SAN MATEO, Calif.--(BUSINESS WIRE)--Guidewire (NYSE: GWRE) today announced Elysian, the latest in a series of market-defining cloud releases. Elysian innovations equip insurers to quickly connect third-party apps, including insurtech solutions, with Integration Gateway, launch lines of business fast with Guidewire GO and Advanced Product Designer (APD), and expand distribution with a new Embedded Insurance Solution for travel. Enter: Elysian, the Guidewire Elysian Release Launch event, will stream live at 8:00 am PT on May 19. It will also be available on-demand. For details about what’s new in Elysian, visit guidewire.com/Elysian.

Connect Apps Easily with Integration Gateway

Elysian reduces integration complexity and increases developer efficiency with Integration Gateway, a cloud micro-service that externalizes integration logic and orchestrates calls to and from InsuranceSuite and third-party applications, making it easier to integrate with 170+ partner apps on the Guidewire Marketplace.

“The cost and time required to integrate core systems with third-party apps significantly impacts speed to market. Integration Gateway sets a new bar for openness and reinvents how easy it is for developers to integrate to Guidewire,” said Diego Devalle, chief product development officer at Guidewire.

Launch Products Fast with Guidewire GO and APD

Elysian accelerates speed to market with expanded country-specific content across lines of business now available in Guidewire GO, a library of pre-packaged product definitions to jump-start the product design process. Guidewire GO content is available for download from the Guidewire Marketplace.

- Underwrite risk flexibly with new commercial lines content and messaging integration for the London Market.

- Process claims efficiently in the French motor market with full IRSA, IRCA, and bodily injury support, including allocation of claims, real-time asynchronous messaging, and payment processing.

- Excel in the Australian personal motor market with full support of regional addresses, currency, product structures, data models and rules, and regulatory data and tax collection.

- Launch products quickly with 1,000+ ISO SBT updates. Reduce product configuration and maintenance effort with new AAIS Commercial Inland Marine products for insurers in North America.

- Implement farm insurance in the U.S. market up to twice as fast with a new GO Product for InsuranceNow.

Elysian features enhancements to APD, a visual configuration cloud service for product model definition that supports the entire insurance lifecycle, simplifying configuration and accelerating product launches. Elysian adds new functionality that enables insurers with existing PolicyCenter LOBs to auto generate the creation of cloud-ready APIs and integration views that streamline the transition to Guidewire Cloud.

“Elysian demonstrates our continued investment in high-value industry content, expanding our insurance product library with new Guidewire GO out-of-the-box product lines and commercial, personal, and country-specific content to help insurers get to market faster,” said Eugene Lee, senior vice president and general manager at Guidewire.

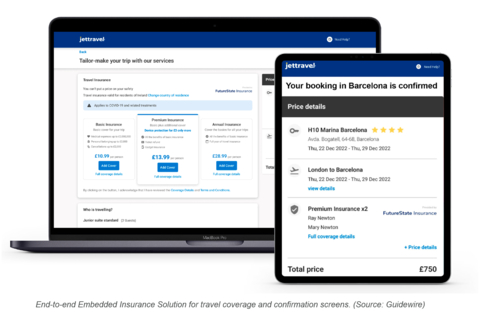

Expand Distribution with Embedded Travel Insurance

According to a report from InsTech London, the embedded insurance market is expected to grow to $722 billion in gross written premium (GWP) within eight years – six times its size today. And Lightyear Capital has reported that the U.S. market value of embedded insurance is expected to increase from $5 billion in 2020 to $70.7 billion in 2025.

Elysian introduces market-specific solutions that are pre-configured to address key line-of-business requirements so insurers can launch embedded insurance for travel in 12 weeks and deliver an end-to-end solution from quote to claim. The Guidewire Embedded Insurance Solution for travel combines the data and functionality of Guidewire Cloud Platform (GWCP) with integrated capabilities from its partner ecosystem to provide support across the entire travel insurance lifecycle.

“Guidewire customers trust us to respond quickly to evolving market demands,” said Devalle. “With the introduction of our first Embedded Insurance Solution, insurers can quickly activate another distribution channel on GWCP.”

For more information about Guidewire, Guidewire Cloud Platform, or the Elysian release, visit guidewire.com. And, read more about Guidewire’s Embedded Insurance Solution for travel here.

About Guidewire

Guidewire is the platform P&C insurers trust to engage, innovate, and grow efficiently. We combine digital, core, analytics, and AI to deliver our platform as a cloud service. More than 450 insurers, from new ventures to the largest and most complex in the world, run on Guidewire.

As a partner to our customers, we continually evolve to enable their success. We are proud of our unparalleled implementation track record, with 1,000+ successful projects, supported by the largest R&D team and partner ecosystem in the industry. Our marketplace provides hundreds of applications that accelerate integration, localization, and innovation.

For more information, please visit www.guidewire.com and follow us on twitter: @Guidewire_PandC.

NOTE: All products mentioned in this announcement are Guidewire products. Not all products are available in every geography or to self-managed customers. Any unreleased services or features referenced in this or other press releases or public statements are not currently available and may not be delivered on time or at all. Customers who purchase Guidewire applications should make their purchase decisions based upon features that are currently available.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding the future availability of the Elysian release, the general availability of features, programs, services, and tools related to Elysian mentioned in this release such as, Integration Gateway, Guidewire GO, and Embedded Insurance Solution for travel. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Guidewire’s control. Guidewire’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in Guidewire’s most recent Forms 10-K and 10-Q filed with the Securities and Exchange Commission as well as other documents that may be filed by the Company from time to time with the Securities and Exchange Commission. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: quarterly and annual operating results may fluctuate more than expected; the impact of the COVID-19 pandemic on our employees and our business and the businesses of our customers, system integrator (“SI”) partners, and vendors; seasonal and other variations related to our customer agreements and related revenue recognition may cause significant fluctuations in our results of operations and cash flows; our reliance on sales to and renewals from a relatively small number of large customers for a substantial portion of our revenue; our ability to successfully manage any changes to our business model, including the transition of our products to cloud offerings and the costs related to cloud operations; our products or cloud-based services may experience data security breaches; we face intense competition in our market; our services revenue produces lower gross margins than our license, subscription and support revenue; our product development and sales cycles are lengthy and may be affected by factors outside of our control; changes in accounting guidance, such as revenue recognition, which have and may cause us to experience greater volatility in our quarterly and annual results; assertions by third parties that we violate their intellectual property rights could substantially harm our business; weakened global economic conditions may adversely affect the P&C insurance industry including the rate of information technology spending; general political or destabilizing events, including war, conflict or acts of terrorism; our ability to sell our products is highly dependent on the quality of our professional services and SI partners; the risk of losing key employees; the challenges of international operations, including changes in foreign exchange rates; and other risks and uncertainties. Past performance is not necessarily indicative of future results. The forward-looking statements included in this press release represent Guidewire’s views as of the date of this press release. The Company anticipates that subsequent events and developments will cause its views to change. Guidewire undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing Guidewire’s views as of any date subsequent to the date of this press release.

For information about Guidewire’s trademarks, visit https://www.guidewire.com/legal-notices.