NEW YORK--(BUSINESS WIRE)--Marstone, Inc., a leading digital wealth technology firm, today announced its newest product, Marstone Maps™, a financial health and wellness platform for institutions that enables end clients to set, plan for, and evolve their financial goals. Benefitting from a dynamic, digital-first solution, end clients are offered strategies from Marstone’s team of industry experts to meet their unique financial situation and ambitions. Marstone Maps is launching with its first institution to provide sophisticated, personalized, and transparent financial health and wellness experiences to existing and new clients without both the technical lift and material expense of building an in-house solution.

“When you think about a person’s financial life, regardless of their income level or assets, there are a handful of big expenses many of us share: buying a home, helping out family, and saving for retirement. In what is a persistently volatile financial climate, many people remain hesitant to truly articulate their financial goals when in reality this is the moment where understanding the potential benefit of a longer time horizon can be healthy and provide calm,” said Margaret J. Hartigan, co-founder and CEO of Marstone. “Marstone Maps is intentionally built to engage and inspire. We want individuals to dream big, explore, and choose the goals that matter most to them. This simulation of scenarios serves to educate the user as their investment needs transform.”

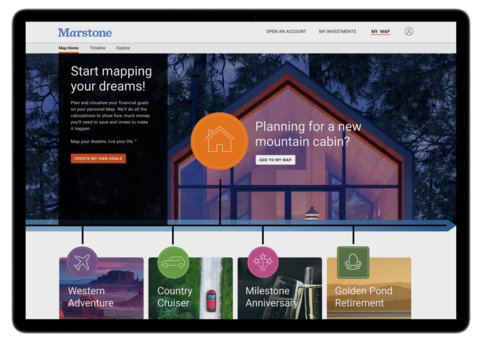

Marstone Maps helps people articulate and advance towards their financial goals through an easy to navigate user experience. On a timeline inspired by a subway map, users can simulate the impact of shifting deadlines on their finances to create meaningful plans that meet their unique situations.

Marstone Maps’ capabilities include:

- Financial tips, scenarios, and simulations;

- A transparent financial wellness solution that ties together benefits (401K, insurance, HSA, FSA), outside accounts, checking accounts, and investments;

- Real-time calculations of achieving goals through a simple drag-and-drop method onto a timeline and answering a few basic questions;

- Third-party integrations to ensure a personalized, robust, and comprehensive process.

“At Marstone we’ve always believed in doing the hard work first. Our integrations into enterprise financial solutions, custodial cores, and more enable us to now rapidly deliver turnkey products like Maps to our institutional customers ensuring the trust their clients have in them extends to an ever larger customer base,” continued Hartigan. “When looking at other solutions that attempt to crack this nut for clients, we saw a limited universe of tools offering account aggregation and goal or expense tracking. Yet a client’s unique financial goals require a much more sophisticated, long-term view and strategy. While understanding things like how and where they spend is important, the changes one must make in the pursuit of financial goals are easier to make when given clarity on how they interrelate. Without that long-term view, clients understandably lack accountability to themselves and can delay vital early savings.”

To learn more about Marstone Maps, please visit https://www.marstone.com/ or contact us at info@marstone.com.

About Marstone

Marstone is a leading digital wealth management platform with a mission to enhance financial literacy, deepen financial inclusion, and humanize finance for all. Its enterprise-ready solution, Powered by MarstoneTM, enables financial institutions to efficiently and affordably reach, acquire, and retain clients who seek straightforward information and engagement around their finances.

As a proven and trusted technology partner, Marstone has comprehensive integrations with custodians including Pershing, core banking platforms including Fiserv, account aggregation platforms, and investment managers. These integrations, in addition to Marstone’s partnerships with globally recognized foundations including the World Economic Forum Centre for the Fourth Industrial Revolution and leadership participation in the Milken Institute's FinTech Advisory Committee, provide organizations the opportunity to deploy a technology that will help future-proof their businesses as consumer expectations for digital wealth management evolve.