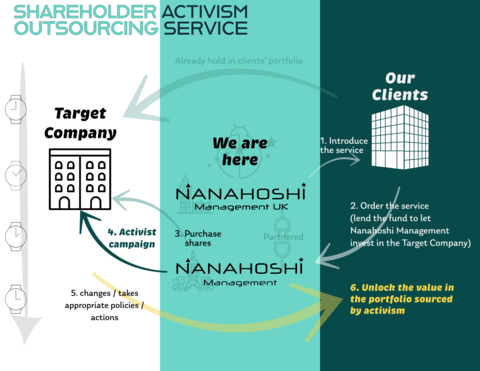

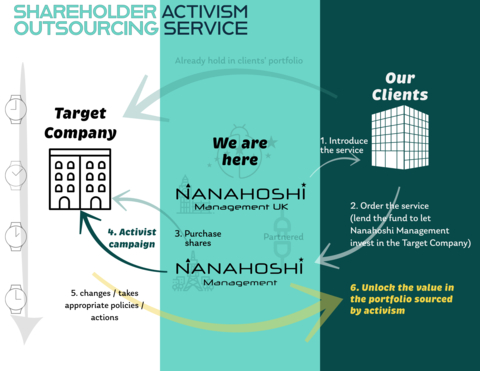

TOKYO & LONDON--(BUSINESS WIRE)--Nanahoshi Management Ltd., a dedicated Japanese shareholder activist, and Nanahoshi Management UK Ltd. (collectively, the “Companies”) today announced that they are revealing their shareholder activism outsourcing service called “Shareholder Activism on your behalf”.

“Shareholder Activism on your behalf” service enables investors to reconsider Japanese equities as an alternative-ish asset in an activism context rather than just one of Asian equity exposure. The Companies are excited to propose additional alpha sourced by activism for those investors who are willing to tackle the below bottlenecks:

- Inevitable reputational risks of hard engagement due to the instinctively hated Activism in Japan.

- Difficulty in educating non-English-speaking management.

- Limited resources for dedicated engagement focusing on shareholder activism.

The service overview: -

- A Client and Nanahoshi Management Ltd. (“NM”) take a general discussion about desired actions to be taken by a company existing in the client’s portfolio (the “Target Company”).

- NM purchases the appropriate number of shares of the Target Company from the market in Japan, funded by borrowing from the client.

- NM takes dialogues with the Target Company to encourage the Target Company to employ the desired actions and immediately starts activist campaigns in a very timely manner.

- Should the campaigns successfully change the management policy and/or take action, the client can expect the shareholders' value of the Target Company increases.

In a nutshell, all clients need to do are “1. order the service from us” and “4. wait for the expected increase in shareholders’ value” without disclosing their names in public. See also the below table for comparison.

Comparison of types to unlock alpha via activism

|

Our service |

Clients by

|

Via investing in

|

Co-investment

|

Clients’ names in public

|

No* (Low*) |

Yes (High) |

No* (Low*) |

Yes (High) |

Access to clients’ existing

|

Yes* |

Yes* |

Yes or No |

Yes* |

Degree of customizability of

|

High* |

High* |

Low |

Medium |

Fee |

No* |

Low |

High to Medium |

Low |

(Source: Nanahoshi Management Ltd.; * is the most appropriate for potential clients.) |

||||

|

||||

Satoru Matsuhashi, Founder and CEO of the Companies, said in London, “Throughout my entire equity investment professional career, I found it difficult for active/judgemental investors to access the policies of Japanese listed companies involving capital allocation, assurance of misconduct, health of employees, etc.

Our shareholder activism outsourcing service can help unlock alpha sourced by activism. Should you be concerned about the reputational risks of employing activism strategies in Japan or difficulty in communication with management, we would be happy to hear from you.”

About the Companies

Nanahoshi Management Ltd. is owned/operated by Satoru Matsuhashi, CFA, CESGA. The company focuses on ESG (environment, social, societal and governance) issues and encourages management to maximise their shareholders’ value through activist activities. For more information on Nanahoshi Management Ltd., please visit https://nanahoshimgmt.com.

The information on the ongoing shareholder activist campaign website for YSK (2812 JP Equity) is https://www.optimizeyaizu.com/english/.

Nanahoshi Management UK Ltd. was established in the UK by Satoru to push forward with the shareholder activism business. For more information on Nanahoshi Management UK Ltd., please visit https://nanahoshimgmt.co.uk.

Disclaimer

Nanahoshi Management Ltd. and Nanahoshi Management UK Ltd., each trading as Nanahoshi Management provide professional independent consulting services and all information used in the publication of our content has been compiled from publicly available sources that are believed to be reliable.

This content has been prepared purely for information purposes, and nothing contained within should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment. The content reflects the objective views of Satoru Matsuhashi and does not constitute investment advice. The Nanahoshi Management group does not make recommendations.

The information provided in our content is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Nanahoshi Management or its affiliates to any registration requirement within such jurisdiction or country.

Each investor must make their own independent decisions and obtain their own independent advice regarding any information, projects, securities, or financial instruments mentioned herein. Each investor’s particular needs, investment objectives and financial situation were not taken into account in the preparation of our content and the material contained herein. Each investor should consider whether an investment strategy of the purchase or sale of any product or security is appropriate for them in the light of their investment needs, objectives and financial circumstances.

Our content may constitute a “financial promotion” for the purposes of section 21 Financial Services and Markets Act 2000 (United Kingdom) (“FSMA”) and accordingly, its distribution in the United Kingdom is restricted.

Neither Nanahoshi Management nor any other person authorised by the Financial Conduct Authority (United Kingdom) has approved or authorised the contents of this document for the purposes of section 21 FSMA. Accordingly, this document is only directed at:

- persons who have professional experience in matters relating to investments falling within Article 19(5) (Investment Professionals) or Article 49 (High Net Worth Companies, Unincorporated Associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (as amended) (the “Order”);

- certified high net worth individuals within the meaning of Article 48 of the Order;

- certified sophisticated investors and self-certified sophisticated investors within the meaning of Article 50 and Article 50A of the Order;

- associations of high net worth investors or sophisticated investors within the meaning of Articles 51 of the Order; and

- any other person whom it may lawfully be communicated,

(collectively, the “Relevant Recipients”).

Our content is directed at only Relevant Recipients and must not, under any circumstances be acted on or relied on by persons who are not Relevant Recipients. Any investment or investment activity to which this communication relates is only available to Relevant Recipients and will be engaged in only with Relevant Recipients. The UK compensation scheme and rules for the protection of private customers do not apply to the services provided or products sold by non-UK regulated affiliates.

The receipt of our content by any person is not to be taken as constituting the giving of investment advice by Nanahoshi Management to any such person.

No part of our content may be reproduced, stored in a retrieval system or transmitted in any form or by any means, mechanical, photocopying, recording or otherwise, without prior permission from Nanahoshi Management.

By accepting our content, the recipient agrees to be bound by the limitations set out in this notice.

This notice shall be governed and construed in accordance with English law.