BOSTON--(BUSINESS WIRE)--Direct Indexing remains poised to grow at a faster rate than exchange-traded funds (ETFs), mutual funds, and separate accounts over the next five years and will reach more than $800 billion in assets by 2026, according to The Case for Direct Indexing: Differentiation in a Competitive Marketplace, the second annual report on direct indexing from Cerulli Associates and sponsored by Parametric Portfolio Associates. In addition to updating the size and growth projections for the marketplace, this year’s report provides the first comprehensive analysis of how advisory firms are using direct indexing to address a range of client needs.

“As advisors universally adopt fee-based models and financial planning, the line between business models is blurring, making differentiation challenging. Many wealth managers are looking to the tax management and customization features of direct indexing to create a personalized client experience,” said Tom O’Shea, Director at Cerulli. “Given investors’ desire to exercise more control over their portfolios, we believe that direct indexing will continue on its current growth trajectory for years to come.”

According to the report, assets in direct index products reached $462 billion in 1Q 2022, growing at a 15% rate from 2Q 2021. Yet, recent Cerulli surveys show that only 14% of financial advisors are aware of, and recommend, direct indexing solutions to clients. This is despite 63% of financial advisors serving clients with a core market of more than $500,000 in investable assets, and 14% targeting a core market of more than $5 million. In other words, many advisors with clients who are well suited for direct indexing are not using these strategies in their practices.

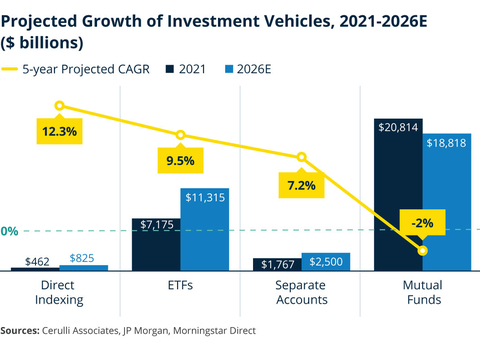

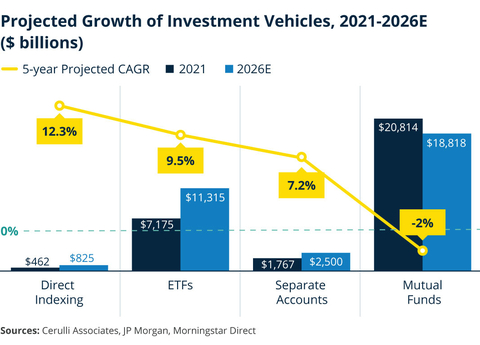

As direct indexing becomes more mainstream, Cerulli expects that assets will grow at an annualized rate of 12.3% over the next five years, faster than ETFs, mutual funds, or retail separate accounts. Cerulli also expects direct indexing to make up 33% of the retail separate account market by 2026.

This year’s report is designed to help financial advisors to identify situations where direct indexing can benefit their clients. The report examines seven real-world use cases by advisors across five direct indexing implementations, including:

- Tax-Loss Harvesting – How one wirehouse advisor has had substantial success in their practice by using direct indexing and tax-loss harvesting as the core of client portfolios, while actively managing satellite sleeves on a discretionary basis.

- Trimming Highly Appreciated Stock Positions – How exiting a concentrated position in GameStop through direct index solutions led to multiple referral opportunities.

- Planned Charitable Giving – How replacing highly appreciated securities that are donated with new cash resets the cost basis of these securities, creating new potential tax-loss harvesting opportunities in the future.

- ESG Investing – How a highly sophisticated multi-family office that classifies itself as an ESG dabbler used direct indexing as the spur to implement values-based investing.

- Customized Fixed-Income Ladders – How a fixed-income direct indexing strategy allowed a practice to meet the objectives of a mid-sized business owner, without forfeiting transparency, control, or liquidity.

“The industry buzz around direct indexing over the last several years is already translating into adoption as more advisors seize on the opportunity and move direct indexing into the mainstream,” said Tom Lee, Co-President and CIO at Parametric Portfolio Associates. “As the industry ramps up education efforts, we expect advisors will increasingly appreciate the flexibility of direct indexing to meet a wide range of needs specific to high-net-worth investors such as tax management, customization, and values-based investing.”

This report follows Cerulli’s inaugural examination of the direct indexing market, Improving Client Experience: Customizing with Direct Indexing.

ABOUT CERULLI ASSOCIATES

For over 30 years, Cerulli has provided global asset and wealth management firms with unmatched, actionable insights.

Headquartered in Boston with fully staffed offices in London and Singapore, Cerulli Associates is a global research and consulting firm that provides financial institutions with guidance in strategic positioning and new business development. Our analysts blend industry knowledge, original research, and data analysis to bring perspective to current market conditions and forecasts for future developments.