WATERLOO, Ontario--(BUSINESS WIRE)--The independent Special Committee of the Board of Directors of Magnet Forensics Inc. (TSX: MAGT) (“Magnet” or the “Company”), a developer of digital investigation solutions for more than 4,000 enterprises and public safety agencies in over 100 countries, acknowledges the press release issued by Nellore, and is reiterating its support for the previously announced transaction with Morpheus Purchaser Inc. (the “Purchaser”), a newly created corporation controlled by Thoma Bravo, pursuant to which the Purchaser would acquire all of the outstanding shares of the Company (the “Arrangement”). Concurrently, the Company is posting an investor presentation to the investor relations page of its website that sets out further details regarding the robust process undertaken by the Special Committee and the reasons that they continue to recommend the Arrangement. The presentation can be found at https://investors.magnetforensics.com and is filed under the Company’s profile on SEDAR.

As previously disclosed, under the terms of the Arrangement Agreement entered into on January 20, 2023 between the Company and the Purchaser (the “Arrangement Agreement”), holders of the outstanding Subordinate Voting Shares of the Company (“SV Shares”) (other than Messrs. Jad Saliba and Adam Belsher and associates and affiliates thereof (collectively with Mr. Jim Balsillie and his associates and affiliates, the “Rolling Shareholders”)) will receive CA$44.25 cash per SV Share (the “Purchase Price”) and the Rolling Shareholders will receive CA$39.00 for each outstanding SV Share and Multiple Voting Share of the Company (“MV Share”) (together with the SV Shares, the “Shares”) they sell for cash to the Purchaser, representing an aggregate total equity value of approximately CA$1.8 billion on a fully-diluted, in-the-money, treasury method basis and inclusive of Shares held by the Rolling Shareholders, as further detailed in the Company’s January 20, 2023 press release.

Key Highlights of the Arrangement:

- The Purchase Price represents a premium of ~15% to the closing price on the TSX of public SV Shares on January 19, 2023, the last trading day before announcement of the Arrangement, and ~87% to the closing price on October 5, 2022, the last day prior to Thoma Bravo’s submission of its initial non-binding proposal.

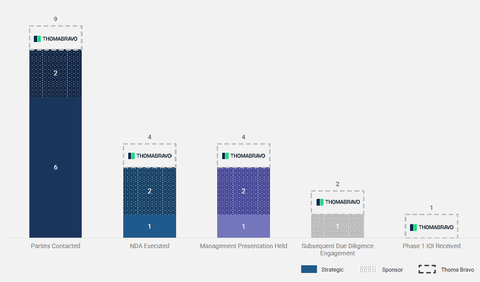

- Morgan Stanley ran a robust and fair process that identified eight additional strategic and financial buyers representing the most synergistic, highest ability to pay counterparties. Three other parties entered into Non-Disclosure Agreements and two of the three conducted due diligence.

- The Purchase Price was arrived at after a robust negotiation between Thoma Bravo and the Special Committee.

- Transaction crystalizes attractive value for Magnet shareholders, while relieving them of the risk of continued ownership that would be subject to normal course risks related to competition, industry consolidation, market conditions and the Company’s access to growth capital.

- Thoma Bravo’s offer is not subject to financing conditions and they have exhibited a proven ability to close.

The Special Committee issued the following statement regarding the transaction:

The Special Committee is committed to acting in the best interests of shareholders. We are confident that this transaction offers the most compelling value creation opportunity for all shareholders. The Arrangement Agreement is the result of a comprehensive negotiation process that was undertaken at arm’s length and led by the Special Committee, which was formed to review strategic alternatives for the Company and advised by independent and highly qualified legal and financial advisors.

THE SPECIAL COMMITTEE CONDUCTED A RIGOROUS, INDEPENDENT PROCESS TO MAXIMIZE SHAREHOLDER VALUE

The Board regularly reviews opportunities to maximize value and in line with this has evaluated various alternatives, including approaching Grayshift about a potential combination during their sale process in the first quarter of 2022.

On October 6, 2022, the Company received an unsolicited, non-binding proposal from Thoma Bravo, pursuant to which Thoma Bravo offered to purchase all of the outstanding Shares for CA$34.00. Such proposal contemplated that a portion of the MV Shares would not be converted to cash and would instead continue to exist as equity interests in the combined company following the close of the Arrangement. Shortly after receiving the proposal from Thoma Bravo, the Board of Directors formed the Special Committee, comprised of Carol Leaman, as Chair and Jerome Pickett, both independent directors of Magnet. The Special Committee’s mandate was to consider the proposal from Thoma Bravo, as well as other strategic alternatives available to the Company, including remaining a public company and pursuing its long-term growth strategy.

Shortly after formation, the Special Committee further engaged its own independent legal advisors, financial advisors, and formal valuator, and considered a variety of value creating opportunities, including the prospects of continuing as a standalone publicly traded company.

On the advice of Morgan Stanley, the Special Committee’s financial advisor, a comprehensive market check was conducted in order to maximize value for the public shareholders. As depicted in the chart below, Morgan Stanley contacted eight additional strategic and financial buyers representing the most synergistic, highest ability to pay counterparties which resulted in three other parties entering into Non-Disclosure Agreements and conducting due diligence, which included access to Magnet management. Morgan Stanley was well-positioned to identify potential candidates, given its prior experience in advising Grayshift in connection with its sale process pursuant to which it was acquired by Thoma Bravo in July 2022. All parties, including Thoma Bravo, were managed on the same timeline and received equal access to management and due diligence information.

All participants were asked to submit proposals on or before December 6, 2022. The initial indication was that in addition to Thoma Bravo, one other financial sponsor that had completed extensive due diligence intended to submit a proposal. However, on December 6, 2022, that party advised that despite its interest in the Company, with the increased share price to over CA$40, and based on its diligence and valuation of the Company, it would not be able to make an offer that would even approach the trading price of the Shares. On December 13, 2022, Thoma Bravo submitted a significantly increased proposal of CA$40.00 per share, representing a 17% increase from their non-binding letter of intent. After further negotiations with both Thoma Bravo and the holders of the MV Shares, the Special Committee was able to negotiate a further CA$4.25 per share in consideration for the public holders of SV Shares, marking a 30% increase in consideration for the public SV Shares through the process. This increase was partially a result of an increased offer from Thoma Bravo and partially as a result of the holders of the MV Shares agreeing to receive CA$39.00 per share.

The Rolling Shareholders had no participation in the discussions or deliberations of the Special Committee, and the Special Committee was under no obligation to execute a transaction.

The Special Committee received a formal valuation and related fairness opinion from CIBC World Markets Inc. (“CIBC”) that concluded, among other things, that, based upon and subject to the assumptions, limitations and qualifications set forth therein, the fair market value of the Shares as at January 20, 2023 was in the range of CA$36.50 to CA$48.75 per Share, with the CA$44.25 Purchase Price being well above the midpoint of the range. CIBC was paid a fixed-fee for their formal valuation and fairness opinion. Morgan Stanley also issued a fairness opinion dated January 20, 2023, to the Special Committee that concluded that, based upon and subject to the assumptions, limitations and qualifications set out in such opinion, the consideration to be received by the holders of SV Shares (other than the Rolling Shareholders) pursuant to the Arrangement is fair, from a financial point of view, to such shareholders.

THIS TRANSACTION ENABLES MAGNET TO EXPAND ITS PRODUCT PORTFOLIO TO MEET CUSTOMER NEEDS IN A WAY MAGNET WOULD BE CHALLENGED TO ACCOMPLISH AS A STANDALONE COMPANY

Strategic considerations were of critical importance to the Special Committee’s determination to recommend the Arrangement as it considered the premium and certain value delivered to public holders of SV Shares against its assessment of the Company’s prospects as a standalone publicly traded company. These focused on three factors:

- Mobile Extraction Capability - The increasing proportion of data stored on mobile devices requires the capability to extract data from mobile devices. Magnet’s current capabilities related to mobile extraction are limited, which was considered a key challenge to future growth.

- Rare Strategic Opportunity –The prospect that an acquisition target or partner of sufficient scale with mobile extraction capability was considered to be diminishing, leaving the Company exposed to the prospect that no superior alternative transaction would be available and the resulting strategic and execution risks of maintaining the status quo.

- Increasing Competition – Other providers of digital forensics and adjacent services are developing new products and expanding into the Company’s areas of core competency. Coupled with the growing significance of mobile extraction, these developments may represent a long-run threat to the Company’s continued growth.

For these, and other reasons, the Special Committee determined that the Arrangement represents a compelling opportunity compared to the risk of continuing to execute as a standalone company without having consummated a transaction such as a combination with Grayshift. In light of the foregoing, and other reasons, including the certainty of value of an all cash deal, the Special Committee believes that the Arrangement offers the public holders of SV Shares the best value for their Shares.

THE TRANSACTION DELIVERS SIGNIFICANT, IMMEDIATE, AND CERTAIN VALUE TO MAGNET SHAREHOLDERS

The Purchase Price represents a premium of:

- ~15% to the closing price on the TSX of public SV Shares on January 19, 2023;

- ~41% to the 90-trading day volume weighted average trading price per public SV Share as at January 19, 2023;

- ~87% to the closing price on October 5, 2022, the last day prior to Thoma Bravo’s submission of its initial non-binding proposal; and

- ~160% to the IPO price of the public SV Shares of CA$17.00.

Furthermore, the all-cash Purchase Price of CA$44.25 for public holders of SV Shares exceeds the 52-week high on the Toronto Stock Exchange, and crystallizes extremely compelling valuation multiples, all while eliminating execution risk for the public holders of SV Shares.

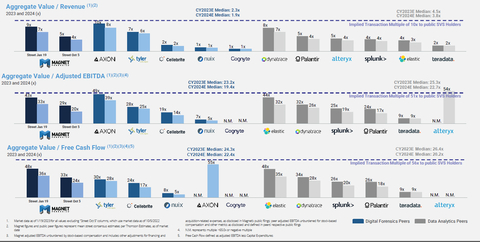

The Purchase Price also represents 10x Aggregate Value / 2023 Street Consensus Revenue multiple, 51x Aggregate Value / Street Consensus 2023 Adjusted EBITDA and 56x Aggregate Value / Street Consensus 2023 Free Cash Flow and is highly attractive compared to recent transactions and public market trading multiples. At the time of Thoma Bravo’s initial letter of intent, Magnet was trading at 5x Aggregate Value / 2023 Street Consensus Revenue and had been trading in line with peer digital forensics and data analytics companies throughout calendar 2022.

Further details relating to the Arrangement, including reasons for the Arrangement, may be found in the presentation filed on SEDAR today, and in the Company’s management information circular which is expected to be filed on SEDAR and mailed to Shareholders later this month, in advance of the Special Meeting of Shareholders to be held on March 23, 2023.

This press release is for informational purposes only and is not a solicitation of proxies. Proxies will only be solicited after the Company’s management information circular is filed in accordance with all applicable Canadian corporate and securities laws.

About Magnet Forensics

Founded in 2010, Magnet Forensics is a developer of digital investigation software that acquires, analyzes, reports on, and manages evidence from digital sources, including computers, mobile devices, IoT devices and cloud services. Magnet Forensics’ software is used by more than 4,000 public and private sector customers in over 100 countries and helps investigators fight crime, protect assets and guard national security.

Cautionary Note Regarding Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws. Such forward-looking information or statements (“FLS”) are provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such FLS may be identified by words such as “proposed”, “expects”, “intends”, “may”, “will”, and similar expressions. FLS contained or referred to in this press release includes, but is not limited to, statements regarding the proposed timing and various steps contemplated in respect of the Arrangement, the holding of the Company’s shareholders’ meeting and capturing growth opportunities.

FLS is based on a number of factors and assumptions which have been used to develop such statements and information, but which may prove to be incorrect. Although the Company believes that the expectations reflected in such FLS are reasonable, undue reliance should not be placed on FLS because the Company can give no assurance that such expectations will prove to be correct. Factors that could cause actual results to differ materially from those described in such FLS include, without limitation, the following factors, many of which are beyond the Company’s control and the effects of which can be difficult to predict: (a) the possibility that the Arrangement will not be completed on the terms and conditions, or on the timing, currently contemplated, and that it may not be completed at all, due to a failure to obtain or satisfy, in a timely manner or otherwise, required shareholder, Court and regulatory approvals and other conditions of closing necessary to complete the Arrangement or for other reasons; (b) risks related to tax matters; (c) the possibility of adverse reactions or changes in business relationships resulting from the announcement or completion of the Arrangement; (d) risks relating to Company’s ability to retain and attract key personnel during and following the period ending with the consummation of the Arrangement; (e) the possibility of litigation relating to the Arrangement; (f) credit, market, currency, operational, liquidity and funding risks generally and relating specifically to the Arrangement, including changes in economic conditions, interest rates or tax rates; (g) business, operational and financial risks and uncertainties relating to the COVID-19 pandemic; (h) risks related to the Company resulting from the combination of the Company and Grayshift in retaining existing customers and attracting new customers, retaining key personnel, executing on growth strategies, advancing its product line and protecting its intellectual property rights and proprietary information; (i) risks related to the Company’s ability to prevent unauthorized access to or disclosure, loss, destruction or modification of data, through cybersecurity breaches or computer viruses disrupting the functionality of the Company’s products; (j) the impact of competition; (k) changes and trends in the Company’s industry and the global economy; and (l) the identified risk factors included in the Company’s public disclosure, including the annual information form dated March 9, 2022, which is available on SEDAR at www.sedar.com and on the Company’s website at www. magnetforensics.com. If any of these risks or uncertainties materialize, or if the assumptions underlying the FLS prove incorrect, actual results or future events might vary materially from those anticipated in the FLS. Although the Company has attempted to identify important risk factors that could cause actual results to differ materially from those contained in FLS, there may be other risk factors not presently known to the Company or that the Company presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such FLS. The FLS in this press release reflect the current expectations, assumptions, judgements and/or beliefs of the Company based on information currently available to the Company, and are subject to change without notice.

Any FLS speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any FLS, whether as a result of new information, future events or results or otherwise, except as required under applicable securities laws. The FLS contained in this press release are expressly qualified by this cautionary statement. For more information on the Company, please review the Company's continuous disclosure filings that are available at www.sedar.com.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The TSX accepts no responsibility for the adequacy or accuracy of this release.