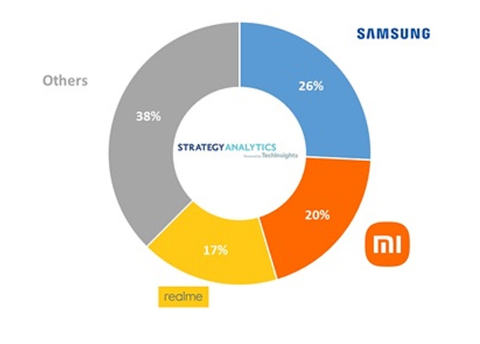

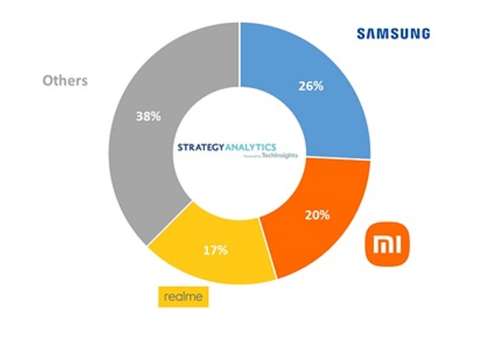

BOSTON--(BUSINESS WIRE)--According to new research from Strategy Analytics, India smartphone sales revenue grew +17% annually in the first eight days of festive season sales from September 23rd to 30th, 2022, driven by the wholesale ASP growth of +19%. Samsung leads the pack with 26% market share, followed by Xiaomi and Realme.

Abhilash Kumar, Industry Analyst at Strategy Analytics, said, “We estimate 12.8 million units of smartphones were sold during the first week of smartphone festive season sales in India this year. It registered US$2.1 billion revenues, up +17% YoY. Smartphone wholesale ASP improved +19% YoY at US$165. This year’s sale was more inclined towards middle and higher end smartphones as compared to lower tiers. This is one of the reasons for the solid ASP growth. In terms of units, the sales declined -2% compared to last festive season week one due to less sales of entry level devices which got impacted by high inflation and recession worries. But the ASP growth offset the volume decline and delivered a decent revenue grew.”

Commenting on vendor dynamics and Samsung’s performance, Linda Sui, Senior Director at Strategy Analytics, added, “Samsung, Xiaomi and Realme are the top 3 benefiters from this festive season sale. These three brands combined accounted for 62% of the overall sales in volume terms. Samsung led the chart in the first week of festive season sales this year, with 26% market share. We estimate Samsung sold out 3.3 million units of smartphones this year. It has successfully surpassed Chinese vendors driven by the attractive price discounts across all price tiers, as well as the enhanced channel presence. This time, Samsung devices were discounted to the max of around 60% from their actual retail price. The premium models like S22 Ultra, S21 FE, S22 Plus, Z Flip 3 were handsomely discounted and were sold quite well during the festive season. In mid-range, Samsung Galaxy F13 and M13 were heavily discounted and sold well.”

Commenting on Chinese brands’ performance, Rajeev Nair, Senior Analyst at Strategy Analytics, added, “We estimate Xiaomi and Realme sold out 2.5 million units and 2.2 million units respectively this year, ranking in the top three list with 20% and 17% market share. Chinese brands were facing strong headwinds in India and restricted with limited budgets on channel promotions, leading to the soft performance this year. Xiaomi yield the leading position to Samsung.”

Commenting on Apple’s performance, Abhilash Kumar, Senior Analyst at Strategy Analytics, added, “Apple couldn’t make to the top 3 in terms of units but sold well. Apple devices were discounted up to 33% at major e-retailers. The second gen devices like iPhone 13 was handsomely discounted and well received. We believe iPhone 13 was the best-selling model for two reasons. Firstly, it’s the latest one of all the models available for sale with attractive discount. Secondly, apart from satellite connectivity and crash detection iPhone 14’s look and feel are quite similar to that of iPhone 13 and the processor is also the same in both the devices. Hence, people already have the option for a cheaper iPhone 13. We believe after the discount on iPhone 13, its demand will grow more in the following festive sales.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Wireless Smartphone Strategies Service: Click Here