BILLERICA, Mass.--(BUSINESS WIRE)--Quanterix Corporation (NASDAQ: QTRX), a company fueling scientific discovery through ultrasensitive biomarker detection, today announced financial results for the fourth quarter and twelve months ended December 31, 2022.

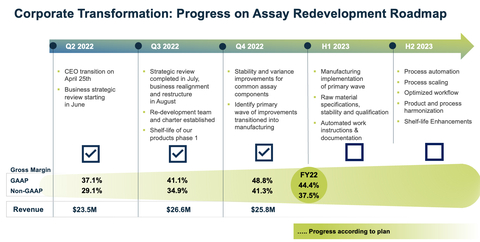

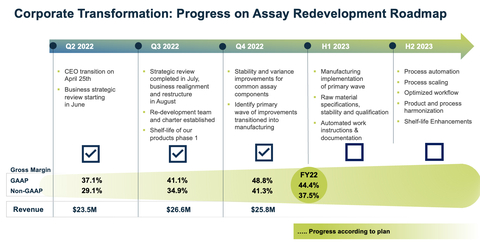

“Our Simoa technology continues to be on the forefront of research, testing, therapeutic trials and has been an integral part of recent advances in Alzheimer’s disease. In order to best capture and lead in this area, two quarters ago we began a corporate transformation and we’re pleased to announce the program is on track, with good progress quarter over quarter,” said Masoud Toloue, President and Chief Executive Officer of Quanterix.

Sequential Progress with Strategic Business Realignment

In August 2022, the Company initiated a strategic business realignment to maximize its full potential to enable access to current and future Simoa technology. As part of the realignment, the Company established an assay redevelopment program with the goal of improving its capability to manufacture high-quality assays at scale.

Quanterix’s fourth quarter and full year revenue results were in line with expectations set forth with this plan. Gross margin, a key success indicator of the Company’s strategic realignment, saw strong quarter-over-quarter improvement. Q4 GAAP gross margin was 48.8% versus Q3 GAAP gross margin of 41.1%. Q4 non-GAAP gross margin was 41.3% versus Q3 non-GAAP gross margin of 34.9%.

GAAP operating loss of $22.3 million for the fourth quarter of 2022 included approximately $10 million of restructuring and impairment related charges. As a result of the restructuring, SG&A costs were $19.3 million for the quarter, down $9.1 million from last year Q4.

Year over Year Financial Highlights

Fourth Quarter 2022

- Q4 GAAP revenue was $25.8 million versus prior year Q4 of $30.3 million, a decrease of 14.7%. Prior year Q4 revenue included $1.0 million of RADx revenue.

- Q4 GAAP gross margin was 48.8% versus prior year Q4 of 53.7%; Q4 non-GAAP gross margin was 41.3% versus prior year Q4 of 47.2%.

- Cash burn for Q4 was $5 million; ended 2022 with $338.7 million of unrestricted cash.

Full Year 2022

- FY GAAP total revenue was $105.5 million versus prior year FY of $110.6 million, which included RADx revenue of $5.2 million.

- FY GAAP gross margin was 44.4% versus prior year FY of 55.8%; and FY non-GAAP gross margin was 37.5% versus prior year FY of 49.6%.

For additional information on the non-GAAP financial measures included in this press release, please see “Use of Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below.

Fourth Quarter and Full Year Business Highlights

- In Q1 2022, Quanterix announced new agreements with Lilly to advance Alzheimer’s disease diagnosis and treatment; the agreements provide Quanterix access to Lilly’s P-tau217 antibody technology to create pathways for plasma-based biomarkers for use in Alzheimer’s disease and establish a framework for future collaboration and supports the development of Quanterix tests to advance diagnosing and treating life-threatening diseases.

- In Q2 2022, the Company received funding from the Alzheimer’s Drug Discovery Foundation to accelerate Alzheimer’s disease diagnostic plasma test development. The Company is collaborating with Amsterdam University Medical Centers on four phases of clinical trials to validate Quanterix’s multi-analyte test. Phase 1 training cohort was completed in Q4 with 1,200 samples and Phase 1b (independent retrospective cohort) and Phase 2 (prospective trial) are expected to start by the end of Q1 2023.

- The Company is participating in the BioHermes trial with the Global Alzheimer’s Platform Foundation. The 17 US site and 1,000 early Alzheimer’s patient trial closed in November of 2022 and is expected to complete data analysis in Q2 of this year. This prospective validation trial is expected to support a regulatory filing for FDA clearance for Quanterix’s P-tau181 test.

- In Q4 2022, the Company presented findings at the 15th Clinical Trials on Alzheimer’s Disease conference, revealing that Quanterix’s Simoa® technology has powered critical advances in ongoing clinical trials for the treatment of Alzheimer’s disease.

- The Company expanded its LDT menu with the launch of a neurofilament light chain (NfL) LDT, which can be used as an aid in the evaluation of individuals for possible neurodegenerative conditions or other causes of neuronal or central nervous system damage. Quanterix’s Simoa NfL is the most widely published NfL test with hundreds of research papers, demonstrating its validity for assessing neuronal damage, and Simoa NfL has become widely adopted in therapeutic clinical trial designs.

- Published discoveries enabled through Quanterix’s Simoa technology continue to illustrate industry reliance on the Company’s ultra-sensitive technology for breakthrough discovery in research and clinical applications. The technology was highlighted in 137 new publications in Q4 2022, bringing total Simoa-specific inclusions to over 2,100 as of the end of 2022.

Conference Call

In conjunction with this announcement, Quanterix Corporation will host a conference call on March 6, 2023 at 8:30 a.m. Eastern Time. Individuals interested in listening to the conference call may do so by pre-registering here and obtaining a dial-in number and passcode.

A live webcast will also be available at: https://edge.media-server.com/mmc/p/e6rxupm5. You may also access the live webcast by visiting the News & Events page within the Investors section of the Quanterix website at www.quanterix.com. The webcast will be available on the Company’s website for one year following completion of the call.

Financial Highlights

Quanterix Corporation |

|||||||||||

Condensed Consolidated Statements of Operations |

|||||||||||

(Unaudited and in thousands, except share and per share data) |

|||||||||||

|

Three Months Ended December 31, |

Year Ended December 31, |

|||||||||

2022 |

|

2021 |

2022 |

|

2021 |

||||||

Product revenue |

$ |

16,674 |

$ |

23,476 |

$ |

69,808 |

$ |

81,062 |

|||

Service and other revenue |

|

8,767 |

|

5,674 |

|

34,495 |

|

23,629 |

|||

Collaboration revenue |

|

170 |

|

162 |

|

649 |

|

648 |

|||

Grant revenue |

|

213 |

|

975 |

|

570 |

|

5,217 |

|||

Total revenue |

|

25,824 |

|

30,287 |

|

105,522 |

|

110,556 |

|||

Costs of goods sold: |

|

|

|

|

|

|

|

|

|||

Cost of product revenue |

|

9,631 |

|

9,916 |

|

40,809 |

|

34,149 |

|||

Cost of service and other revenue |

|

3,601 |

|

4,110 |

|

17,907 |

|

14,679 |

|||

Total costs of goods sold and services |

|

13,232 |

|

14,026 |

|

58,716 |

|

48,828 |

|||

Gross profit |

|

12,592 |

|

16,261 |

|

46,806 |

|

61,728 |

|||

Gross margin |

48.8% |

53.7% |

44.4% |

55.8% |

|||||||

Operating expenses: |

|

|

|

|

|

|

|

|

|||

Research and development |

|

5,600 |

|

7,734 |

|

25,890 |

|

27,978 |

|||

Selling, general and administrative |

|

19,272 |

|

28,423 |

|

91,995 |

|

92,336 |

|||

Other lease costs |

669 |

— |

1,278 |

— |

|||||||

Restructuring |

329 |

— |

3,755 |

— |

|||||||

Goodwill impairment |

— |

— |

8,220 |

— |

|||||||

Impairment expense |

|

8,677 |

|

— |

|

17,372 |

|

— |

|||

Total operating expenses |

|

34,547 |

|

36,157 |

|

148,510 |

|

120,314 |

|||

Loss from operations |

|

(21,955) |

|

(19,896) |

|

(101,704) |

|

(58,586) |

|||

Interest income (expense), net |

|

2,815 |

|

15 |

|

5,131 |

|

(403) |

|||

Other income (expense), net |

|

614 |

|

(213) |

|

(62) |

|

1,265 |

|||

Loss before income taxes |

|

(18,526) |

|

(20,094) |

|

(96,635) |

|

(57,724) |

|||

Income tax (expense) benefit |

(75) |

4 |

(65) |

36 |

|||||||

Net loss |

$ |

(18,601) |

$ |

(20,098) |

$ |

(96,700) |

$ |

(57,760) |

|||

Net loss per share, basic and diluted |

$ |

(0.50) |

$ |

(0.55) |

$ |

(2.61) |

$ |

(1.60) |

|||

Weighted-average common shares outstanding, basic and diluted |

|

37,160,472 |

|

36,659,254 |

|

36,990,965 |

|

35,997,473 |

|||

Quanterix Corporation |

|||||||

Condensed Consolidated Balance Sheets |

|||||||

(Unaudited and in thousands) |

|||||||

December 31, 2022 |

|

December 31, 2021 |

|||||

Assets |

|||||||

Current assets: |

|

|

|||||

Cash and cash equivalents |

$ |

338,740 |

$ |

396,465 |

|||

Accounts receivable, net |

|

19,017 |

|

23,786 |

|||

Inventory |

|

16,786 |

|

22,190 |

|||

Prepaid expenses and other current assets |

|

6,860 |

|

6,514 |

|||

Total current assets |

381,403 |

|

448,955 |

||||

Restricted cash |

|

2,597 |

|

2,577 |

|||

Property and equipment, net |

|

20,162 |

|

17,960 |

|||

Intangible assets, net |

|

7,516 |

|

10,534 |

|||

Goodwill |

|

— |

|

9,632 |

|||

Right-of-use assets |

21,223 |

11,491 |

|||||

Other non-current assets |

|

1,298 |

|

378 |

|||

Total assets |

$ |

434,199 |

$ |

501,527 |

|||

Liabilities and stockholders’ equity |

|

|

|

|

|||

Current liabilities: |

|

|

|

|

|||

Accounts payable |

$ |

3,836 |

$ |

9,209 |

|||

Accrued compensation and benefits |

|

10,658 |

|

13,252 |

|||

Other accrued expenses |

|

4,747 |

|

6,486 |

|||

Deferred revenue |

|

8,644 |

|

6,361 |

|||

Short-term lease liabilities |

2,687 |

1,428 |

|||||

Other current liabilities |

|

386 |

|

241 |

|||

Total current liabilities |

|

30,958 |

|

36,977 |

|||

Deferred revenue, net of current portion |

|

1,415 |

|

1,099 |

|||

Long-term lease liabilities |

41,417 |

20,464 |

|||||

Other non-current liabilities |

|

1,469 |

|

2,035 |

|||

Total liabilities |

|

75,259 |

|

60,575 |

|||

Total stockholders’ equity |

|

358,940 |

|

440,952 |

|||

Total liabilities and stockholders’ equity |

$ |

434,199 |

$ |

501,527 |

|||

Use of Non-GAAP Financial Measures

To supplement its financial statements presented on a GAAP basis, the Company presents non-GAAP gross profit and non-GAAP gross margin, which are calculated by including shipping and handling costs for product sales within cost of goods sold instead of within selling, general and administrative expenses. Management uses these non-GAAP measures to evaluate the Company’s operating performance in a manner that allows for meaningful period-to-period comparison and analysis of trends between the Company’s business and its competitors. Management believes that presentation of non-GAAP gross margin provides useful information to investors in assessing the Company’s operating performance within its industry and in order to allow comparability to the presentation of other companies in its industry where shipping and handling costs are included in cost of goods sold for products. Management also uses non-GAAP gross margin as a factor in assessing the Company’s progress against the strategic business realignment plan. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for, the financial information presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these pro-forma measures to their most directly comparable GAAP financial measures set forth below.

Reconciliation of GAAP to Non-GAAP Financial Measures

| Quanterix Corporation | |||||||||||||||||

| Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures | |||||||||||||||||

| (Unaudited and in thousands, except percentages) | |||||||||||||||||

Three Months Ended December 31, |

Three Months Ended

|

Three Months Ended

|

Year Ended December 31, |

||||||||||||||

2022 |

2021 |

2022 |

2022 |

2022 |

2021 |

||||||||||||

| GAAP gross profit | $ | 12,592 |

$ | 16,261 |

$ | 10,944 |

$ | 8,711 |

$ | 46,806 |

$ | 61,728 |

|||||

| Shipping and handling costs (1) | (1,926) |

(1,976) |

(1,636) |

(1,868) |

(7,206) |

(6,892) |

|||||||||||

| Non-GAAP gross profit | $ | 10,666 |

$ | 14,285 |

$ | 9,308 |

$ | 6,843 |

$ | 39,600 |

$ | 54,836 |

|||||

| GAAP Revenue | 25,824 |

30,287 |

26,646 |

23,500 |

105,522 |

110,556 |

|||||||||||

| GAAP Gross margin (GAAP gross profit as % of revenue) | 48.8% |

53.7% |

41.1% |

37.1% |

44.4% |

55.8% |

|||||||||||

| Non-GAAP gross margin (non-GAAP gross profit as % of revenue) | 41.3% |

47.2% |

34.9% |

29.1% |

37.5% |

49.6% |

|||||||||||

| GAAP total operating expenses | $ | 34,547 |

$ | 36,157 |

$ | 47,547 |

$ | 33,670 |

$ | 148,510 |

$ | 120,314 |

|||||

| Shipping and handling costs (1) | (1,926) |

(1,976) |

(1,636) |

(1,868) |

(7,206) |

(6,892) |

|||||||||||

| Non-GAAP total operating costs | $ | 32,621 |

$ | 34,181 |

$ | 45,911 |

$ | 31,802 |

$ | 141,304 |

$ | 113,422 |

|||||

| GAAP loss from operations | $ | (21,955) |

$ | (19,896) |

$ | (36,603) |

$ | (24,959) |

$ | (101,704) |

$ | (58,586) |

|||||

| Non-GAAP loss from operations | $ | (21,955) |

$ | (19,896) |

$ | (36,603) |

$ | (24,959) |

$ | (101,704) |

$ | (58,586) |

|||||

| (1) Shipping and handling costs, which include freight and other activities costs associated with product shipments, net of charges passed on to the customer, are captured within operating expenses in our consolidated statements of operations. During the three months and year ended December 31, 2022, we incurred $1.9 million and $7.2 million, respectively, of shipping and handling costs recorded within operating expenses. During the three months and year ended December 31, 2021, we incurred $2.0 million and $6.9 million, respectively, of shipping and handling costs recorded within operating expenses. During the three months ended September 30, 2022, we incurred $1.6 million of shipping and handling costs within operating expenses. During the three months ended June 30, 2022, we incurred $2.1 million of shipping and handling costs within operating expenses. | |||||||||||||||||

About Quanterix

From discovery to diagnostics, Quanterix’s ultrasensitive biomarker detection is driving breakthroughs only made possible through its unparalleled sensitivity and flexibility. The Company’s Simoa ® technology has delivered the gold standard for earlier biomarker detection in blood, serum or plasma, with the ability to quantify proteins that are far lower than the Level of Quantification (LoQ). Its industry-leading precision instruments, digital immunoassay technology and CLIA-certified Accelerator laboratory have supported research that advances disease understanding and management in neurology, oncology, immunology, cardiology and infectious disease. Quanterix has been a trusted partner of the scientific community for nearly two decades, powering research published in more than 2,000 peer-reviewed journals. Find additional information about the Billerica, Massachusetts-based company at https://www.quanterix.com or follow us on Twitter and LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "may," "will," "expect," "plan," "anticipate," "estimate," "intend" and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements about Quanterix’ financial performance, including anticipated progress associated with Quanterix’ strategic business alignment plan, and are subject to a number of risks, uncertainties and assumptions. Forward-looking statements in this news release are based on Quanterix’ expectations and assumptions as of the date of this press release. Each of these forward-looking statements involves risks and uncertainties. Factors that may cause Quanterix’ actual results to differ from those expressed or implied in the forward-looking statements in this press release include, but are not limited to, those described in “Part I, Item 1A, “Risk Factors” in Quanterix’ Annual Report on Form 10-K for the year ended December 31, 2022, to be filed with the SEC on March 6, 2023. Except as required by law, Quanterix assumes no obligation to update any forward-looking statements contained herein to reflect any change in expectations, even as new information becomes available.