Counterpoint Research: Global Smartphone Q1 2022 Revenues Cross $110 Billion Led by Apple’s Record First Quarter

Counterpoint Research: Global Smartphone Q1 2022 Revenues Cross $110 Billion Led by Apple’s Record First Quarter

- Apple led the global smartphone market in revenue terms in Q1 2022 with revenue of over $50 billion.

- The top five smartphone brands contributed more than 80% of the total revenue.

- HONOR’s revenue grew 188% YoY, the fastest among the top 10 smartphone OEMs.

- Global smartphone ASP increased 9% YoY in Q1 2022, driven by the iPhone 13 series.

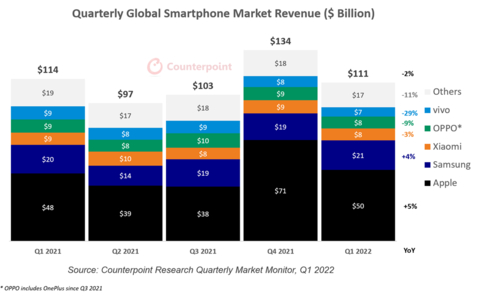

NEW DELHI & HONG KONG & SEOUL & LONDON & BEIJING & SAN DIEGO & DENVER & BUENOS AIRES--(BUSINESS WIRE)--Global smartphone market revenue surpassed $110 billion in Q1 2022, according to the latest research from Counterpoint’s Market Monitor service. It declined 2% YoY from the peak Q1 smartphone revenue of over $114 billion in 2021. In QoQ terms, the revenue saw a cyclical decline of 17% from an all-time high of over $134 billion in Q4 2021.

Commenting on the market dynamics, Senior Analyst Harmeet Singh Walia said, “The global smartphone revenue decline in Q1 2022, lower than the shipment decline of 8% YoY, is reflective of a 9% YoY and 4% QoQ increase in the average selling price (ASP) led by three critical factors — Apple’s performance surpassed expectations in Europe where its Pro and Pro Max iPhones did markedly better; 5G shipment share reached an all-time high of over 48% in Q1 2022 thanks to the success of Apple’s 5G devices, as well as shortages of 4G chips causing a faster than expected transition to 5G; and Chinese brands such as Xiaomi moved up the price tiers to improve their profit margin.”

Market summary

- Apple’s iPhone revenue grew 5% YoY in Q1 2022 to cross $50 billion, a first-quarter record thanks to the brand’s double-digit growth in China and Western Europe, despite a marginal annual shipment decline. Apple’s 5G shipments and revenues in China more than doubled from their Q1 2021 levels. A 20% YoY increase in Apple’s global 5G shipments driven by the iPhone 13 series raised its overall ASP by 6% to $848. Furthermore, the new iPhone SE, which now comes with 5G, also added to Apple’s 5G growth.

- Xiaomi’s 20% YoY ASP increase in Q1 2022 helped limit its revenue decline to 3% YoY even as it battled supply issues causing shipments to decline by 20% YoY. The rise in Xiaomi’s ASP, now at $214, was fueled by a 19% YoY growth in its 5G shipments. Xiaomi’s shipments in the $800 and above segment more than tripled from Q1 2021 levels, driven by greater success of its flagship series, the 11 and 12, relative to the previous versions, particularly in Europe, MEA and India.

- Samsung’s smartphone revenues increased 4% YoY in Q1 2022 to nearly $21 billion, despite a 6% YoY shipment decline. Samsung’s ASP grew 10% YoY to reach $270, driven by the double-digit growth of its shipments in the $300-$499 segment, which saw multiple new launches, many of them being 5G enabled. Samsung’s high revenue growth in South Korea, LATAM and India helped offset declines in other regions. The brand’s ASP in India recorded high double-digit growth driven by the increase in shipment share of the $800 and above price band, led by the Galaxy S22 Ultra.

- vivo’s revenue declined 29% YoY in Q1 2022 to $6.5 billion owing to the economic slowdown in China, exacerbated by a wave of COVID-19 lockdowns in several Chinese provinces. vivo’s ASP grew marginally YoY as its shipment share increased in the above-$100 price band. vivo’s India shipments recorded high growth in the $300-$499 price band and more than doubled in the $500-$799 price band led by the V23 Pro 5G, V23 5G, iQOO 9 series and the X70 Pro.

- OPPO’s* revenue declined 18% YoY in Q1 2022 to $8.5 billion, with the ASP growing 8% YoY to reach $275. The brand’s shipments in the $500 and above price band saw double-digit annual growth, helping drive the ASP growth and somewhat softening the impact of a 24% YoY shipment decline. OnePlus’ 5G shipments and revenues grew 16% YoY in Q1 2022 driven by 5G launches like the Nord CE 2 and 10 Pro and high growth in China and North America.

*Note: OPPO includes OnePlus since Q3 2021

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

Some of our latest smartphone market analyses:

- Global Smartphone Market Declined by 7% YoY Amidst Supply Constraints and Geopolitical Uncertainty in Q1 2022

- Supply-hit India Smartphone Shipments Decline in Jan-Mar

- China Q1 2022 Smartphone Sales Drop 14% YoY to Test 2020 Levels; HONOR Registers Highest YoY Growth

- China Smartphone Market $250-$399 Price Band Share Grows 10% YoY in Q1 2022, vivo Takes Top Spot

- US Smartphone Sales Decline 6% YoY in Q1 2022 as Pandemic Demand Cools

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Contacts

Analyst Contacts:

Harmeet Singh Walia

Jan Stryjak

Tarun Pathak

press@counterpointresearch.com

Contact information

Counterpoint Research

+82 2 553 4813

Tom Kang, Director

press@counterpointresearch.com