AUSTIN, Texas--(BUSINESS WIRE)--Cleartrace, a leading carbon and energy management software company, announced today a $20 million financing round led by ClearSky with strategic investment from Brookfield Renewable, EDF Energy North America, Tenaska, and Exelon. This raise follows major growth announcements from Cleartrace, including its selection to provide auditable and assurance-ready proof of decarbonization for all of Iron Mountain’s U.S. data centers, Brookfield Properties’ premier skyscraper One Manhattan West, and JPMorgan Chase’s offices.

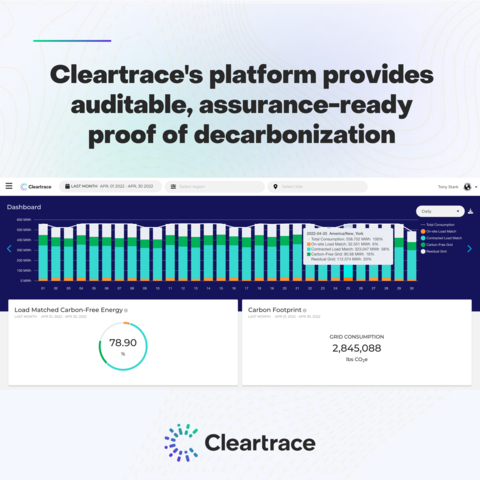

Cleartrace illuminates previously unseen data for renewable energy buyers and suppliers. Its product delivers 100% traceable and actionable hourly energy and carbon records for organizations with ESG and/or sustainability goals, such as real estate owners, investors, data centers and renewable energy suppliers. This enables its clients to be proactive leaders in their respective markets and take meaningful steps towards achieving tangible 24/7 decarbonization through load-matched renewable energy purchases or sales. Further, this level of data enables companies to prove when they have achieved their decarbonization goals and report on compliance with local environmental policies.

“Despite the rise in decarbonization goals as part of Environmental Social and Governance (ESG) commitments, energy data today is largely siloed, not validated and non-standardized,” said Lincoln Payton, CEO of Cleartrace. “Renewable energy buyers and suppliers need to understand the carbon intensity of the electricity they consume or produce – on an hourly basis–in order to advance their decarbonization strategies.”

“Leveraging Cleartrace’s hourly energy and carbon data positions our business ahead of the market to offer maximum decarbonization for our clients,” said Stephen Gallagher, Chief Commercial Officer of Brookfield Renewable’s U.S. business. “Demand by companies for 24/7 clean energy has never been higher, and this technology helps make that possible.”

“There are significant macro effects that are forcing more transparent and granular carbon reporting,” explained James Huff, Managing Director at ClearSky. “Consumers are forcing it. Compliance is forcing it. And that’s not to mention the marketing and capital markets value that having hourly data can bring to an organization. Cleartrace has the team, the technology and the partnerships to capitalize on the market opportunity.”

By providing sustainability leaders with auditable data, Cleartrace continues to advance its leadership in the energy and carbon management sector. The investment comes on the heels of the company's series of successful partnerships:

- JPMorgan Chase announced that they will partner with Cleartrace and NextEra to optimize its energy use and manage its carbon footprint;

- Iron Mountain announced that they will partner with Cleartrace across all the US data centers to attain the data needed to achieve their 24/7 load-matched renewable energy goals; and

- Brookfield Properties announced that they will partner with Cleartrace to provide 100% load matched carbon free energy to power their commercial real estate property One Manhattan West to exceed standards set by LL97.

As part of the funding, ClearSky, Brookfield Renewable, EDF Energy North America, and Tenaska gain board representation.

About Cleartrace

Cleartrace illuminates previously unseen data for renewable energy buyers and suppliers, delivering 100% traceable and actionable hourly energy and carbon records. The platform is trusted by the world’s most reputable companies, including JP Morgan Chase, NextEra, Iron Mountain, Brookfield Properties, and Brookfield Renewable.

About Brookfield Renewable

Brookfield Renewable operates one of the world’s largest publicly traded, pure-play renewable power platforms. Its portfolio consists of hydroelectric, wind, solar and storage facilities in North America, South America, Europe and Asia, and totals approximately 21,000 megawatts of installed capacity and an approximately 69,000-megawatt development pipeline. Investors can access its portfolio either through Brookfield Renewable Partners L.P. (NYSE: BEP; TSX: BEP.UN), a Bermuda-based limited partnership, or Brookfield Renewable Corporation (NYSE, TSX: BEPC), a Canadian corporation. Further information is available at www.bep.brookfield.com.

About EDF Energy North America

EDF Energy NA (formed of EDF Energy Services and EDF Trading North America) offers a full range of structured solutions — energy supply, transportation, risk management products and technology — to help customers optimize their energy assets and successfully compete in the marketplace. Customers include third-party power stations across North America, retail energy aggregators and commercial and industrials. EDF Energy NA also provides comprehensive wholesale market coverage of financial and physical products in power, natural gas, environmental products, NGLs, congestion management, derivatives and financial crude oil products. EDF Energy NA is part of the EDF Group, a global leader in low-carbon energies, with a diversified generation mix based on nuclear power, hydropower, new renewable energies and thermal energy.

About Tenaska

Tenaska is one of the leading independent energy companies in the United States, with a reputation for high standards and expertise in natural gas and electric power marketing, energy management, development and acquisition of energy assets, and operation of generating facilities. Forbes Magazine consistently ranks Tenaska among the largest private U.S. companies. Gross operating revenues were $18.4 billion in 2021.

Tenaska has developed, managed and/or operated approximately 22 gigawatts (GW) of natural gas-fueled and renewables generation. Its development portfolios include more than 23 GW of solar, wind and energy storage projects. The current Tenaska operating fleet includes 7.5 GW of generating facilities.

About Exelon

Exelon (Nasdaq: EXC) is a Fortune 200 company and the nation’s largest utility company, serving more than 10 million customers through six fully regulated transmission and distribution utilities — Atlantic City Electric (ACE), Baltimore Gas and Electric (BGE), Commonwealth Edison (ComEd), Delmarva Power & Light (DPL), PECO Energy Company (PECO), and Potomac Electric Power Company (Pepco). More than 18,000 Exelon employees dedicate their time and expertise to supporting our communities through reliable, affordable and efficient energy delivery, workforce development, equity, economic development and volunteerism. Follow Exelon on Twitter @Exelon

About ClearSky

ClearSky is a venture capital/growth equity group that invests in innovative companies, with a special focus on (i) technologies driving the energy transition, climate related technologies, and sustainability, (ii) the digital transformation of enterprise customers’ operations and communications, and (iii) disruptive solutions for cybersecurity, industrial security, and critical infrastructure security.