IRVINE, Calif.--(BUSINESS WIRE)--CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its annual Wildfire Report for 2022, which examines property-related wildfire risk alongside reconstruction resource availability, temporary housing capacity for displaced individuals, and community economic recovery potential among fire-prone regions. The report tracks wildfire risks in 15 Western U.S. states and Florida.

Wildfires commonly affect the Western U.S., but climate change and the region’s severe drought of recent years has only exacerbated the issue. Decreasing water levels in the Colorado River and Lake Mead, along with declines in snowpacks, have contributed to a longer wildfire season by an average of three months, resulting in a 1500% increase in burn areas. Over the past decade, CoreLogic data found that wildfires burned an average of 6.8 million acres per year, with that number topping 10 million acres in three of those years.

The 2022 CoreLogic Wildfire Report accompanies worrisome trends in wildfire-prone California, which is grappling not only with prolonged drought conditions, but also with firefighter shortages. The Golden State employed about 25% fewer of these crucial first responders in the summer of 2022 than initially projected, amounting to 1,300 unfilled jobs.

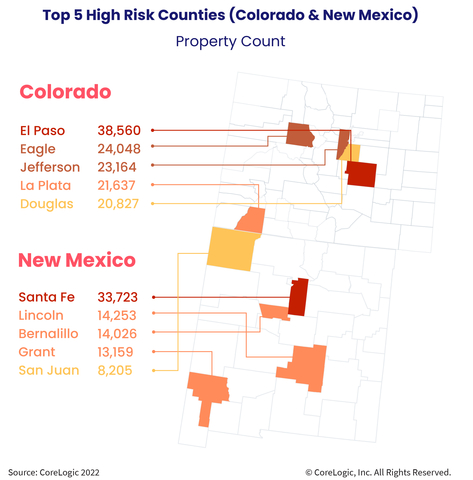

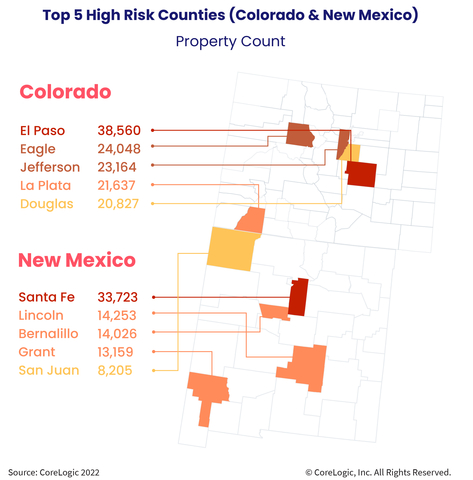

Since California is the most populous state in the U.S. and also has the largest number of properties, it is once again the state where owners run the greatest risk of wildfire damage. Florida, Texas, Colorado and New Mexico round out the top five other riskiest housing markets for wildfire damages.

Two counties in Colorado and New Mexico have particularly concerning wildfire damage risks, given the number of homes that could be impacted. In Colorado’s El Paso County – the state’s most heavily populated and home to Colorado Springs – a wildfire could affect 39,000 homes,. New Mexico’s Santa Fe County has an even greater percentage of risk, given it is much smaller.

If a wildfire displaces large portions of a population at once, there are obvious societal ripple effects. Recovery times may take longer, fewer local workers might be available due to the disaster’s impact on their own lives and housing options could be slim for outside workers helping to rebuild the damaged communities.

Since the global climate is shifting too quickly to rely on past wildfire activity and property damage as an accurate future barometer, CoreLogic has developed highly accurate risk models with the latest data and analysis from our team of experts. These models evaluate simulations of weather variations and help homeowners, communities, property businesses and insurers plan for risks and losses associated with climate change and the resulting wildfires.

“Consuming thousands of homes in the U.S. every year, wildfires present a real and present threat to our families and communities. Mitigating this risk will require commitment from homeowners, first responders, insurers and regulators. A first step in achieving the resilient communities we seek is to quantify what is at risk,” said Tom Larsen, senior director of Insurance solutions at CoreLogic.

Climate change and the resulting uptick in wildfire activity is particularly relevant to home insurers in states like California, where new regulations will likely go into effect in the summer of 2023. These amended guidelines would require insurers to more accurately account for the mitigation of risks by factoring in a property’s surroundings, attic and subfloor ventilation vulnerabilities, and other circumstances that could affect its exposure to wildfire damage.

Homeowners, city planners and insurers all play key roles in mitigating wildfire risks and the resulting property damage. The full CoreLogic 2022 Wildfire Report, including maps, charts and analysis can be found here.

To follow CoreLogic coverage of ongoing natural catastrophe events, including wildfires, visit the company’s natural hazard risk information center, Hazard HQ™ at www.hazardhq.com.

Methodology

CoreLogic used its Wildfire Risk model to identify a 1-in-50-year fire scenario in each of the 14 wildfire-prone states (15 western U.S. states plus Florida) to understand how many homes would be at risk of being damaged in a wildfire at least once in 50 years (the average length to which residential homes are built to last, via building codes). CoreLogic compared the number of homes at risk of damage from a 1-in-50-year fire (an extreme event) to the total housing stock in each state to determine the communities that have the most economic risk from wildfire. Wildfires that devastate large numbers of homes are infrequent. The number of homes included in the 1-in-50-year fire analysis has a 98% probability of not being exceeded in a single year (or the maximum number of homes that could burn in a single year).

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.