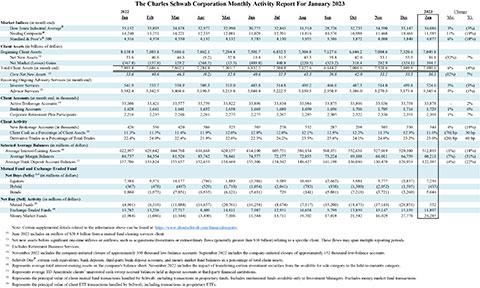

WESTLAKE, Texas--(BUSINESS WIRE)--The Charles Schwab Corporation released its Monthly Activity Report today. Company highlights for the month of January 2023 include:

- Core net new assets brought to the company by new and existing clients totaled $36.1 billion. Net new assets excluding mutual fund clearing totaled $34.8 billion.

- Total client assets were $7.48 trillion as of month-end January, down 4% from January 2022 and up 6% compared to December 2022.

- Client cash as a percentage of assets was 11.6% as of month-end January, compared with 11.3% in January 2022 and 12.3% in December 2022.

Commentary from the CFO

CFO Peter Crawford commented, “Our strong business momentum carried over into the new year as we gathered a record $36.1 billion in core net new assets during January, an annualized growth rate of 6%. Investor engagement and sentiment improved from year-end levels as equity markets rebounded – with the S&P 500® index notching its best start in four years. Given the strong performance of the markets during the month, in conjunction with normal seasonal patterns, clients increased allocations to equity and fixed income securities to start the year. Over the remainder of 2023, Schwab’s diversified financial model keeps us well-positioned to convert our continued success with clients into earnings growth and meaningful capital return.”

Forward-Looking Statements

This press release contains forward-looking statements relating to Schwab’s business momentum and client success; positioning; earnings growth; and returning capital to stockholders. These forward-looking statements reflect management’s expectations as of the date hereof. Achievement of these expectations and objectives is subject to risks and uncertainties that could cause actual results to differ materially from the expressed expectations.

Important factors that may cause such differences include, but are not limited to, the company’s ability to attract and retain clients and independent investment advisors and grow those relationships and client assets; develop and launch new and enhanced products, services, and capabilities, as well as enhance its infrastructure and capacity, in a timely and successful manner; hire and retain talent; support client activity levels; successfully implement integration strategies and plans; monetize client assets; and manage expenses. Other important factors include client use of the company’s advisory solutions and other products and services; general market conditions, including equity valuations and the level of interest rates; the level and mix of client trading activity; market volatility; margin loan balances; securities lending; competitive pressures on pricing; client cash sorting; client sensitivity to rates; level of client assets, including cash balances; capital and liquidity needs and management; balance sheet positioning relative to changes in interest rates; interest earning asset mix and growth; the migration of bank deposit account balances; and other factors set forth in the company’s most recent reports on Form 10-K and Form 10-Q.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with 33.9 million active brokerage accounts, 2.4 million corporate retirement plan participants, 1.7 million banking accounts, and $7.48 trillion in client assets as of January 31, 2023. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiaries, Charles Schwab & Co., Inc., TD Ameritrade, Inc., and TD Ameritrade Clearing, Inc., (members SIPC, https://www.sipc.org), and their affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent, fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at https://www.aboutschwab.com.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are separate but affiliated companies and subsidiaries of TD Ameritrade Holding Corporation. TD Ameritrade Holding Corporation is a wholly owned subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank.

The Charles Schwab Corporation Monthly Activity Report For January 2023 |

|||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||

2022 |

|

2023 |

|

Change |

|||||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Mo. |

Yr. |

|||||||||||||||||||||||||||

| Market Indices (at month end) |

|

|

|||||||||||||||||||||||||||||||||||||||

| Dow Jones Industrial Average® | 35,132 |

|

33,893 |

|

34,678 |

|

32,977 |

|

32,990 |

|

30,775 |

|

32,845 |

|

31,510 |

|

28,726 |

|

32,733 |

|

34,590 |

|

33,147 |

|

34,086 |

|

3% |

(3%) |

|||||||||||||

| Nasdaq Composite® | 14,240 |

|

13,751 |

|

14,221 |

|

12,335 |

|

12,081 |

|

11,029 |

|

12,391 |

|

11,816 |

|

10,576 |

|

10,988 |

|

11,468 |

|

10,466 |

|

11,585 |

|

11% |

(19%) |

|||||||||||||

| Standard & Poor’s® 500 | 4,516 |

|

4,374 |

|

4,530 |

|

4,132 |

|

4,132 |

|

3,785 |

|

4,130 |

|

3,955 |

|

3,586 |

|

3,872 |

|

4,080 |

|

3,840 |

|

4,077 |

|

6% |

(10%) |

|||||||||||||

| Client Assets (in billions of dollars) |

|

|

|||||||||||||||||||||||||||||||||||||||

| Beginning Client Assets | 8,138.0 |

|

7,803.8 |

|

7,686.6 |

|

7,862.1 |

|

7,284.4 |

|

7,301.7 |

|

6,832.5 |

|

7,304.8 |

|

7,127.6 |

|

6,644.2 |

|

7,004.6 |

|

7,320.6 |

|

7,049.8 |

|

|

|

|||||||||||||

| Net New Assets (1) | 33.6 |

|

40.6 |

|

46.3 |

|

(9.2 |

) |

32.8 |

|

19.8 |

|

31.5 |

|

43.3 |

|

39.8 |

|

42.0 |

|

33.1 |

|

53.3 |

|

36.1 |

|

(32%) |

7% |

|||||||||||||

| Net Market (Losses) Gains | (367.8 |

) |

(157.8 |

) |

129.2 |

|

(568.5 |

) |

(15.5 |

) |

(489.0 |

) |

440.8 |

|

(220.5 |

) |

(523.2 |

) |

318.4 |

|

282.9 |

|

(324.1 |

) |

394.7 |

|

|

|

|||||||||||||

| Total Client Assets (at month end) | 7,803.8 |

|

7,686.6 |

|

7,862.1 |

|

7,284.4 |

|

7,301.7 |

|

6,832.5 |

|

7,304.8 |

|

7,127.6 |

|

6,644.2 |

|

7,004.6 |

|

7,320.6 |

|

7,049.8 |

|

7,480.6 |

|

6% |

(4%) |

|||||||||||||

| Core Net New Assets (2) | 33.6 |

|

40.6 |

|

46.3 |

|

(9.2 |

) |

32.8 |

|

40.6 |

|

31.5 |

|

43.3 |

|

39.8 |

|

42.0 |

|

33.1 |

|

53.3 |

|

36.1 |

|

(32%) |

7% |

|||||||||||||

| Receiving Ongoing Advisory Services (at month end) |

|

|

|||||||||||||||||||||||||||||||||||||||

| Investor Services | 541.9 |

|

533.7 |

|

538.9 |

|

509.3 |

|

513.0 |

|

483.8 |

|

514.8 |

|

499.2 |

|

466.6 |

|

487.3 |

|

514.0 |

|

499.8 |

|

524.6 |

|

5% |

(3%) |

|||||||||||||

| Advisor Services (3) | 3,382.4 |

|

3,342.5 |

|

3,404.6 |

|

3,190.5 |

|

3,213.8 |

|

3,040.4 |

|

3,222.5 |

|

3,150.5 |

|

2,950.9 |

|

3,106.0 |

|

3,270.5 |

|

3,173.4 |

|

3,345.4 |

|

5% |

(1%) |

|||||||||||||

| Client Accounts (at month end, in thousands) |

|

|

|||||||||||||||||||||||||||||||||||||||

| Active Brokerage Accounts (4) | 33,308 |

|

33,421 |

|

33,577 |

|

33,759 |

|

33,822 |

|

33,896 |

|

33,934 |

|

33,984 |

|

33,875 |

|

33,896 |

|

33,636 |

|

33,758 |

|

33,878 |

|

- |

2% |

|||||||||||||

| Banking Accounts | 1,628 |

|

1,641 |

|

1,641 |

|

1,652 |

|

1,658 |

|

1,669 |

|

1,680 |

|

1,690 |

|

1,696 |

|

1,706 |

|

1,705 |

|

1,716 |

|

1,729 |

|

1% |

6% |

|||||||||||||

| Corporate Retirement Plan Participants | 2,216 |

|

2,235 |

|

2,246 |

|

2,261 |

|

2,275 |

|

2,275 |

|

2,267 |

|

2,285 |

|

2,305 |

|

2,322 |

|

2,336 |

|

2,351 |

|

2,369 |

|

1% |

7% |

|||||||||||||

| Client Activity |

|

|

|||||||||||||||||||||||||||||||||||||||

| New Brokerage Accounts (in thousands) | 426 |

|

356 |

|

420 |

|

386 |

|

323 |

|

305 |

|

278 |

|

332 |

|

287 |

|

298 |

|

303 |

|

330 |

|

344 |

|

4% |

(19%) |

|||||||||||||

| Client Cash as a Percentage of Client Assets (5) | 11.3 |

% |

11.5 |

% |

11.4 |

% |

11.9 |

% |

12.0 |

% |

12.8 |

% |

12.0 |

% |

12.1 |

% |

12.9 |

% |

12.2 |

% |

11.5 |

% |

12.3 |

% |

11.6 |

% |

(70) bp |

30 bp |

|||||||||||||

| Derivative Trades as a Percentage of Total Trades | 22.4 |

% |

24.0 |

% |

22.4 |

% |

21.9 |

% |

22.6 |

% |

22.3 |

% |

24.2 |

% |

23.3 |

% |

23.6 |

% |

24.1 |

% |

24.6 |

% |

23.2 |

% |

23.0 |

% |

(20) bp |

60 bp |

|||||||||||||

| Selected Average Balances (in millions of dollars) |

|

|

|||||||||||||||||||||||||||||||||||||||

| Average Interest-Earning Assets (6) | 622,997 |

|

629,042 |

|

644,768 |

|

636,668 |

|

620,157 |

|

614,100 |

|

605,751 |

|

586,154 |

|

568,351 |

|

552,631 |

|

527,019 |

|

520,100 |

|

512,893 |

|

(1%) |

(18%) |

|||||||||||||

| Average Margin Balances | 86,737 |

|

84,354 |

|

81,526 |

|

83,762 |

|

78,841 |

|

74,577 |

|

72,177 |

|

72,855 |

|

73,224 |

|

69,188 |

|

66,011 |

|

64,759 |

|

60,211 |

|

(7%) |

(31%) |

|||||||||||||

Average Bank Deposit Account Balances (7) |

157,706 |

|

153,824 |

|

155,657 |

|

152,653 |

|

154,669 |

|

155,306 |

|

154,542 |

|

148,427 |

|

141,198 |

|

136,036 |

|

130,479 |

|

126,953 |

|

122,387 |

|

(4%) |

(22%) |

|||||||||||||

Mutual Fund and Exchange-Traded Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Net Buys (Sells) (8,9) (in millions of dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Equities |

7,384 |

|

9,371 |

|

14,177 |

|

(786 |

) |

1,889 |

|

(1,586 |

) |

5,589 |

|

10,465 |

|

(2,662 |

) |

3,984 |

|

3,777 |

|

(1,837 |

) |

7,236 |

|

|

|

|||||||||||||

Hybrid |

(367 |

) |

(478 |

) |

(497 |

) |

(529 |

) |

(1,718 |

) |

(1,054 |

) |

(2,041 |

) |

(783 |

) |

(938 |

) |

(1,380 |

) |

(2,052 |

) |

(1,595 |

) |

(433 |

) |

|

|

|||||||||||||

Bonds |

1,804 |

|

(1,973 |

) |

(7,851 |

) |

(6,933 |

) |

(6,121 |

) |

(5,631 |

) |

729 |

|

(141 |

) |

(5,801 |

) |

(7,218 |

) |

(3,721 |

) |

(3,260 |

) |

5,646 |

|

|

|

|||||||||||||

Net Buy (Sell) Activity (in millions of dollars) |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Mutual Funds (8) | (4,961 |

) |

(6,318 |

) |

(11,888 |

) |

(16,657 |

) |

(20,761 |

) |

(16,258 |

) |

(8,674 |

) |

(7,117 |

) |

(15,200 |

) |

(18,473 |

) |

(17,143 |

) |

(21,851 |

) |

552 |

|

|

|

|||||||||||||

| Exchange-Traded Funds (9) | 13,782 |

|

13,238 |

|

17,717 |

|

8,409 |

|

14,811 |

|

7,987 |

|

12,951 |

|

16,658 |

|

5,799 |

|

13,859 |

|

15,147 |

|

15,159 |

|

11,897 |

|

|

|

|||||||||||||

| Money Market Funds | (1,984 |

) |

(1,086 |

) |

(1,344 |

) |

(3,430 |

) |

7,106 |

|

11,544 |

|

13,711 |

|

19,702 |

|

17,018 |

|

21,542 |

|

16,929 |

|

27,778 |

|

24,285 |

|

|

|

|||||||||||||

| Note: Certain supplemental details related to the information above can be found at: https://www.aboutschwab.com/financial-reports. | |

(1) |

June 2022 includes an outflow of $20.8 billion from a mutual fund clearing services client. |

(2) |

Net new assets before significant one-time inflows or outflows, such as acquisitions/divestitures or extraordinary flows (generally greater than $10 billion) relating to a specific client. These flows may span multiple reporting periods. |

(3) |

Excludes Retirement Business Services. |

(4) |

November 2022 includes the company-initiated closure of approximately 350 thousand low-balance accounts. September 2022 includes the company-initiated closure of approximately 152 thousand low-balance accounts. |

(5) |

Schwab One®, certain cash equivalents, bank deposits, third-party bank deposit accounts, and money market fund balances as a percentage of total client assets. |

(6) |

Represents average total interest-earning assets on the company's balance sheet. November 2022 includes the impact of transferring certain investment securities from the available for sale category to the held-to-maturity category. |

(7) |

Represents average TD Ameritrade clients’ uninvested cash sweep account balances held in deposit accounts at third-party financial institutions. |

(8) |

Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. |

(9) |

Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. |