Affirm and Stripe Partner to Help Businesses Grow Their Revenue

Affirm and Stripe Partner to Help Businesses Grow Their Revenue

Millions of businesses using Stripe can offer their customers flexible and transparent payment options with Affirm

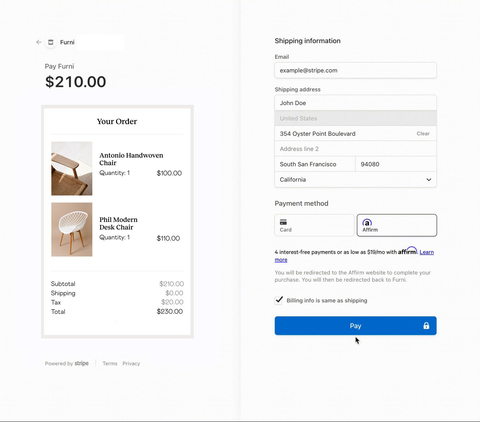

SAN FRANCISCO--(BUSINESS WIRE)--Affirm (NASDAQ: AFRM), the payment network that empowers consumers and helps merchants drive growth and Stripe, a financial infrastructure platform for businesses, announced a strategic partnership that makes Affirm’s Adaptive Checkout™ available to Stripe users in the U.S. today. Adaptive Checkout uses Affirm’s smart decision engine to make a real-time underwriting decision and offer consumers optimized bi-weekly and monthly pay over time options side-by-side.

Now, businesses using Stripe can add this technology to their checkout experience in minutes. Eligible customers will then have the option to use Affirm to split the cost of purchases ranging from $50 to $30,000, with a maximum credit limit of $17,500. True to Affirm’s long-standing commitment to never charge late or hidden fees, customers will never owe more than they agree to upfront.

“Businesses who offer Affirm at checkout have reported as much as 85% higher average order values compared to other payment methods, and our new partnership delivers a powerful growth engine to the millions of businesses and platforms that use Stripe,” said Geoff Kott, Chief Revenue Officer at Affirm. “Stripe’s infrastructure, combined with Affirm’s customizable payment options and unrivaled flexibility and transparency, provides immense value for businesses looking to reach new customers, increase sales, and drive growth.”

Businesses who offer Affirm’s Adaptive Checkout see increased cart conversion, approvals, and sales compared to those who offer monthly payments through Affirm alone.

“We were able to integrate Affirm, test, and then launch in production within one day,” said Ignacio Flores, Technical Lead Engineer at Orchard Mile. “More than 25% of purchases are being paid through buy now, pay later, and our conversion rate continues to improve as customers have more flexibility to purchase the products they want.”

"Businesses need to move quickly to keep up with changing consumer preferences," said Sophie Sakellariadis, Payments Product Lead at Stripe. “For ten years, Affirm has been a powerful tool for businesses to reach new customers and drive growth. Stripe users can now get started accepting payments with Affirm in mere minutes."

Interested Stripe users can learn more about offering Affirm to their customers here.

About Affirm

Affirm’s mission is to deliver honest financial products that improve lives. By building a new kind of payment network — one based on trust, transparency and putting people first — we empower millions of consumers to spend and save responsibly, and give thousands of businesses the tools to fuel growth. Unlike most credit cards and other pay-over-time options, we show consumers exactly what they will pay up front, never increase that amount, and never charge any late or hidden fees. Follow Affirm on social media: LinkedIn | Instagram | Facebook | Twitter | TikTok.

AFRM-F

About Stripe

Stripe is a financial infrastructure platform for businesses. Millions of companies—from the world’s largest enterprises to the most ambitious startups—use Stripe to accept payments, grow their revenue, and accelerate new business opportunities. Headquartered in San Francisco and Dublin, the company aims to increase the GDP of the internet.

Payment options through Affirm are subject to eligibility, and are provided by these lending partners: affirm.com/lenders. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to California Finance Lender license 60DBO-111681.

Contacts

Press

Affirm

Ryan Phillips

press@affirm.com

(973) 820-1820

Stripe

Aly Pavela

media@stripe.com