BOSTON--(BUSINESS WIRE)--Financial advisors are looking to increase client assets under management (AUM) by 10% (median) this year, and with little of that likely to come from market performance, they are counting primarily on new assets from new clients to grow their business, according to findings from Natixis Investment Managers (IM) 2022 Survey of Financial Professionals, published today.

Natixis IM surveyed 300 U.S. financial advisors, as part of a larger global survey of 2,700 financial professionals. The U.S. findings presented here provide insight about advisors’ growth strategies, the challenges they face, and how they are adapting their business to changes in the market.

Over the next three years, financial advisors are targeting a median AUM growth rate of 15% growth and 10 new clients per year, on average. While the long bull market helped turbo charge asset growth over the past ten years, advisors aren’t counting on the double-digit returns over the long term. In fact, they are optimistic in forecasting a 4.4% return by the S&P 5001 this year. Rather, the survey suggests that advisors are looking to catch a tailwind from the vast amount of money in motion, including rollover retirement assets and the transfer of significant generational wealth. Many may be hard-pressed to hit their targets unless they also adapt their business practices and assumptions.

The survey found:

- Client acquisition is the most difficult way for advisors to go about growing their business. When asked which business growth strategy is most challenging, 59% cite winning new assets from new clients, compared to 31% who cite gaining more assets from existing clients. One in four (24%) say retaining clients is most challenging.

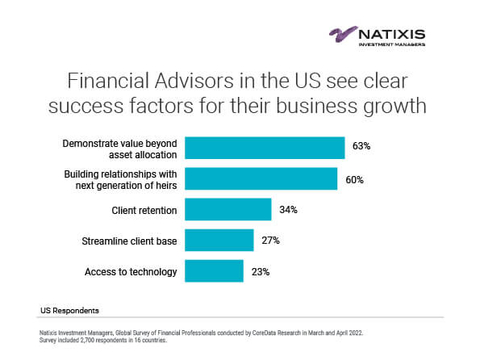

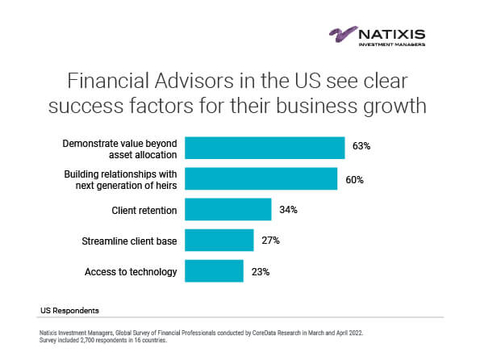

- The two factors most advisors say are crucial to their success are demonstrating value to clients beyond investment management (63%) and establishing relationships with clients’ next-generation heirs (60%).

- 57% of advisors say that the time involved in adding value beyond investment management and establishing relationships with next generation heirs make both challenging.

“Advisors have to expand their capacity to grow their business while meeting the needs of new and existing clients,” said David Giunta, President and Chief Executive Officer for the U.S. at Natixis Investment Managers. “Advisory relationships are no longer defined by transactions in an investment portfolio, but rather by a deeper understanding of clients’ financial needs and the services they feel add the most value for the money. Technology and product innovation are helping advisors deliver the consistent investment experience clients expect while supporting the transition of their business to a broader focus on financial planning.”

Modeling the business for new clients

One key way advisors are expanding their capacity on the planning side is by using model portfolios on the investing side. On average, 93% of client assets under management are in model portfolios, including 54% of assets in models that advisors build themselves, 26% in models built and managed by their firm, and 21% from third-party asset managers.

The survey found:

- 89% of financial advisors say that clients whose assets are in model portfolios view comprehensive financial planning as the greatest value of having a relationship with a professional advisor.

- A significant number of advisors also said clients value tax management (56%), financial education and engagement with family members (56%), and trust and estate planning services (48%).

- The very small percentage (7%) of financial advisors who don’t use model portfolios say that personally building and managing clients’ investment portfolios is essential to their value proposition.

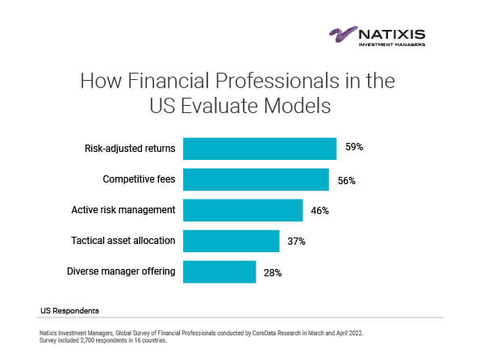

“The actively-managed, risk-adjusted performance features inherent in model portfolios make them particularly compelling in the current market environment,” said Marina Gross, Co-Head of Natixis Investment Managers Solutions. “Our portfolio consulting practice shows that core moderate-risk model portfolios consistently deliver higher risk-adjusted returns with less volatility than the broad market, enabling advisors to focus more time on long-term goals, than short-term performance.”

The survey found the most effective ways financial advisors are incorporating model portfolios into their practice are by:

- Transitioning assets on a case-by-case basis, depending on each client’s willingness (58%)

- Focusing on retirement account rollovers (42%)

- Focusing on new assets from new clients (29%)

One in five advisors (20%) took the plunge and moved all their client assets into models at once, and 21% who intend to transition all their clients into model portfolios, have done so in phases. Few advisors have found it particularly effective to reserve their use of model portfolios for clients who represent less revenue potential, including clients with lower balances (18%), retirement drawdown clients (17%), and younger clients (10%).

Prospecting efforts come into focus

In their search for new clients, financial advisors are looking in all the usual places, with most (81%) considering the life stages of their prospects. Most (93%) place the highest priority on pre-retirees, or people between the ages of 50 and 60, followed by those between the ages of 60 and 65 who are at or just entering retirement (84%). Six in ten (60%) also focus on older accumulators between the ages of 35 and 50 who are in their peak earning years and likely in need of comprehensive financial services to address multiple financial goals such as saving for retirement, funding education, and managing debt.

Given the market environment and generational transfer of wealth underway, advisors may be missing opportunities to reach the oldest and youngest group of potential clients.

- Fewer than half (47%) of financial advisors are focused on post-retirees, many of who are drawing down versus accumulating assets but who still need robust financial planning and advice to protect, use and pass on their assets.

- Only 16% place a high priority on prospecting for clients between the ages of 18 and 35, members of Generations Y and Z, who represent the largest segment of the U.S. population.

Beyond age segmentation, advisors are tailoring their business offering and business development strategies to appeal to specific high-valued groups. When asked which segments they are prioritizing for client acquisition and retention, the survey found again, that advisors might be overlooking opportunities to meet the distinct needs of certain segments, namely women and the LGBTQ community.

When financial advisors were asked which groups they prioritize for client acquisition and retention, the survey found:

- 76% of advisors are focused on professionals, such as lawyers, doctors, and corporate executives and nearly as many (75%) are targeting business owners

- 69% are focused on HENRYs (High Earners, Not Rich Yet)

- 44% are looking to establish or strengthen relationships with next-generation heirs

- 29% are concentrating on the needs of women

- 7% target the LGBTQ+ community

Just 8% of financial advisors think that meeting investor demand for cryptocurrency2 investments is very important to the growth of their business. Most (86%) don’t offer clients access to cryptocurrency trading on their platform, even though 58% of advisors say they have clients who invest in cryptocurrency either directly or through other trading platforms.

As the wealth management business transitions to a more holistic financial planning business model, some advisors are reevaluating the way they charge for their services. The number of advisors whose fees are based on assets under management is expected to decline from 63% today to 58% over the next five years. A subscription-based fee model, that charges clients a one-time or annual upfront fee and then a recurring fee for any ongoing services throughout the year, is expected to rise incrementally from 2% to 9%. Twenty-seven percent of advisors expect to offer a mixed fee structure employing AUM-based, subscription-based, and transactional fees for services or time rendered, depending on the client.

Natixis Investment Manager’s global report on the findings of its 2022 survey of Financial Advisors can be found here.

Methodology

Natixis Investment Managers surveyed 300 financial advisors across the United States, as part of a larger global survey of 2,700 financial professionals in 16 countries. Data were gathered in March and April 2022 by the research firm CoreData with additional analysis conducted by the Natixis Center for Investor Insights.

About the Natixis Center for Investor Insight

The Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 20 active managers. Ranked among the world’s largest asset managers1 with more than $1.3 trillion assets under management2 (€1.2 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; AlphaSimplex Group; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seeyond; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various U.S. registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2021 ranked Natixis Investment Managers as the 15th largest asset manager in the world based on assets under management as of December 31, 2020.

2 Assets under management (“AUM”) of current affiliated entities measured as of March 31, 2022 are $1,320.6 billion (€1,187.6 billion). AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted.

The data shown represents the opinion of those surveyed, and may change based on market and other conditions. It should not be construed as investment advice.

All investing involves risk, including the risk of loss. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

4801413.1.1

______________________________

1 S&P 500® Index is a widely recognized measure of US stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large-cap segment of the US equities market.

2 Cryptocurrencies are subject to numerous market risks, they are speculative and volatile, can become illiquid at any time, and are for investors who can tolerate the full loss of their investment.