Custom Indexing Leader Canvas® Expands ESG Investing Capabilities

Custom Indexing Leader Canvas® Expands ESG Investing Capabilities

The added functionality provides financial advisors with further control and transparency in creating portfolios that precisely reflect individual clients’ values

STAMFORD, Conn.--(BUSINESS WIRE)--O’Shaughnessy Asset Management (OSAM), a subsidiary of Franklin Templeton, today announced an expansion of ESG investing capabilities on its Custom Indexing platform Canvas®. Utilizing proprietary advances in software development and quantitative investment research, this added functionality provides financial advisors with further control and transparency in aligning individual clients’ values with portfolio holdings. To encourage greater exploration and adoption of personalized investing, Canvas does not charge additional fees for constructing ESG portfolios on the platform.

“Canvas makes it simple for financial advisors to create and customize client portfolios in minutes,” said Patrick O’Shaughnessy, CFA, Chief Executive Officer of OSAM. “ESG investing is intensely personal and Canvas provides a meaningful alternative to one-size-fits-all ESG funds and rigid SMA products. The latest release provides advisors with more and improved tools to overcome current ESG challenges: low-quality data, lack of portfolio control, and poor performance. The ability for advisors to build precisely to client needs is core to the growth of their practices.”

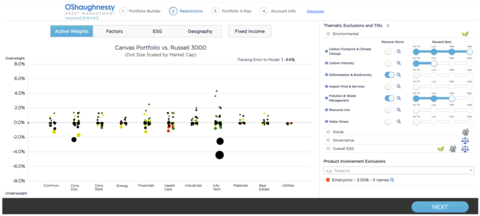

Canvas empowers advisors to easily construct and manage Custom Indexes in separately managed accounts (SMAs) targeting clients’ needs, values, and goals. In terms of ESG investing capabilities, OSAM’s quantitative research team scores companies on a full range of ESG-related policies and practices using proprietary and third-party data. Within the platform, advisors and their clients can select from a growing list of ESG themes and “product-involvement exclusions” like Carbon Intensity, Community Relations, Gender Diversity, Alcohol, and Gun Manufacturing & Distribution. Where many Direct Indexing providers focus solely on exclusions, Canvas enables advisors to overweight positive scoring companies using high, medium, and low tilts. For example, an investor could build a portfolio that excludes companies without women on their boards and rewards companies with strong environmental practices.

The newly expanded ESG functionality includes the following:

- New Portfolio Construction Interface: A greater degree of digitization allows advisors to move from ESG contemplation to selection to implementation in minutes. After constructing a portfolio, advisors can establish a transition plan and lock-in tax specifications ensuring a total and optimal client experience.

- Dynamic Data Visualization: As advisors contemplate ESG selections they can see dynamic feedback such as expected return impact, position-level over and underweights, and thematic repositioning of the portfolio. Increasing transparency assures investors that what they intend to express is being accurately captured in the portfolio. See below:

- Performance Reporting: Advisors can access performance data on Canvas to understand the drivers of performance over different time periods. A new extension of the reporting functionality allows advisors to demonstrate the specific effects of ESG-related allocation decisions on performance and real-world impacts.

- Country Exclusions: As part of the ESG enhancements, advisors can now set country exclusions to prohibit the purchase of stocks of companies in certain countries.

“We’re working to build a future where every investor has their own individually-tailored investment strategy incorporating a range of considerations including ESG,” added O’Shaughnessy. “Canvas offers simple and efficient customization. Do you want to build a custom ESG portfolio? Do you want to exclude Russia-based companies? Do you want to build a momentum-based portfolio? With Canvas, you can do all of this.”

About OSAM

O’Shaughnessy Asset Management (OSAM) is a quantitative asset management firm based in Stamford, CT, and wholly owned subsidiary of Franklin Templeton, with $7.2 billion in assets under management as of March 31, 2022. The firm delivers a broad range of equity portfolios including Custom Indexes to institutional investors, individual investors, and high-net-worth clients of financial advisors. OSAM also serves as the investment advisor for a U.S. mutual fund and as a subadvisor to a family of mutual funds through the Royal Bank of Canada. The firm’s team has been managing money for clients since 1996. For more information, please go to https://osam.com/.

Contacts

Jonathan Mairs

Ax Communications

jmairs@axcommunications.com

917-517-7097