SAN FRANCISCO--(BUSINESS WIRE)--Parafin, a fintech infrastructure startup that companies such as marketplaces, vertical SaaS, and payment processors rely on to launch and embed financial services for their sellers, announced that it has raised a $60 million Series B financing round led by GIC, bringing its total equity funding to $94 million. This round includes participation from new and existing investors, including Series A and Seed lead investors Thrive Capital and Ribbit Capital.

Today, Parafin powers the embedded capital offerings of companies with over $100 billion in payments volume, including DoorDash Capital and Mindbody Capital. Companies that use Parafin together serve over 700,000 small and medium-sized businesses around the world. In Q2 2022, Parafin’s quarterly run-rate revenue and total financing volume grew by 87% and 77%, respectively.

“Small businesses have a huge, unmet need for capital and are poorly served by the status quo,” said Vineet Goel, co-founder of Parafin. “We make it simple, seamless, and fast for any Platform that serves a small business to offer financial products that accelerate their small business’ growth and increase their loyalty and lifetime value.”

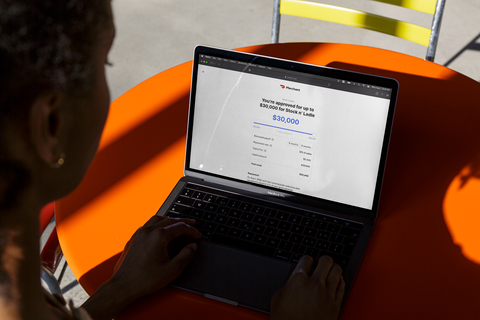

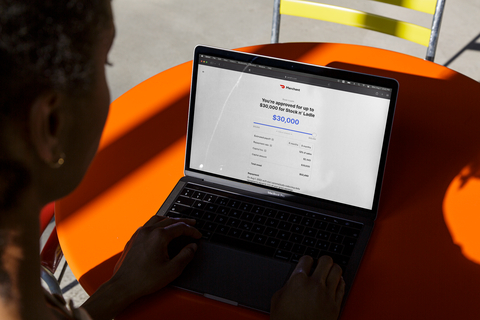

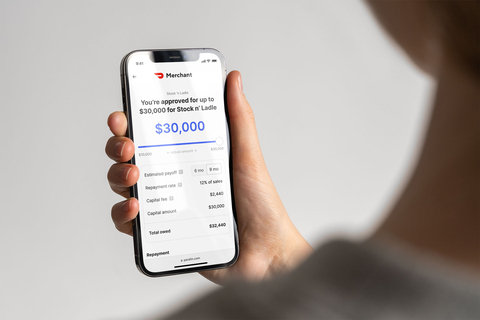

Before Parafin, most Platforms would find it too complex and expensive to launch a financial services program for their small businesses. Because Parafin is a vertically integrated, full-stack offering that manages everything from product, underwriting, capital markets, compliance, and marketing for its partners, companies that serve small businesses can launch a white-labeled financial services program with Parafin in as little as a few days.

Small businesses love Parafin-powered financial products. These businesses can accept Capital in a few clicks, ensuring that they can get the support they need while continuing to focus on running their business. In recent surveys, more than 90% of small businesses say their perception of the platform they use has improved since the launch of a Parafin-powered capital program.

With its new capital, Parafin intends to continue to launch new, innovative products for small businesses, such as business charge cards, and further establish its market leadership in embedded financial services.

“Most platforms fail to recognize both how much untapped demand their Sellers have for capital and how hard it is to build these financial products in-house,” said Sanyam Satia, Engineering Lead at Parafin. “We’re focused on solving hard infrastructure problems so that Platforms can best serve their Sellers.”

To learn more about Parafin, visit https://www.parafin.com. For inquiries from companies interested in using Parafin to launch financial services for their small businesses, contact info@parafin.com.

ABOUT PARAFIN

Parafin is full-stack embedded financial infrastructure that serves small businesses better, faster, and cheaper. Parafin works with the platforms that small businesses already use — such as marketplaces, payment processors, and software providers — to help small businesses bridge their cash flow needs, invest in their growth, and run their business. Parafin was founded in 2020 by Sahill Poddar, Ralph Furman, and Vineet Goel, three of the earliest employees at Robinhood. Together, they served as the head of machine learning, first data scientist, and head of risk and fraud, respectively.