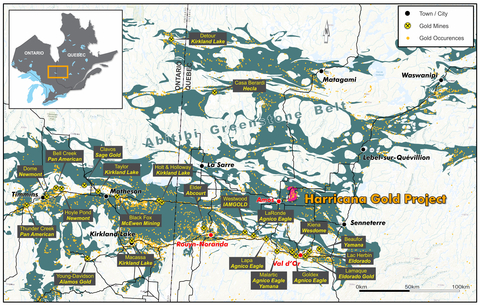

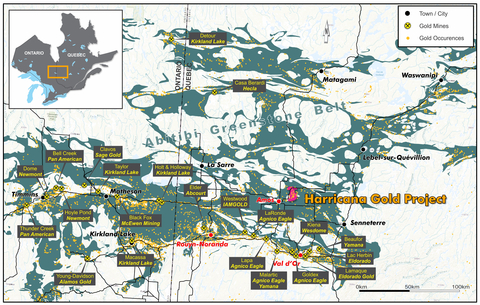

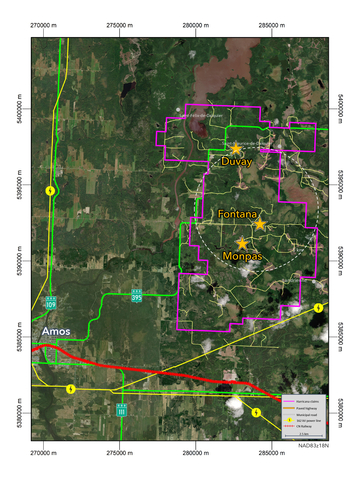

KELOWNA, British Columbia--(BUSINESS WIRE)--Kiboko Gold Inc. (TSXV: KIB) (“Kiboko” or the “Company”) reported today results from 8 holes (1,092 metres (“m”)) drilled as part of its systematic 70-hole (11,269 m) exploration program at its Harricana Gold Project, located 55 km north of Val-d’Or, Québec (see figures 1 and 2). This includes additional results from the Marcotte zone (formerly referred to as Fontana Main) and the first-time reporting of results from the Claverny zone, located a kilometre east of Marcotte. In addition, visible gold was observed in several drillholes for which assays are pending.

Jeremy Link, President and Chief Executive Officer, stated, "Our drilling at Harricana continues to intersect significant intervals of mineralization, including visible gold. These results are expected to verify a significant portion of the nearly 80,000 metres of historical drilling at the Fontana area of our project. With the laboratory bottleneck recently cleared, we are eager to share more results shortly – and lots of them – as assays from 6,853 metres drilled over 36 holes, representing about 61% of the metres drilled in this program are still to be reported. With a maiden mineral resource anticipated next quarter, our excitement for the Harricana Gold Project’s potential remains high.”

Gold mineralization intercepted in 7 of 8 drillholes

Select highlights from Table 1 include:

- Claverny zone

- 0.6 g/t Au over 35 m (DDFON22-008)

- 1.0 g/t Au over 5 m (RCFON22-027)

- Marcotte zone

- 6.1 g/t Au over 1 m (DDFON22-006)

- 0.6 g/t Au over 8 m (RCFON22-025)

Visible gold observed in drill core with assays pending

As shown in Figure 3:

- DDFON23-007 (Marcotte)

- DDFON23-014 (Hooper Bunkhouse)

- DDFON23-015 (Hooper Bunkhouse)

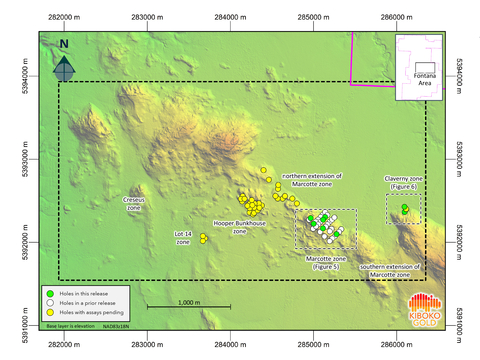

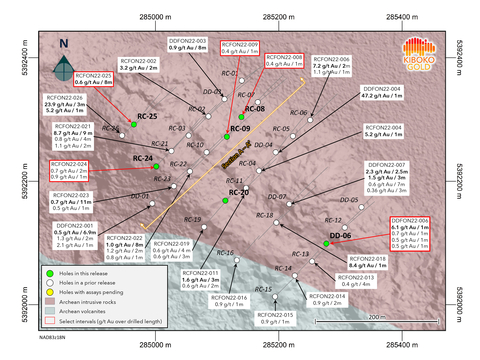

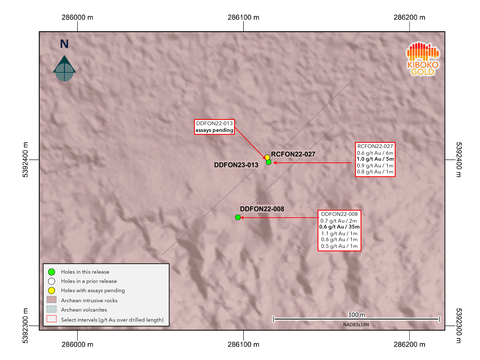

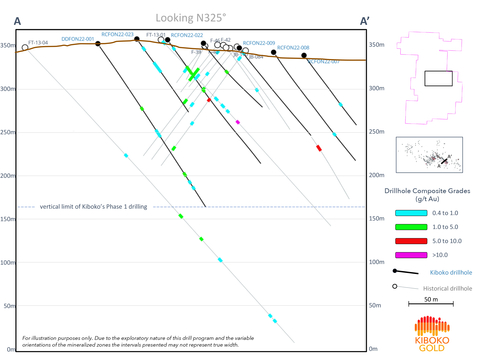

Figures 4, 5, and 6 presents maps of all the zones and locations of all holes drilled as part of the Phase 1 exploration program on the Fontana area of the Project. Figure 7 is a cross-section through line 6480 of the central portion of the Marcotte zone, for which all results have been reported. Tables 1 and 2 provide a summary of all assay results presented in this release and reported to date, respectively. Table 3 provides location data for the drillholes reported herein.

Assays from 61% of metres drilled in Phase 1 (36 holes over 6,853 m) still to be reported

Assay results from 21 holes drilled (3,796 m) in 2022 and 15 holes (3,057 m) drilled in 2023 have yet to be reported for a total of 36 holes (6,853 m), representing about 61% of the total metres drilled in the Company’s Phase 1 Fontana area verification drill program.

Maiden mineral resource targeted for Q3-2023

The Company believes that the areas targeted in the Phase 1 exploration program have the potential to support a near-surface, pit-constrained mineral resource. Subject to the timely completion of assay results from the 2023 drill program, which are expected shortly, the Company is targeting the reporting of a maiden mineral resource for a portion of the Fontana area in Q3-2023.

Re-assay program verified preliminary results

Kiboko has completed the priority portion of the Fontana area’s re-assay program that commenced in late 2022. Kiboko has concluded that original samples collected from large diameter HQ-sized core or 5.25-inch RC drilling that are rotary split into nominal 0.5 kg sub-samples for assaying represents the original sample grade with an appropriate level of accuracy. The Company further concludes that the current drilling, sampling, and assay protocol is well suited for the mineralization being explored.

As a result, Kiboko does not believe it is warranted to undertake a full campaign to re-sample and assay samples from its own drilling. Additional details are provided below in the re-assay program discussion section.

Drilling expected to verify historical results for use in mineral resource estimation

Today’s results continue to align with or exceed management’s expectation for its first exploration program at the Fontana area of the Harricana Gold Project.

At the Marcotte zone, formerly referred to as Fontana Main, 32 holes have been drilled in the central portion of the zone in the area shown in Figures 4 and 5. The Company’s observations are that the variability in gold grades is coherent with historical data and reflects the natural heterogeneity common to moderate-grade environments that include fine grains of coarse (native) gold.

The number of mineralized structures, their continuity and variability in apparent thickness supports Kiboko’s view that the Marcotte zone first-order mineralization is primarily associated with a reasonably large anastomosing network of altered igneous rocks containing quartz-carbonate veins and veinlets, and shears, anastomosed within a large, sub-vertical and northwesterly striking shear zone. At this stage in the data compilation and review, the view is consistent with Kiboko’s interpretation and exploration model. Although the first-order mineralization displays reasonable continuity along sub-vertical structures, additional work is required to characterize the structural attitude and determine the significance of second- and third-order mineralized structures within and along this zone.

Kiboko’s technical team has concluded that this drilling has sufficiently verified the results of historical drilling in the central portion of the Marcotte zone and has demonstrated that the zone remains open to the east (see Figure 6). The northern extension of the Marcotte zone was drilled during the 2023 winter program and assays are pending. Kiboko did not drill the southern extension of the Marcotte zone in its Phase 1 drill program.

At the Claverny zone, located 1 km east of Marcotte, the two holes drilled in 2022 provided exciting results, as evidenced by a 35 m interval grading 0.6 g/t Au and a 1 m interval grading 6.1 g/t Au in DDFON22-008, confirming Claverny as an area of interest. Kiboko’s technical team is of the view that these results are highly encouraging, given the limited amount of historical drilling in this area. Considering the lack of historical structural information in this area and to refine the Company’s understanding of the geological framework, another hole was drilled in this area as part of the 2023 winter drill program, with assay results pending.

Follow-up drilling was also completed in the Hooper Bunkhouse zone. After drill permits were received in late April, the Company drilled two additional holes totalling 399 m (DDFON23-014 and DDFON23-015) to further test its interpretation and exploration model. While assays are pending, the Company is pleased to report that both holes encountered visible gold within the Bunkhouse zone, consistent with its exploration model.

Overall, results in the Marcotte zone are generally consistent with the historical dataset that the Company’s exploration model is based upon, as 32 of the 34 holes reported to date have intercepted mineralization, representing 94% of the holes drilled. The results are therefore validating Kiboko’s exploration model, which will be refined as part of the resource estimation process.

Kiboko’s technical team continues to review new drilling information in relation to its current understanding of the geology and mineralization of the area and for reporting purposes. Kiboko also continues to assess the assay results from the 79,565 m of historical drilling data that its Fontana Area Exploration Target (as defined herein) is based upon and summarized below.

Re-assay test work program discussion

In late 2022, the Company initiated a re-assay test work program on duplicate samples to gain a more comprehensive understanding of the gold mineralization distribution and evaluate the potential risk for inadequate sub-sampling and resulting bias, which is typical in the early stages of exploration in coarse (native) gold environments, like Harricana.

Initially, the Company received a small number of highly encouraging partial assay results. The results were from 0.5 kg sub-sample duplicates that suggested that the variability in grade indicated the risk of a significant in situ (or geological) nugget effect. This can result in a natural Poisson distribution, which may lead to a statistical underestimation of the grade of the original sample. Due to the potential implications of this test work, the Company decided to suspend the reporting of results until all assays for the priority portion of this test work were available.

Upon review of preliminary results, the small number of samples suggesting the potential for a significant in situ nugget effect (up to a two order of magnitude difference) were determined to be a result of inadvertent laboratory errors. After an extensive investigation, it was determined that these errors affected a limited number of samples, which have been corrected.

While there are still a few instances of a pronounced in situ nugget effect, Kiboko has observed that the assay results from the 0.5-kg rotary split samples do not deviate materially from the head grade of the 3 to 4 kg duplicate samples. While there was variability in individual riffle split duplicates, the overall tenor and metal content of mineralization along the assessed intervals were largely consistent.

As a result, Kiboko has concluded that samples collected from large diameter HQ-sized core or 5.25-inch RC drilling that are rotary split into nominal 0.5 kg sub-samples for assaying represent the sample grade with reasonable accuracy. The Company further concludes that the current sub-sampling and assay protocol is well suited for the mineralization being explored. Based upon this conclusion, Kiboko does not believe it is warranted to undertake a full campaign to re-sample and assay samples from its own drilling.

Notwithstanding, Kiboko will continue to assess duplicate samples to locally monitor the in situ nugget effect and potential for sub-sampling bias as part of its exploration programs.

Exploration intended to verify historical Fontana drilling and partially validate Exploration Targets

The Phase 1 program is intended to verify a significant portion of the 79,565 m of historical Fontana area drilling, characterize gold mineralization in the wall rock surrounding the main vein systems, and partially validate the Fontana area Exploration Targets (as defined herein).

The near-surface Exploration Targets for the Fontana area of the Project total 13.6 million to 23.1 million tonnes at a range of grades of 3.0 to 3.4 grams of gold per tonne (“g/t Au”). The primary Exploration Targets for the Harricana Project are summarized in Table 4 at the end of this release.

The Company cautions that while the Exploration Targets are based upon results from historical drilling, the potential quantity and grade of the Exploration Targets are conceptual in nature, there has been insufficient verifiable exploration to define a mineral resource, and it is uncertain if further exploration will result in any of the Exploration Targets being delineated as a mineral resource.

The Phase 1 exploration program is only intended to partially validate a portion of the Exploration Targets for the Fontana area of the Project, which does not have any mineral resources or mineral reserves. For further details regarding scientific or technical information relating to the Harricana Project, including the recommended exploration programs to validate the Exploration Targets, please refer to the technical report entitled “Harricana Gold Project Technical Report, Duverny Township, Québec” with an effective date of April 1, 2022, and an issue date of May 2, 2022 (the “Harricana Technical Report”), which is filed under the Company’s SEDAR profile at www.sedar.com and the Company’s website at www.kibokogold.com.

Quality Assurance and Quality Control

Orientated HQ-size drill core was delivered directly from the drill site to Kiboko’s field office in Amos, Québec, where it was systematically logged, photographed, and sampled on 1 m intervals by a geologist. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently), bagged, securely sealed, labelled, and submitted for analysis. The other half of the core was stored securely at Kiboko’s core logging facility as a witness sample.

For each metre of RC drilling, the stream of RC chips was split into three samples. Two nominal 5 kg samples were collected for analysis, and the remnant nominal 25 kg was bagged for future use if required. The samples were collected directly from the RC drill rig’s cyclone, where they were bagged and labeled. The two 5 kg samples were delivered by Kiboko personnel to Kiboko’s field office in Amos, Québec, for processing. One of the 5 kg samples was submitted to the laboratory for analysis, and the other was stored securely as a witness sample until the results of the first stream of samples were received. At site, a small sub-sample of RC chips was collected from the remnant 25 kg, washed, placed in chip trays, and then delivered by Kiboko personnel to the field office in Amos, where they were systematically logged by a geologist.

In addition to the laboratory’s QA/QC practices, Kiboko personnel inserted certified reference materials (standards) and blank samples at regular intervals into the sample stream to monitor laboratory performance. Duplicates have been inserted at the laboratory, and selected intervals are in the process of being analyzed as field duplicates. Only results that have met the requirements of Kiboko’s quality control program are considered final and are reported.

Bagged samples were collected in larger bags by Kiboko personnel to ensure an appropriate chain of custody until the samples were delivered to the laboratory. Samples were delivered by either courier or Kiboko personnel on pallets to ensure an appropriate chain of custody during transport to MSALABS INC.’s (“MSA”) secure facility in Val-d’Or, Québec for processing and analysis.

The entire half-drill core sample was crushed to approximately 70% passing 2 millimetres. RC chips required no crushing. Sub-samples were rotary split to fill a 350 ml sealed plastic jar for PhotonAssay containing approximately 0.5 kg of sample material. MSA operates numerous laboratories worldwide and maintains ISO-17025 accreditation for many metal determination methods. Accreditation of the PhotonAssay method at MSA’s Val D’Or laboratory is in progress.

About the Harricana Gold Project

Kiboko’s Harricana gold project is a consolidated 100+ km2 prospective mineral claim package that is located 55 km north of Val- d’Or, Québec, in the world-renowned Abitibi greenstone belt. Historical records compiled and digitized by Kiboko into a new geospatial dataset includes data from 937 historical diamond drillholes totalling 139,397 metres.

The Harricana Project benefits from an exceptional location, close to operating mines, with excellent access and proximity to existing infrastructure, including road, rail, and clean, low-cost, renewable hydroelectric grid power. The Harricana Project also benefits from low royalty coverage with the most significant royalty being a 2% NSR production royalty held by Globex Mining Enterprises Inc. on 195 claims covering an area of 85 km2, which includes the areas drilled in the Company’s Phase 1 drill program.

Additional information about Kiboko and its Harricana Gold Project can be found on SEDAR at www.sedar.com and on the Company’s website at www.kibokogold.com.

Qualified Person

Ivor W.O. Jones, B.Sc. (Hons), M.Sc., FAusIMM, P. Geo., (OGQ Special Authorization Permit 74658), Kiboko’s Vice-President, Technical Services & Project Evaluation, has reviewed and approved the pertinent technical or scientific information contained in this news release. Mr. Jones is the Company’s designated “Qualified Person” as defined by Canadian Securities Administrators within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

Exploration programs at the Harricana Project are managed by Mr. Jones and Yves Caron, M.Sc., géo (OGQ 548), both of whom are “Qualified Persons” as defined by NI 43-101.

About Kiboko Gold Inc.

Kiboko is a Canadian-based gold exploration company focussed on advancing its 100+ km2 Harricana Project, located 55 km north of Val-d’Or, Québec, within the world-renowned southern Abitibi gold belt. Kiboko’s shares trade on the TSX Venture Exchange under the symbol “KIB”.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition, belief, estimate or opinion, or result to occur. Forward looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “interpreted”, “pending”, “suggests”, “preliminary”, “estimates”, “may”, “aims”, “targets”, “could”, “would”, “will”, or “plans” and similar expressions, or that events or conditions “will, “would”, “may”, “can”, “could” or “should” occur, or are those statements, which, by their nature, refer to future events. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based upon information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward looking information.

Forward looking information in this news release includes, but is not limited to the Company’s objectives, goals or future plans, statements, exploration results, assay results, re-assay results, potential mineralization, the interpretation of drilling and assay results, the results of the drilling program and re-assay program, mineralization and the discovery of zones of high-grade mineralization, verification of historical drilling results; the Company’s cost estimates and plans to execute and complete its Phase 1 exploration program including the completion of a maiden mineral resource; future exploration and mine development plans; future news releases by the Company, and the funding of the exploration program, and the timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other Indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, scarcity and cost of skilled and unskilled labour, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and travel and supply chains, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Table 1: Harricana Gold Project - Fontana Area Assay Results |

|||||||

Drillhole ID |

From (m) |

To (m) |

Interval (m) |

Grade (g/t Au) |

Comment |

Zone |

Line |

DDFON22-006 |

17 |

18 |

1 |

6.1 |

visible gold |

Marcotte |

6240 |

and |

24 |

25 |

1 |

0.5 |

|

Marcotte |

6240 |

and |

31 |

32 |

1 |

0.5 |

|

Marcotte |

6240 |

and |

81 |

82 |

1 |

0.7 |

|

Marcotte |

6240 |

DDFON22-008 |

12 |

14 |

2 |

0.7 |

|

Claverny |

5840 |

and |

21 |

56 |

35 |

0.6 |

|

Claverny |

5840 |

and |

76 |

77 |

1 |

1.1 |

|

Claverny |

5840 |

and |

84 |

85 |

1 |

0.6 |

|

Claverny |

5840 |

and |

103 |

104 |

1 |

0.5 |

|

Claverny |

5840 |

RCFON22-008 |

117 |

118 |

1 |

0.4 |

|

Marcotte |

6480 |

RCFON22-009 |

7 |

8 |

1 |

0.4 |

|

Marcotte |

6480 |

RCFON22-020 |

no significant intersections |

Marcotte |

6400 |

||||

RCFON22-024 |

79 |

81 |

2 |

0.7 |

|

Marcotte |

6520 |

and |

161 |

162 |

1 |

0.9 |

|

Marcotte |

6520 |

RCFON22-025 |

15 |

16 |

1 |

0.6 |

|

Marcotte |

6600 |

and |

34 |

35 |

1 |

0.5 |

|

Marcotte |

6600 |

and |

45 |

46 |

1 |

0.7 |

|

Marcotte |

6600 |

and |

104 |

112 |

8 |

0.6 |

|

Marcotte |

6600 |

RCFON22-027 |

8 |

14 |

6 |

0.4 |

|

Claverny |

5840 |

and |

27 |

32 |

5 |

1.0 |

|

Claverny |

5840 |

and |

56 |

57 |

1 |

0.8 |

|

Claverny |

5840 |

and |

67 |

68 |

1 |

0.9 |

|

Claverny |

5840 |

|

|||||||

Intervals are reported over a minimum downhole length of 1 m at a minimum length-weighted grade of 0.4 g/t Au with up to 4 m of consecutive internal dilution. Included high-grade intercepts are reported as any consecutive interval with grades greater than 10 g/t Au. No assays were capped. Due to the exploratory nature of this program and the variable orientations of the mineralized zones the intervals presented may not represent the true width of mineralization. |

|||||||

Table 2: Harricana Gold Project - Fontana Area Assay Results to Date |

|||||||

Drillhole ID |

From (m) |

To (m) |

Interval (m) |

Grade (g/t Au) |

Comment |

Zone |

Line |

DDFON22-001 |

90 |

91 |

1 |

2.1 |

|

Marcotte |

6480 |

and |

121.1 |

128 |

6.9 |

0.5 |

|

Marcotte |

6480 |

and |

180 |

182 |

2 |

1.3 |

|

Marcotte |

6480 |

and |

191 |

192 |

1 |

0.5 |

|

Marcotte |

6480 |

DDFON22-003 |

15 |

23 |

8 |

0.9 |

|

Marcotte |

6520 |

DDFON22-004 |

98 |

99 |

1 |

47.2 |

|

Marcotte |

6400 |

DDFON22-005 |

no significant intersections |

Marcotte |

6240 |

||||

DDFON22-006 |

17 |

18 |

1 |

6.1 |

visible gold |

Marcotte |

6240 |

and |

24 |

25 |

1 |

0.5 |

|

Marcotte |

6240 |

and |

31 |

32 |

1 |

0.5 |

|

Marcotte |

6240 |

and |

81 |

82 |

1 |

0.7 |

|

Marcotte |

6240 |

DDFON22-007 |

5 |

12 |

7 |

0.6 |

|

Marcotte |

6320 |

and |

56 |

59 |

3 |

0.6 |

|

Marcotte |

6320 |

and |

103.5 |

106 |

2.5 |

2.3 |

|

Marcotte |

6320 |

and |

114 |

117 |

3 |

1.5 |

|

Marcotte |

6320 |

DDFON22-008 |

12 |

14 |

2 |

0.7 |

|

Claverny |

5840 |

and |

21 |

56 |

35 |

0.6 |

|

Claverny |

5840 |

and |

76 |

77 |

1 |

1.1 |

|

Claverny |

5840 |

and |

84 |

85 |

1 |

0.6 |

|

Claverny |

5840 |

and |

103 |

104 |

1 |

0.5 |

|

Claverny |

5840 |

RCFON22-001 |

75 |

76 |

1 |

0.4 |

|

Marcotte |

6520 |

RCFON22-002 |

36 |

38 |

2 |

3.2 |

hole ended in mineralization |

Marcotte |

6520 |

and |

149 |

150 |

1 |

0.7 |

Marcotte |

6520 |

|

RCFON22-003 |

31 |

32 |

1 |

0.9 |

|

Marcotte |

6520 |

and |

98 |

99 |

1 |

0.7 |

|

Marcotte |

6520 |

RCFON22-004 |

9 |

10 |

1 |

5.2 |

|

Marcotte |

6400 |

RCFON22-005 |

64 |

65 |

1 |

0.5 |

|

Marcotte |

6400 |

RCFON22-006 |

18 |

19 |

1 |

1.1 |

|

Marcotte |

6400 |

and |

26 |

28 |

2 |

7.2 |

|

Marcotte |

6400 |

including |

27 |

28 |

1 |

14.0 |

|

Marcotte |

6400 |

RCFON22-007 |

70 |

71 |

1 |

0.5 |

|

Marcotte |

6480 |

RCFON22-008 |

117 |

118 |

1 |

0.4 |

|

Marcotte |

6480 |

RCFON22-009 |

7 |

8 |

1 |

0.4 |

|

Marcotte |

6480 |

RCFON22-010 |

42 |

43 |

1 |

1.1 |

|

Marcotte |

6480 |

RCFON22-011 |

19 |

22 |

3 |

1.6 |

|

Marcotte |

6400 |

and |

37 |

39 |

2 |

0.6 |

|

Marcotte |

6400 |

RCFON22-012 |

no significant intersections |

Marcotte |

6240 |

||||

RCFON22-013 |

71 |

75 |

4 |

0.4 |

|

Marcotte |

6240 |

RCFON22-014 |

57 |

59 |

2 |

0.9 |

|

Marcotte |

6240 |

RCFON22-015 |

88 |

89 |

1 |

0.9 |

|

Marcotte |

6240 |

RCFON22-016 |

10 |

11 |

1 |

0.9 |

|

Marcotte |

6320 |

RCFON22-017 |

63 |

64 |

1 |

0.6 |

|

Marcotte |

6320 |

RCFON22-018 |

97 |

98 |

1 |

0.6 |

|

Marcotte |

6320 |

and |

112 |

116 |

4 |

0.4 |

|

Marcotte |

6320 |

and |

123 |

124 |

1 |

8.4 |

|

Marcotte |

6320 |

and |

147 |

148 |

1 |

0.6 |

|

Marcotte |

6320 |

RCFON22-019 |

33 |

36 |

3 |

0.6 |

|

Marcotte |

6400 |

and |

64 |

68 |

4 |

0.6 |

|

Marcotte |

6400 |

RCFON22-020 |

No significant intersections |

Marcotte |

6400 |

||||

RCFON22-021 |

5 |

6 |

1 |

0.6 |

|

Marcotte |

6520 |

and |

33 |

35 |

2 |

1.1 |

|

Marcotte |

6520 |

and |

41 |

42 |

1 |

0.4 |

|

Marcotte |

6520 |

and |

106 |

115 |

9 |

8.7 |

|

Marcotte |

6520 |

including |

106 |

109 |

3 |

22.2 |

|

Marcotte |

6520 |

and |

178 |

182 |

4 |

0.8 |

|

Marcotte |

6520 |

RCFON22-022 |

12 |

13 |

1 |

0.8 |

|

Marcotte |

6480 |

and |

39 |

47 |

8 |

1.0 |

|

Marcotte |

6480 |

and |

71 |

72 |

1 |

1.2 |

|

Marcotte |

6480 |

RCFON22-023 |

13 |

14 |

1 |

0.5 |

|

Marcotte |

6480 |

and |

35 |

46 |

11 |

0.7 |

|

Marcotte |

6480 |

RCFON22-024 |

79 |

81 |

2 |

0.7 |

|

Marcotte |

6520 |

and |

161 |

162 |

1 |

0.9 |

|

Marcotte |

6520 |

RCFON22-025 |

15 |

16 |

1 |

0.6 |

|

Marcotte |

6600 |

and |

34 |

35 |

1 |

0.5 |

|

Marcotte |

6600 |

and |

45 |

46 |

1 |

0.7 |

|

Marcotte |

6600 |

and |

104 |

112 |

8 |

0.6 |

|

Marcotte |

6600 |

RCFON22-026 |

99 |

100 |

1 |

5.2 |

|

Marcotte |

6600 |

and |

140 |

141 |

1 |

1.8 |

|

Marcotte |

6600 |

and |

148 |

151 |

3 |

23.9 |

|

Marcotte |

6600 |

including |

148 |

150 |

2 |

35.4 |

|

Marcotte |

6600 |

and |

157 |

158 |

1 |

0.5 |

|

Marcotte |

6600 |

RCFON22-027 |

8 |

14 |

6 |

0.4 |

|

Claverny |

5840 |

and |

27 |

32 |

5 |

1.0 |

|

Claverny |

5840 |

and |

56 |

57 |

1 |

0.8 |

|

Claverny |

5840 |

and |

67 |

68 |

1 |

0.9 |

|

Claverny |

5840 |

Intervals are reported over a minimum downhole length of 1 m at a minimum length-weighted grade of 0.4 g/t Au with up to 4 m of consecutive internal dilution. Included high-grade intercepts are reported as any consecutive interval with grades greater than 10 g/t Au. No assays were capped. Due to the exploratory nature of this program and the variable orientations of the mineralized zones the intervals presented may not represent the true width of mineralization. |

|||||||

Table 3: Harricana Gold Project - Fontana Area Drillhole Locations in this News Release |

|||||||

Drillhole ID |

Easting (m) |

Northing (m) |

Length (m) |

Azimuth (°) |

Dip (°) |

Type |

Zone |

DDFON22-006 |

285,277 |

5,392,099 |

150 |

43 |

-56 |

DD |

Marcotte |

DDFON22-008 |

286,097 |

5,392,366 |

141 |

46 |

-55 |

DD |

Claverny |

RCFON22-008 |

285,140 |

5,392,305 |

156 |

45 |

-56 |

RC |

Marcotte |

RCFON22-009 |

285,117 |

5,392,273 |

130 |

51 |

-54 |

RC |

Marcotte |

RCFON22-020 |

285,114 |

5,392,169 |

100 |

46 |

-55 |

RC |

Marcotte |

RCFON22-024 |

285,001 |

5,392,224 |

175 |

43 |

-55 |

RC |

Marcotte |

RCFON22-025 |

284,966 |

5,392,292 |

130 |

46 |

-46 |

RC |

Marcotte |

RCFON22-027 |

286,116 |

5,392,399 |

110 |

42 |

-52 |

RC |

Claverny |

Collar coordinates surveyed using DGPS in UTM NAD 83 Zone 18N RC = reverse circulation drillhole, DD = diamond drillhole |

|||||||

Table 4: Harricana Gold Project – Near Surface Exploration Targets Summary |

||||

|

Material |

Tonnage Range |

Grade Range |

|

|

Project Area |

(millions) |

(g/t Au) |

|

|

Vein |

|

|

|

|

Fontana |

10.9 – 15.4 |

3.5 – 4.3 |

|

|

Monpas |

3.0 – 4.2 |

2.1 – 4.8 |

|

|

Duvay |

2.2 – 2.5 |

2.8 – 5.7 |

|

|

Wall Rock |

|

|

|

|

Fontana |

2.7 – 7.7 |

0.9 – 1.6 |

|

|

Monpas |

0.7 – 2.1 |

0.9 – 1.6 |

|

|

Duvay |

0.5 – 1.2 |

0.9 – 1.6 |

|

|

Vein + Wall Rock Combined |

|

|

|

|

Fontana |

13.6 – 23.1 |

3.0 – 3.4 |

|

|

Monpas |

3.7 – 6.3 |

1.9 – 3.7 |

|

|

Duvay |

2.7 – 3.7 |

2.4 – 4.4 |

|

|

Total Harricana Gold Project |

20.0 – 33.1 |

2.7 – 3.6 |

|

The Company cautions that while the Exploration Targets are based upon the results from 784 historical diamond drillholes totalling 108,681 m of drilling, the potential quantity and grade of the Exploration Targets are conceptual in nature, there has been insufficient verifiable exploration to define a mineral resource, and it is uncertain if further exploration will result in any of the Exploration Targets being delineated as a mineral resource. For additional information regarding the Exploration Targets, please review sections 9.4 – Exploration Targets and 26 - Recommendations in the Harricana Technical Report that is available on the Company’s website (www.kibokogold.com) and under its profile on SEDAR (www.sedar.com).