SAN FRANCISCO--(BUSINESS WIRE)--In an effort to provide valuable insights to the retirement industry, Ubiquity Retirement + Savings® (Ubiquity), conducted its independent inaugural "State of the Industry" survey which revealed concerns around the economy and its impact on the performance of 401(k) plans in 2023.

The company, a financial technology pioneer in flat-fee small business retirement plans, polled thousands of retirement plan sponsors and financial advisors across the country on their industry sentiment, economic outlook, and satisfaction with Ubiquity’s robust suite of plan offerings.

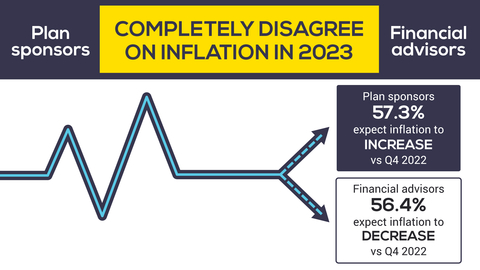

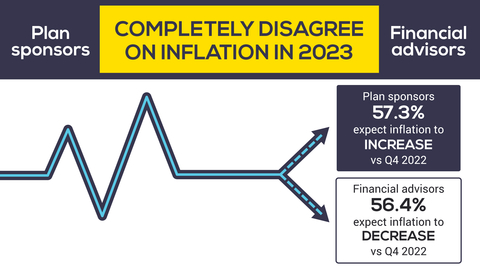

Most notably, the independent survey found that plan sponsors and financial advisors have opposite expectations for inflation at the end of 2023. 56.4% of financial advisors expect inflation to be lower by the end of 2023 versus Q4 2022. However, the survey found that 57.3% of plan sponsors expect inflation to be higher at the end of 2023 versus Q4 2022.

“One party is going to be right,” commented Ubiquity Founder and CEO Chad Parks. “It will be interesting to see where inflation is at the end of 2023 and whether plan sponsors or financial advisors had a better feel for this in Q4 2022.”

Despite the disparate points of view on inflation, both plan sponsors and financial advisors agree there will likely be two interest rate hikes from the Federal Reserve in 2023.

61.9% of plan sponsors and 57.4% of financial advisors are concerned about how a recession may impact the performance of 401(k) plans in 2023. Worries about inflation and poor investment returns also ranked high for both groups. In response to these concerns, 80.3% of plan sponsors expect to maintain their employee match. Financial advisors noted little to no change in 401(k) contributions, loans, and risk appetite for clients in 2023.

“With both groups anticipating two rate hikes from the Federal Reserve in 2023, low-cost and effective retirement plan solutions are a necessary component of a small business offering and benefits plan,” continued Parks.

Data also revealed that 86.7% of plan sponsors and 82.1% of financial advisors find Ubiquity’s 401(k) offering helpful in attracting and retaining employees and clients. This sentiment is reflective of Ubiquity’s high customer satisfaction.

“The traditional three-legged stool of retirement made up of personal savings, pensions, and Social Security is broken, putting retirement readiness at the forefront of Americans’ minds, as was brought to light in our documentary, Broken Eggs: The Looming Retirement Crisis in America,” said Parks. “For over 23 years, plan sponsors and financial advisors have trusted Ubiquity to provide transparent, trustworthy, and low-cost pricing that withstands industry competition and economic challenges. As the priorities of small business owners change with increasing economic uncertainty, we remain dedicated to providing the most comprehensive solutions that ensure all Americans can achieve a secure and comfortable retirement.”

With 58.8% of financial advisors and 42.9% of retirement plan sponsors expressing low cost as a top reason for using Ubiquity’s services, and ease of use as the second most-cited reason, the firm is committed to providing small businesses with greater access to retirement solutions and savings.

For additional information and survey results, please visit our website.

About Ubiquity Retirement + Savings

Since launching Ubiquity Retirement + Savings in 1999, the company’s driving force has been to provide qualified retirement plans that meet the needs of small business owners. Our mission is to empower small businesses and their employees to create a more secure financial future by leveraging technology with affordable retirement solutions and world-class customer support.

Ubiquity is a leading fintech company that is one of the first flat-fee-for-service small business plan providers in the nation. With our exclusive, best-in-class Paradigm RKS™ cloud-based platform that automates recordkeeping and plan management functions, we’re able to deliver an easy-to-use experience and peace of mind with zero hidden fees. The company is headquartered in San Francisco with satellite offices from coast to coast. Ubiquity serves over 10,000 American small businesses and hundreds of thousands of savers. With over $3 billion in retirement assets, Ubiquity has clients in all 50 states, delivering a transparent, flat-fee2, customizable savings experience. Our tenured team are retirement experts and future-you champions!

Visit myubiquity.com to learn more.

1 Ubiquity is not a registered investment advisor and no portion of the material herein should be construed as legal or tax advice. Please consult with your financial planner, attorney and/or tax advisor for advice.

2 Flat fees are charged by Decimal, Inc. for recordkeeping and administrative services. Third-party service providers may assess asset-based fees to customers. Plan sponsors are advised to review all service agreements with providers (e.g., investment advisors, custodians, broker-dealers) to evaluate total plan costs.