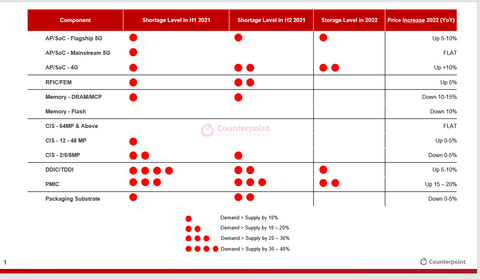

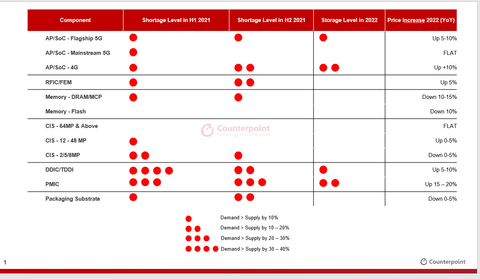

LONDON & HONG KONG & BOSTON & TORONTO & NEW DELHI & BEIJING & TAIPEI, Taiwan & SEOUL, South Korea--(BUSINESS WIRE)--Global semiconductor chip shortages are likely to continue easing during the second half of 2022 as demand-supply gaps decrease across most components, according to Counterpoint Research’s latest smartphone Component Tracker Report.

These shortages have plagued many industries for the past two years and vendors across the supply chain have spent much effort dealing with uncertainties. Since late 2021, demand-supply gaps have been shrinking, signaling an approaching end to supply tightness across the broader ecosystem.

Inventory levels of 5G-related chipsets including mainstream application processors, power amplifiers and RF transceivers have increased significantly, though some exceptions exist, like older-generation 4G processors as well as power management ICs.

Across PCs and laptops, the supply gap for the most important PC components like power management ICs, Wi-Fi and I/O interface IC has narrowed. “We saw OEMs and ODMs continued to accumulate component inventory to cope with uncertainties cropping up from COVID-19 earlier this year.” said research analyst William Li, who focuses on semiconductors and components.

However, Li suggests H1 2022 will see downward shipment revisions, largely due to increasing inventory in the channel and a slowdown in consumer PC momentum. “Coupled with wafer production expansion and continuous supplier diversification, we have witnessed significant improvement in the component supply situation, at least in the first quarter,” observed Li. “The big risk factor moving forward is the lockdowns happening across China right now, especially in and around Shanghai. But if the government can manage the outbreak and help key ecosystem players turn the corner quickly, we believe the broader semiconductor shortage will ease around late Q3 or early Q4.”

“Last year, supply tightness dovetailed with the rebound in consumer and business demand, causing a lot of headaches across the supply chain. But over the past few months, what we have seen is softening demand intersecting nicely with higher inventories,” observed Dale Gai, director of Counterpoint Research’s semiconductor and components practice. “The issue now isn’t shortages but shock to the system from lockdowns, which is having a domino effect across China at the moment.”

Industry and government alike have been focusing on dealing with the short-term risks associated with unpredictable and sharp production stoppages. Senior analyst Ivan Lam noted, “Holding the line is a priority, especially for local governments, and we have seen how some companies are able to continue operations as closed-loop systems. The supply chain was lucky last year, but this latest COVID wave is a big test the country needs to manage carefully but quickly. It is crunch time now and all eyes are on China.”

Press Inquiries

For related data and questions, please contact press@counterpointresearch.com.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.