MUNICH--(BUSINESS WIRE)--The 10th Allianz Motor Day addressed the question of how sustainable car insurance can be. The discussions at the international event hosted by Allianz focused on how electromobility can be promoted as a key lever for decarbonization on both the product and service sides and how CO2 emissions can be reduced through sustainable claims management.

Repair instead of replacing with new parts

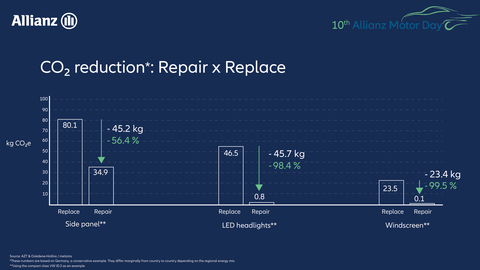

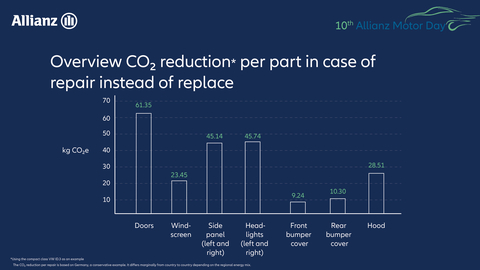

The Allianz proposition was clear: “In car insurance, we see many levers in sustainable claims management that can significantly reduce CO2 emissions,” says Klaus-Peter Roehler, member of the Board of Management of Allianz SE, responsible for the insurance business in Germany, Switzerland, Central and Eastern Europe as well as Global P&C Retail and SMC and Global Claims. “In this context, finding suitable opportunities to repair rather than use new parts is of the greatest importance.”

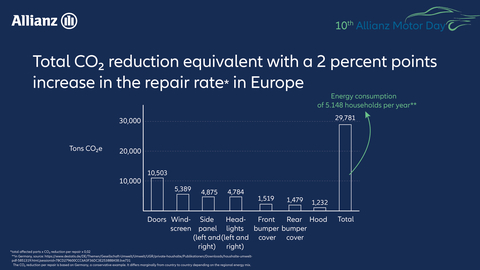

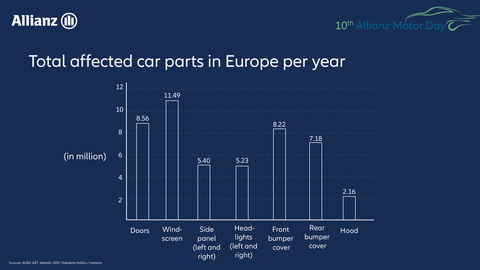

A majority of motor vehicle collision damages are small to medium-sized, mainly affecting the exterior parts of the vehicle. For these, there are green repair options. The production of a new part has a significantly higher CO2 footprint than a repair. “While these repair options are already being used today, we still see great potential for improvement here. If insurers increase repair rates in Europe by just two percentage points per year, according to the calculations of our experts, almost 30,000 tons of CO2 emissions can be avoided, equivalent to the annual energy consumption of around 5,100 households,” explains Roehler. “This underpins our proposition to increase green repairs in the future.”

Certification as sustainable workshop

Another lever for more sustainable claims management is the standardized certification of workshops in the European markets according to sustainability criteria. “Allianz, along with other stakeholders in the motor vehicle industry, would like to create common standards across Europe,” says Roehler. “Only in this way is it possible for us to consciously include adherence to sustainability criteria in choosing a workshop.”

Let electric vehicles become suitable for the masses

The EU climate law stipulates that Europe should become climate-neutral by 2050 and that by 2030, there should be at least 55 percent reduction of greenhouse gas emissions, compared to 1990 levels. The activities of the United Nations-convened Net Zero Insurance Alliance, NZIA for short, contribute to this overall reduction. Allianz was an early mover and co-founded the NZIA in the summer of 2021, with the aim of promoting the decarbonization of insurance portfolios.

“We take a holistic approach to the topic of sustainable mobility. And one thing is clear: Without sustainable mobility and the consistent expansion of electric mobility, the ambitious goals of the EU cannot be achieved,” says Roehler. “To make electric mobility suitable for the masses, all market participants must create customer-friendly solutions. These include, among other things, faster expansion of the charging infrastructure, competitive prices and useful services related to electric vehicles.”

Platform for electric vehicles to help customers decide on sustainable mobility

Allianz is partnering with recognized experts and brands to create a dedicated digital platform for electric vehicles. The platform will provide comprehensive information to customers regarding electric mobility and offer a curated marketplace for everything related to electric vehicles. The offerings of the platform range from information on topics such as coverage or charging stations; services such as a battery check before buying/selling a used electric vehicle; wallbox-installation with an on-site check; as well as a charging card on favorable conditions. It also includes suitable insurance products for electric vehicles. The platform will go live at the beginning of 2023, starting with Germany. Over the course of next year, Allianz Partners will facilitate its rollout in many other markets. “With this platform, Allianz aims to help customers decide in favor of sustainable mobility by offering them a wide range of information, products and services related to electromobility, all in one place,” Roehler says.

About Allianz

The Allianz Group is one of the world's leading insurers and asset managers with more than 126 million* private and corporate customers in more than 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 809 billion euros on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage 2.0 trillion euros of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2021, over 155,000 employees achieved total revenues of 148.5 billion euros and an operating profit of 13.4 billion euros for the group.

These assessments are, as always, subject to the disclaimer provided below.

* Including non-consolidated entities with Allianz customers.

Cautionary note regarding forward-looking statements

This document includes forward-looking statements, such as prospects or expectations, that are based on management's current views and assumptions and subject to known and unknown risks and uncertainties. Actual results, performance figures, or events may differ significantly from those expressed or implied in such forward-looking statements.

Deviations may arise due to changes in factors including, but not limited to, the following: (i) the general economic and competitive situation in the Allianz’s core business and core markets, (ii) the performance of financial markets (in particular market volatility, liquidity, and credit events), (iii) adverse publicity, regulatory actions or litigation with respect to the Allianz Group, other well-known companies and the financial services industry generally, (iv) the frequency and severity of insured loss events, including those resulting from natural catastrophes, and the development of loss expenses, (v) mortality and morbidity levels and trends, (vi) persistency levels, (vii) the extent of credit defaults, (viii) interest rate levels, (ix) currency exchange rates, most notably the EUR/USD exchange rate, (x) changes in laws and regulations, including tax regulations, (xi) the impact of acquisitions including and related integration issues and reorganization measures, and (xii) the general competitive conditions that, in each individual case, apply at a local, regional, national, and/or global level. Many of these changes can be exacerbated by terrorist activities.

No duty to update

Allianz assumes no obligation to update any information or forward-looking statement contained herein, save for any information we are required to disclose by law.

Privacy Note

Allianz SE is committed to protecting your personal data. Find out more in our privacy statement.