EL SEGUNDO, Calif.--(BUSINESS WIRE)--Griffin Realty Trust, Inc. ("GRT" or the "Company") announced its results for the quarter ended June 30, 2022.

Highlights for the Quarter Ended June 30, 2022

- Revenue of approximately $123.1 million, a 3.6% increase compared to the same quarter last year.

- Net (loss) income attributable to common stockholders of $(72.2) million, compared to $3.0 million for the same quarter last year.

- Adjusted Funds from Operations ("AFFO")1 available to common stockholders and limited partners of $0.17 per basic and diluted share.

- Collected approximately 100% of contractual rent for the quarter and the last two years.

- Portfolio economic occupancy reached 92.7% at quarter end.

- Signed five new leases totaling approximately 214,000 square feet and three renewal leases totaling approximately 700,000 square feet.

Highlights Subsequent to June 30, 2022

- Collected approximately 100% of contractual rent due in July.

- Signed four new leases for an aggregate of approximately 47,000 square feet with lease terms ranging from five to ten years.

Management Commentary

Michael J. Escalante, GRT's Chief Executive Officer commented, “Amidst economic uncertainty, rising concerns about inflation, higher interest rates and lingering headwinds from COVID-19, we are pleased with our portfolio’s resilience and our team’s hard work and diligence. We continue to collect 100% of our contractual rents, and proactively execute both new and renewal leases. Nevertheless, the backdrop has been a challenging one, especially for office properties.”

Mr. Escalante added, "On August 5th we announced our strategic monetization plan which we believe is the optimal way to achieve our dual objectives of providing the Company and stockholders as much liquidity as possible amid the current capital markets environment, while also maximizing stockholder value.”

Results for the Quarter Ended June 30, 2022

Revenue

Total revenue grew 3.6% to approximately $123.1 million for the quarter ended June 30, 2022, an increase of $4.2 million compared to the same quarter last year.

Net Income (Loss)

Net income (loss) attributable to common stockholders was approximately $(72.2) million, or $(0.22) per basic and diluted share, for the quarter ended June 30, 2022, compared to a net income (loss) attributable to common stockholders of approximately $3.0 million, or $0.01 per basic and diluted share, for the quarter ended June 30, 2021. The change in net income (loss) attributable to common stockholders was primarily driven by an impairment provision of approximately $75.6 million during the quarter ended June 30, 2022, as it was determined that the carrying value of certain real estate assets was not likely recoverable.

AFFO

AFFO was approximately $60.9 million and $55.3 million, or $0.17 and $0.16 per basic and diluted share, for the quarter ended June 30, 2022 and 2021, respectively. The increase was primarily attributable to an increase in termination income as compared to the same quarter last year.

Adjusted EBITDA

Adjusted EBITDA, as defined per the Company's credit facility agreement, was approximately $84.2 million for the quarter ended June 30, 2022. This outcome resulted in fixed charge and interest coverage ratios of 3.4x and 3.9x, respectively, for the quarter.

Leasing Activity

The Company signed five new leases totaling approximately 214,000 square feet. This activity includes a new 15 year lease in Scottsdale, AZ for approximately 133,400 square feet. The Company also signed three lease renewals for approximately 700,000 square feet, which includes a six year lease extension with Zebra Technologies Corporation.

Consolidated Financial Statistics

The Company's Net Debt was approximately $2.3 billion. Our Net Debt to Normalized EBITDAre and Net Debt plus Preferred to Normalized EBITDAre were 7.2x and 7.6x, respectively. The ratio of consolidated debt, less cash and cash equivalents, to total real estate, was 42.7%.

As of June 30, 2022, the Company's weighted average loan maturity was 3.2 years with 70% of the loan balance having a fixed interest rate, including the effect of interest rate swaps. Approximately 40% of the Company's consolidated debt was secured and approximately 60% was unsecured.

Net Asset Value

On August 5, 2022, the Company published an updated estimate of its NAV as of June 30, 2022. The Company's average NAV across all share classes decreased to $7.42 per share when compared to $9.10 per share as of June 30, 2021. The decrease was primarily driven by changes in the fair value of office assets.

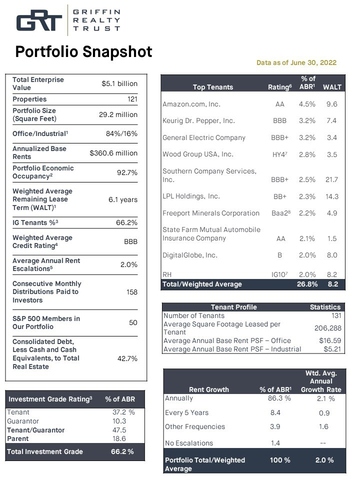

Portfolio Overview as of June 30, 2022

- Enterprise value was approximately $5.1 billion.2

- Weighted average remaining lease term was approximately 6.1 years with approximately 2.0% average annual contractual rent growth for the remainder of the existing term.

- The portfolio was 93.0% leased, and the economic occupancy was 92.7%.

- Economic occupancy for the industrial and office portfolios was 100% and 88.3%, respectively.

- 86.3% of the Company's annualized base rents3 are subject to annual escalations that average approximately 2.2%, and over 98.6% is subject to periodic increases.

- Approximately 66.2% of the portfolio’s annualized base rents were generated by investment-grade companies.4

An overview of GRT's portfolio is provided in the accompanying Portfolio Snapshot.

About Griffin Realty Trust, Inc.

Griffin Realty Trust, Inc. – America's Blue-Chip LandlordTM – is an internally managed, publicly-registered, non- traded REIT. The Company owns and operates a geographically-diversified portfolio of strategically-located, high- quality, corporate office and industrial properties that are primarily net leased to single tenants that the Company has determined to be creditworthy. As of June 30, 2022, the Company's real estate portfolio consisted of 121 properties and one land parcel held for future development, in 26 states consisting substantially of office, warehouse, and manufacturing facilities.

Additional information is available at www.grtreit.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company intends for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. The forward-looking statements contained in this press release reflect the Company's current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause the Company's actual results to differ significantly from those expressed in any forward-looking statement.

The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: general economic and financial conditions; market volatility; inflation; any potential recession or threat of recession; interest rates; the impact of the COVID-19 pandemic and resulting economic disruption on the markets in which we operate and on work-from-home trends, occupancy, rent deferrals and the financial condition of GRT’s tenants; whether any easing of the pandemic or other factors will impact the attractiveness of industrial and/or office assets; whether we will be successful in renewing leases as they expire, including the approximately 10% of office lease expirations scheduled to occur prior to or at the end of 2023 (as a percentage of our contractual base rent before abatements and deducting base year operating expenses for gross and modified gross leases); future financial and operating results, plans, objectives, expectations and intentions; expected sources of financing and the availability and attractiveness of the terms of any such financing; legislative and regulatory changes that could adversely affect our business; whether we will continue to publish our net asset value on an annual basis, more frequently or at all; our future capital expenditures, operating expenses, net income, operating income, cash flow and developments and trends of the real estate industry; whether the strategic monetization process will maximize stockholder value; whether the spin off will be completed on the anticipated timing or at all; whether we will be successful in liquidating our remaining assets after the spin off; whether we will effect the strategic monetization process at the time and in a manner that maximizes value for the Company’s stockholders; when stockholders will receive any net proceeds in connection with the disposition of our remaining assets after the spin off; whether we will succeed in our investment objectives; whether the combination of net proceeds from the ultimate sale of your shares of the spin off company and the distribution of the net proceeds by the Company from the sale of the remaining assets will equal our current NAV; our ability to find purchasers for the remaining assets on such terms as our Board of Directors determines to be in the best interests of our stockholders; unanticipated difficulties or expenditures relating to the strategic monetization process or the pursuit of sales of our remaining assets; the response of stockholders, tenants, business partners and competitors to the announcement of the strategic monetization process; legal proceedings that may be instituted against us and others related to the strategic monetization process; risks associated with our dependence on key personnel whose continued service is not guaranteed; risks related to the disruption of management’s attention from ongoing business operations due to pursuit of the strategic monetization process; other factors, including those risks disclosed in Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company's most recent Annual Report on Form 10-K and Part I, Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Part II, Item 1A. “Risk Factors” of the Company's Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission. The Company cautions investors not to place undue reliance on these forward-looking statements and urge you to carefully review the disclosures it makes concerning risks. While forward-looking statements reflect the Company's good faith beliefs, assumptions and expectations, they are not guarantees of future performance. The forward-looking statements speak only as of the date of this press release.

Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

Additional Information and Where to Find It

In connection with its 2022 annual meeting of stockholders (“Annual Meeting”), GRT filed a preliminary proxy statement on Schedule 14A on August 5, 2022, with the Securities and Exchange Commission (the “SEC”). Promptly after filing its definitive proxy statement with the SEC, GRT intends to mail or otherwise provide the definitive proxy statement and a proxy card to each stockholder entitled to vote at the Annual Meeting. INVESTORS AND SECURITY HOLDERS OF GRT ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE ANNUAL MEETING THAT GRT FILES WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING. The definitive proxy statement, the preliminary proxy statement and any other documents filed by GRT with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov or at the “Investors” section of our website at www.grtreit.com or by writing to Griffin Realty Trust, Inc., Attention: Secretary, 1520 E. Grand Avenue, El Segundo, California 90245.

GRT and its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from GRT’s stockholders with respect to the Annual Meeting. Information about GRT’s directors and executive officers and their ownership of GRT securities is set forth in GRT’s preliminary proxy statement for the Annual Meeting on Schedule 14A filed with the SEC on August 5, 2022. You can obtain free copies of these documents at the SEC’s website at www.sec.gov or at the “Investors” section of our website at www.grtreit.com. Additional information regarding the identity of participants in the solicitation of proxies will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the Annual Meeting.

______________________________

1 FFO, as described by the National Association of Real Estate Investment Trusts ("NAREIT"), is adjusted for redeemable preferred distributions. Additionally, the Company uses AFFO as a non-GAAP financial measure to evaluate its operating performance. FFO and AFFO have been revised to include amounts available to both common stockholders and limited partners for all periods presented. |

2 Enterprise value includes the outstanding debt balance (net of cash and cash equivalents) (excluding deferred financing costs and premium/discounts), plus unconsolidated debt - pro rata share, plus preferred equity, plus total outstanding shares multiplied by the NAV per share. Total outstanding shares includes limited partnership units issued and shares issued pursuant to the Company's distribution reinvestment plan, net of redemptions. |

3 Annualized base rents or “ABR” means the annualized contractual base rents before abatements and base year operating expenses as of June 30, 2022, unless otherwise specified, multiplied by 12 months. For properties in our portfolio that had rent abatements as of June 30, 2022, we used the monthly contractual base rent payable following expiration of the abatement. For our gross modified leases, we deduct base year operating expenses to arrive at ABR. |

4 Investment-grade companies means companies (e.g., a tenant or a guarantor or non-guarantor parent of a tenant) that have received an investment grade credit rating from a Nationally Recognized Statistical Rating Organization (“NRSRO”) approved by the U.S. Securities and Exchange Commission (e.g., Moody’s Investors Service, Inc., S&P Global Ratings and/or Fitch Ratings Inc.) or a company with a non-NRSRO credit rating (e.g., Bloomberg’s default risk rating) that management believes is generally equivalent to an NRSRO investment grade rating; management can provide no assurance as to the comparability of these ratings methodologies or that any particular rating for a company is indicative of the rating that a single NRSRO would provide in the event that it rated all companies for which the Company provides credit ratings; to the extent such companies are rated only by non-NRSRO ratings providers, such ratings providers may use methodologies that are different and less rigorous than those applied by NRSROs; moreover, because GRT provides credit ratings for some companies that are non-guarantor parents of Company's tenants, such credit ratings may not be indicative of the creditworthiness of the relevant tenants. Approximately 66.2% of the portfolio's ABR was generated by investment-grade companies; 60.5% generated from companies with a NRSRO credit rating; and the remaining 5.7% from companies with a non-NRSRO credit rating that the Company believes is generally equivalent to an NRSRO investment grade rating. Bloomberg’s default risk rating is an example of a non-NRSRO rating. |

GRIFFIN REALTY TRUST, INC. CONSOLIDATED BALANCE SHEETS (Unaudited; in thousands, except units and share amounts) |

|||||||

|

|

June 30, 2022 |

December 31, 2021 |

||||

ASSETS |

|

|

|||||

Cash and cash equivalents |

|

$ |

202,655 |

|

$ |

168,618 |

|

Restricted cash |

|

|

19,638 |

|

|

17,522 |

|

Real estate: |

|

|

|

||||

Land |

|

|

573,306 |

|

|

584,291 |

|

Building and improvements |

|

|

4,029,828 |

|

|

4,104,782 |

|

Tenant origination and absorption cost |

|

|

853,542 |

|

|

876,324 |

|

Construction in progress |

|

|

4,581 |

|

|

4,763 |

|

Total real estate |

|

|

5,461,257 |

|

|

5,570,160 |

|

Less: accumulated depreciation and amortization |

|

(1,066,176 |

) |

|

(993,323 |

) |

|

Total real estate, net |

|

4,395,081 |

|

|

4,576,837 |

|

|

Intangible assets, net |

|

40,179 |

|

|

43,100 |

|

|

Deferred rent receivable |

|

111,507 |

|

|

108,896 |

|

|

Deferred leasing costs, net |

|

48,835 |

|

|

44,505 |

|

|

Goodwill |

|

229,948 |

|

|

229,948 |

|

|

Due from affiliates |

|

226 |

|

|

271 |

|

|

Right of use asset |

|

39,997 |

|

|

39,482 |

|

|

Interest rate swap asset |

|

21,905 |

|

|

3,456 |

|

|

Other assets |

|

39,045 |

|

|

40,382 |

|

|

Total assets |

$ |

5,149,016 |

|

$ |

5,273,017 |

|

|

LIABILITIES AND EQUITY |

|||||||

Debt, net |

$ |

2,529,228 |

|

$ |

2,532,377 |

|

|

Restricted reserves |

|

8,417 |

|

|

8,644 |

|

|

Interest rate swap liability |

|

— |

|

|

25,108 |

|

|

Distributions payable |

|

12,078 |

|

|

12,396 |

|

|

Due to affiliates |

|

1,690 |

|

|

2,418 |

|

|

Intangible liabilities, net |

|

27,420 |

|

|

30,626 |

|

|

Lease liability |

|

52,244 |

|

|

50,896 |

|

|

Accrued expenses and other liabilities |

|

110,815 |

|

|

109,121 |

|

|

Total liabilities |

|

2,741,892 |

|

|

2,771,586 |

|

|

Perpetual convertible preferred shares |

|

125,000 |

|

|

125,000 |

|

|

Noncontrolling interests subject to redemption; 556,099 units as of June 30, 2022 and December 31, 2021 |

|

4,671 |

|

|

4,768 |

|

|

Stockholders’ equity: |

|

|

|||||

Common stock, $0.001 par value; 800,000,000 shares authorized; 324,740,552 and 324,638,112 shares outstanding in the aggregate as of June 30, 2022 and December 31, 2021, respectively |

|

325 |

|

|

325 |

|

|

Additional paid-in capital |

|

2,954,932 |

|

|

2,951,972 |

|

|

Cumulative distributions |

|

(979,028 |

) |

|

(922,562 |

) |

|

Accumulated earnings |

|

69,927 |

|

|

141,983 |

|

|

Accumulated other comprehensive income (loss) |

|

21,078 |

|

|

(18,708 |

) |

|

Total stockholders’ equity |

|

2,067,234 |

|

|

2,153,010 |

|

|

Noncontrolling interests |

|

210,219 |

|

|

218,653 |

|

|

Total equity |

|

2,277,453 |

|

|

2,371,663 |

|

|

Total liabilities and equity |

$ |

5,149,016 |

|

$ |

5,273,017 |

|

|

GRIFFIN REALTY TRUST, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited; in thousands, except share and per share amounts) |

|||||||||||||||

Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||

|

2022 |

2021 |

|

2022 |

2021 |

||||||||||

Revenue: |

|

|

|

|

|

||||||||||

Rental income |

$ |

123,073 |

|

$ |

118,824 |

|

|

$ |

239,262 |

|

$ |

220,179 |

|

||

Expenses: |

|||||||||||||||

Property operating expense |

|

14,335 |

|

|

14,425 |

|

|

29,378 |

|

|

28,743 |

|

|||

Property tax expense |

|

11,482 |

|

|

10,050 |

|

|

21,515 |

|

|

19,856 |

|

|||

Property management fees to non-affiliates |

|

1,045 |

|

|

1,017 |

|

|

2,084 |

|

|

1,998 |

|

|||

General and administrative expenses |

|

8,892 |

|

|

10,198 |

|

|

18,415 |

|

|

19,667 |

|

|||

Corporate operating expenses to affiliates |

|

416 |

|

|

635 |

|

|

926 |

|

|

1,260 |

|

|||

Impairment provision |

|

75,557 |

|

|

— |

|

|

75,557 |

|

|

4,242 |

|

|||

Depreciation and amortization |

|

59,980 |

|

|

55,109 |

|

|

112,843 |

|

|

99,447 |

|

|||

Total expenses |

|

171,707 |

|

|

91,434 |

|

|

260,718 |

|

|

175,213 |

|

|||

Income before other income and (expenses) |

|

(48,634 |

) |

|

27,390 |

|

|

(21,456 |

) |

|

44,966 |

|

|||

Other income (expenses): |

|

|

|

|

|||||||||||

Interest expense |

|

(22,366 |

) |

|

(21,492 |

) |

|

(44,032 |

) |

|

(42,177 |

) |

|||

Other income, net |

|

(54 |

) |

|

100 |

|

|

47 |

|

|

224 |

|

|||

(Loss) gain from disposition of assets |

|

— |

|

|

(320 |

) |

|

— |

|

|

(326 |

) |

|||

Transaction expense |

|

(5,545 |

) |

|

— |

|

|

(8,428 |

) |

|

— |

|

|||

Net (loss) income |

|

(76,599 |

) |

|

5,678 |

|

|

(73,869 |

) |

|

2,687 |

|

|||

Distributions to redeemable preferred shareholders |

|

(2,516 |

) |

|

(2,359 |

) |

|

(5,032 |

) |

|

(4,718 |

) |

|||

Net loss (income) attributable to noncontrolling interests |

|

6,952 |

|

|

(292 |

) |

|

6,933 |

|

|

277 |

|

|||

Net income (loss) attributable to controlling interest |

|

(72,163 |

) |

|

3,027 |

|

|

(71,968 |

) |

|

(1,754 |

) |

|||

Distributions to redeemable noncontrolling interests attributable to common stockholders |

|

(44 |

) |

|

(44 |

) |

|

(88 |

) |

|

(87 |

) |

|||

Net (loss) income attributable to common stockholders |

$ |

(72,207 |

) |

$ |

2,983 |

|

$ |

(72,056 |

) |

$ |

(1,841 |

) |

|||

Net (loss) income attributable to common stockholders per share, basic and diluted |

$ |

(0.22 |

) |

$ |

0.01 |

|

$ |

(0.22 |

) |

$ |

(0.01 |

) |

|||

Weighted average number of common shares outstanding, basic and diluted |

|

324,719,145 |

|

|

324,433,017 |

|

|

324,681,374 |

|

|

293,909,092 |

|

|||

Cash distributions declared per common share |

|

0.09 |

|

|

0.09 |

|

|

0.17 |

|

|

0.17 |

|

|||

GRIFFIN REALTY TRUST, INC.

Funds from Operations and Adjusted Funds from Operations

(Unaudited; in thousands except share and per share amounts)

Funds from Operations and Adjusted Funds from Operations

The Company's management believes that historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient.

Management is responsible for managing interest rate, hedge and foreign exchange risks. To achieve the Company's objectives, it may borrow at fixed rates or variable rates. In order to mitigate interest rate risk on certain financial instruments, if any, the Company may enter into interest rate cap agreements or other hedge instruments and in order to mitigate its risk to foreign currency exposure, if any, the Company may enter into foreign currency hedges. The Company view's fair value adjustments of derivatives, impairment charges and gains and losses from dispositions of assets as non- recurring items or items which are unrealized and may not ultimately be realized, and which are not reflective of ongoing operations and are therefore typically adjusted for when assessing operating performance.

In order to provide a more complete understanding of the operating performance of a REIT, the National Association of Real Estate Investment Trusts (“NAREIT”) promulgated a measure known as Funds from Operations (“FFO”). FFO is defined as net income or loss computed in accordance with GAAP, excluding extraordinary items, as defined by GAAP, and gains and losses from sales of depreciable operating property, adding back asset impairment write-downs, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), and after adjustment for unconsolidated partnerships, joint ventures and preferred distributions. Because FFO calculations exclude such items as depreciation and amortization of real estate assets and gains and losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates), they facilitate comparisons of operating performance between periods and between other REITs. As a result, the Company believes that the use of FFO, together with the required GAAP presentations, provides a more complete understanding of the Company's performance relative to its competitors and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities. It should be noted, however, that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than the Company does, making comparisons less meaningful.

Additionally, the Company uses Adjusted Funds from Operations (“AFFO”) as a non-GAAP financial measure to evaluate the Company's operating performance. AFFO excludes non-routine and certain non-cash items such as revenues in excess of cash received, amortization of stock-based compensation net, deferred rent, amortization of in-place lease valuation, acquisition-related costs, financed termination fee, net of payments received, gain or loss from the extinguishment of debt, unrealized gains (losses) on derivative instruments, write-off transaction costs and other one-time transactions. FFO and AFFO have been revised to include amounts available to both common stockholders and limits partners for all periods presented.

AFFO is a measure used among the Company's peer group, which includes daily NAV REITs. The Company also believes that AFFO is a recognized measure of sustainable operating performance by the REIT industry. Further, the Company believes AFFO is useful in comparing the sustainability of its operating performance with the sustainability of the operating performance of other real estate companies.

Management believes that AFFO is a beneficial indicator of its ongoing portfolio performance and ability to sustain its current distribution level. More specifically, AFFO isolates the financial results of the Company's operations. AFFO, however, is not considered an appropriate measure of historical earnings as it excludes certain significant costs that are otherwise included in reported earnings. Further, since the measure is based on historical financial information, AFFO for the period presented may not be indicative of future results or the Company's future ability to pay distributions. By providing FFO and AFFO, the Company presents information that assists investors in aligning their analysis with management’s analysis of long- term operating activities.

For all of these reasons, the Company believes the non-GAAP measures of FFO and AFFO, in addition to income (loss) from operations, net income (loss) and cash flows from operating activities, as defined by GAAP, are helpful supplemental performance measures and useful to investors in evaluating the performance of the Company's real estate portfolio.

However, a material limitation associated with FFO and AFFO is that they are not indicative of the Company's cash available to fund distributions since other uses of cash, such as capital expenditures at the Company's properties and principal payments of debt, are not deducted when calculating FFO and AFFO. The use of AFFO as a measure of long-term operating performance on value is also limited if the Company does not continue to operate under its current business plan as noted above. AFFO is useful in assisting management and investors in assessing the Company's ongoing ability to generate cash flow from operations and continue as a going concern in future operating periods, and in particular, after the offering and acquisition stages are complete. However, FFO and AFFO are not useful measures in evaluating NAV because impairments are taken into account in determining NAV but not in determining FFO and AFFO. Therefore, FFO and AFFO should not be viewed as a more prominent measure of performance than income (loss) from operations, net income (loss) or to cash flows from operating activities and each should be reviewed in connection with GAAP measurements.

Neither the SEC, NAREIT, nor any other applicable regulatory body has opined on the acceptability of the adjustments contemplated to adjust FFO in order to calculate AFFO and its use as a non-GAAP performance measure. In the future, the SEC or NAREIT may decide to standardize the allowable exclusions across the REIT industry, and the Company may have to adjust the calculation and characterization of this non-GAAP measure.

Our calculation of FFO and AFFO is presented in the following table for the three and six months ended June 30, 2022 and 2021, respectively (dollars in thousands, except per share amounts):

Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

|||||||||||||

Net income |

$ |

(76,599 |

) |

$ |

5,678 |

|

$ |

(73,869 |

) |

$ |

2,687 |

|

|||||

Adjustments: |

|

|

|

|

|||||||||||||

Depreciation of building and improvements |

|

32,494 |

|

|

32,733 |

|

|

64,587 |

|

|

59,279 |

|

|||||

Amortization of leasing costs and intangibles |

|

27,575 |

|

|

22,472 |

|

|

48,433 |

|

|

40,335 |

|

|||||

Impairment provision |

|

75,557 |

|

|

— |

|

|

75,557 |

|

|

4,242 |

|

|||||

Loss (Gain) from disposition of assets |

|

— |

|

|

320 |

|

|

— |

|

|

326 |

|

|||||

Equity interest of gain on sale - unconsolidated entities |

|

— |

|

|

— |

|

|

— |

|

|

(8 |

) |

|||||

FFO |

|

59,027 |

|

|

61,203 |

|

|

114,708 |

|

|

106,861 |

|

|||||

Distribution to redeemable preferred shareholders |

|

(2,516 |

) |

|

(2,359 |

) |

|

(5,032 |

) |

|

(4,718 |

) |

|||||

FFO attributable to common stockholders and limited partners |

$ |

56,511 |

|

$ |

58,844 |

|

$ |

109,676 |

|

$ |

102,143 |

|

|||||

Reconciliation of FFO to AFFO: |

|

|

|

|

|||||||||||||

FFO attributable to common stockholders and limited partners |

$ |

56,511 |

|

$ |

58,844 |

|

$ |

|

109,676 |

|

$ |

|

102,143 |

|

|||

Adjustments: |

|

|

|

|

|||||||||||||

Revenues in excess of cash received, net |

|

(3,389 |

) |

|

(6,092 |

) |

|

(6,687 |

) |

|

(6,543 |

) |

|||||

Amortization of share-based compensation |

|

1,685 |

|

|

2,117 |

|

|

3,442 |

|

|

3,830 |

|

|||||

Deferred rent - ground lease |

|

511 |

|

|

516 |

|

|

1,028 |

|

|

1,032 |

|

|||||

Unrealized loss (gain) on investments |

|

68 |

|

|

(30 |

) |

|

158 |

|

|

(36 |

) |

|||||

Amortization of above/(below) market rent, net |

|

(432 |

) |

|

(444 |

) |

|

(846 |

) |

|

207 |

|

|||||

Amortization of debt premium/(discount), net |

|

102 |

|

|

102 |

|

|

203 |

|

|

203 |

|

|||||

Amortization of ground leasehold interests |

|

(90 |

) |

|

(96 |

) |

|

(179 |

) |

|

(168 |

) |

|||||

Amortization of below tax benefit amortization |

|

372 |

|

|

372 |

|

|

740 |

|

|

499 |

|

|||||

Employee separation expense |

|

2 |

|

|

— |

|

|

72 |

|

|

— |

|

|||||

Write-off of transaction costs |

|

10 |

|

|

13 |

|

|

28 |

|

|

46 |

|

|||||

Transaction expenses |

|

5,545 |

|

|

— |

|

|

8,428 |

|

|

— |

|

|||||

AFFO available to common stockholders and limited partners |

$ |

60,895 |

|

$ |

55,302 |

|

$ |

116,063 |

|

$ |

101,213 |

|

|||||

FFO per share, basic and diluted |

$ |

0.16 |

|

$ |

0.17 |

|

$ |

0.31 |

|

$ |

0.31 |

|

|||||

AFFO per share, basic and diluted |

$ |

0.17 |

|

$ |

0.16 |

|

$ |

0.33 |

|

$ |

0.31 |

|

|||||

|

|

|

|

|

|||||||||||||

Weighted-average common shares outstanding - basic EPS |

|

324,719,145 |

|

|

324,433,017 |

|

|

324,681,374 |

|

|

293,909,092 |

|

|||||

Weighted-average OP Units |

|

31,838,890 |

|

|

31,838,890 |

|

|

31,838,890 |

|

|

31,838,890 |

|

|||||

Weighted-average common shares and OP Units outstanding - basic and diluted FFO/AFFO |

|

356,558,035 |

|

|

356,271,907 |

|

|

356,520,264 |

|

|

325,747,982 |

|

|||||

GRIFFIN REALTY TRUST, INC.

Net Debt as of June 30, 2022

(Unaudited; dollars in thousands)

Net Debt is defined as the Company's consolidated debt, net, plus unamortized deferred financing costs and discounts, net, less the Company's unrestricted cash and cash equivalents. Net debt plus Perpetual Convertible Preferred Shares is defined as Net debt plus the Company's perpetual convertible preferred shares. The Company's management believes both of these are useful metrics for analyzing the Company's level of indebtedness as unrestricted cash and cash equivalents could potentially be used to pay down a portion of the Company's outstanding debt.

|

Amount |

|||

Debt, net (as reported) |

$ |

|

2,529,228 |

|

Add: unamortized deferred financing costs and discounts, net |

|

|

7,682 |

|

Total consolidated debt |

|

|

2,536,910 |

|

Less: Cash & cash equivalents - excl. restricted |

|

|

(202,655 |

) |

Net debt |

|

|

2,334,255 |

|

Perpetual convertible preferred shares |

|

|

125,000 |

|

Net debt plus perpetual convertible preferred shares |

$ |

|

2,459,255 |

|

GRIFFIN REALTY TRUST, INC.

Normalized EBITDAre & Adjusted EBITDA

(Unaudited; dollars in thousands)

The Company uses Normalized EBITDAre as a non-GAAP supplemental performance measure to evaluate the operating performance of the Company. Normalized EBITDAre, as defined by the Company, represents EBITDAre (as defined by NAREIT), modified to exclude nonroutine items such as acquisition-related expenses, employee separation expenses and other non- routine costs. Normalized EBITDAre also omits the Normalized EBITDAre impact of properties sold during the period and extrapolates the operations of acquired properties to estimate a full quarter of ownership. Management believes these adjustments to reconcile to Normalized EBITDAre provides investors with supplemental performance information that is consistent with the performance models and analysis used by management, and provides investors a view of the performance of our portfolio over time. Therefore, Normalized EBITDAre should not be considered as an alternative to net income, as computed in accordance with GAAP. Normalized EBITDAre may not be comparable to similarly titled measures of other companies.

Adjusted EBITDA, as defined in the Company's credit facility agreement, is calculated as net income before interest, taxes, depreciation and amortization (EBITDA), plus acquisition fees and expenses, asset and property management fees, straight- line rents and in-place lease amortization for the period, further adjusted for acquisitions that have closed during the quarter and certain reserves for capital expenditures. The Company believes that Adjusted EBITDA is helpful to investors as a supplemental measure of the Company's operating performance as a real estate company because it is a direct measure of the actual operating results of the Company's properties.

Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||

|

2022 |

2021 |

2022 |

2021 |

|||||||||

Reconciliation of EBITDA/EBITDAre/Normalized EBITDAre/Adjusted EBITDA: |

|

|

|

|

|||||||||

Reconciliation of Net income (loss) to EBITDAre |

|

|

|

|

|||||||||

Net income (loss) |

$ |

(76,599 |

) |

$ |

5,678 |

|

$ |

(73,869 |

) |

$ |

2,687 |

|

|

Depreciation and amortization |

|

59,980 |

|

|

55,109 |

|

|

112,843 |

|

|

99,447 |

|

|

Interest expense |

|

22,366 |

|

|

21,492 |

|

|

44,032 |

|

|

42,177 |

|

|

EBITDA |

|

5,747 |

|

|

82,279 |

|

|

83,006 |

|

|

144,311 |

|

|

Loss/(Gain) on disposition of assets |

|

— |

|

|

320 |

|

|

— |

|

|

326 |

|

|

Impairment provision |

|

75,557 |

|

|

— |

|

|

75,557 |

|

|

4,242 |

|

|

EBITDAre |

|

81,304 |

|

|

82,599 |

|

|

158,563 |

|

|

148,879 |

|

|

Adjustment for acquisitions and dispositions |

|

— |

|

|

— |

|

|

— |

|

|

12,378 |

|

|

Write-off of transaction costs |

|

10 |

|

|

13 |

|

|

28 |

|

|

46 |

|

|

Employee separation expense |

|

2 |

|

|

— |

|

|

72 |

|

|

— |

|

|

Transaction Expense |

|

5,545 |

|

|

— |

|

|

8,428 |

|

|

— |

|

|

Normalized EBITDAre |

|

86,861 |

|

|

82,612 |

|

|

167,091 |

|

|

161,303 |

|

|

Reconciliation of Normalized EBITDAre to Adjusted EBITDA (per the credit facility) |

|

|

|

|

|||||||||

Amortization of deferred financing costs |

|

840 |

|

|

788 |

|

|

1,631 |

|

|

1,567 |

|

|

Amortization of debt premium/(discount), net |

|

102 |

|

|

102 |

|

|

203 |

|

|

203 |

|

|

Amortization of above/(below) market rent, net |

|

(432 |

) |

|

(444 |

) |

|

(846 |

) |

|

207 |

|

|

Income taxes |

|

142 |

|

|

579 |

|

|

473 |

|

|

852 |

|

|

Amortization of Other Intangibles |

|

372 |

|

|

372 |

|

|

740 |

|

|

499 |

|

|

Property management fees to non-affiliates |

|

1,045 |

|

|

1,017 |

|

|

2,084 |

|

|

1,998 |

|

|

Deferred rent |

|

(2,879 |

) |

|

(5,576 |

) |

|

(5,661 |

) |

|

(5,511 |

) |

|

Equity percentage of net loss for the Parent’s non-wholly owned direct and indirect subsidiaries |

|

— |

|

|

— |

|

|

— |

|

|

(8 |

) |

|

Equity percentage of EBITDA for the Parent’s non-wholly owned direct and indirect subsidiaries |

|

— |

|

|

— |

|

|

— |

|

|

20 |

|

|

Adjustment to interest |

|

(932 |

) |

|

(1,071 |

) |

|

(2,568 |

) |

|

(2,139 |

) |

|

Adjustment for write-off of transaction costs |

|

(10 |

) |

|

(13 |

) |

|

(28 |

) |

|

(46 |

) |

|

Reversal of adjustment for acquisitions and disposition |

|

— |

|

|

— |

|

|

— |

|

|

(12,378 |

) |

|

Less: Capital reserves |

|

(958 |

) |

|

(963 |

) |

|

(1,922 |

) |

|

(1,978 |

) |

|

Adjusted EBITDA (per credit facility agreement) |

$ |

84,151 |

|

$ |

77,403 |

|

$ |

161,197 |

|

$ |

144,589 |

|

|