CLEVELAND--(BUSINESS WIRE)--Ancora Holdings Group, LLC today announced that it has sent the below letter to Hasbro, Inc.’s (NYSE: HAS) Board of Directors. A downloadable PDF of the letter can be found above.

***

May 2, 2022

Hasbro, Inc.

Attention: The Board of Directors

1011 Newport Avenue

Pawtucket, Rhode Island, 02861

Members of the Board of Directors,

Ancora Holdings Group, LLC (together with its affiliates, “Ancora” or “we”) is a meaningful shareholder of Hasbro, Inc. (“Hasbro” or the “Company”), with an approximately 1% ownership position. We have spent a significant amount of time diligencing Hasbro’s assets, business plans, governance and historical performance from both the financial and operational perspectives. We have also closely followed the recent exchanges between Alta Fox Capital Management LLC (“Alta Fox”) and the Company’s Board of Directors (the “Board”). After considering the stagnation that has set in at Hasbro over the past several years, as evidenced by persistent share price underperformance, we are urging the Board to begin taking decisive action to help the Company keep up with Mattel, Inc. (“Mattel”) and other players in the fast-moving gaming and entertainment worlds. This is a message we sought to convey directly and privately, but your investor relations team has yet to respond to our outreach in April. In our view, the recent appointment of Chris Cocks as Hasbro’s new Chief Executive Officer should encourage fresh thinking and open-mindedness about the Company’s long-term strategy – not defensiveness, dismissiveness and entrenchment on the part of the current Board.

Ancora believes Hasbro’s long-term results on an absolute and relative basis demonstrate that the Company’s conglomerate configuration has created value-destructive complexity. The consequences of this complexity include extremely poor capital allocation decisions, including failed acquisitions and underinvestment in crown jewel segments such as Wizards of the Coast (“WOTC”), and a perpetually large trading price discount relative to intrinsic value. Our own sum-of-the-parts analysis indicates that Hasbro’s shares are currently trading at a 75% discount to intrinsic value:

|

2024E |

|

|

|

|

|

|

|

|

|

EBITDA |

|

Multiple |

|

Enterprise Value |

||||

|

|

|

|

|

|

|

|

|

|

WOTC |

$965 |

|

16.0x |

18.0x |

20.0x |

|

$15,440 |

$17,370 |

$19,300 |

|

|

|

|

|

|

|

|

|

|

Consumer |

675 |

|

8.0x |

8.0x |

8.0x |

|

5,400 |

5,400 |

5,400 |

|

|

|

|

|

|

|

|

|

|

Entertainment |

230 |

|

8.0x |

8.0x |

8.0x |

|

1,840 |

1,840 |

1,840 |

|

|

|

|

|

|

|

|

|

|

Total |

$1,870 |

|

12.1x |

13.2x |

14.2x |

|

$22,680 |

$24,610 |

$26,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enterprise value |

|

|

$22,680 |

$24,610 |

$26,540 |

|

|

|

|

Net debt |

|

|

2,998 |

2,998 |

2,998 |

|

|

|

|

Equity value |

|

|

$19,682 |

$21,612 |

$23,542 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-forma diluted shares |

|

|

141.5 |

141.5 |

141.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Implied share price |

|

|

$139.10 |

$152.73 |

$166.37 |

|

|

|

|

% to current |

|

|

58.1% |

73.6% |

89.1% |

|

|

|

|

Fortunately, we see three near-term action items for Hasbro that can yield long-term benefits for shareholders:

-

Initiate an Authentic Refresh of the Board – Well-governed companies frequently collaborate with engaged shareholders on their director refreshment efforts. While your expansion from 11 to 13 members added gaming expertise, that defensive maneuver did not cycle out long-serving directors or solve the apparent skill gap that has allowed the Company to fall behind Mattel and dramatically underperform over the long-term. We urge you to immediately commence a real refresh that replaces long-tenured incumbents with members of the Alta Fox slate. In particular, we like that the Alta Fox nominees have strong experience in capital allocation, corporate governance, finance, transactions and transformations. The Board should welcome, rather than fight, the fact that a top shareholder has identified individuals with the ability to support efforts to improve the Company’s questionable capital allocation, disclosures and overall strategic planning during a period of rapid change in the gaming and entertainment sectors.

When considering this recommendation, we hope you try to empathize with shareholders and view the situation from our perspective. It is not in shareholders’ best interests to continue giving the same directors who have overseen significant underperformance, poor capital allocation and costly acquisitions carte blanche to control the Board and, in turn, the Company. The captain responsible for steering the Titanic into an iceberg did not have the option to pick the crew for another ship. Here, however, stale directors have access to life rafts and can do what is best for long-suffering shareholders by handing their seats to individuals with the fresh perspectives and skillsets required to enhance value.

- Pursue a Full or Partial Sale of eOne to Improve Long-Term Focus– A refreshed Board should begin assessing a full or partial sale of Hasbro’s Entertainment One (“eOne”) subsidiary, which was acquired in late 2019 for more than $4.5 billion. We contend Hasbro’s venture into content production has been an abject failure with extremely limited long-term potential and substantial execution risk. It is clear to us – and apparently many of our fellow shareholders – that eOne is a non-synergistic business that is capital-intensive, low margin and very volatile. There are also non-GAAP add-backs every year that force us to question the reporting and earnings quality of the segment, and these frequent adjustments pre-date Hasbro’s acquisition, as you can see in the exhibit immediately below. Moreover, it is also instructive to highlight that over the cumulative five-year period preceding the acquisition, eOne generated a paltry $167 million (USD) in operating cash flow and negative $400 million (USD) once factoring in cash flow from investing activities. Rather than use the excuse of unfortunate timing due to the 2020 pandemic, the Board should own the reality that the entertainment production industry is difficult and littered with failures. As you can see below, eOne’s actual historical operating results reflect these very risks and spotlight the incredible lapse of judgment on the Board’s part that resulted in approving this transaction. It was a $4.5+ billion transaction for a business that generated $167 million of cash flow over five years prior to being acquired, representing an outrageously expensive premium for an entity that on an unadjusted basis is marginally attractive, even at a fraction of the cost paid.

eOne Results Prior to Acquisition |

eOne (Hasbro) |

|||||||

Fiscal Year Ending March 31 |

FYE December 31 |

|||||||

in mil. GBP |

2015 |

2016 |

2017 |

2018 |

2019 |

2019 (PF) |

2020 |

|

Revenue |

785.8 |

802.7 |

1,082.4 |

1,029.0 |

941.2 |

1,215.8 |

956.5 |

|

Operating Profit |

60.2 |

75.0 |

67.6 |

100.7 |

70.7 |

20.0 |

(79.2) |

|

Operating Margin |

7.7% |

9.3% |

6.2% |

9.8% |

7.5% |

1.6% |

-8.3% |

|

Adjusted Operating Profit |

78.0 |

93.2 |

108.4 |

107.8 |

138.7 |

163.0 |

131.1 |

|

Adjusted Operating Margin |

9.9% |

11.6% |

10.0% |

10.5% |

14.7% |

13.4% |

13.7% |

|

Net Cash Flow from Operations |

(19.7) |

69.3 |

34.0 |

14.9 |

30.0 |

NA |

NA |

|

Cash flow before Financing |

(120.1) |

(112.5) |

22.7 |

(106.8) |

8.9 |

NA |

NA |

|

5 YR Cumulative Cash flow from Ops |

128.5 |

|||||||

5 YR Cumulative Cash flow before Financing |

(307.8) |

|||||||

5 YR Cumulative cash flow from Ops (USD) |

167.3 |

|||||||

5 YR Cumulative cash flow before Financing (USD) |

(400.8) |

|||||||

In the context of considering what is in shareholders’ best long-term interests, a refreshed Board should also contemplate the consequences of management spending its energy and time on what we deem a black hole of a segment. Most of the value Hasbro can derive from having its own entertainment arm could likely be obtained via less risky collaborations with other production entities and studios, including the many with better capabilities and track records. We assume the Board is aware that owning a production entity is not a prerequisite for brands to produce and monetize their intellectual property. Hasbro should be partnering with production and distribution partners instead of taking on the capital and execution risk of managing these processes.

To put a finer point on it, Hasbro does not need to own eOne in order to bring Dungeons & Dragons to the big screen, much like George R.R. Martin did not need his own production studio to bring Game of Thrones to life. Along the same lines, the Board should think about the massive opportunity cost for the Company with regards to the return on invested capital (“ROIC”) that can be gleaned from eOne versus other segments, particularly WOTC. Our own analysis suggests eOne is a terrible ROIC story for Hasbro. We fear that the eOne deal has created a perverse incentive for the Board to prioritize content production linked to legacy Hasbro brands and intellectual property even though it is not the best use of shareholders’ resources. Without the pressure of trying to prove that the eOne deal made sense, the Board could be singularly focused on the core business and supercharging the growth of WOTC.

It is equally critical for a refreshed Board to reflect on how the eOne deal has adversely impacted Hasbro’s valuation multiple due to balance sheet leverage and the perceived complexity and execution risk that was added to the corporate story. For reference, in July 2019 (prior to the eOne deal announcement in August 2019), Hasbro’s forward Enterprise Value/EBITDA multiple was approximately 15x. This was also prior to Hasbro disclosing the size, growth trajectory and margin profile of its WOTC segment, so the market was effectively ascribing a high multiple for Hasbro’s consumer toy and game business with an unlevered balance sheet. Today, Hasbro is trading at an approximately 10.5x Enterprise Value/EBITDA multiple despite WOTC being disclosed as its own segment and now representing nearly 50% of consolidated EBITDA versus roughly 20% of consolidated EBITDA in 2019. The value-destructive acquisition of eOne has resulted in not only a levered balance sheet, but a significant decrease in ROIC. Contracting returns on capital has a similarly dampening impact on valuation, as higher return businesses trade at higher multiples.

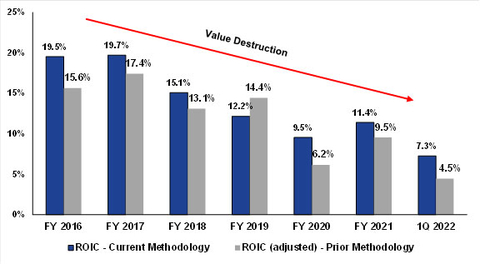

For Hasbro, the consequences of the eOne acquisition are extremely evident in the negative impact it has had on overall ROIC. This point is irrefutable. As shown below, Hasbro also revised its own ROIC calculation following the eOne deal in order to make the metric more favorable for the Company. The exhibit below details a comparison of a standard ROIC calculation versus the methodology utilized by Hasbro from 2016 to 2019. We note the first quarter 2022 metric is annualized to make the comparisons appropriate.

FY |

FY |

FY |

FY |

FY |

FY |

Q1 |

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Adjusted EBITDA (Non-GAAP) |

977.2 |

1,036.3 |

796.5 |

911.1 |

1,015.2 |

1,214.0 |

174.0 |

NOPAT Adjustments: |

|||||||

Less Depreciation |

119.7 |

143.0 |

139.3 |

133.5 |

120.2 |

163.3 |

25.1 |

Rent Expense |

52.6 |

63.6 |

65.2 |

68.9 |

90.6 |

88.2 |

22.3 |

Lease-Related Interest |

4.5 |

5.4 |

5.5 |

5.8 |

8.3 |

7.1 |

1.7 |

Adjusted EBITA |

905.6 |

951.5 |

716.8 |

840.7 |

977.3 |

1,131.8 |

169.5 |

Cash Taxes |

199.2 |

209.3 |

157.7 |

185.0 |

215.0 |

249.0 |

37.3 |

NOPAT |

706.4 |

742.2 |

559.1 |

655.7 |

762.3 |

882.8 |

132.2 |

ROIC |

19.5% |

19.7% |

15.1% |

12.2% |

9.5% |

11.4% |

7.3% |

ROIC (prior methodology): |

|

|

|

|

|

|

|

Net Earnings - as adjusted |

566.1 |

693.1 |

488.8 |

524.7 |

514.6 |

723.4 |

79.4 |

Total Debt |

1,721.0 |

1,848.6 |

1,704.8 |

1,697.1 |

5,099.2 |

4,201.4 |

3,997.8 |

Total Equity |

1,900.1 |

2,126.5 |

2,022.8 |

1,938.6 |

3,253.2 |

3,381.7 |

3,122.4 |

Total Invested Capital |

3,621.1 |

3,975.0 |

3,727.7 |

3,635.7 |

8,352.4 |

7,583.1 |

7,120.2 |

ROIC (adjusted) - Prior Methodology |

15.6% |

17.4% |

13.1% |

14.4% |

6.2% |

9.5% |

4.5% |

While the Board may be reluctant to cut its losses soon on a highly dilutive and debt-funded acquisition that saw Hasbro issue 10 million new shares, shareholders should not have to continually suffer the consequences of what is obviously a flawed deal. The Board needs to consider Mattel’s acquisition of The Learning Company in the late 1990s. After making a bad acquisition and throwing good money after bad for a multi-year period, Mattel ultimately did the right thing and sold The Learning Company in the early 2000s. Ironically, Mattel required engaged shareholder intervention to divest The Learning Company. Unfortunately, the Board’s inaction is putting Hasbro in the same position today.

We suspect Hasbro could recoup up to $2 billion via a sale of eOne, as well as gain meaningful future tax benefits associated with the acknowledged loss. There may be multiple ways to extract value for the asset while still retaining rights to Peppa Pig and PJ Masks, as eOne’s film content library was valued at $2.5 billion (USD) as of March 31, 2018. Proceeds could be used to pay down debt and make long-term investments in growing segments. Further, a divestiture of the eOne business will streamline the current convoluted conglomerate structure, which will reduce the operational complexity, inefficiency and hidden costs that often lead to depressed valuation multiples for conglomerates.

3. Reevaluate Alternatives for WOTC as Conditions Permit – A refreshed Board should continually assess strategic alternatives, including a tax-free spin, for the WOTC segment. We consider WOTC to be an exceptional business that deserves strong focus and investment. But the fact is the market has not been giving Hasbro nearly enough credit for WOTC, as evidenced by the Company’s lagging share price over the long-term. It gives us great concern that you apparently rejected this reality when recently concluding that it is best for shareholders to keep WOTC within Hasbro’s corporate structure. Our analysis indicates a spin of WOTC could unlock more than 75% upside value from Hasbro’s current share price.1 As far as we can tell, the Board does not have any plans that aim to produce similar value over the near-term or long-term.

WOTC is a fantastic segment, coupling great growth potential with high EBITDA margins and returns on capital. Businesses with these characteristics will warrant premium multiples as standalone entities, which is something that is unlikely to happen in Hasbro’s confusing conglomerate configuration and for as long as the "Brand Blueprint" remains the north star.

Though our initial outreach apparently fell on deaf ears, we still welcome the opportunity to meet with you to share more detailed analysis and provide specific recommendations for repositioning Hasbro as a leader. There is no reason to continue doubling down on the governance missteps that have eroded the Company’s foundation and resulted in sustained underperformance. If the Board takes the right steps today, as Mr. Cocks begins his tenure as Chief Executive Officer, we believe it will result in superior value creation for shareholders and stakeholders over the long-term.

Sincerely,

Fredrick D. DiSanto |

James Chadwick |

|||||||

Chief Executive Officer and Executive Chairman |

President |

|||||||

Ancora Holdings Group, LLC |

Ancora Alternatives LLC |

***

About Ancora

Founded in 2003, Ancora Holdings Group, LLC offers integrated investment advisory, wealth management and retirement plan services to individuals and institutions across the United States. The firm's comprehensive service offering is complemented by a dedicated team that has the breadth of expertise and operational structure of a global institution, with the responsiveness and flexibility of a boutique firm. For more information about Ancora, please visit https://ancora.net.

1 Ancora’s base case sum of the parts valuation for Hasbro assumes an 18x multiple for WOTC, resulting in a $155-$160/share price representing 75% or more upside from current share price levels. This valuation multiple splits the difference between the average multiple of current video game publishers (~14x) and dominant technology companies with similar financial profiles as WOTC (~21x).