Strategy Analytics: MediaTek Exited 2021 with Over 75 Million Unit Lead Over Qualcomm in Smartphone Apps Processors

Strategy Analytics: MediaTek Exited 2021 with Over 75 Million Unit Lead Over Qualcomm in Smartphone Apps Processors

Qualcomm Maintains Revenue Share

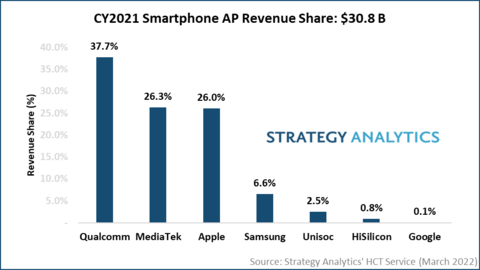

BOSTON--(BUSINESS WIRE)--The global smartphone applications processor (AP) market grew 23 percent to $30.8 billion in 2021, according to Strategy Analytics' Handset Component Technologies (HCT) service report.

According to this Strategy Analytics' Handset Component Technologies (HCT) research report, " Smartphone Apps Processor Market Share Tracker Q4 2021: Qualcomm Increases Revenue Share Lead", Qualcomm, MediaTek, Apple, Samsung LSI and Unisoc grabbed the top-five revenue share ranking spots in the smartphone applications processor (AP) market in 2021.

- Qualcomm maintained its smartphone AP leadership with a 38 percent revenue share, followed by MediaTek and Apple with each 26 percent.

- Apple, MediaTek, Qualcomm and Unisoc gained market share while HiSilicon and Samsung LSI lost share.

- 5G-attached AP shipments grew 84 percent year-over-year, accounting for 46 percent of total smartphone APs shipped in 2021.

- Shipments of APs with on-device artificial intelligence (AI) engines crossed 900 million in 2021, roughly flat compared to 2020. However, increased shipments of mid-range APs without AI engines limited the growth.

- Top-selling Android AI APs include Snapdragon 888/888+, 765/G, 750G and 662 and Dimensity 700.

- TSMC manufactured three in four smartphone APs shipped in 2021. In addition, semiconductor foundries, including TSMC and Samsung Foundry, held up well despite supply constraints and helped the industry capture growth.

- Smartphone APs manufactured in 7 nm and below process technologies accounted for 43 percent of total smartphone AP shipments in 2021.

- Google entered the smartphone AP market in 2021 with its Pixel Tensor chip, capturing approximately 0.1 percent unit and revenue share.

Sravan Kundojjala, author of the report and Director of Handset Component Technologies service at Strategy Analytics, commented, "For the first time on an annual basis, MediaTek overtook Qualcomm in units and established over 75 million unit-lead in smartphone APs 2021. MediaTek capitalized on Qualcomm's defocus on mid and low tier 4G LTE APs and gained volume share. Despite the loss of unit share crown, Qualcomm exited 2021 with over 43% higher revenue than MediaTek, thanks to an increased mix of higher-priced premium and high-tier APs. Both companies performed well in the 5G AP segment and posted a 13-year high in their AP average selling prices (ASPs)."

Mr. Kundojjala continued, "Unisoc made a strong comeback in 2021 with the help of renewed LTE AP portfolio and tier-one design wins. Strategy Analytics believes that Unisoc has the potential to take LTE AP share from MediaTek in 2022 as the latter shifts its focus to 5G. On the other hand, Samsung LSI saw a sharp decline in its AP shipments as its primary customer Samsung Mobile shifted orders to Qualcomm, MediaTek and Unisoc. As a result, for the first time in the last six years, Samsung shipped less than 100 million APs in 2021. However, Samsung could regain market share with its new Exynos 1280 mid-range 5G AP in 2022."

Source: Strategy Analytics, Inc.

#SA_Components

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Service Name: Handset Component Technologies

Service Name: RF and Wireless Component Service

Contacts

Report:

European Contact: Stephen Entwistle, +44 (0)1908 423 636, sentwistle@strategyanalytics.com

US Contact: Christopher Taylor, +1 617 614 0706, ctaylor@strategyanalytics.com

Asia Contact: Sravan Kundojjala, +44(0) 1908 423 638, skundojjala@strategyanalytics.com