NEW YORK--(BUSINESS WIRE)--Three-quarters (76%) of semiconductor executives expect the industry’s supply chain challenges to ease by 2024, yet companies need to be prepared to withstand other market pressures by focusing on investments that will help drive future growth, according to a new study from Accenture (NYSE: ACN).

The report, titled “Pulse of the Semiconductor Industry: Balancing Resilience with Innovation,” is based on a global survey of 300 senior semiconductor executives who evaluate their companies’ supply chain outlooks and innovation roadmaps.

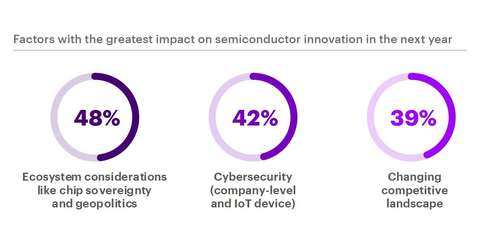

The executives cited challenges that could affect their ability to innovate even as the lingering effects of COVID-19 on the supply chain lift. The other challenges identified most often were geopolitics (cited by 48% of respondents), cybersecurity threats (42%), the changing competitive landscape (39%) and talent shortages (35%), among others. Faced with a changing industry landscape, two-thirds (65%) of the executives said they believe that the rate of Moore’s law — in which the number of transistors in an integrated circuit doubles about every two years — will slow down by 2024. In addition, 56% believe that promoting strong IP protection and enforcement is one of the best ways to enhance the industry’s resilience moving forward.

“As the demand for chips slows down amid inflationary concerns and an easing of the chip shortage, semiconductor businesses face a new set of challenges driven by geopolitics and a growing talent shortage,” said Syed Alam, global lead of Accenture’s High Tech industry practice. “To succeed, companies need to balance being resilient in tough times with continued investments in innovation.”

The report identifies areas for investment that will drive future semiconductor growth, including:

- The Metaverse – Two-thirds (67%) of executives believe that semiconductors are the most critical technology to the development of the metaverse, and 44% of executives expect to allocate more than 20% of their semiconductor production budget to the metaverse by 2024.

- Digital Health – Fitness trackers and smart watches represent the biggest growth opportunity for the industry, as these popular devices will benefit most from improved connectivity enabled by semiconductors.

- Mobility – Extended chip shortages and cost concerns are cited as the biggest roadblocks to mobility’s future, leading 93% of executives to believe that car manufacturers should partner with semiconductor and technology businesses to develop next-generation mobility technologies.

- Sustainability – More than nine in 10 executives (93%) believe that sustainability initiatives will have a positive impact on profitability and create more sustainable consumer products. Sustainability was also cited as the area most likely to play the largest role in the semiconductor value chain within the next five years.

To learn more, read the full report.

About the Report

Accenture surveyed 300 semiconductors executives globally to understand (1) the industry’s outlook; (2) a technology and product outlook; and (3) the role of semiconductors in both. Respondents represented all types of semiconductor companies and were primarily at the C-suite and EVP/ VP levels. The majority of respondents were based primarily in The United States, China, Japan, The Netherlands, South Korea and The United Kingdom and are involved to an extent in their company’s product strategy, with most in roles aligning to manufacturing & design and / or enterprise strategy. The survey was conducted online in September and October 2022.

About Accenture

Accenture is a leading global professional services company that helps the world’s leading businesses, governments and other organizations build their digital core, optimize their operations, accelerate revenue growth and enhance citizen services — creating tangible value at speed and scale. We are a talent and innovation led company with 738,000 people serving clients in more than 120 countries. Technology is at the core of change today, and we are one of the world’s leaders in helping drive that change, with strong ecosystem relationships. We combine our strength in technology with unmatched industry experience, functional expertise and global delivery capability. We are uniquely able to deliver tangible outcomes because of our broad range of services, solutions and assets across Strategy & Consulting, Technology, Operations, Industry X and Accenture Song. These capabilities, together with our culture of shared success and commitment to creating 360° value, enable us to help our clients succeed and build trusted, lasting relationships. We measure our success by the 360° value we create for our clients, each other, our shareholders, partners and communities. Visit us at www.accenture.com.

Copyright © 2022 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture.