HOUSTON--(BUSINESS WIRE)--Voss Capital, LLC, together with its affiliates (“Voss”, “we” or “our”), the largest shareholder of Thunderbird Entertainment Group Inc. (CVE: TBRD) (“Thunderbird” or the “Company”), today issued the below public letter to Thunderbird’s shareholders.

Dear Fellow Thunderbird Shareholders,

We are writing to provide an update regarding the ongoing entrenchment tactics of Thunderbird’s board of directors (the “Board”) and its failure to address clear shareholder concerns. Voss strongly believes that the Board continues to demonstrate a lack of understanding of public company corporate governance and has proven ill-equipped to generate value for stakeholders. Despite our early attempts to work constructively with the Board and our recent offer to engage in discussions, the Board has made it clear that it is not open to shareholder input and is unwilling to acknowledge the growing base of shareholder support Voss has garnered, which is calling for urgent change at the Company.

In fact, in its latest press release, the Board continues to make baffling, defeatist comments and actually talks down the Company’s value, which Thunderbird’s employees have worked hard to create for years. The Board believes that exploring strategic alternatives will “almost certainly fail” and that being a Canadian media studio could, “restrict the pool of interested parties and diminish the price offered to Thunderbird shareholders.” This type of fatalistic attitude is the last thing shareholders want to hear from the Board whose duty it is to maximize value. While we acknowledge that any strategic transaction will necessarily need to account for Thunderbird’s Canadian regulatory and tax framework, we do not believe the mere existence of these regulatory considerations renders a strategic process dead on arrival.

The Board still has not put forward any credible strategic plan to unlock the Company’s value, which we requested weeks ago. At this point, we cannot help but conclude that the Board simply does not have a plan. Instead, its latest press release bizarrely brags about massive margin compression under its tenure as its “value creation.” Since fiscal year 2020, the year Marni Wieshofer joined the Board, direct operating costs have risen 151%, and EBITDA margins have gone from 19% to 11.3% (as of the twelve months ended September 30th, 2022).[1] We believe that the Company’s push further into low margin premium scripted content is a continuation of this trajectory.

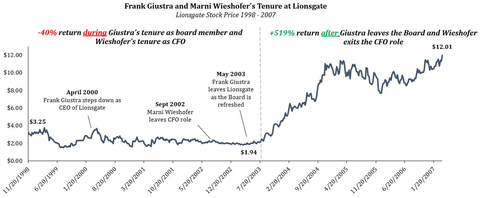

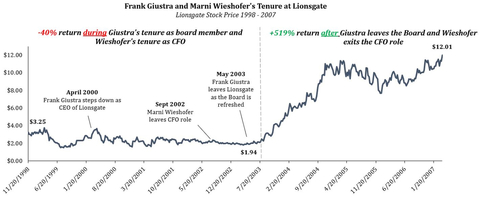

Perhaps we should not be surprised by this situation – in examining the track records of the members of the Board, we note the media careers of two directors in particular. During Mr. Giustra and Mrs. Wieshofer’s tenure as a board member and the CFO of Lions Gate Entertainment Corp. (“Lionsgate”), respectively, they oversaw a ~40% decline in Liongate’s stock price over five years and steady financial losses. However, immediately after Mrs. Wieshofer’s exit as CFO, and Mr. Giustra left the Lionsgate board as part of a significant refresh (not dissimilar to what we’re calling for today at Thunderbird), Lionsgate stock subsequently returned over 500% during the next few years. We believe we are in a similar position with Thunderbird today.

[see chart entitled “Frank Giustra and Marni Wieshofer’s Tenure at Lionsgate”]

Voss and our fellow shareholders do not want Thunderbird to similarly languish under Frank and Marni’s tenure. The Board’s lack of a strategic plan for the Company and misplaced priorities, should not be allowed to hold back the value of the hard work by Thunderbird’s management team and hundreds of brilliant content creators. It is the Board’s responsibility to be open-minded and explore all options to unlock value, including letting the Company operate out of the public eye with increased access to capital.

Based on ongoing feedback from industry executives and other shareholders, we believe there is a common consensus that the Company’s shares are meaningfully undervalued. Our view is that maintaining the unsatisfactory status quo is the best we can expect from the existing Board, which clearly does not share our vision of Thunderbird’s bright future. In clear contrast to the current Board, the Voss director nominees (the “Voss Nominees”) see the value that Thunderbird’s employees have worked so hard to create and are confident in their ability to swiftly unlock that value for all stakeholders while simultaneously helping Thunderbird take the critical step toward being the next major global studio.

The Voss Nominees will bring fresh perspectives, true independence, industry-specific knowledge, and deep mergers and acquisitions experience to the Board. Each nominee was sought out by Voss specifically for their experience creating value at similar companies and proven ability to run a successful strategic review. We, as well as the Voss Nominees, are intimately familiar with over a dozen acquisitions of Canadian studios over the past few years alone. Our nominee Mark Trachuk structured the largest one, advising on the $4 billion acquisition of Entertainment One Ltd. by Hasbro, Inc. in 2019. This is precisely the type of expertise the Voss Nominees will bring to Thunderbird’s boardroom. If the current Board lacks the confidence and skillsets to successfully run a strategic review, we believe it should step aside and allow our highly qualified candidates to handle the task.

As Thunderbird’s largest shareholder, we have no desire to damage the Company’s reputation or disrupt its business in any way. In fact, we have been perhaps Thunderbird’s most prolific and vocal supporters to the investment community time and time again. We have repeatedly highlighted the Company in our quarterly letters and industry publications for a number of years. Jenn McCarron and her team’s passion for building the business and unique creative culture shine through every time we speak with them and practically all industry participants corroborate this positive impression.

Given that the Board was unreceptive to our constructive outreach, Thunderbird’s shareholders must now be allowed to exercise their rights to decide the Company’s future. Thunderbird’s Board has the ability to put an end to their perceived disruption caused by this campaign by promptly announcing the date of the 2022 annual and special meeting of shareholders (the “2022 Annual Meeting”), which had been originally scheduled for December 6, 2022. Voss will continue its efforts to ensure that Thunderbird’s shareholders are given the ability to exercise their rights and voice their valuable opinions with their votes in a reasonable time frame.

We welcome any shareholders or employees to reach out to us with questions and feedback.

Sincerely,

Travis Cocke

Chief Investment Officer

Voss Capital

investors@vosscap.com

832-519-9427

1. Company filings FY 2021, FY 2022 annual report and Q1 2023 report

2. LGF.A stock price data from Factset. Management changes from SEC filing: https://www.sec.gov/Archives/edgar/data/929351/000095014803001313/v90342exv99.htm

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward‐looking statements. All statements contained in this filing that are not clearly historical in nature or that necessarily depend on future events are forward‐looking, and the words “anticipate,” “believe,” “expect,” “estimate,” “plan,” and similar expressions are generally intended to identify forward‐looking statements. These statements are based on current expectations of Voss and currently available information. They are not guarantees of future performance, involve certain risks and uncertainties that are difficult to predict, and are based upon assumptions as to future events that may not prove to be accurate. Voss does not assume any obligation to update any forward‐looking statements contained in this press release.

Additional Information:

On November 7, 2022, Thunderbird announced that it would be postponing the 2022 Annual Meeting, previously scheduled for December 6, 2022, and that it would hold the 2022 Annual Meeting no later than March 6, 2023. The Voss Nominees will be considered for election at the 2022 Annual Meeting. Depending on the total number of directors eligible for election at the 2022 Annual Meeting, we reserve the right to withdraw, not withdraw or nominate additional candidates to the Board, subject to the Company’s governing documents and applicable law. Prior to the 2022 Annual Meeting, Voss expects to furnish an update of the Voss Circular (as defined below) to shareholders of Thunderbird, together with an updated WHITE proxy card. SHAREHOLDERS OF THUNDERBIRD ARE URGED TO READ THE PROXY CIRCULAR CAREFULLY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain free copies of the proxy circular and any amendments or supplements thereto and further proxy circulars at no charge on SEDAR at http://www.sedar.com. In addition, shareholders will also be able to obtain free copies of the proxy circular and other relevant documents by calling Voss’s proxy solicitor, Carson Proxy Advisors Ltd. (“Carson”), at 1-800-530-5189, local (collect outside North America): 416-751-2066 or by email at info@carsonproxy.com.

Information in Support of Public Broadcast Solicitation

Voss is relying on the exemption under section 9.2(4) of National Instrument 51‐102 ‐ Continuous Disclosure Obligations (“NI 51-102”) to make this public broadcast solicitation. The following information is provided in accordance with corporate and securities laws applicable to public broadcast solicitations.

This solicitation is being made by Voss and not by or on behalf of the management of Thunderbird.

Founded in 2011, Voss Capital, LLC is a fundamental research-driven, bottom-up, value-oriented manager focused on underfollowed special situations. The principal address of Voss is 3773 Richmond Avenue, Suite 500 Houston, Texas 77046.

The address of Thunderbird is 123 W7th Ave Vancouver, BC, V5Y 1L8, Canada.

Voss has filed an information circular (the “Voss Circular”) containing the information required by NI 51-102 in respect of its proposed nominees. The Voss Circular is available on Thunderbird’s company profile on SEDAR at http://www.sedar.com.

Proxies for the 2022 Annual Meeting may be solicited by mail, telephone, facsimile, email or other electronic means as well as by newspaper or other media advertising and in person by managers, directors, officers and employees of Voss who will not be specifically remunerated therefor. In addition, Voss may solicit proxies in reliance upon the public broadcast exemption to the solicitation requirements under applicable Canadian corporate and securities laws, conveyed by way of public broadcast, including press release, speech or publication, and by any other manner permitted under applicable Canadian laws. Voss may engage the services of one or more agents and authorize other persons to assist it in soliciting proxies on behalf of Voss.

Voss has entered into an agreement with Carson pursuant to which Carson will act as Voss’s proxy solicitation agent. Carson has been paid a retainer and will be paid fees at an hourly rate for services provided under the agreement. Fees will be limited to $175,000, unless otherwise authorized by Voss. Fees payable under the agreement will be adjusted as follows: (i) if there is a successful outcome, Voss will pay Carson’s fees plus a premium equal to 100% of all fees payable; (ii) if there is not a successful outcome, a 50% discount will be applied to all fees.

All costs incurred for the solicitation will be borne by Voss.

A registered holder of common shares of Thunderbird that gives a proxy may revoke it: (a) by completing and signing a valid proxy bearing a later date and returning it in accordance with the instructions contained in the form of proxy to be provided by Voss, or as otherwise provided in the Voss Circular, as updated and made available to shareholders; (b) by depositing an instrument in writing executed by the shareholder or by the shareholder's attorney authorized in writing, as the case may be: (i) at the Company’s registrar and transfer agent at any time up to and including the last business day preceding the day of the 2022 Annual Meeting or any adjournment or postponement of the meeting is to be held, or (ii) with the chairman of the 2022 Annual Meeting prior to its commencement on the day of the meeting or any adjournment or postponement of the meeting; or (c) in any other manner permitted by law.

A non‐registered holder of common shares of Thunderbird will be entitled to revoke a form of proxy or voting instruction form given to an intermediary at any time by written notice to the intermediary in accordance with the instructions given to the non-registered holder by its intermediary. It should be noted that revocation of proxies or voting instructions by a non‐registered holder can take several days or even longer to complete and, accordingly, any such revocation should be completed well in advance of the deadline prescribed in the form of proxy or voting instruction form to ensure it is given effect in respect of the meeting.

Other than disclosed herein, in the Voss Circular or Thunderbird’s public filings, neither Voss nor any of its directors or officers, or any associates or affiliates of the foregoing, nor any of Voss’s Nominees, or their respective associates or affiliates, has: (i) any material interest, direct or indirect, in any transaction since the beginning of Thunderbird’s most recently completed financial year or in any proposed transaction that has materially affected or would materially affect Thunderbird or any of its subsidiaries; or (ii) any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter currently known to be acted on at the 2022 Annual Meeting, other than the election of directors.