IRVINE, Calif.--(BUSINESS WIRE)--CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its latest Mortgage Fraud Report. The report shows a 7.5% year-over-year decrease in fraud risk at the end of the second quarter of 2022, as measured by the CoreLogic Mortgage Application Fraud Risk Index. The decline in mid-2022 follows a large increase seen in the same period in 2021 and is partially due to the recalibration of CoreLogic’s scoring model in the first quarter of 2022. Since that update, higher risks were recorded during months in the second quarter, particularly for certain types of mortgage fraud.

In the second quarter of 2022, an estimated 0.76% of all mortgage applications contained fraud, about 1 in 131 applications. By comparison, in the second quarter of 2021, that estimate was 0.83%, or about 1 in 120 applications. Risks of income and property fraud posted the largest year-over-year increases in the second quarter, a respective 27.3% and 22.6%. This trend is perhaps not surprising, considering that purchase loans now account for more mortgage transactions than refinances, and that the former are more susceptible to fraudulent activity.

“Income fraud risk remains a top concern for lenders, but there is a rising focus on property value risk as home prices slow their growth and homes are taking longer to sell. CoreLogic data backs up those concerns, as our most predictive flags for both income and property frauds increased in the last year more than 20%,” said Bridget Berg, principal, Industry & Fraud Solutions.

Report Highlights:

- Nationally, five of the six types of mortgage fraud types CoreLogic tracks showed increased risks since the second quarter of 2021. The exception was undisclosed real estate debt, which declined by 12%.

- The top five states for fraud risk increases are Rhode Island, South Dakota, Kentucky, New York and Nebraska. Less-populous states are prone to volatile index values, as small groups of higher-risk loans are more likely to move the index. For instance, Rhode Island’s 60% year-over-year fraud risk increase was in part due to a large share of government-backed loans, which have become riskier over the past year.

- New York moved into the top position for mortgage application fraud risk, with Florida, Rhode Island, Nevada and Connecticut rounding out the top five.

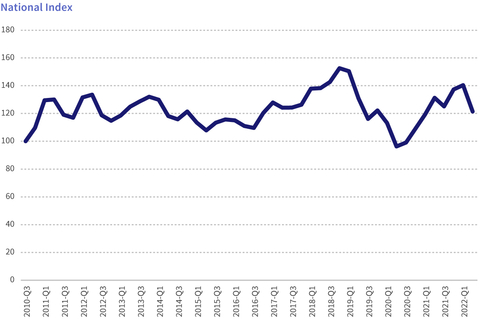

National Mortgage Origination Fraud Index (Q3 2010 – Q2 2022)

The CoreLogic Mortgage Fraud Report analyzes the collective level of loan application fraud risk experienced in the mortgage industry each quarter. CoreLogic develops the index based on residential mortgage loan applications processed by CoreLogic LoanSafe Fraud Manager™, a predictive scoring technology. The report includes detailed data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction and undisclosed real estate debt.

To view the full CoreLogic Mortgage Fraud Report, visit www.corelogic.com/mortgagefraudreport.

Methodology

Our comprehensive fraud risk analysis is based on a lender-driven mortgage fraud consortium and leading predictive-scoring technology.

The CoreLogic Mortgage Application Fraud Risk Index represents the collective level of fraud risk the mortgage industry is experiencing in each period, based on the share of loan applications with a high risk of fraud. The index is standardized to a baseline of 100 for the share of high-risk loan applications nationally in the third quarter of 2010.

The Fraud Type Indicators are based on specific CoreLogic LoanSafe Fraud Manager alerts. These alerts are compiled consistently for all CoreLogic Mortgage Fraud Consortium members. Indicator levels are based on the prevalence and predictive ability of the relevant alerts. An increase in the indicator correlates with increased risk of the corresponding fraud type.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Robin Wachner at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, and LoanSafe Fraud Manager are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.