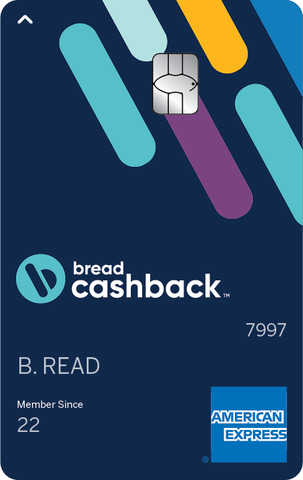

COLUMBUS, Ohio--(BUSINESS WIRE)--Bread Financial (NYSE: BFH), a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions, today announced the launch of a new consumer credit card – the Bread Cashback™ American Express® Credit Card. Bread Cashback offers unlimited 2% cash back with no reward caps and no categories to manage. Plus, there are no annual fees or foreign transaction fees. Cardholders will also have access to premium American Express offers and benefits.

“When we rebranded to Bread Financial in March, we made a promise to our customers to focus on delivering the innovative payment, lending and saving solutions they need at each and every stage of their financial journeys,” said Val Greer, executive vice president and chief commercial officer, Bread Financial. “The new Bread Cashback American Express Credit Card offers cardholders unlimited 2% cash back, no annual or foreign transaction fees, access to dining, travel and entertainment offers, as well as comprehensive purchase, identity and travel protections. This unique combination of premium benefits and value was designed to meet the needs of today’s consumers who demand more choice and access.”

“We’re excited to be partnering with Bread Financial to offer their customers a new leading cashback product backed by the American Express network with compelling value, rewards and services,” said Will Stredwick, senior vice president and general manager, global network services, American Express. “This partnership expands and extends the backing of the American Express network to more people, providing important card protections, offers and access they expect from American Express.”

The Bread Cashback American Express Credit Card provides consumers with the financial flexibility to help unlock new opportunities and live their best lives. Cardholders gain access to several industry-leading benefits to help them make confident, secure and seamless purchases every day, including:

- Unlimited 2% cash back: No reward caps, opt-ins or categories to manage

- No annual fees

- No foreign transaction fees

- Premium protection benefits: Purchase protection, zero fraud liability, identity theft insurance and emergency assistance

- American Express lifestyle benefits: Access to merchant, dining, and entertainment offers and discounts

The Bread Cashback American Express Credit Card joins an existing suite of simple, personalized Bread Financial solutions — including Bread PayTM (buy now, pay later and installment loans) and Bread SavingsTM, formerly Comenity Direct. With the addition of the Bread Cashback American Express Credit Card, consumers at all stages of their financial lives have access to a robust suite of solutions to serve their payment and saving needs.

“From the just-getting-started college graduate to the credit-savvy bargain hunter, everyone deserves access to financial flexibility that’s free of gimmicks and complexity,” said Greer. “The Bread Cashback American Express Card opens up limitless opportunities for consumers, and empowers them to make the purchases they need in the moment or in the future with ease and transparency.”

Beginning today, consumers can apply for a Bread Cashback American Express Credit Card at BreadFinancial.com. The Bread Cashback Card is issued by Comenity Capital Bank, a Bread Financial company.

For more details about the card, including terms and conditions, visit BreadFinancial.com.

About Bread Financial

Bread FinancialTM (NYSE: BFH) is a tech-forward financial services company providing simple, personalized payment, lending and saving solutions. The company creates opportunities for its customers and partners through digitally enabled choices that offer ease, empowerment, financial flexibility and exceptional customer experiences. Driven by a digital-first approach, data insights and white-label technology, Bread Financial delivers growth for its partners through a comprehensive product suite, including private label and co-brand credit cards, installment lending, and buy now, pay later (BNPL). Bread Financial also offers direct-to-consumer solutions that give customers more access, choice and freedom through its branded Bread CashbackTM American Express® Credit Card and Bread SavingsTM products.

Formerly Alliance Data, Bread Financial is an S&P MidCap 400 company headquartered in Columbus, Ohio, and committed to sustainable business practices powered by its 6,000+ global associates. To learn more about Bread Financial products and services, visit BreadFinancial.com or follow us on Facebook, LinkedIn, Twitter and Instagram.

About American Express

American Express is a globally integrated payments company, providing customers with access to products, insights and experiences that enrich lives and build business success. Learn more at americanexpress.com and connect with us on facebook.com/americanexpress, instagram.com/americanexpress, linkedin.com/company/american-express, twitter.com/americanexpress, and youtube.com/americanexpress.

Key links to products, services and corporate responsibility information: personal cards, business cards, travel services, gift cards, prepaid cards, merchant services, Accertify, Kabbage, Resy, corporate card, business travel, diversity and inclusion, corporate responsibility and Environmental, Social, and Governance reports.

Forward-looking statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our expectations or forecasts of future events and can generally be identified by the use of words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “project,” “plan,” “likely,” “may,” “should” or other words or phrases of similar import. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements we make regarding, and the guidance we give with respect to, our anticipated operating or financial results, initiation or completion of strategic initiatives including our ability to realize the intended benefits of the spinoff of our LoyaltyOne segment, future dividend declarations, and future economic conditions, including, but not limited to, market conditions and COVID-19 impacts related to relief measures for impacted borrowers and depositors, labor shortages due to quarantine, and reduction in demand from clients. We believe that our expectations are based on reasonable assumptions. Forward-looking statements, however, are subject to a number of risks and uncertainties that could cause actual results to differ materially from the projections, anticipated results or other expectations expressed in this release, and no assurances can be given that our expectations will prove to have been correct. These risks and uncertainties include, but are not limited to, factors set forth in the Risk Factors section in our Annual Report on Form 10-K for the most recently ended fiscal year, which may be updated in Item 1A of, or elsewhere in, our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K. Our forward-looking statements speak only as of the date made, and we undertake no obligation, other than as required by applicable law, to update or revise any forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise.