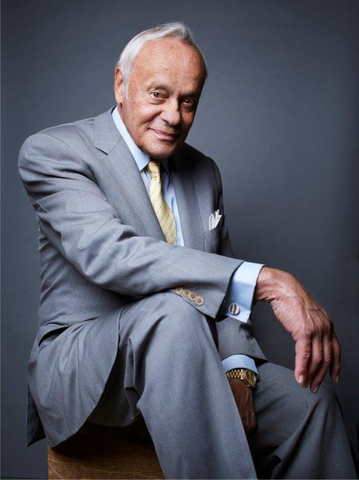

Growth Investing Pioneer and Jennison Associates Founder, Spiros ‘Sig’ Segalas, Has Passed Away

Growth Investing Pioneer and Jennison Associates Founder, Spiros ‘Sig’ Segalas, Has Passed Away

NEW YORK--(BUSINESS WIRE)--Jennison Associates announced, with great sadness, the death of Spiros “Sig” Segalas, co-founder and long-time Large Cap Growth portfolio manager. Segalas was a pioneer in growth equity investing and built one of the industry’s longest growth equity track records.

Segalas founded Jennison Associates in 1969 along with six co-founders and managed Jennison client portfolios for more than five decades. He was instrumental in building Jennison from its beginnings as a large cap growth specialist manager to becoming a preeminent institutional investment management firm with world-class equity and fixed income capabilities and clients around the world. Over his career, Segalas earned industry accolades including Institutional Investor’s Money Manager of the Year and U.S. Investment Management Awards.

Segalas served as an officer in the U.S. Navy before starting his investment career. Beginning as a bank research analyst, he learned the value of independent research and long-term investment thinking, which remain at the core of Jennison’s investment philosophy today. The firm’s investment approach across teams continues to be driven by proprietary, fundamental investment research dedicated to building deep knowledge of industries and companies. This approach has served clients well for more than 50 years.

Segalas built a firm steeped in values which are foundational to Jennison’s culture to this day. He understood the importance of inclusion long before it took the meaning it has today, hiring some of the first women investors in the industry in the 1970s. Independent thinking, diversity of perspectives and experiences, and talent development remain essential to Jennison’s culture and hiring and promotion practices.

Segalas remained an active contributor and Large Cap Growth portfolio manager until his death at age 89. Jennison has always had robust succession plans in place to ensure seamless oversight of the investment teams and client portfolios. Kathleen McCarragher will continue to lead the Large Cap Growth team alongside Blair Boyer, who together have more than 50 years’ experience with the firm. McCarragher has led the Large Cap Growth team for nearly 20 years, with Boyer as co-head since 2019. They, along with Jennison portfolio managers and analysts, who average 20 years at the firm, have continued to practice the team-oriented approach in which Segalas so firmly believed. CEO Jeffrey Becker, who joined Jennison in 2016, will continue to lead the firm. There will be no change to the investment process and no impact to the daily management of client portfolios.

Becker said, “I have deep respect and admiration for Sig and the legacy he has left at Jennison and across the industry. He will be greatly missed by all of us at Jennison. Our team feels a deep responsibility to live up to the values and commitment to excellence he embodied.”

Jennison expresses deepest condolences to Segalas’ family, friends and colleagues.

Jennison is an affiliate manager of PGIM, the global asset management business of Prudential Financial, Inc. (NYSE: PRU).

ABOUT JENNISON ASSOCIATES LLC

Founded in 1969, Jennison Associates offers a range of equity and fixed income investment strategies. Its equity expertise spans styles, geographies, and market capitalizations. Its fixed income capability includes investment-grade active and structured strategies of various durations. Original fundamental research, specialized investment teams, strong client focus, and highly experienced investment professionals are among the firm’s competitive distinctions. As of Sept. 30, 2022, Jennison managed $164 billion in client assets. For more information, please visit jennison.com.

Jennison Associates LLC has not been licensed or registered to provide investment services in any jurisdiction outside the United States. Certain investment vehicles are distributed or offered through Prudential Investment Management Services LLC (also a Prudential Financial Company) or other affiliated entities. Additionally, vehicles may not be registered or available for investment in all jurisdictions.

ABOUT PGIM

PGIM is the global asset management business of Prudential Financial, Inc. (NYSE: PRU), a leading global investment manager with more than $1.2 trillion in assets under management as of Sept. 30, 2022. With offices in 18 countries, PGIM’s businesses offer a range of investment solutions for retail and institutional investors around the world across a broad range of asset classes, including public fixed income, private fixed income, fundamental equity, quantitative equity, real estate and alternatives. For more information about PGIM, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom, or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. For more information please visit news.prudential.com.

CONNECT WITH US:

Visit pgim.com

Join the conversation

@PGIM

Contacts

MEDIA

Leah Pappas

+1 609-902-5855

leah.pappas@pgim.com