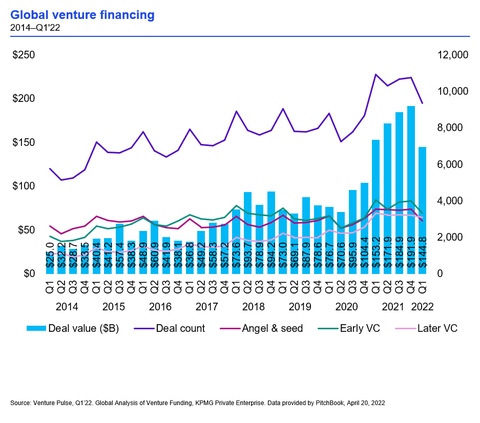

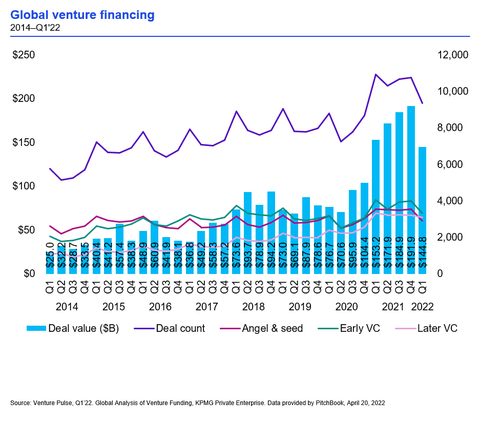

NEW YORK--(BUSINESS WIRE)--Global VC investment during Q1’22 reached $144.8 billion, higher than all, but the four consecutive record-breaking quarters seen during 2021 – making for a robust result, despite the decline, according to the KPMG’s Venture Pulse report, covering Q1’2022.

The quarterly report, published by KPMG Private Enterprise, analyses key VC deals and trends globally in key jurisdictions around the world. While total investment remained strong, the number of VC deals dropped considerably – from 10,775 deals in Q4’21 to 9,349 in Q1’22 – as geopolitical and economic factors combined to create a storm of uncertainty in the market.

The Russia-Ukraine war, rising inflation and interest rates, turbulence in the global capital markets, ongoing supply chain challenges, and surging cases of COVID-19 in a number of jurisdictions likely contributed to a slowdown in deal-making activity as VC investors enhanced their caution and focused more on due diligence.

VC investment declined in both the Americas and Asia during Q1’22. VC investment in the Americas fell from $103.3 billion in Q4’21 to $77.6 billion in Q1’22, while VC investment in Asia dropped from $55.2 billion to $32.6 billion. Only Europe bucked the downward trend, experiencing a modest increase from $31.5 billion in Q4’21 to $31.7 billion in Q1’22.

After a record year for exits, Q1’22 saw exit value drop more than 60% quarter-over-quarter - with just $122.3 billion in exit value across 684 deals, compared to $344.2 billion in exit value across 941 deals in Q4’21.

“The capital markets globally have had a turbulent start to the year, which has effectively slammed the door shut on most IPO activity for the moment,” said Conor Moore, Head of KPMG Private Enterprise in the Americas region, and Partner at KPMG in the US. “Given the heightened geopolitical tension on top of shifting macroeconomic factors like interest rates and inflation, IPO activity will likely remain soft heading into Q2’22.”

Key Highlights – Q1’22

- Global VC investment dropped from a high of $191.9 billion across 10,775 deals in Q4’21 to $144.8 billion across 9,349 deals in Q1’22.

- VC investment in the Americas fell from $103.3 billion across 4,628 deals in Q4’21 to $77.6 billion across 4,138 deals in Q1’22. The US accounted for $70.7 billion of Q1’22 investment the Americas ($95.4 billion of investment in Q4’21).

- VC investment in Asia dropped from $55.2 billion across 3,139 deals in Q4’21 to $32.6 billion across 2,712 deals in Q1’22.

- Europe saw a slight increase in VC investment during Q1’22, attracting $31.7 billion across 2,219 deals, compared to $31.5 billion across 2,705 deals in Q4’21.

- Global first-time VC financing was soft in Q1’22, accounting for just $12.6 billion.

- CVC-affiliated investment rose in Europe, accounting for $14.4 billion in Q1’22 compared to $12.5 billion in Q4’22. CVC-participant investment in Americas dropped from $43.7 billion to $30.8 billion, while Asia-based CVC also declined – from $33.3 billion to $18.2 billion quarter-over-quarter.

- Exit value dropped considerably quarter-over-quarter, with $122.3 billion in exit value in Q1’22, compared to $344.2 billion in exit value in Q4’21.

Seven countries attract the ten largest VC deals – highlighting geographic diversity

The number of $1 billion+ megadeals fell to 2 during Q1’22 (Altos Labs, Checkout.com) – with both deals occurring during the first three weeks of the quarter, before the crisis in Ukraine began. The drop in $1 billion+ deals helped showcase the breadth of countries now attracting large VC deals. Companies from seven countries attracted the top ten largest deals this quarter, including the US.

The Americas saw $77.6 billion in investment during Q1’22. The US accounted for $70.7 billion of this total – and for the top three largest deals in the Americas this quarter, including a $3 billion raise by cellular regeneration-focused biotech Altos Labs, a $935 million raise by logistics company Flexport, and a $750 million raise by corporate management company Ramp.

Europe attracted $31.7 billion in VC investment during Q1’22, a minor increase compared to the $31.5 billion in deal value seen in Q4’21. Six different countries attracted the top 6 funding rounds in Europe this quarter. UK-based payments company Checkout.com’s $1 billion raise was the largest in Q1’22, followed by an $871 million raise by Germany-based insurtech Wefox, a $768 million raise by Turkey-based delivery company Getir, a $710 million raise by Estonia-based checkout platform Bolt, a $566 million raise by Finland-based business productivity company Relex, and a $557 million raise by France-based healthtech Doctolib.

Meanwhile, VC investment in Asia dropped to a six-quarter low of $32.6 billion in Q1’22, driven by global geopolitical uncertainty, macroeconomic factors, and ongoing regulatory concerns in China. The region saw no $1 billion+ deals during the quarter. The largest deals included $800 million raises by both India-based edtech Byju and China-based proptech JD Property, a $784 million raise by China-based Changan New Energy Vehicles Technology, and a $700 million raise by India-based food delivery company Swiggy. Outside of India and China, Singapore-based Princton Digital Group ($505 million) and Korea-based Megazone Cloud ($442.1 million) also raised big rounds this quarter.

Dry powder expected to help keep VC market stable despite growing uncertainty

Despite the significant uncertainty plaguing the VC market globally, VC investment is expected to remain relatively stable in Q2’22 thanks to a significant amount of dry powder. VC investors will likely continue to be cautious, focusing on late stage companies and proven bets. This could cause concern for startups looking for first-time financing or at early stages of their growth trajectory.

“It’s a bit early to predict what effect the Russia-Ukraine war will have on the broader VC market, although caution will likely be the name of the game for investors in Q2’22 and beyond,” said Jonathan Lavender, Global Head, KPMG Private Enterprise. “Despite the uncertainty, VC investment will likely remain steady given the amount of capital available in the market. There’s been a lot of VC funds raised in recent quarters and that funding will be looking for a home.”

About KPMG Private Enterprise You know KPMG, you might not know KPMG Private Enterprise. We’re dedicated to working with businesses like yours. It’s all we do. Whether you’re an entrepreneur, a family business, or a fast-growing company, we understand what’s important to you.

The KPMG Private Enterprise global network for Emerging Giants has extensive knowledge and experience working with the startup ecosystem. From seed to speed, we’re here throughout your journey. You gain access to KPMG’s global resources through a single point of contact—a trusted adviser to your company. It’s a local touch with a global reach.

About KPMG International KPMG is a global organization of independent professional services firms providing Audit, Tax and Advisory services. KPMG is the brand under which the member firms of KPMG International Limited (“KPMG International”) operate and provide professional services. “KPMG” is used to refer to individual member firms within the KPMG organization or to one or more member firms collectively.

KPMG firms operate in 145 countries and territories with more than 236,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. Each KPMG member firm is responsible for its own obligations and liabilities.

KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

For more detail about our structure, please visit home.kpmg/governance.