) as the legacy automaker continued to invest in electric vehicles (EVs), including a strategic partnership with Tesla on a network of charging stations. TD Ameritrade millennial clients were also net buyers of Walt Disney (DIS); though their theme-parks performed well, the stock lost ground during the period, largely due to a reported loss of 2.4 million paid subscribers for Disney+.

While the S&P 500 moved modestly higher during the period, growth-oriented names, particularly those with ties to artificial intelligence (AI), tended to shine. This was best exemplified by Nvidia (NVDA), which soared after reporting a blowout earnings quarter and exceptional revenue guidance that was way above street forecasts. TD Ameritrade millennial clients sold strength in the name, reducing exposure. Shares of Advanced Micro Devices (AMD) also jumped during the period and TD Ameritrade millennial clients took the opportunity to lighten up exposure into its recent strength. TD Ameritrade millennial clients were also net sellers of Uber Technologies (UBER), reducing exposure during the recent rally as a sticky delivery business, return to ride-hailing, and future deals with autonomous vehicle makers underscored optimism in the name.

At the sector level, TD Ameritrade millennial clients bought most heavily in Financials, Consumer Staples, and Health Care, while selling was most prevalent in Information Technology, Communication Services and Consumer Discretionary.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010, to view the full report from May 2023, or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success. Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade. IMX data includes that from accounts of TD Ameritrade clients which recently transferred to our affiliate, Charles Schwab & Co., Inc., as part of our planned integration.

About TD Ameritrade

TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. A leader in U.S. retail trading, we leverage the latest in cutting-edge technologies and one-on-one client care to help our clients stay on top of market trends. Learn more by visiting www.tdameritrade.com.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co. Inc. All rights reserved.

Contacts

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com