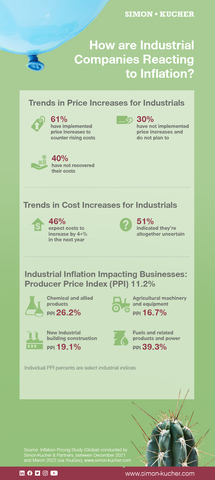

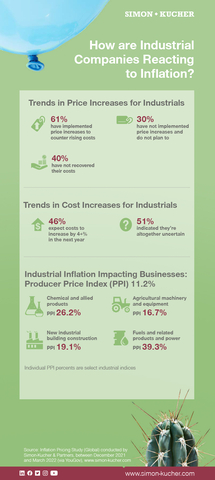

BOSTON--(BUSINESS WIRE)--With inflation at levels not seen for decades in many markets, businesses are facing significant margin erosion. A recent Inflation Pricing Study* by global consultancy Simon-Kucher & Partners surveyed more than 3,000 businesses across 20 countries (524 in the U.S.) and revealed that of the companies that currently measure costs, roughly 50 percent expect their costs to increase by 10+ percent in the next year, as a result of the sharp increases in labor and production. Additionally, thirty percent of U.S. businesses have not increased prices and do not plan to do so in response to climbing costs and inflation rates.

CPI metric does not fully capture the impact of inflation on industrials

While inflation in the U.S continues to accelerate, industrial companies are being confronted with harsh realities underestimated by the Consumer Price Index (CPI). The three largest components of CPI are housing, food/beverages, and transportation, which rely heavily on upstream suppliers. Due in part to the 39 percent increase in power, fuels, and related products, transportation showed the largest increase with a significant impact on industrial companies compared to the general public.

Industrial companies are facing major challenges due to inflation

While the CPI is trending at 8.5 percent, producers are facing daunting Producer Price Index (PPI) levels higher than 11.2 percent, and in some cases two to three times higher. Some examples include:

- Power, fuels, and related products PPI: 39.3 percent

- Chemical and allied products PPI: 26.2 percent

- New industrial building construction PPI: 19.1 percent

- Agricultural machinery and equipment PPI: 16.7 percent

For industrial companies to remain nimble and react in real-time, they must understand their supply chain inputs, and specifically, changes in the prices of these inputs.

William Humsi, Partner, Simon-Kucher, commented:

“While the general public is attuned to the 8.5 percent CPI, the reality for upstream suppliers is much higher… the industrials industry is experiencing double digit inflation numbers in most sectors.”

Jeb Wilson, Senior Director, Simon-Kucher, commented:

“Industrial executives and managers are having to take more difficult and frequent actions than ever before related to the transfer of rising costs to their customers”

Industrial companies are uncertain and pessimistic about expected cost increases

The study also shows that in the last year and into the next, industrial companies are unprepared for continued cost increases. Less than 4 percent of U.S. respondents expect cost increases to be 3 percent or less, while a total of 46 percent expect costs to increase by over 4 percent. Additionally, 51 percent of respondents indicated they are altogether uncertain.

Industrial companies should prepare for a continuation of the recent inflationary environment and plan to increase prices in greater amounts and with higher frequency in the future. The study showed that 61 percent of respondents implemented price increases to counter rising costs, while the remaining (almost) 40 percent did not sufficiently recover their costs.

Thomas McClure, Senior Manager, Simon-Kucher, commented:

“Our results find that many businesses are already behind in developing strategic plans to increase pricing. This puts companies in a position where the required price increase to “catch up” becomes unpalatable for their customers.”

Traditionally, companies are accustomed to executing price increases on an annual, or even less frequent basis, and these changes can often take more than a quarter to plan and execute. Less than half of the respondents indicated they carried out a price increase in recent months and plan to in the future. In our experience, the most successful companies understand the need to get ahead of price increases, and they do so in a deliberate and methodical way that analyzes both their product/service portfolio as well as their customers. In times of inflation, this is even more critical to maintaining the profitability of the business.

Brad Soper, Partner, Simon-Kucher, commented:

“Most companies and management teams have not seen inflation at these levels within their professional careers. This means that management teams need to develop repeatable processes to recognize the need for pricing adjustments and then to efficiently bring that to the market. In particular, a well-thought-out price increase and communication strategy, as well as the ability to monitor effectiveness of efforts via KPIs, are fundamental skills that companies will need to survive over the next couple of years of market development.”

Study available for download here

Complete study findings are available upon request, including country splits.

*About the Study: The Inflation Pricing Study was conducted online between December 2021 and March 2022 by the global consultancy Simon-Kucher & Partners (via YouGov). Over 3,000 companies from across 20 countries were surveyed on the topics of inflation and price increases.

Simon-Kucher & Partners, Strategy & Marketing Consultants:

Simon-Kucher & Partners is a global consulting firm specializing in TopLine Power®. We help our clients achieve growth and profit targets by applying practical, evidence-based strategies. Simon-Kucher & Partners is regarded as the world’s leading pricing advisor and thought leader. The consultancy has more than 1,700 employees in 42 offices worldwide.