MONTREAL--(BUSINESS WIRE)--Lomiko Metals Inc. (TSX.V: LMR) (“Lomiko Metals” or the “Company”) is pleased to announce that it has entered into an agreement (the “Acquisition Agreement”) with SOQUEM and a private owner to acquire 100% of 17 mineral claims forming the Carmin project (the “Property”), subject to customary closing conditions expected to be completed within the next 3 to 4 weeks (the “Closing Date”). These claims cover 678 hectares (6,780 Sq km). The agreement was signed on March 2, 2023.

The Property is located 40 km west of Mont Tremblant and situated north-east and contiguous to the La Loutre property where Lomiko has mineral rights (see Figure 1 below). The Property is accessible by road and forest road from Lac-des-Plages and the northern end of the claims are partially contiguous to the Papineau-Labelle Wildlife Reserve. Lomiko commits to not exploring or developing within 1km of park boundaries. The La Loutre and Carmin project site are located within the Kitigan Zibi Anishinabeg (KZA) First Nation’s territory and the KZA First Nation is part of the Algonquin Nation. KZA territory is situated within the Outaouais and Laurentides region.

Belinda Labatte, CEO and director of Lomiko stated: “Our team is developing a regional and responsible approach to natural flake graphite development via organic growth of its La Loutre project, its six regional claims and this new claim acquisition. The Carmin property has the potential to add significant mineral resources and mineral reserves to La Loutre’s existing resource base. This can positively impact La Loutre project economics, and importantly, it provides for additional responsible site planning in the region. We also welcome SOQUEM as a shareholder of Lomiko and look forward to working with SOQUEM in the long term. The regional geophysical surveys being anticipated to be carried out in the region, in 2023, mark significant opportunities and actions towards creating a regional approach to developing natural flake graphite, that if developed can feed into the North American electric vehicle supply chain.”

Carmin Property and historical works

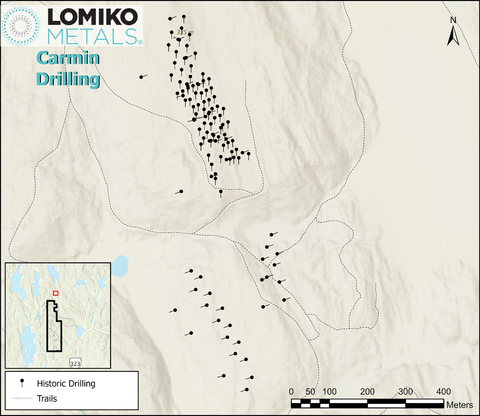

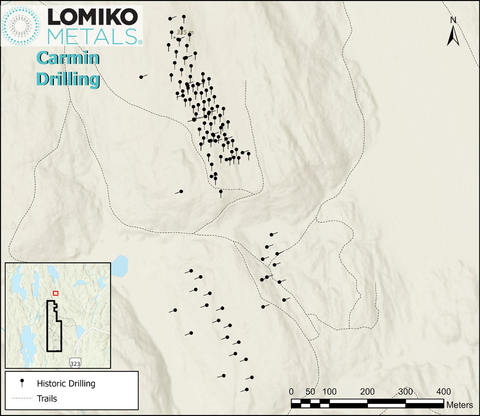

All work including the mineral resource and mineral reserve estimates are considered to be historic. The Property consists of the Carmin deposit which consists of three previously identified mineral occurrences identified as site A, B and C; where the main mineral occurrence is identified as Site A. The historical estimate was completed by SOQUEM in December 1990, using sections and polygonal methods accounting for the blocks between sections 975N and 1425N using 2.6t/m3 density. The property has been worked on since the late 1980s and early 1990s when a pre-feasibility study was published. This historic pre-feasibility study wasn’t completed in compliance with current CIM guidelines and NI-43-101 reporting requirements.

The historic mineral resource estimate is based on Site A and the 91 boreholes drilled for a total of 5,688 metres, with the average hole depth of 62.5 m. The historic mineral resource estimate for Site B is based on 27 holes for a total of 2,937m metres and average hole depth of 108.8m.

The original historical estimate contemplated certain assumptions where the mineral resources are stated as Proven and Probable resources for Sites A and B. This historic pre-feasibility study wasn’t completed in compliance with current CIM guidelines and NI-43-101 reporting requirements.

Site A: total in place 1.55 Mt at 10.0% Cg

- Proven: 1.47 Mt at 10.29% Cg (holes drilled at 25 meters spacing) – likely measured

- Probable: 0.073 Mt at 4.10% Cg

- In-situ graphite content: 155,000t

Site B: in place

- Proven 123,000t at 13.1% Cg

- Probable: 39,000t at 13.1% Cg

Site C: undetermined mineral resources

Lomiko has not done sufficient work to classify the historical estimate as a current resource, however the Company believes the original results can be relied upon to determine a subsequent exploration drill program, with the objective of updating the historical estimate using NI 43-101 guidelines. The Company is not treating the historical estimate as a current resource (“Historical estimate” – a non-verified estimate prepared prior to issuer’s interest in the property).

A historic Pre-feasibility study was completed in March 1991 by SNC Lavallin Inc. This historic pre-feasibility study wasn’t completed in compliance with current CIM guidelines and NI-43-101 reporting requirements. The study considered only Site A and outlines:

- Exploitable reserves: 1,013,000 tonnes at 8.75% Cg, diluted using 15% dilution at 1% Cg

- Cut-off content: 3% Cg

- Strip ratio waste: ore: 2:1

- Plant production of 87,200t or 15,000 tons of concentrate per year, mine life of 6 years

The historic metallurgical test results completed as part of this study by Centre de Recherches Minérales (“CRM”) in December 1990 for SOQUEM indicated the following:

- Overall recovery: 85%

-

Concentrates grading 95% Cg

- +48 meshes: 16.5%

- -48 +100 meshes: 28.5%

- -100 meshes: 55%

Definitive Agreement terms

Lomiko to acquire SOQUEM’s interest in all mineral rights forming part of the Property in consideration of (i) $50,000 payable in cash to SOQUEM in a single payment on the Closing Date; (ii) the issuance to SOQUEM of 1,250,000 Shares; and (iii) the granting to SOQUEM of a royalty of 0.75% on net smelter revenues (NSR) on the Property. However, Lomiko retains the exclusive and irrevocable right and option to redeem one-third of the Royalty, thus reducing the Royalty to 0.50% NSR, for a total amount of $250,000 payable in cash to SOQUEM.

Lomiko to acquire private owner’s interest in the mineral rights forming part of the Property in consideration of (i) the issuance to the private owner of 1,250,000 Shares; and (ii) the granting to the private owner of a 0.75% royalty on the NSRs on the Property. However, Lomiko retains the exclusive and irrevocable right and option to redeem one-third of the royalty, thereby reducing the royalty to 0.50% NSR, for a total amount of $250,000 payable in cash to the private owner.

The transaction is subject to customary closing conditions including the approval of the TSX Venture Exchange. The shares issuable by Lomiko under this transaction will be subject to a regulatory hold period of 4 months and 1 day following the Closing Date. Lomiko is not paying any finders fees in order to acquire the property.

Next steps

Lomiko intends to review existing data and continue with work required to update the historical mineral resource and issue a NI 43-101 compliant technical report in 2023, subject to available financing. It may also conduct metallurgical testing of the prospect to confirm historical results.

In addition, and as mentioned in its press release dated February 21, 2023, Lomiko plans to advance exploration on its six graphite minerals properties, acquired in the spring of 2022 in the Grenville Metasedimentary Graphite Belt. The objective of the Carmin acquisition and the regional exploration is to develop a sustainable, responsible approach and resilient strategic stockpile of natural flake graphite that can feed into the graphite market at large, and the regional market for electric vehicles battery manufacturing.

Qualified Person for technical content at Carmin

The technical information in this press release has been prepared and approved by Ms. Gordana Slepcev P.Eng., who is the Company’s COO and registered professional engineer in the province of Ontario, a qualified person as defined by NI 43-101 guidelines.

About Lomiko Metals Inc.

The Company holds mineral interests in its La Loutre graphite development in southern Quebec. The La Loutre project site is located within the Kitigan Zibi Anishinabeg (KZA) First Nation’s territory. The KZA First Nation is part of the Algonquin Nation and the KZA traditional territory is situated within the Outaouais and Laurentides regions. Located 180 kilometres northwest of Montreal, the property consists of one large, continuous block with 76 mineral claims totalling 4,528 hectares (45.3 km2).

The Property is underlain by rocks belonging to the Grenville Province of the Precambrian Canadian Shield. The Grenville was formed under conditions that were very favourable for the development of coarse-grained, flake-type graphite mineralization from organic-rich material during high-temperature metamorphism.

Lomiko Metals published a July 29, 2021 Preliminary Economic Estimate (PEA) which indicated the project had a 15-year mine life producing per year 100,000 tonnes of graphite concentrate at 95% Cg or a total of 1.5Mt of graphite concentrate. This report was prepared as National Instrument 43-101 Technical Report for Lomiko Metals Inc. by Ausenco Engineering Canada Inc., Hemmera Envirochem Inc., Moose Mountain Technical Services, and Metpro Management Inc., collectively the Report Authors.

In addition to La Loutre, Lomiko is working with Critical Elements Lithium Corporation towards earning its 70% stake in the Bourier Project as per the option agreement announced on April 27th, 2021. The Bourier project site is located near Nemaska Lithium and Critical Elements south-east of the Eeyou Istchee James Bay territory in Quebec which consists of 203 claims, for a total ground position of 10,252.20 hectares (102.52 km2), in Canada’s lithium triangle near the James Bay region of Quebec that has historically housed lithium deposits and mineralization trends.

On behalf of the Board,

Belinda Labatte

CEO and Director, Lomiko Metals Inc.

For more information on Lomiko Metals, review the website at www.lomiko.com.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the Company; and any other information herein that is not a historical fact may be "forward-looking information" (“FLI”). All statements, other than statements of historical fact, are FLI and can be identified by the use of statements that include words such as "anticipates," "plans," "continues," "estimates," "expects," "may," "will," "projects," "predicts," “proposes”, "potential," "target," "implement," “scheduled”, "intends," "could," "might," "should," "believe" and similar words or expressions. FLI in this new release includes, but is not limited to: expected timing of completion of the closing conditions in connection with the acquisition and closing of the acquisition, expected costs of exploration and timing to achieve certain milestones, timing for completion of exploration programs; the Company’s ability to successfully fund, or remain fully funded for the implementation of its business strategy and for exploration of any of its projects (including from the capital markets); any anticipated impacts of COVID-19 on the Company’s business objectives or projects and the Company's financial position or operations. FLI involves known and unknown risks, assumptions and other factors that may cause actual results or performance to differ materially. This FLI reflects the Company’s current views about future events, and while considered reasonable by the Company at this time, are inherently subject to significant uncertainties and contingencies. Accordingly, there can be no certainty that they will accurately reflect actual results. Assumptions upon which such FLI is based include, without limitation: the ability of the Company to meet the closing conditions of the acquisition, including regulatory approval, and complete the transaction within the anticipated timing; ability to implement its business strategy and to fund, explore, advance and develop each of its projects, including results therefrom and timing thereof; uncertainties related to receiving and maintaining exploration, environmental and other permits or approvals in Quebec; any unforeseen impacts of COVID-19; impact of increasing competition in the mineral exploration business, including the Company’s competitive position in the industry; general economic conditions, including in relation to currency controls and interest rate fluctuations.

The FLI contained in this news release are expressly qualified in their entirety by this cautionary statement, the “Forward-Looking Statements” section contained in the Company’s most recent management’s discussion and analysis (MD&A), which is available on SEDAR at www.sedar.com, and on the investor presentation on its website. All FLI in this news release are made as of the date of this news release. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.