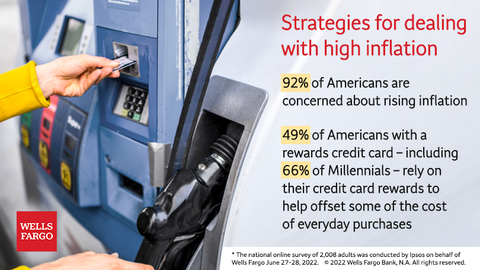

SAN FRANCISCO--(BUSINESS WIRE)--Amid concerns about rising inflation, many Americans find credit card rewards useful in helping to ease inflation woes, a Wells Fargo study reveals. With 92% of Americans concerned about rising inflation (59% very concerned, 33% somewhat concerned), nearly half of rewards cardholders (49%) are leaning on their credit card rewards to help offset some of the costs of everyday purchases.

Almost three quarters (71%) of Americans have a credit card that offers rewards, and 45% of rewards cardholders say their credit card usage increased during the pandemic. What’s more, two-thirds of rewards cardholders (65%) say they care about credit card rewards now more than ever.

“The survey data underscores the significance of rising inflation and supply chain issues, and how American consumers have been affected in so many ways—not only their summer vacation plans but also with everyday purchases,” said Krista Phillips, EVP, head of Branded Cards and Marketing for Wells Fargo Credit Cards.

The national online survey of 2,008 adults was conducted by Ipsos on behalf of Wells Fargo June 27-28, 2022.

Love-hate relationship with travel

The study revealed that Americans are planning vacations, although over half (57%) report a “love-hate” relationship with travel these days. For many (44%) the urge to travel has returned with a vengeance, with a third (34%) reporting that they are planning to “go big” on their next trip.

Americans are mostly vacationing by car. Two-thirds (66%) say they prefer good old-fashioned road trips over flying with about a third (31%) planning an automobile trip in the next six months, compared to 22% who are planning to fly. Two-thirds (64%) of respondents said they are cutting back on air travel because it is too expensive while some (45%) are cutting back on air travel because of COVID concerns. A quarter (24%) of rewards cardholders used travel rewards to subsidize a vacation this year.

“Our customers tend to focus on rewards as a top credit card preference, and that’s one reason we’re expanding our consumer portfolio to include more competitive rewards offerings – like the new Autograph Card,” Phillips said. “It starts with listening to our customers to develop products that align with their lifestyles, and right now many are looking for ways to make the most of their everyday purchases. There is a big opportunity for savvy cardholders to earn rewards on purchases they are already making by using a card like Autograph, which offers unlimited 3X rewards points on top spending categories including at gas stations – a great incentive amid the current gas prices.”

58% of Americans planned a vacation in the past six months and 63% are planning a vacation in the next six months

|

Planned a vacation in the past six months |

Planning a vacation in the next six months |

|||

Automobile vacation (Road trip) |

31% |

31% |

|||

Airline vacation |

22% |

22% |

|||

Staycation (Vacation close to home) |

20% |

21% |

|||

International vacation |

9% |

11% |

|||

Boat/Cruise vacation |

9% |

10% |

|||

None of the above |

42% |

37% |

Still, for many, high gas prices and inflation are cramping travel plans. A third (32%) said that high gas prices have forced them to cancel a road trip this summer. Another third (37%) are not planning any vacations at all in the next six months and 21% are planning a “staycation” – a vacation close to home.

Credit Card Rewards Redemption

Even though people report using their credit card rewards to offset the cost of everyday purchases, the study found that many do not take full advantage of their card benefits.

- Only half (53%) of rewards cardholders say they focus on high-value categories when they use their credit card.

- Thirty-eight percent of rewards cardholders have not cashed in their credit card rewards or offers this year.

- Thirteen percent of rewards cardholders say they don’t really understand how their credit card rewards program works.

“It’s important for consumers to fully understand all of the benefits their rewards card offers in order to make the most of their purchases and to help defray some of the cost of rising inflation,” added Phillips.

After groceries, the top things rewards cardholders use their credit card for is gas, restaurants, and travel/transit.

Rewards card owner (n = 1,273) |

Top Three Choices |

||

Groceries |

62% |

||

Gas |

51% |

||

Restaurants and eating out |

43% |

||

Travel and transit |

30% |

||

Emergencies |

27% |

||

Entertainment |

23% |

||

Home improvement |

23% |

||

Health, fitness, and beauty purchases |

16% |

||

Phone service |

12% |

||

Streaming services |

12% |

About the study

These are the findings of an Ipsos poll conducted between June 27-28, 2022. For this survey, a sample of 2,008 adults age 18+ from the continental U.S., Alaska, and Hawaii was interviewed online in English. The sample included 1,273 adults who have a rewards credit card. The poll has a credibility interval of plus or minus 2.4 percentage points for all respondents.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial services company that has approximately $1.9 trillion in assets, proudly serves one in three U.S. households and more than 10% of small businesses in the U.S., and is a leading middle market banking provider in the U.S. We provide a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management. Wells Fargo ranked No. 41 on Fortune’s 2022 rankings of America’s largest corporations. In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health, and a low-carbon economy.

News, insights, and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo

News Release Category: WF-ERS