Investing Platform Public Debuts Rare Sneaker Portfolio

Investing Platform Public Debuts Rare Sneaker Portfolio

First-of-its-kind investable asset supports Public’s mission to make more asset classes available to more investors

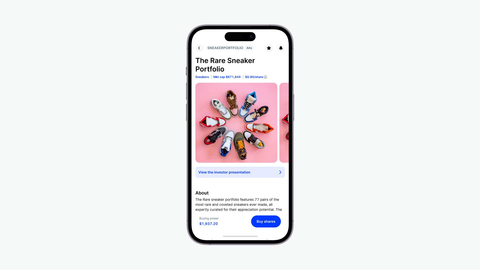

NEW YORK--(BUSINESS WIRE)--Public.com, an investing platform that lets members invest in stocks, ETFs, crypto, and alternative assets, debuts a first-of-its-kind alternative asset, The Rare Sneaker Portfolio.

This asset bundles together 77 pairs of iconic and rare sneakers into one investable asset, curated for investment potential— similar to how ETFs function for equities. The concept of grouping assets like sneakers into a single alternative asset Portfolio is unique to Public’s platform and allows for broad category exposure and further diversification.

The Rare Sneaker Portfolio presents an opportunity for investors and sneaker fans alike to invest in the growing sneaker resale market, estimated by Cowen & Company to reach $30 billion by 2030. By bundling dozens of different sneakers into one investable asset, the Portfolio provides a unique opportunity for investors to get broad exposure to the sneaker market rather than researching which individual pairs may have the highest appreciation value.

Sneakers in the Portfolio were evaluated based on a variety of factors including:

- Cultural significance, i.e., associated with a celebrity, artist, athlete, or collector

- Scarcity, with some sneakers in the Portfolio having never been released to the public

- Condition, with the large majority in brand new, deadstock condition

- Size, prioritizing men’s sizes 9-13, the most desirable sizes

The Portfolio consists of culturally significant mainstays such as original Air Jordan Is, rare grails such as Nike Air Force 1 x Jay-Z “France” (only two pairs ever made), and artist collaborations with KAWS, Tom Sachs, Virgil Abloh, and Futura. Other highlights include 1985 Air Jordan I BRED (recently sold for $16,250), Nike MAG (recently sold for $63,000), Nike SB Low “Freddy Krueger” (recently sold for $30,000), and FLOM Dunk (recently sold for $56,139).

The Rare Sneaker Portfolio is the first alternative asset Portfolio to debut on the Public platform, with additional Portfolios set to launch in 2023. Public launched alternative asset trading in late 2022 after acquiring Otis, a leading platform for investing in cultural assets and collectibles. By offering fractional investing in alternative assets, Public aims to make this asset class, historically popular with the ultrawealthy, more accessible to retail investors who may not otherwise be able to invest hundreds of thousands dollars in art, rare collectibles, or sneakers.

“We’re pleased to be able to introduce innovative new ways for our members to invest in alternative assets. While we’re beginning with sneakers, we’re actively exploring Portfolios across a variety of categories,” said Keith Marshall, General Manager of Alternatives at Public. “The concept of curated Portfolios means that our members will be able to invest in categories like art, trading cards, royalties, and real estate without needing to become subject matter experts on individual assets.”

The Rare Sneaker Portfolio is exclusively available on the Public platform. Members can explore the investment thesis and buy and sell shares of the Portfolio through the Public mobile app or website. Visit Public.com to sign up or learn more.

About Public.com

Public is an investing platform that allows everyone to invest in stocks, ETFs, crypto, and alternative assets, like fine art and collectibles—all in one place. We help people be better investors with access to custom company metrics, live shows about the markets, and insights from a community of millions of investors, creators, and analysts. Public puts investors first, and doesn't sell trades to market makers or take money from Payment for Order Flow (PFOF). Learn more at www.public.com.

This content is not investment advice. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Brokerage services for US-listed, registered securities available on Public are offered by Open to the Public Investing, Inc. (OTTP), member FINRA & SIPC. Alternative assets, such as the “Rare Sneaker Portfolio”, available on Public.com are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public.com, are equity securities that have been issued pursuant to Regulation A of the Securities Act of 1933 (as amended) (“Regulation A”). These investments are speculative, involve substantial risks (including illiquidity and loss of principal), and are not FDIC or SIPC insured. Alternative Assets purchased on the Public.com platform are not held in an OTTP brokerage account, are executed by Public on an agency basis on behalf of customers, and are self-custodied by the purchaser. The issuers of these securities may be an affiliate of Public.com, and Public.com (or an affiliate) may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures.

Cryptocurrency trading provided by Apex Crypto LLC (NMLS ID 1828849). Apex Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services.

Contacts

Steph Goldberg, Director of Marketing (steph.goldberg@public.com)