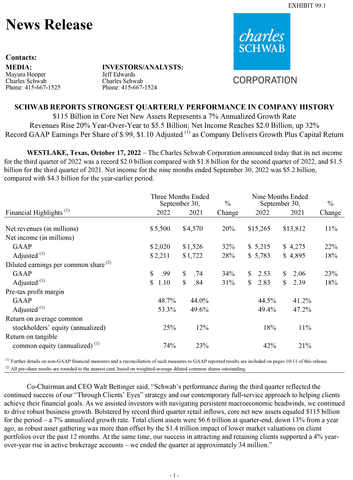

WESTLAKE, Texas--(BUSINESS WIRE)--The Charles Schwab Corporation announced today that its net income for the third quarter of 2022 was a record $2.0 billion compared with $1.8 billion for the second quarter of 2022, and $1.5 billion for the third quarter of 2021. Net income for the nine months ended September 30, 2022 was $5.2 billion, compared with $4.3 billion for the year-earlier period.

|

Three Months Ended

|

% |

Nine Months Ended

|

% |

||||||||||||||||||

Financial Highlights (1) |

2022 |

|

2021 |

|

Change |

|

2022 |

|

2021 |

|

Change |

|||||||||||

|

|

|

|

|

|

|

||||||||||||||||

Net revenues (in millions) |

$ |

5,500 |

|

$ |

4,570 |

|

20 |

% |

$ |

15,265 |

|

$ |

13,812 |

|

11 |

% |

||||||

Net income (in millions) |

|

|

|

|

|

|

||||||||||||||||

GAAP |

$ |

2,020 |

|

$ |

1,526 |

|

32 |

% |

$ |

5,215 |

|

$ |

4,275 |

|

22 |

% |

||||||

Adjusted (1) |

$ |

2,211 |

|

$ |

1,722 |

|

28 |

% |

$ |

5,783 |

|

$ |

4,895 |

|

18 |

% |

||||||

Diluted earnings per common share (2) |

|

|

|

|

|

|

||||||||||||||||

GAAP |

$ |

.99 |

|

$ |

.74 |

|

34 |

% |

$ |

2.53 |

|

$ |

2.06 |

|

23 |

% |

||||||

Adjusted (1) |

$ |

1.10 |

|

$ |

.84 |

|

31 |

% |

$ |

2.83 |

|

$ |

2.39 |

|

18 |

% |

||||||

Pre-tax profit margin |

|

|

|

|

|

|

||||||||||||||||

GAAP |

|

48.7 |

% |

|

44.0 |

% |

|

|

44.5 |

% |

|

41.2 |

% |

|

||||||||

Adjusted (1) |

|

53.3 |

% |

|

49.6 |

% |

|

|

49.4 |

% |

|

47.2 |

% |

|

||||||||

Return on average common stockholders’ equity (annualized) |

|

25 |

% |

|

12 |

% |

|

|

18 |

% |

|

11 |

% |

|

||||||||

Return on tangible common equity (annualized) (1) |

|

74 |

% |

|

23 |

% |

|

|

42 |

% |

|

21 |

% |

|

||||||||

(1) |

Further details on non-GAAP financial measures and a reconciliation of such measures to GAAP reported results are included on pages 10-11 of this release. |

|

(2) |

All per-share results are rounded to the nearest cent, based on weighted-average diluted common shares outstanding. |

Co-Chairman and CEO Walt Bettinger said, “Schwab’s performance during the third quarter reflected the continued success of our 'Through Clients’ Eyes' strategy and our contemporary full-service approach to helping clients achieve their financial goals. As we assisted investors with navigating persistent macroeconomic headwinds, we continued to drive robust business growth. Bolstered by record third quarter retail inflows, core net new assets equaled $115 billion for the period – a 7% annualized growth rate. Total client assets were $6.6 trillion at quarter-end, down 13% from a year ago, as robust asset gathering was more than offset by the $1.4 trillion impact of lower market valuations on client portfolios over the past 12 months. At the same time, our success in attracting and retaining clients supported a 4% year-over-year rise in active brokerage accounts – we ended the quarter at approximately 34 million.”

“Our modern wealth management approach provides a wide array of investing and financial capabilities to support investors through a range of market conditions – particularly in difficult times like these,” Mr. Bettinger continued. “Equity markets remained under pressure throughout the quarter – including the largest percentage drop for a September since 2008 – with the S&P 500® extending its year-to-date losses to 25%. The Federal Reserve assumed an increasingly hawkish stance, tightening monetary policy at the fastest rate in four decades, as it wrestled with elevated inflation and lingering effects from the global pandemic. Additionally, the continued war in Ukraine, along with increasing challenges across other major global economies weighed on overall market sentiment. That being said, clients remained engaged – with daily average trading volume of 5.5 million essentially flat versus the third quarter of last year, including net buying activity across both equities and fixed income securities.”

“Given our four decades of experience assisting individual investors and the advisors who serve them, we know prolonged environmental challenges can impact clients’ financial confidence, reinforcing the importance of continued investment across our three strategic initiatives: scale and efficiency, client segmentation, and win-win monetization,” Mr. Bettinger added. “Schwab’s extensive suite of advisory solutions, along with the recently introduced personalized investing capabilities, are designed to help clients achieve their evolving goals throughout their financial lives. This suite includes Wasmer SchroederTM Strategies, which offers investors a range of tax-exempt and taxable fixed income solutions. This team’s expertise, along with an attractive value proposition, increasing client demand for income solutions, and rising interest rates has helped these strategies attract over $5 billion in net flows over the last two years, including $1 billion during the third quarter of 2022 alone. Another example of win-win monetization is the recent steps we have taken to bolster our fund offering for RIAs by expanding our institutional no transaction fee (INTF) mutual fund platform to include over 800 additional highly rated equity and bond funds across 15 leading third-party asset managers.”

Mr. Bettinger concluded, “Through consistent strategic focus and disciplined execution, we believe we can drive sustained business momentum while continuing to deliver a high-quality wealth experience for clients and to build long-term value for stockholders.”

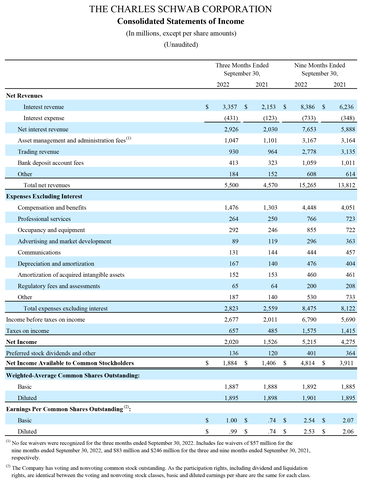

CFO Peter Crawford noted, “Schwab’s diversified financial model and a significant benefit from higher rates helped us convert ongoing success with clients into record total revenues of $5.5 billion, up 20% on a year-over-year basis. Net interest revenue increased by 44% to $2.9 billion, as rising rates helped our net interest margin to expand sequentially by 35 basis points to 1.97%. This movement more than offset the 6% contraction in interest-earning assets driven by clients’ cash sorting behavior and their continued market engagement. Asset management and administration fees decreased 5% to $1.0 billion as the challenging equity markets weighed on client asset balances. Trading revenue also declined slightly to $930 million primarily due to a mix shift within client trading activity.”

Mr. Crawford continued, “Driven largely by ongoing investments in our people and technology, GAAP expenses for the quarter increased 10% year-over-year to $2.8 billion. This amount includes $101 million in acquisition and integration-related costs and $152 million in amortization of acquired intangibles. Exclusive of these items, adjusted total expenses (1) were up 12% versus the third quarter of 2021 – consistent with our planned spending in 2022. Our pre-tax profit margin expanded to 48.7%, or 53.3% on an adjusted basis (1) – both all-time highs.”

“Diligent balance sheet management keeps us positioned to navigate a rapidly evolving environment while concurrently enhancing our financial performance and returning excess capital to our owners,” added Mr. Crawford. “In late July, the board of directors approved a 10% increase in our common dividend and a $15 billion stock repurchase authorization. During the third quarter, we repurchased 21.9 million shares for $1.5 billion. We’ve also announced the redemption of the $400 million Series A Preferred stock effective November 1. Inclusive of these actions, the company’s preliminary Tier 1 Leverage Ratio at quarter-end was 6.8%, above our recently updated operating objective of 6.50% – 6.75%. This quarter’s record overall results further demonstrate the durability of our all-weather model and its ability to deliver both profitable growth and meaningful return of excess capital through the cycle.”

(1) Further details on non-GAAP financial measures and a reconciliation of such measures to GAAP reported results are included on pages 10-11 of this release.

Commentary from the CFO

Periodically, our Chief Financial Officer provides insight and commentary regarding Schwab’s financial picture at: https://www.aboutschwab.com/cfo-commentary. The most recent commentary, which provides perspective on the recent repurchase of nonvoting common stock, was posted on August 1, 2022.

Fall Business Update

The company has scheduled a Fall Business Update for institutional investors on Thursday, October 27, 2022. The Update, which will be held via webcast, is scheduled to run from approximately 10:00 a.m. - 11:00 a.m. PT, 1:00 p.m. - 2:00 p.m. ET. Registration for this Update is accessible at https://www.aboutschwab.com/schwabevents.

Forward-Looking Statements

This press release contains forward-looking statements relating to success with clients; strategic initiatives; investments to attract and retain talent, improve service and the client experience, expand products, services and offerings to meet client needs, diversify revenues, and drive scale and efficiency; business momentum; stockholder value; balance sheet management; financial performance; returning excess capital to stockholders; Tier 1 Leverage Ratio operating objective; and all-weather model. These forward-looking statements reflect management’s expectations as of the date hereof. Achievement of these expectations and objectives is subject to risks and uncertainties that could cause actual results to differ materially from the expressed expectations.

Important factors that may cause such differences include, but are not limited to, the company’s ability to attract and retain clients and independent investment advisors and grow those relationships and client assets; develop and launch new and enhanced products, services, and capabilities, as well as enhance its infrastructure and capacity, in a timely and successful manner; hire and retain talent; support client activity levels; successfully implement integration strategies and plans; manage expenses; and monetize client assets. Other important factors include client use of the company’s advisory solutions and other products and services; general market conditions, including equity valuations and the level of interest rates; the level and mix of client trading activity; market volatility; margin loan balances; securities lending; competitive pressures on pricing; client cash sorting; client sensitivity to rates; level of client assets, including cash balances; capital and liquidity needs and management; balance sheet positioning relative to changes in interest rates; interest earning asset mix and growth; the migration of bank deposit account balances; and other factors set forth in the company’s most recent reports on Form 10-K and Form 10-Q.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with 33.9 million active brokerage accounts, 2.3 million corporate retirement plan participants, 1.7 million banking accounts, and $6.64 trillion in client assets. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiaries, Charles Schwab & Co., Inc., TD Ameritrade, Inc., and TD Ameritrade Clearing, Inc., (members SIPC, https://www.sipc.org), and their affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent, fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at https://www.aboutschwab.com.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are separate but affiliated companies and subsidiaries of TD Ameritrade Holding Corporation. TD Ameritrade Holding Corporation is a wholly owned subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank.

THE CHARLES SCHWAB CORPORATION |

||||||||||||||||

Consolidated Statements of Income |

||||||||||||||||

(In millions, except per share amounts) |

||||||||||||||||

(Unaudited) |

||||||||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

||||||||||||

Net Revenues |

|

|

|

|

||||||||||||

Interest revenue |

$ |

3,357 |

|

$ |

2,153 |

|

$ |

8,386 |

|

$ |

6,236 |

|

||||

Interest expense |

|

(431 |

) |

|

(123 |

) |

|

(733 |

) |

|

(348 |

) |

||||

Net interest revenue |

|

2,926 |

|

|

2,030 |

|

|

7,653 |

|

|

5,888 |

|

||||

Asset management and administration fees (1) |

|

1,047 |

|

|

1,101 |

|

|

3,167 |

|

|

3,164 |

|

||||

Trading revenue |

|

930 |

|

|

964 |

|

|

2,778 |

|

|

3,135 |

|

||||

Bank deposit account fees |

|

413 |

|

|

323 |

|

|

1,059 |

|

|

1,011 |

|

||||

Other |

|

184 |

|

|

152 |

|

|

608 |

|

|

614 |

|

||||

Total net revenues |

|

5,500 |

|

|

4,570 |

|

|

15,265 |

|

|

13,812 |

|

||||

Expenses Excluding Interest |

|

|

|

|

||||||||||||

Compensation and benefits |

|

1,476 |

|

|

1,303 |

|

|

4,448 |

|

|

4,051 |

|

||||

Professional services |

|

264 |

|

|

250 |

|

|

766 |

|

|

723 |

|

||||

Occupancy and equipment |

|

292 |

|

|

246 |

|

|

855 |

|

|

722 |

|

||||

Advertising and market development |

|

89 |

|

|

119 |

|

|

296 |

|

|

363 |

|

||||

Communications |

|

131 |

|

|

144 |

|

|

444 |

|

|

457 |

|

||||

Depreciation and amortization |

|

167 |

|

|

140 |

|

|

476 |

|

|

404 |

|

||||

Amortization of acquired intangible assets |

|

152 |

|

|

153 |

|

|

460 |

|

|

461 |

|

||||

Regulatory fees and assessments |

|

65 |

|

|

64 |

|

|

200 |

|

|

208 |

|

||||

Other |

|

187 |

|

|

140 |

|

|

530 |

|

|

733 |

|

||||

Total expenses excluding interest |

|

2,823 |

|

|

2,559 |

|

|

8,475 |

|

|

8,122 |

|

||||

Income before taxes on income |

|

2,677 |

|

|

2,011 |

|

|

6,790 |

|

|

5,690 |

|

||||

Taxes on income |

|

657 |

|

|

485 |

|

|

1,575 |

|

|

1,415 |

|

||||

Net Income |

|

2,020 |

|

|

1,526 |

|

|

5,215 |

|

|

4,275 |

|

||||

Preferred stock dividends and other |

|

136 |

|

|

120 |

|

|

401 |

|

|

364 |

|

||||

Net Income Available to Common Stockholders |

$ |

1,884 |

|

$ |

1,406 |

|

$ |

4,814 |

|

$ |

3,911 |

|

||||

Weighted-Average Common Shares Outstanding: |

|

|

|

|

||||||||||||

Basic |

|

1,887 |

|

|

1,888 |

|

|

1,892 |

|

|

1,885 |

|

||||

Diluted |

|

1,895 |

|

|

1,898 |

|

|

1,901 |

|

|

1,895 |

|

||||

Earnings Per Common Shares Outstanding (2): |

|

|

|

|

||||||||||||

Basic |

$ |

1.00 |

|

$ |

.74 |

|

$ |

2.54 |

|

$ |

2.07 |

|

||||

Diluted |

$ |

.99 |

|

$ |

.74 |

|

$ |

2.53 |

|

$ |

2.06 |

|

||||

(1) |

No fee waivers were recognized for the three months ended September 30, 2022. Includes fee waivers of $57 million for the nine months ended September 30, 2022, and $83 million and $246 million for the three and nine months ended September 30, 2021, respectively. |

|

(2) |

The Company has voting and nonvoting common stock outstanding. As the participation rights, including dividend and liquidation rights, are identical between the voting and nonvoting stock classes, basic and diluted earnings per share are the same for each class. |

THE CHARLES SCHWAB CORPORATION |

||||||||||||||||||||||||||

Financial and Operating Highlights |

||||||||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||||||||

|

Q3-22 % change |

2022 |

2021 |

|||||||||||||||||||||||

|

vs. |

vs. |

Third |

Second |

First |

Fourth |

Third |

|||||||||||||||||||

(In millions, except per share amounts and as noted) |

Q3-21 |

Q2-22 |

Quarter |

Quarter |

Quarter |

Quarter |

Quarter |

|||||||||||||||||||

Net Revenues |

|

|

|

|

|

|

|

|||||||||||||||||||

Net interest revenue |

44 |

% |

15 |

% |

$ |

2,926 |

|

$ |

2,544 |

|

$ |

2,183 |

|

$ |

2,142 |

|

$ |

2,030 |

|

|||||||

Asset management and administration fees |

(5 |

) % |

— |

|

|

1,047 |

|

|

1,052 |

|

|

1,068 |

|

|

1,110 |

|

|

1,101 |

|

|||||||

Trading revenue |

(4 |

) % |

5 |

% |

|

930 |

|

|

885 |

|

|

963 |

|

|

1,017 |

|

|

964 |

|

|||||||

Bank deposit account fees |

28 |

% |

17 |

% |

|

413 |

|

|

352 |

|

|

294 |

|

|

304 |

|

|

323 |

|

|||||||

Other |

21 |

% |

(29 |

) % |

|

184 |

|

|

260 |

|

|

164 |

|

|

135 |

|

|

152 |

|

|||||||

Total net revenues |

20 |

% |

8 |

% |

|

5,500 |

|

|

5,093 |

|

|

4,672 |

|

|

4,708 |

|

|

4,570 |

|

|||||||

Expenses Excluding Interest |

|

|

|

|

|

|

|

|||||||||||||||||||

Compensation and benefits |

13 |

% |

4 |

% |

|

1,476 |

|

|

1,426 |

|

|

1,546 |

|

|

1,399 |

|

|

1,303 |

|

|||||||

Professional services |

6 |

% |

2 |

% |

|

264 |

|

|

258 |

|

|

244 |

|

|

271 |

|

|

250 |

|

|||||||

Occupancy and equipment |

19 |

% |

(1 |

) % |

|

292 |

|

|

294 |

|

|

269 |

|

|

254 |

|

|

246 |

|

|||||||

Advertising and market development |

(25 |

) % |

(15 |

) % |

|

89 |

|

|

105 |

|

|

102 |

|

|

122 |

|

|

119 |

|

|||||||

Communications |

(9 |

) % |

(22 |

) % |

|

131 |

|

|

169 |

|

|

144 |

|

|

130 |

|

|

144 |

|

|||||||

Depreciation and amortization |

19 |

% |

5 |

% |

|

167 |

|

|

159 |

|

|

150 |

|

|

145 |

|

|

140 |

|

|||||||

Amortization of acquired intangibles assets |

(1 |

) % |

(1 |

) % |

|

152 |

|

|

154 |

|

|

154 |

|

|

154 |

|

|

153 |

|

|||||||

Regulatory fees and assessments |

2 |

% |

(3 |

) % |

|

65 |

|

|

67 |

|

|

68 |

|

|

67 |

|

|

64 |

|

|||||||

Other |

34 |

% |

— |

|

|

187 |

|

|

187 |

|

|

156 |

|

|

143 |

|

|

140 |

|

|||||||

Total expenses excluding interest |

10 |

% |

— |

|

|

2,823 |

|

|

2,819 |

|

|

2,833 |

|

|

2,685 |

|

|

2,559 |

|

|||||||

Income before taxes on income |

33 |

% |

18 |

% |

|

2,677 |

|

|

2,274 |

|

|

1,839 |

|

|

2,023 |

|

|

2,011 |

|

|||||||

Taxes on income |

35 |

% |

37 |

% |

|

657 |

|

|

481 |

|

|

437 |

|

|

443 |

|

|

485 |

|

|||||||

Net Income |

32 |

% |

13 |

% |

$ |

2,020 |

|

$ |

1,793 |

|

$ |

1,402 |

|

$ |

1,580 |

|

$ |

1,526 |

|

|||||||

Preferred stock dividends and other |

13 |

% |

(4 |

) % |

|

136 |

|

|

141 |

|

|

124 |

|

|

131 |

|

|

120 |

|

|||||||

Net Income Available to Common Stockholders |

34 |

% |

14 |

% |

$ |

1,884 |

|

$ |

1,652 |

|

$ |

1,278 |

|

$ |

1,449 |

|

$ |

1,406 |

|

|||||||

Earnings per common share (1): |

|

|

|

|

|

|

|

|||||||||||||||||||

Basic |

35 |

% |

15 |

% |

$ |

1.00 |

|

$ |

.87 |

|

$ |

.67 |

|

$ |

.77 |

|

$ |

.74 |

|

|||||||

Diluted |

34 |

% |

14 |

% |

$ |

.99 |

|

$ |

.87 |

|

$ |

.67 |

|

$ |

.76 |

|

$ |

.74 |

|

|||||||

Dividends declared per common share |

22 |

% |

10 |

% |

$ |

.22 |

|

$ |

.20 |

|

$ |

.20 |

|

$ |

.18 |

|

$ |

.18 |

|

|||||||

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|||||||||||||||||||

Basic |

— |

|

— |

|

|

1,887 |

|

|

1,896 |

|

|

1,894 |

|

|

1,892 |

|

|

1,888 |

|

|||||||

Diluted |

— |

|

— |

|

|

1,895 |

|

|

1,904 |

|

|

1,905 |

|

|

1,902 |

|

|

1,898 |

|

|||||||

Performance Measures |

|

|

|

|

|

|

|

|||||||||||||||||||

Pre-tax profit margin |

|

|

|

48.7 |

% |

|

44.6 |

% |

|

39.4 |

% |

|

43.0 |

% |

|

44.0 |

% |

|||||||||

Return on average common stockholders’ equity (annualized) (2) |

|

|

|

25 |

% |

|

19 |

% |

|

12 |

% |

|

12 |

% |

|

12 |

% |

|||||||||

Financial Condition (at quarter end, in billions) |

|

|

|

|

|

|

|

|||||||||||||||||||

Cash and cash equivalents |

36 |

% |

(28 |

) % |

$ |

46.5 |

|

$ |

64.6 |

|

$ |

91.1 |

|

$ |

63.0 |

|

$ |

34.3 |

|

|||||||

Cash and investments segregated |

4 |

% |

(18 |

) % |

|

44.1 |

|

|

53.5 |

|

|

54.4 |

|

|

53.9 |

|

|

42.3 |

|

|||||||

Receivables from brokerage clients — net |

(15 |

) % |

(3 |

) % |

|

73.9 |

|

|

76.1 |

|

|

84.1 |

|

|

90.6 |

|

|

86.6 |

|

|||||||

Available for sale securities (3) |

(37 |

) % |

(11 |

) % |

|

236.5 |

|

|

265.3 |

|

|

272.0 |

|

|

390.1 |

|

|

377.0 |

|

|||||||

Held to maturity securities (3) |

N/M |

|

(4 |

) % |

|

96.3 |

|

|

100.1 |

|

|

105.3 |

|

|

— |

|

|

— |

|

|||||||

Bank loans — net |

28 |

% |

2 |

% |

|

40.4 |

|

|

39.6 |

|

|

37.2 |

|

|

34.6 |

|

|

31.6 |

|

|||||||

Total assets |

(5 |

) % |

(9 |

) % |

|

577.6 |

|

|

637.6 |

|

|

681.0 |

|

|

667.3 |

|

|

607.5 |

|

|||||||

Bank deposits |

— |

|

(10 |

) % |

|

395.7 |

|

|

442.0 |

|

|

465.8 |

|

|

443.8 |

|

|

395.3 |

|

|||||||

Payables to brokerage clients |

(3 |

) % |

(4 |

) % |

|

110.0 |

|

|

114.9 |

|

|

125.3 |

|

|

125.7 |

|

|

113.1 |

|

|||||||

Short-term borrowings |

(83 |

) % |

(64 |

) % |

|

0.5 |

|

|

1.4 |

|

|

4.2 |

|

|

4.9 |

|

|

3.0 |

|

|||||||

Long-term debt |

7 |

% |

(1 |

) % |

|

20.8 |

|

|

21.1 |

|

|

21.9 |

|

|

18.9 |

|

|

19.5 |

|

|||||||

Stockholders’ equity |

(36 |

) % |

(17 |

) % |

|

37.0 |

|

|

44.5 |

|

|

48.1 |

|

|

56.3 |

|

|

57.4 |

|

|||||||

Other |

|

|

|

|

|

|

|

|||||||||||||||||||

Full-time equivalent employees (at quarter end, in thousands) |

9 |

% |

— |

|

|

35.2 |

|

|

35.2 |

|

|

34.2 |

|

|

33.4 |

|

|

32.4 |

|

|||||||

Capital expenditures — purchases of equipment, office facilities, and property, net (in millions) |

10 |

% |

(43 |

) % |

$ |

193 |

|

$ |

339 |

|

$ |

209 |

|

$ |

431 |

|

$ |

176 |

|

|||||||

Expenses excluding interest as a percentage of average client assets (annualized) |

|

|

|

0.16 |

% |

|

0.16 |

% |

|

0.15 |

% |

|

0.13 |

% |

|

0.13 |

% |

|||||||||

Clients’ Daily Average Trades (DATs) (in thousands) |

— |

|

(11 |

) % |

|

5,523 |

|

|

6,227 |

|

|

6,578 |

|

|

6,102 |

|

|

5,549 |

|

|||||||

Number of Trading Days |

— |

|

3 |

% |

|

64.0 |

|

|

62.0 |

|

|

62.0 |

|

|

63.5 |

|

|

64.0 |

|

|||||||

Revenue Per Trade (4) |

(3 |

) % |

15 |

% |

$ |

2.63 |

|

$ |

2.29 |

|

$ |

2.36 |

|

$ |

2.62 |

|

$ |

2.71 |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||

(1) |

The Company has voting and nonvoting common stock outstanding. As the participation rights, including dividend and liquidation rights, are identical between the voting and nonvoting stock classes, basic and diluted earnings per share are the same for each class. |

|

(2) |

Return on average common stockholders’ equity is calculated using net income available to common stockholders divided by average common stockholders’ equity. |

|

(3) |

In January 2022, the Company transferred a portion of its investment securities designated as available for sale to the held to maturity category, as described in Part I – Item 1 – Note 4 of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. |

|

(4) |

Revenue per trade is calculated as trading revenue divided by DATs multiplied by the number of trading days. |

|

N/M Not meaningful. Percentage changes greater than 200% are presented as not meaningful. |

||

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||||||||||||||||

Net Interest Revenue Information |

|||||||||||||||||||||||||||||||||||||||||

(In millions, except ratios or as noted) |

|||||||||||||||||||||||||||||||||||||||||

(Unaudited) |

|||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||||||||||||||

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|||||||||||||||||||||||||||||||

|

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

|||||||||||||||||||||||||||||

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

Cash and cash equivalents |

$ |

53,127 |

$ |

294 |

2.16 |

% |

$ |

38,732 |

$ |

11 |

0.12 |

% |

$ |

63,598 |

$ |

461 |

|

0.95 |

% |

$ |

39,848 |

$ |

27 |

|

0.09 |

% |

|||||||||||||||

Cash and investments segregated |

|

49,554 |

|

214 |

1.69 |

% |

|

42,617 |

|

5 |

0.04 |

% |

|

50,891 |

|

308 |

|

0.80 |

% |

|

43,914 |

|

19 |

|

0.06 |

% |

|||||||||||||||

Receivables from brokerage clients |

|

72,751 |

|

912 |

4.91 |

% |

|

80,873 |

|

628 |

3.04 |

% |

|

78,630 |

|

2,244 |

|

3.76 |

% |

|

74,831 |

|

1,800 |

|

3.17 |

% |

|||||||||||||||

Available for sale securities (1,2) |

|

273,968 |

|

1,161 |

1.69 |

% |

|

362,204 |

|

1,187 |

1.30 |

% |

|

281,897 |

|

3,196 |

|

1.51 |

% |

|

348,477 |

|

3,381 |

|

1.29 |

% |

|||||||||||||||

Held to maturity securities (2) |

|

97,568 |

|

345 |

1.41 |

% |

|

— |

|

— |

— |

|

|

100,890 |

|

1,062 |

|

1.40 |

% |

|

— |

|

— |

|

— |

|

|||||||||||||||

Bank loans |

|

39,984 |

|

300 |

2.99 |

% |

|

30,235 |

|

161 |

2.12 |

% |

|

38,238 |

|

717 |

|

2.50 |

% |

|

27,336 |

|

448 |

|

2.18 |

% |

|||||||||||||||

Total interest-earning assets |

|

586,952 |

|

3,226 |

2.17 |

% |

|

554,661 |

|

1,992 |

1.42 |

% |

|

614,144 |

|

7,988 |

|

1.73 |

% |

|

534,406 |

|

5,675 |

|

1.41 |

% |

|||||||||||||||

Securities lending revenue |

|

|

124 |

|

|

|

159 |

|

|

|

383 |

|

|

|

|

557 |

|

|

|||||||||||||||||||||||

Other interest revenue |

|

|

7 |

|

|

|

2 |

|

|

|

15 |

|

|

|

|

4 |

|

|

|||||||||||||||||||||||

Total interest-earning assets |

$ |

586,952 |

$ |

3,357 |

2.26 |

% |

$ |

554,661 |

$ |

2,153 |

1.54 |

% |

$ |

614,144 |

$ |

8,386 |

|

1.81 |

% |

$ |

534,406 |

$ |

6,236 |

|

1.55 |

% |

|||||||||||||||

Funding sources |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

Bank deposits |

$ |

420,132 |

$ |

241 |

0.23 |

% |

$ |

384,561 |

$ |

14 |

0.01 |

% |

$ |

440,801 |

$ |

285 |

|

0.09 |

% |

$ |

371,974 |

$ |

40 |

|

0.01 |

% |

|||||||||||||||

Payables to brokerage clients |

|

96,802 |

|

41 |

0.17 |

% |

|

92,498 |

|

3 |

0.01 |

% |

|

101,472 |

|

47 |

|

0.06 |

% |

|

89,087 |

|

7 |

|

0.01 |

% |

|||||||||||||||

Short-term borrowings |

|

708 |

|

4 |

1.95 |

% |

|

3,485 |

|

3 |

0.34 |

% |

|

2,656 |

|

12 |

|

0.60 |

% |

|

2,617 |

|

6 |

|

0.32 |

% |

|||||||||||||||

Long-term debt |

|

21,024 |

|

131 |

2.49 |

% |

|

19,030 |

|

99 |

2.10 |

% |

|

20,673 |

|

363 |

|

2.34 |

% |

|

17,225 |

|

281 |

|

2.18 |

% |

|||||||||||||||

Total interest-bearing liabilities |

|

538,666 |

|

417 |

0.31 |

% |

|

499,574 |

|

119 |

0.09 |

% |

|

565,602 |

|

707 |

|

0.17 |

% |

|

480,903 |

|

334 |

|

0.09 |

% |

|||||||||||||||

Non-interest-bearing funding sources |

|

48,286 |

|

|

|

55,087 |

|

|

|

48,542 |

|

|

|

53,503 |

|

|

|||||||||||||||||||||||||

Securities lending expense |

|

|

13 |

|

|

|

4 |

|

|

|

28 |

|

|

|

|

16 |

|

|

|||||||||||||||||||||||

Other interest expense |

|

|

1 |

|

|

|

— |

|

|

|

(2 |

) |

|

|

|

(2 |

) |

|

|||||||||||||||||||||||

Total funding sources |

$ |

586,952 |

$ |

431 |

0.29 |

% |

$ |

554,661 |

$ |

123 |

0.09 |

% |

$ |

614,144 |

$ |

733 |

|

0.16 |

% |

$ |

534,406 |

$ |

348 |

|

0.09 |

% |

|||||||||||||||

Net interest revenue |

|

$ |

2,926 |

1.97 |

% |

|

$ |

2,030 |

1.45 |

% |

|

$ |

7,653 |

|

1.65 |

% |

|

$ |

5,888 |

|

1.46 |

% |

|||||||||||||||||||

(1) |

Amounts have been calculated based on amortized cost. |

|

(2) |

In January 2022, the Company transferred a portion of its investment securities designated as available for sale to the held to maturity category, as described in Part I – Item 1 – Note 4 of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. |

THE CHARLES SCHWAB CORPORATION |

||||||||||||||||||||||||||||||||||||||||||

Asset Management and Administration Fees Information |

||||||||||||||||||||||||||||||||||||||||||

(In millions, except ratios or as noted) |

||||||||||||||||||||||||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||||||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

||||||||||||||||||||||||||||||||||||||

|

Average Client Assets |

Revenue |

Average Fee |

Average Client Assets |

Revenue |

Average Fee |

Average Client Assets |

Revenue |

Average Fee |

Average Client Assets |

Revenue |

Average Fee |

||||||||||||||||||||||||||||||

Schwab money market funds before fee waivers |

$ |

184,834 |

$ |

132 |

0.28 |

% |

$ |

149,508 |

$ |

112 |

|

0.30 |

% |

$ |

158,525 |

$ |

340 |

|

0.29 |

% |

$ |

158,749 |

$ |

348 |

|

0.29 |

% |

|||||||||||||||

Fee waivers |

|

|

— |

|

|

|

(83 |

) |

|

|

|

(57 |

) |

|

|

|

(246 |

) |

|

|||||||||||||||||||||||

Schwab money market funds |

|

184,834 |

|

132 |

0.28 |

% |

|

149,508 |

|

29 |

|

0.08 |

% |

|

158,525 |

|

283 |

|

0.24 |

% |

|

158,749 |

|

102 |

|

0.09 |

% |

|||||||||||||||

Schwab equity and bond funds, ETFs, and collective trust funds (CTFs) |

|

422,711 |

|

89 |

0.08 |

% |

|

441,344 |

|

99 |

|

0.09 |

% |

|

436,928 |

|

278 |

|

0.09 |

% |

|

411,312 |

|

279 |

|

0.09 |

% |

|||||||||||||||

Mutual Fund OneSource® and other non-transaction fee funds |

|

183,019 |

|

139 |

0.30 |

% |

|

234,582 |

|

188 |

|

0.32 |

% |

|

196,032 |

|

453 |

|

0.31 |

% |

|

228,643 |

|

540 |

|

0.32 |

% |

|||||||||||||||

Other third-party mutual funds and ETFs |

|

747,676 |

|

160 |

0.08 |

% |

|

918,363 |

|

187 |

|

0.08 |

% |

|

805,204 |

|

510 |

|

0.08 |

% |

|

888,003 |

|

533 |

|

0.08 |

% |

|||||||||||||||

Total mutual funds, ETFs, and CTFs (1) |

$ |

1,538,240 |

|

520 |

0.13 |

% |

$ |

1,743,797 |

|

503 |

|

0.11 |

% |

$ |

1,596,689 |

|

1,524 |

|

0.13 |

% |

$ |

1,686,707 |

|

1,454 |

|

0.12 |

% |

|||||||||||||||

Advice solutions (1) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Fee-based |

$ |

431,276 |

|

452 |

0.42 |

% |

$ |

463,827 |

|

511 |

|

0.44 |

% |

$ |

446,979 |

|

1,409 |

|

0.42 |

% |

$ |

445,521 |

|

1,469 |

|

0.44 |

% |

|||||||||||||||

Non-fee-based |

|

85,567 |

|

— |

— |

|

|

90,649 |

|

— |

|

— |

|

|

87,528 |

|

— |

|

— |

|

|

87,758 |

|

— |

|

— |

|

|||||||||||||||

Total advice solutions |

$ |

516,843 |

|

452 |

0.35 |

% |

$ |

554,476 |

|

511 |

|

0.37 |

% |

$ |

534,507 |

|

1,409 |

|

0.35 |

% |

$ |

533,279 |

|

1,469 |

|

0.37 |

% |

|||||||||||||||

Other balance-based fees (2) |

|

537,809 |

|

58 |

0.04 |

% |

|

632,806 |

|

68 |

|

0.04 |

% |

|

573,733 |

|

186 |

|

0.04 |

% |

|

604,995 |

|

195 |

|

0.04 |

% |

|||||||||||||||

Other (3) |

|

|

17 |

|

|

|

19 |

|

|

|

|

48 |

|

|

|

|

46 |

|

|

|||||||||||||||||||||||

Total asset management and administration fees |

|

$ |

1,047 |

|

|

$ |

1,101 |

|

|

|

$ |

3,167 |

|

|

|

$ |

3,164 |

|

|

|||||||||||||||||||||||

(1) |

Advice solutions include managed portfolios, specialized strategies, and customized investment advice such as Schwab Wealth AdvisoryTM, Schwab Managed PortfoliosTM, Managed Account Select®, Schwab Advisor Network®, Windhaven Strategies®, ThomasPartners® Strategies, Schwab Index Advantage® advised retirement plan balances, Schwab Intelligent Portfolios®, Institutional Intelligent Portfolios®, Schwab Intelligent Portfolios Premium®, TD Ameritrade AdvisorDirect®, Essential Portfolios, Selective Portfolios, and Personalized Portfolios; as well as legacy non-fee advice solutions including Schwab Advisor Source and certain retirement plan balances. Average client assets for advice solutions may also include the asset balances contained in the mutual fund and/or ETF categories listed above. For the total end of period view, please see the Monthly Activity Report. |

|

(2) |

Includes various asset-related fees, such as trust fees, 401(k) recordkeeping fees, and mutual fund clearing fees and other service fees. |

|

(3) |

Includes miscellaneous service and transaction fees relating to mutual funds and ETFs that are not balance-based. |

THE CHARLES SCHWAB CORPORATION |

||||||||||||||||||||||||||

Growth in Client Assets and Accounts |

||||||||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||||||||

|

Q3-22 % Change |

2022 |

2021 |

|||||||||||||||||||||||

|

vs. |

vs. |

Third |

Second |

First |

Fourth |

Third |

|||||||||||||||||||

(In billions, at quarter end, except as noted) |

Q3-21 |

Q2-22 |

Quarter |

Quarter |

Quarter |

Quarter |

Quarter |

|||||||||||||||||||

Assets in client accounts |

|

|

|

|

|

|

|

|||||||||||||||||||

Schwab One®, certain cash equivalents and bank deposits |

— |

|

(9 |

) % |

$ |

501.4 |

|

$ |

552.5 |

|

$ |

584.3 |

|

$ |

566.1 |

|

$ |

503.9 |

|

|||||||

Bank deposit account balances |

(9 |

) % |

(10 |

) % |

|

139.6 |

|

|

155.6 |

|

|

154.8 |

|

|

158.5 |

|

|

153.3 |

|

|||||||

Proprietary mutual funds (Schwab Funds® and Laudus Funds®) and CTFs |

|

|

|

|

|

|

|

|||||||||||||||||||

Money market funds (1) |

43 |

% |

33 |

% |

|

211.1 |

|

|

159.2 |

|

|

143.1 |

|

|

146.5 |

|

|

147.7 |

|

|||||||

Equity and bond funds and CTFs (2) |

(15 |

) % |

(5 |

) % |

|

141.5 |

|

|

149.5 |

|

|

175.8 |

|

|

183.1 |

|

|

167.4 |

|

|||||||

Total proprietary mutual funds and CTFs |

12 |

% |

14 |

% |

|

352.6 |

|

|

308.7 |

|

|

318.9 |

|

|

329.6 |

|

|

315.1 |

|

|||||||

Mutual Fund Marketplace® (3) |

|

|

|

|

|

|

|

|||||||||||||||||||

Mutual Fund OneSource® and other non-transaction fee funds |

(23 |

) % |

(8 |

) % |

|

181.5 |

|

|

196.6 |

|

|

235.5 |

|

|

234.9 |

|

|

234.7 |

|

|||||||

Mutual fund clearing services |

(36 |

) % |

(5 |

) % |

|

175.3 |

|

|

184.4 |

|

|

235.4 |

|

|

254.2 |

|

|

271.9 |

|

|||||||

Other third-party mutual funds (4) |

(24 |

) % |

(7 |

) % |

|

1,105.7 |

|

|

1,189.4 |

|

|

1,383.3 |

|

|

1,497.7 |

|

|

1,450.1 |

|

|||||||

Total Mutual Fund Marketplace |

(25 |

) % |

(7 |

) % |

|

1,462.5 |

|

|

1,570.4 |

|

|

1,854.2 |

|

|

1,986.8 |

|

|

1,956.7 |

|

|||||||

Total mutual fund assets |

(20 |

) % |

(3 |

) % |

|

1,815.1 |

|

|

1,879.1 |

|

|

2,173.1 |

|

|

2,316.4 |

|

|

2,271.8 |

|

|||||||

Exchange-traded funds (ETFs) |

|

|

|

|

|

|

|

|||||||||||||||||||

Proprietary ETFs (2) |

(8 |

) % |

(2 |

) % |

|

232.2 |

|

|

237.7 |

|

|

268.5 |

|

|

271.8 |

|

|

251.6 |

|

|||||||

Other third-party ETFs |

(8 |

) % |

(3 |

) % |

|

1,094.6 |

|

|

1,129.0 |

|

|

1,270.6 |

|

|

1,296.4 |

|

|

1,183.7 |

|

|||||||

Total ETF assets |

(8 |

) % |

(3 |

) % |

|

1,326.8 |

|

|

1,366.7 |

|

|

1,539.1 |

|

|

1,568.2 |

|

|

1,435.3 |

|

|||||||

Equity and other securities |

(18 |

) % |

(4 |

) % |

|

2,451.3 |

|

|

2,548.5 |

|

|

3,131.1 |

|

|

3,259.8 |

|

|

2,976.7 |

|

|||||||

Fixed income securities |

35 |

% |

19 |

% |

|

481.5 |

|

|

403.5 |

|

|

360.7 |

|

|

356.4 |

|

|

356.8 |

|

|||||||

Margin loans outstanding |

(15 |

) % |

(3 |

) % |

|

(71.5 |

) |

|

(73.4 |

) |

|

(81.0 |

) |

|

(87.4 |

) |

|

(83.8 |

) |

|||||||

Total client assets |

(13 |

) % |

(3 |

) % |

$ |

6,644.2 |

|

$ |

6,832.5 |

|

$ |

7,862.1 |

|

$ |

8,138.0 |

|

$ |

7,614.0 |

|

|||||||

Client assets by business |

|

|

|

|

|

|

|

|||||||||||||||||||

Investor Services |

(15 |

) % |

(3 |

) % |

$ |

3,508.1 |

|

$ |

3,598.7 |

|

$ |

4,235.5 |

|

$ |

4,400.7 |

|

$ |

4,137.7 |

|

|||||||

Advisor Services |

(10 |

) % |

(3 |

) % |

|

3,136.1 |

|

|

3,233.8 |

|

|

3,626.6 |

|

|

3,737.3 |

|

|

3,476.3 |

|

|||||||

Total client assets |

(13 |

) % |

(3 |

) % |

$ |

6,644.2 |

|

$ |

6,832.5 |

|

$ |

7,862.1 |

|

$ |

8,138.0 |

|

$ |

7,614.0 |

|

|||||||

Net growth in assets in client accounts (for the quarter ended) |

|

|

|

|

|

|

|

|||||||||||||||||||

Net new assets by business |

|

|

|

|

|

|

|

|||||||||||||||||||

Investor Services (5) |

(5 |

) % |

N/M |

|

$ |

55.1 |

|

$ |

8.8 |

|

$ |

54.6 |

|

$ |

33.4 |

|

$ |

57.9 |

|

|||||||

Advisor Services |

(27 |

) % |

72 |

% |

|

59.5 |

|

|

34.6 |

|

|

65.9 |

|

|

101.2 |

|

|

81.1 |

|

|||||||

Total net new assets |

(18 |

) % |

164 |

% |

$ |

114.6 |

|

$ |

43.4 |

|

$ |

120.5 |

|

$ |

134.6 |

|

$ |

139.0 |

|

|||||||

Net market gains (losses) |

|

|

|

(302.9 |

) |

|

(1,073.0 |

) |

|

(396.4 |

) |

|

389.4 |

|

|

(99.8 |

) |

|||||||||

Net growth (decline) |

|

|

$ |

(188.3 |

) |

$ |

(1,029.6 |

) |

$ |

(275.9 |

) |

$ |

524.0 |

|

$ |

39.2 |

|

|||||||||

New brokerage accounts (in thousands, for the quarter ended) |

(24 |

) % |

(12 |

) % |

|

897 |

|

|

1,014 |

|

|

1,202 |

|

|

1,318 |

|

|

1,178 |

|

|||||||

Client accounts (in thousands) |

|

|

|

|

|

|

|

|||||||||||||||||||

Active brokerage accounts (6) |

4 |

% |

— |

|

|

33,875 |

|

|

33,896 |

|

|

33,577 |

|

|

33,165 |

|

|

32,675 |

|

|||||||

Banking accounts |

7 |

% |

2 |

% |

|

1,696 |

|

|

1,669 |

|

|

1,641 |

|

|

1,614 |

|

|

1,580 |

|

|||||||

Corporate retirement plan participants |

4 |

% |

1 |

% |

|

2,305 |

|

|

2,275 |

|

|

2,246 |

|

|

2,200 |

|

|

2,207 |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||

(1) |

Total client assets in purchased money market funds are located at: https://www.aboutschwab.com/investor-relations. |

|

(2) |

Includes balances held on and off the Schwab platform. As of September 30, 2022, off-platform equity and bond funds, CTFs, and ETFs were $20.7 billion, $4.5 billion, and $89.6 billion, respectively. |

|

(3) |

Excludes all proprietary mutual funds and ETFs. |

|

(4) |

As of September 30, 2022, third-party money funds were $3.6 billion. |

|

(5) |

Second quarter of 2022 includes an outflow of $20.8 billion from a mutual fund clearing services client. Fourth quarter of 2021 includes outflows of $27.6 billion from mutual fund clearing services clients. |

|

(6) |

Third quarter of 2022 includes the company-initiated closure of approximately 152 thousand low-balance accounts. |

|

N/M Not meaningful. Percentage changes greater than 200% are presented as not meaningful. |

||

The Charles Schwab Corporation Monthly Activity Report For September 2022 |

|||||||||||||||||||||||||||||||||||||||||||||

|

2021 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

Change |

|||||||||||||||||||||||||||||||

|

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Mo. |

Yr. |

||||||||||||||||||||||||||||||

Market Indices (at month end) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Dow Jones Industrial Average® |

33,844 |

|

35,820 |

|

34,484 |

|

36,338 |

|

35,132 |

|

33,893 |

|

34,678 |

|

32,977 |

|

32,990 |

|

30,775 |

|

32,845 |

|

31,510 |

|

28,726 |

|

(9 |

)% |

(15 |

)% |

|||||||||||||||

Nasdaq Composite® |

14,449 |

|

15,498 |

|

15,538 |

|

15,645 |

|

14,240 |

|

13,751 |

|

14,221 |

|

12,335 |

|

12,081 |

|

11,029 |

|

12,391 |

|

11,816 |

|

10,576 |

|

(10 |

)% |

(27 |

)% |

|||||||||||||||

Standard & Poor’s® 500 |

4,308 |

|

4,605 |

|

4,567 |

|

4,766 |

|

4,516 |

|

4,374 |

|

4,530 |

|

4,132 |

|

4,132 |

|

3,785 |

|

4,130 |

|

3,955 |

|

3,586 |

|

(9 |

)% |

(17 |

)% |

|||||||||||||||

Client Assets (in billions of dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Beginning Client Assets |

7,838.2 |

|

7,614.0 |

|

7,982.3 |

|

7,918.3 |

|

8,138.0 |

|

7,803.8 |

|

7,686.6 |

|

7,862.1 |

|

7,284.4 |

|

7,301.7 |

|

6,832.5 |

|

7,304.8 |

|

7,127.6 |

|

|

|

|||||||||||||||||

Net New Assets (1) |

42.9 |

|

22.9 |

|

31.4 |

|

80.3 |

|

33.6 |

|

40.6 |

|

46.3 |

|

(9.2 |

) |

32.8 |

|

19.8 |

|

31.5 |

|

43.3 |

|

39.8 |

|

(8 |

)% |

(7 |

)% |

|||||||||||||||

Net Market Gains (Losses) |

(267.1 |

) |

345.4 |

|

(95.4 |

) |

139.4 |

|

(367.8 |

) |

(157.8 |

) |

129.2 |

|

(568.5 |

) |

(15.5 |

) |

(489.0 |

) |

440.8 |

|

(220.5 |

) |

(523.2 |

) |

|

|

|||||||||||||||||

Total Client Assets (at month end) |

7,614.0 |

|

7,982.3 |

|

7,918.3 |

|

8,138.0 |

|

7,803.8 |

|

7,686.6 |

|

7,862.1 |

|

7,284.4 |

|

7,301.7 |

|

6,832.5 |

|

7,304.8 |

|

7,127.6 |

|

6,644.2 |

|

(7 |

)% |

(13 |

)% |

|||||||||||||||

Core Net New Assets (2) |

42.9 |

|

36.8 |

|

45.1 |

|

80.3 |

|

33.6 |

|

40.6 |

|

46.3 |

|

(9.2 |

) |

32.8 |

|

40.6 |

|

31.5 |

|

43.3 |

|

39.8 |

|

(8 |

)% |

(7 |

)% |

|||||||||||||||

Receiving Ongoing Advisory Services (at month end) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Investor Services |

530.1 |

|

548.3 |

|

543.1 |

|

559.2 |

|

541.9 |

|

533.7 |

|

538.9 |

|

509.3 |

|

513.0 |

|

483.8 |

|

514.8 |

|

499.2 |

|

466.6 |

|

(7 |

)% |

(12 |

)% |

|||||||||||||||

Advisor Services (3) |

3,253.2 |

|

3,399.8 |

|

3,374.3 |

|

3,505.2 |

|

3,382.4 |

|

3,342.5 |

|

3,404.6 |

|

3,190.5 |

|

3,213.8 |

|

3,040.4 |

|

3,222.5 |

|

3,150.5 |

|

2,950.9 |

|

(6 |

)% |

(9 |

)% |

|||||||||||||||

Client Accounts (at month end, in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Active Brokerage Accounts (4) |

32,675 |

|

32,796 |

|

32,942 |

|

33,165 |

|

33,308 |

|

33,421 |

|

33,577 |

|

33,759 |

|

33,822 |

|

33,896 |

|

33,934 |

|

33,984 |

|

33,875 |

|

— |

|

4 |

% |

|||||||||||||||

Banking Accounts |

1,580 |

|

1,593 |

|

1,608 |

|

1,614 |

|

1,628 |

|

1,641 |

|

1,641 |

|

1,652 |

|

1,658 |

|

1,669 |

|

1,680 |

|

1,690 |

|

1,696 |

|

— |

|

7 |

% |

|||||||||||||||

Corporate Retirement Plan Participants |

2,207 |

|

2,213 |

|

2,198 |

|

2,200 |

|

2,216 |

|

2,235 |

|

2,246 |

|

2,261 |

|

2,275 |

|

2,275 |

|

2,267 |

|

2,285 |

|

2,305 |

|

1 |

% |

4 |

% |

|||||||||||||||

Client Activity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

New Brokerage Accounts (in thousands) |

374 |

|

397 |

|

448 |

|

473 |

|

426 |

|

356 |

|

420 |

|

386 |

|

323 |

|

305 |

|

278 |

|

332 |

|

287 |

|

(14 |

)% |

(23 |

)% |

|||||||||||||||

Client Cash as a Percentage of Client Assets (5) |

10.8 |

% |

10.4 |

% |

10.5 |

% |

10.9 |

% |

11.3 |

% |

11.5 |

% |

11.4 |

% |

11.9 |

% |

12.0 |

% |

12.8 |

% |

12.0 |

% |

12.1 |

% |

12.9 |

% |

80 bp |

210 bp |

|||||||||||||||||

Derivative Trades as a Percentage of Total Trades |

23.1 |

% |

22.5 |

% |

23.4 |

% |

23.0 |

% |

22.4 |

% |

24.0 |

% |

22.4 |

% |

21.9 |

% |

22.6 |

% |

22.3 |

% |

24.2 |

% |

23.3 |

% |

23.6 |

% |

30 bp |

50 bp |

|||||||||||||||||

Selected Average Balances (in millions of dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Average Interest-Earning Assets (6) |

565,379 |

|

574,181 |

|

584,362 |

|

605,709 |

|

622,997 |

|

629,042 |

|

644,768 |

|

636,668 |

|

620,157 |

|

614,100 |

|

605,751 |

|

586,154 |

|

568,351 |

|

(3 |

)% |

1 |

% |

|||||||||||||||

Average Margin Balances |

81,705 |

|

83,835 |

|

87,311 |

|

88,328 |

|

86,737 |

|

84,354 |

|

81,526 |

|

83,762 |

|

78,841 |

|

74,577 |

|

72,177 |

|

72,855 |

|

73,224 |

|

1 |

% |

(10 |

)% |

|||||||||||||||

Average Bank Deposit Account Balances (7) |

152,330 |

|

154,040 |

|

153,877 |

|

154,918 |

|

157,706 |

|

153,824 |

|

155,657 |

|

152,653 |

|

154,669 |

|

155,306 |

|

154,542 |

|

148,427 |

|

141,198 |

|

(5 |

)% |

(7 |

)% |

|||||||||||||||

Mutual Fund and Exchange-Traded Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Net Buys (Sells) (8,9) (in millions of dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Equities |

7,596 |

|

8,840 |

|

13,099 |

|

11,519 |

|

7,384 |

|

9,371 |

|

14,177 |

|

(786 |

) |

1,889 |

|

(1,586 |

) |

5,589 |

|

10,465 |

|

(2,662 |

) |

|

|

|||||||||||||||||

Hybrid |

335 |

|

81 |

|

308 |

|

(1,207 |

) |

(367 |

) |

(478 |

) |

(497 |

) |

(529 |

) |

(1,718 |

) |

(1,054 |

) |

(2,041 |

) |

(783 |

) |

(938 |

) |

|

|

|||||||||||||||||

Bonds |

6,232 |

|

4,425 |

|

4,097 |

|

5,600 |

|

1,804 |

|

(1,973 |

) |

(7,851 |

) |

(6,933 |

) |

(6,121 |

) |

(5,631 |

) |

729 |

|

(141 |

) |

(5,801 |

) |

|

|

|||||||||||||||||

Net Buy (Sell) Activity (in millions of dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Mutual Funds (8) |

(308 |

) |

302 |

|

189 |

|

(2,859 |

) |

(4,961 |

) |

(6,318 |

) |

(11,888 |

) |

(16,657 |

) |

(20,761 |

) |

(16,258 |

) |

(8,674 |

) |

(7,117 |

) |

(15,200 |

) |

|

|

|||||||||||||||||

Exchange-Traded Funds (9) |

14,471 |

|

13,044 |

|

17,315 |

|

18,771 |

|

13,782 |

|

13,238 |

|

17,717 |

|

8,409 |

|

14,811 |

|

7,987 |

|

12,951 |

|

16,658 |

|

5,799 |

|

|

|

|||||||||||||||||

Money Market Funds |

(1,512 |

) |

(451 |

) |

(1,725 |

) |

(144 |

) |

(1,984 |

) |

(1,086 |

) |

(1,344 |

) |

(3,430 |

) |

7,106 |

|

11,544 |

|

13,711 |

|

19,702 |

|

17,018 |

|

|

|

|||||||||||||||||

Note: Certain supplemental details related to the information above can be found at: https://www.aboutschwab.com/financial-reports. |

||

(1) |

June 2022 includes an outflow of $20.8 billion from a mutual fund clearing services client. November 2021 includes an outflow of $13.7 billion from a mutual fund clearing services client. October 2021 includes an outflow of $13.9 billion from a mutual fund clearing services client. |

|

(2) |

Net new assets before significant one-time inflows or outflows, such as acquisitions/divestitures or extraordinary flows (generally greater than $10 billion) relating to a specific client. These flows may span multiple reporting periods. |

|

(3) |

Excludes Retirement Business Services. |

|

(4) |

September 2022 includes the company-initiated closure of approximately 152 thousand low-balance accounts. |

|

(5) |

Schwab One®, certain cash equivalents, bank deposits, third-party bank deposit accounts, and money market fund balances as a percentage of total client assets. |

|

(6) |

Represents average total interest-earning assets on the company’s balance sheet. |

|

(7) |

Represents average TD Ameritrade clients’ uninvested cash sweep account balances held in deposit accounts at third-party financial institutions. |

|

(8) |

Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. |

|

(9) |

Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. |

|

THE CHARLES SCHWAB CORPORATION

Non-GAAP Financial Measures

(In millions, except ratios and per share amounts)

(Unaudited)

In addition to disclosing financial results in accordance with generally accepted accounting principles in the U.S. (GAAP), Schwab’s third quarter earnings release contains references to the non-GAAP financial measures described below. We believe these non-GAAP financial measures provide useful supplemental information about the financial performance of the Company, and facilitate meaningful comparison of Schwab’s results in the current period to both historic and future results. These non-GAAP measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may not be comparable to non-GAAP financial measures presented by other companies.

Schwab’s use of non-GAAP measures is reflective of certain adjustments made to GAAP financial measures as described below.

Non-GAAP Adjustment or Measure |

Definition |

Usefulness to Investors and Uses by Management |

Acquisition and integration-related costs and amortization of acquired intangible assets |

Schwab adjusts certain GAAP financial measures to exclude the impact of acquisition and integration-related costs incurred as a result of the Company’s acquisitions, amortization of acquired intangible assets, and, where applicable, the income tax effect of these expenses.

Adjustments made to exclude amortization of acquired intangible assets are reflective of all acquired intangible assets, which were recorded as part of purchase accounting. These acquired intangible assets contribute to the Company’s revenue generation. Amortization of acquired intangible assets will continue in future periods over their remaining useful lives. |

We exclude acquisition and integration-related costs and amortization of acquired intangible assets for the purpose of calculating certain non-GAAP measures because we believe doing so provides additional transparency of Schwab’s ongoing operations, and is useful in both evaluating the operating performance of the business and facilitating comparison of results with prior and future periods.

Acquisition and integration-related costs fluctuate based on the timing of acquisitions and integration activities, thereby limiting comparability of results among periods, and are not representative of the costs of running the Company’s ongoing business. Amortization of acquired intangible assets is excluded because management does not believe it is indicative of the Company’s underlying operating performance. |

Return on tangible common equity |

Return on tangible common equity represents annualized adjusted net income available to common stockholders as a percentage of average tangible common equity. Tangible common equity represents common equity less goodwill, acquired intangible assets — net, and related deferred tax liabilities. |

Acquisitions typically result in the recognition of significant amounts of goodwill and acquired intangible assets. We believe return on tangible common equity may be useful to investors as a supplemental measure to facilitate assessing capital efficiency and returns relative to the composition of Schwab’s balance sheet. |

The Company also uses adjusted diluted EPS and return on tangible common equity as components of performance criteria for employee bonus and certain executive management incentive compensation arrangements. The Compensation Committee of CSC’s Board of Directors maintains discretion in evaluating performance against these criteria.

THE CHARLES SCHWAB CORPORATION |

||||||||||||||||||||||||||||||||

Non-GAAP Financial Measures |

||||||||||||||||||||||||||||||||

(In millions, except ratios and per share amounts) |

||||||||||||||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||||||||||||||

The tables below present reconciliations of GAAP measures to non-GAAP measures: |

||||||||||||||||||||||||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

||||||||||||||||||||||||||||

|

Total

|

Net

|

Total

|

Net

|

Total

|

Net

|

Total

|

Net

|

||||||||||||||||||||||||

Total expenses excluding interest (GAAP), Net income (GAAP) |

$ |

2,823 |

|

$ |

2,020 |

|

$ |

2,559 |

|

$ |

1,526 |

|

$ |

8,475 |

|

$ |

5,215 |

|

$ |

8,122 |

|

$ |

4,275 |

|

||||||||

Acquisition and integration-related costs (1) |

|

(101 |

) |

|

101 |

|

|

(104 |

) |

|

104 |

|

|

(291 |

) |

|

291 |

|

|

(367 |

) |

|

367 |

|

||||||||

Amortization of acquired intangible assets |

|

(152 |

) |

|

152 |

|

|

(153 |

) |

|

153 |

|

|

(460 |

) |

|