ARLINGTON, Va.--(BUSINESS WIRE)--In the past two years, more than 300,000 accountants and auditors have left the field, leading to mass shortages amidst the most critical time of year for businesses: tax season. Consequently, Capterra’s Accounting Shortage Survey of nearly 300 business leaders found that 64% of businesses are struggling to find accounting firms to support them and are increasingly turning to software and overseas firms to avoid costly delays.

Here’s insight on how businesses are currently approaching their accounting needs during tax season:

- A majority (71%) of businesses outsource accounting work for the convenience, expertise, and legal compliance guarantees firms provide.

- The top outsourced tasks include financial advisory services (54%), processing and auditing (50%), and complicated tax compliance (48%).

- Businesses are so reliant on outside firms that 65% of them require full-time support to handle their taxes; however, firms aren’t delivering like they used to.

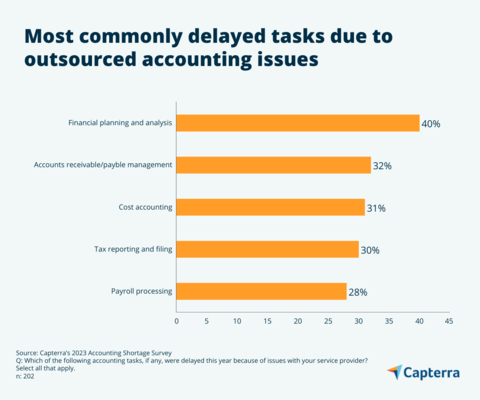

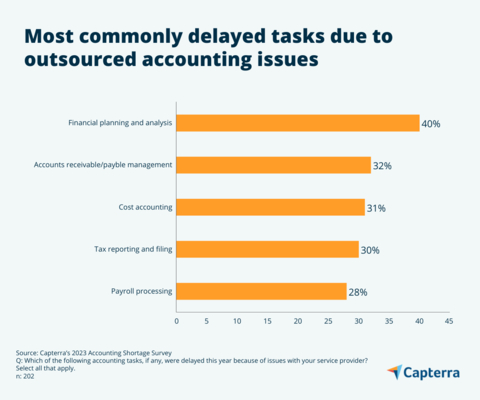

Relations between firms and businesses have become difficult due to the mass shortages of accountants, inflation, and economic downturn. Rising costs (50%) and an inability to support requests (31%) are among the top challenges for organizations using outside firms. With 93% of businesses experiencing accounting delays, over half (52%) of them are turning to software as a potential solution to help automate functions.

“America's accounting shortage has been plaguing accounting firms in the last few years,” says Max Lillard, senior finance analyst at Capterra. “As talent retires and the pipeline of fresh accountants dwindles, firms have struggled to provide the services businesses need to meet their financial needs. Despite the shortage, outsourced assistance is in high demand, and companies are weighing their options with software investments and overseas work.”

Much like outsourcing work to an accounting firm, adopting accounting software is a way to save money, free up time, and help improve an organization’s financial decision-making. The appeal of this technology isn’t going unnoticed either—in the next year, 58% of business leaders plan to spend more than $10K on new accounting software.

To save costs and prepare for tax season, some providers have also outsourced basic, entry-level work overseas. These teams use accounting software to prepare financial statements or attend to tasks like data entry. However, businesses report that working across time zones (33%) is one of the toughest challenges they encounter, so it’s not a perfect solution.

For full survey findings and expert advice on your accounting needs, please visit Capterra.com. To evaluate accounting software for your business, check out Capterra’s Shortlist which ranks software according to user reviews and proprietary data. If your business needs to outsource and expedite accounting needs instead, visit Capterra’s accounting services offering to link up with a firm right away.

About Capterra

Capterra is the #1 destination for organizations to find the right software and services. Our marketplace spans 90,000+ solutions across 1,300 software types, 50,000+ service providers, and offers access to over 2 million verified reviews—helping organizations save time, increase productivity and accelerate their growth.