Strategy Analytics: The Rising Battery Swapping Market in China

Strategy Analytics: The Rising Battery Swapping Market in China

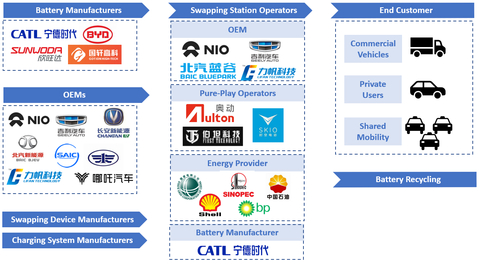

BOSTON--(BUSINESS WIRE)--China is an early leader in the adoption of battery swapping technology and the Battery-as-a-Service (BaaS) business model, thanks to growing policy support since 2020 and the success of some early entrants such as Nio, BAIC and Aulton. The latest Strategy Analytics Electric Vehicles Service (EVS) report, The Rising Battery Swapping Market in China analyzes the Chinese battery swapping market and notes that different players from diverse backgrounds are coming together in the development and exploitation of the battery swapping business model and its opportunities.

Long charging times are perceived as a bottleneck to OEMs seeing increased BEV sales. Battery swapping technology is emerging as an alternative to battery charging infrastructure provisioning a BEV driver with a fully charged battery in a time that is comparable with refueling a combustion vehicle. Separating the battery from the vehicle also helps to lower the upfront cost of BEVs and enables centralized battery charging and management, smoothing demand from the power grid, increasing the lifespan of battery packs, and offering a ready source for the future recycling.

It is applied in various scenarios, across passenger vehicles for private users or shared mobility, including taxi and ride-hailing fleets, and commercial vehicles such as buses, delivery trucks, and vans. Different players from diverse backgrounds in China are coming together in the development and exploitation of the battery swapping business model and its opportunities. Apart from the successful early entrants, including OEMs and station operators such as Nio, BAIC and Aulton, many new entrants are also making material investments in the battery swapping business, varying from energy providers to battery manufacturer.

“As beneficial as the battery swapping business seems to the BEV industry, there are still many challenges,” observed Julia An, report author and industry analyst in the EVS Service. “High cost of building and operating a swap station and difficulty in sharing swap stations across OEMs impose high risks on the commercialization of battery swapping. The rapid improvements in ultra-fast charging and wireless charging technologies and decreasing battery prices could also obviate the current advantages of battery swapping technology.”

“Strong policy support, OEM commitments, and standardization will allow battery swapping to serve as a complementary approach to fast charging networks in China,” noted Asif Anwar, Executive Director |Global Automotive Practice (GAP). “Adoption of battery swapping will be better suited to support the needs of BEV fleets operated by taxis, shared mobility, rental, and commercial fleet operators who have higher daily mileage and are more sensitive to downtime costs.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Part of TechInsights, our multi-discipline capabilities include industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Electric Vehicles Service (EVS)

Contacts

Report contacts:

European Contact: Asif Anwar, +44 (0)1908 423 635, aanwar@strategyanalytics.com

US Contact: Mark Fitzgerald, +1 617 614 0773, mfitzgerald@strategyanalytics.com

China Contact: Kevin Li, +86 186 0110 3697, kli@strategyanalytics.com