CardX Expands Online Payment Capabilities with Mastercard Click to Pay

CardX Expands Online Payment Capabilities with Mastercard Click to Pay

Now available on Lightbox, CardX’s online payment form will facilitate a seamless checkout experience

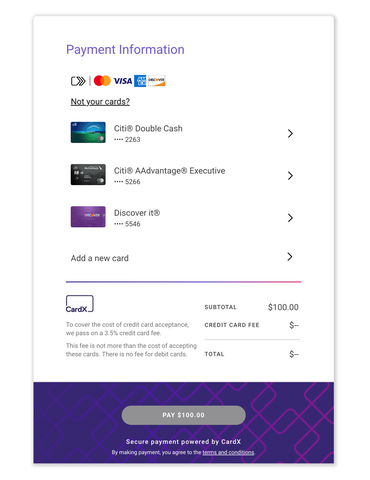

ORLANDO, Fla.--(BUSINESS WIRE)--CardX, a Stax company and the leading surcharging compliance platform, has launched Mastercard Click to Pay on Lightbox, CardX’s online payment form, to expand the product’s reach. With this partnership, Click to Pay is now available for all existing and new card-not-present merchants on CardX’s platform.

Given the present economic uncertainty, managing costs and optimizing approval rates is critical. Click to Pay makes the payment process as frictionless as possible for consumers, leading to higher approval rates and the potential for increased merchant sales. Lightbox enables consumers to enter their card information directly into Mastercard Click to Pay, where it is tokenized, delivering a seamless checkout experience and best-in-class data protection.

“We have worked with Mastercard since the early days of CardX, and our conversations together inspired many of the innovations we launched with Lightbox,” said Jonathan Razi, chief product officer at Stax, and founder and former CEO of CardX. “I can’t think of a more fitting way to progress our partnership than to integrate Mastercard Click to Pay into Lightbox, and we look forward to offering this win-win value proposition to both merchants and consumers.”

Mastercard, together with other EMVCo member brands, launched Click to Pay in the U.S. in 2019 to provide a more seamless and secure digital payment experience for ecommerce consumers. As an enhanced alternative to guest checkout, Click to Pay makes it easier for consumers to access their enrolled cards when purchasing from any ecommerce merchant or platform integrated with the solution. Click to Pay uses intelligent recognition, giving consumers quick access to their cards and associated information without the need to remember or enter a password, reducing cart abandonment. The solution also securely stores card details via tokenization, leading to higher approval rates.

Since being acquired by Stax in November 2021, CardX has been instrumental in helping Stax achieve its goal to eliminate transactional friction between businesses and the customers they serve. Looking ahead to 2023, Stax will focus on further scaling the organization and expanding its operations to better serve its more than 30,000 businesses across the nation.

To learn more about CardX, visit www.cardx.com.

About Stax

Stax Payments is one of America's fastest-growing fintech companies, recognized by U.S. News and World Report, Inc., and Fortune for its radically simple payment technology. Stax Payments empowers more than 30,000 small businesses, large businesses, and software platforms through the industry's only all-in-one payments API. Stax's platform provides businesses and SaaS platforms the ability to manage their payment ecosystem, analyze data, and simplify their customer experience through fully integrated solutions. With access to everything they need to transact and help their customers transact seamlessly, the one-stop tool allows companies to move faster, think smarter, and make better business decisions through the power of payments. Stax has powered more than $30 billion in transactions.

About CardX

CardX is the market leader in compliant surcharging. The CardX payment processing platform automates compliance with the card brand rules and state laws that apply to businesses seeking to eliminate their cost of credit card processing through surcharging.

As a fintech company, CardX offers best-in-class solutions for payments in all environments, all while delivering a compelling IT and process automation layer. And, as a regtech company, CardX addresses the staggering complexity of the legal and contractual requirements that apply to credit card surcharging, automating everything from consumer disclosures and card identification to refund proration and receipt management.

This end-to-end, fintech-meets-regtech value proposition has established CardX as the leader in this rapidly growing space and made it the trusted name for category leaders seeking industry-best technology.

Contacts

Kiley Ribordy

Walker Sands for Stax

staxpr@walkersands.com