Fifty Percent of Parents With College Bound Children Have Saved Less Than $15,000 for Their Child’s Education

Fifty Percent of Parents With College Bound Children Have Saved Less Than $15,000 for Their Child’s Education

Fifty-five percent of parents believe their ability to pay for college has not improved over last year; fears of uncertainty and potential recession drive financial concern for parents

RIVERWOODS, Ill.--(BUSINESS WIRE)--A national survey from Discover Student Loans revealed the volatile economy and rising inflation has put even more strain on families trying to pay for college.

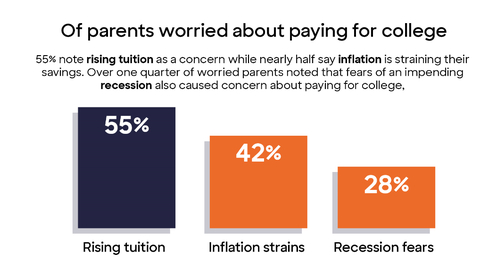

The survey found 66% of parents with kids aged 16-18 planning to go to college are worried about paying for their child’s education. Of parents worried about paying for college, 55% are concerned about rising tuition while nearly half say inflation is straining their savings (42%) and 28% noted that fears of an impending recession caused them concern about paying for college, up 14 percentage points from last year.

“As families are faced with rising costs, we encourage them to have conversations with their students about paying for college early on,” said Rich Finn, vice president of Discover Student Loans. “Free tools like My College Plan help families compare college costs, check out possible careers and earnings of college majors to determine the potential cost and return on investment for their student’s college education.”

Most families have not saved enough for college and half of families believe their ability to pay for college has not improved.

Results from the survey find that most families have not saved enough for college. Half of parents have $15,000 or less saved for their child’s education and nearly a third of parents (32%) feel they did not start saving early enough.

In 2022, 55% of parents surveyed believe their ability to pay for college has not improved since this time last year.

Of parents planning to help pay for their child’s college, 41% aim to take out student loans, and 43% will dip into their savings. The number of parents intending to fund their child's education through scholarships increased 7 percentage points from 2021 to 2022, to 54%.

“Searching for and applying for scholarships is a critical part of the college application process as they can help reduce the cost of college and do not need to be repaid. There are a number of scholarship opportunities and tools available online, such as the Discover scholarship tool, which can help families filter and search for scholarships to apply for,” said Finn.

For more information on free college planning tools and resources from Discover Student Loans, visit https://www.discover.com/student-loans/college-planning?acmpgn=O_ANN_SURV_BM_P_2022.

About the Survey

All figures, unless otherwise stated, are from a Dynata (formerly Research Now/SSI) survey conducted on behalf of Discover Financial Services. The survey was conducted online and fielded by Dynata with a total sample size of 1,000 parents of children ages 16-18 who plan on attending college or trade school. The margin of sampling error was 3 percentage points with a +/-5 percent level of confidence.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover® card, America's cash rewards pioneer, and offers private student loans, personal loans, home loans, checking and savings accounts and certificates of deposit through its banking business. It operates the Discover Global Network® comprised of Discover Network, with millions of merchants and cash access locations; PULSE®, one of the nation's leading ATM/debit networks; and Diners Club International®, a global payments network with acceptance around the world. For more information, visit www.discover.com/company.

Contacts

Media Contact:

Robert Weiss

Discover

robertweiss@discover.com

224-405-6304

@Discover_News