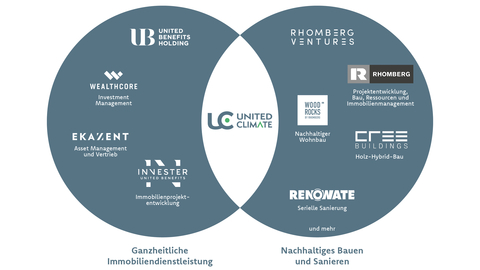

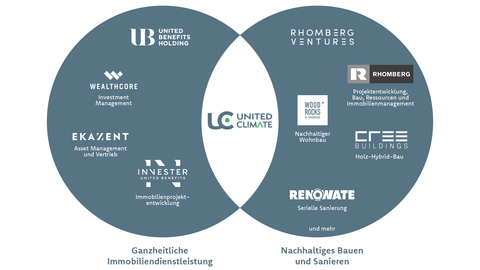

VIENNA--(BUSINESS WIRE)--Comprehensive disclosure requirements, complex ESG standards, rising stranding risks: With property owners and developers facing multiple challenges in the wake of climate change and increasing financial market regulation, United Benefits Holding and Rhomberg ventures, two real estate companies specializing in sustainability, have founded the one-stop solution United Climate. The 50:50 joint venture takes a holistic development approach to existing and new construction projects. United Climate seeks to offer a full range of processes along the entire value chain – from consulting and planning to implementation with directly and indirectly affiliated companies. Its goal is to help other companies optimize their existing and new construction projects in environmental, social and economic terms.

Michael Klement, CEO of United Benefits Holding: “For years, both companies have shared a common strategy: creating long-term value by applying top sustainability standards. United Climate brings together two strong partners who will apply their know-how for the benefit of investors, the environment and society, and offer not only consulting services but also full implementation.

Hubert Rhomberg, CEO of Rhomberg ventures: “Regulatory requirements and the increasing demand among investors for sustainable projects are a veritable challenge for portfolio owners and new-build developers. We want to help these companies comprehensively optimize their real estate projects and manage ESG risks through our holistic approach and comprehensive ESG expertise. Sustainability should not be a regulatory burden, but an investment in the future that leads to long-term financial benefits.”

Investing sustainably for long-term benefits.

How does the “United Climate + one-stop shop” concept work? United Climate manages the full sequence of activities, from inventory through analysis to strategy planning. As a consulting company, it defines concrete construction measures, including time and cost indications, and then coordinates implementation by affiliated companies, including controlling and reporting. For the client, this ensures that the project is optimized in a uniform and consistent manner. Along with United Climate’s products, the key tools applied are the comprehensive expertise and high standards in the field of digitalization provided by both groups of companies and their subsidiaries. Compliance with the highest ESG standards in new build projects and efficient ESG optimization are achieved by reducing carbon emissions in the design, construction and operation phases. In addition to user-oriented project planning, the construction process is also optimized. This facilitates lower operating costs and higher rental income. Instead of having to accept high losses due to stranded assets, United Climate’s method with its optimal “green” implementation strategy provides the basis for a healthy increase in the value of a property.

Climate risk = financial risk

The new company anticipates an enormous potential because 40 percent of all carbon emissions can be traced back to the activities of the construction industry alone. However, there is frequently a lack of knowledge regarding implementation. “This is the dilemma we intend to resolve. For the companies – and for future generations,” says Klement. The climate crisis has a particularly strong impact on the real estate sector. Since the Paris Agreement (COP21) was concluded in 2015, the framework conditions for the construction industry have been tightened with a view to securing an environmentally friendly future. At present, the EU Taxonomy Regulation, Corporate Social Responsibility (CSR), Corporate Sustainability Reporting Directives (CSRD), Insurance Distribution Directives (IDD) and Markets in Financial Instruments Directives (MIFiD2) determine the legal foundations of the economy and the construction industry. Climate change is creating new valuation scales for the profitability of real assets. Today, climate risk = financial risk. United Climate has worked with its cooperation partners, who are industry pioneers in the field of sustainable real estate development, to develop an efficient “manage to ESG” strategy. Pooling the expertise of United Benefits Holding and Rhomberg ventures has resulted in a holistic one-stop shop that manages long-term value creation for real estate in accordance with strict environmental and climate protection standards, from a single source, for commercial and institutional portfolio owners, foundations and family offices as well as project developers of new buildings, renovations and construction in existing buildings, and investors: United Climate offers a high-performance, comprehensive package for optimizing real estate projects in social, economic and environmental terms.

United Benefits Holding is based in Vienna. It was founded in 2020 after two decades of developing real estate projects. Under the management of CEO Michael Klement, the holding company creates holistic, intelligent concepts for sustainable real estate. The dynamic holding company team develops a shared strategy, shared ESG guidelines and shared goals for the subsidiaries and all areas of activity of the entire Group in the German-speaking world. United Benefits Holding comprises several subsidiaries: project developer Invester, asset manager Ekazent, and investment manager WEALTHCORE with its Green Impact fund series as defined by Article 9 of the EU Disclosure Regulation.

Rhomberg ventures is based in Bregenz. Headed by CEO Taras Rebet, the company addresses global issues and develops sustainable, responsible and economic solutions in the fields of PropTech and ClimateTech. Rhomberg ventures’ solutions include, in particular, the holistic CREE building concept for timber hybrid construction using prefabricated components. It can also be used for other building types. CREE also incorporates detailed considerations of space, waste and resource management. Rhomberg ventures works closely with Rhomberg Group companies such as WoodRocks and Renowate.

About United Benefits Holding

United Benefits Holding is an independent real estate service provider with a holistic approach. In cooperation with its subsidiaries INVESTER United Benefits (Development), EKAZENT Asset Management and WEALTHCORE Investment Management, the Group initiates, develops, realizes and manages real estate investments in the German-speaking market and provides a full range of services and processes along the entire value chain of property investments. In line with the company’s clear ESG strategy, all investments focus on independence, transparency and social justice, as well as on reducing carbon emissions and creating sustainable value. The group employs approximately 90 people and manages a volume of some 1.8 billion euros.

For more information, please see www.ub-holding.com.

About Rhomberg ventures

Rhomberg ventures was founded by Hubert Rhomberg to promote innovations and business ideas that are genuinely sustainable. Genuinely sustainable means meeting environmental and social as well as economic sustainability criteria. The company’s investment activities focus on the three areas of Urban Development, Real Estate and Construction, and Infrastructure and Mobility. They are marketed under “Building. Space. Community”.

For more information, please see www.rhombergventures.com